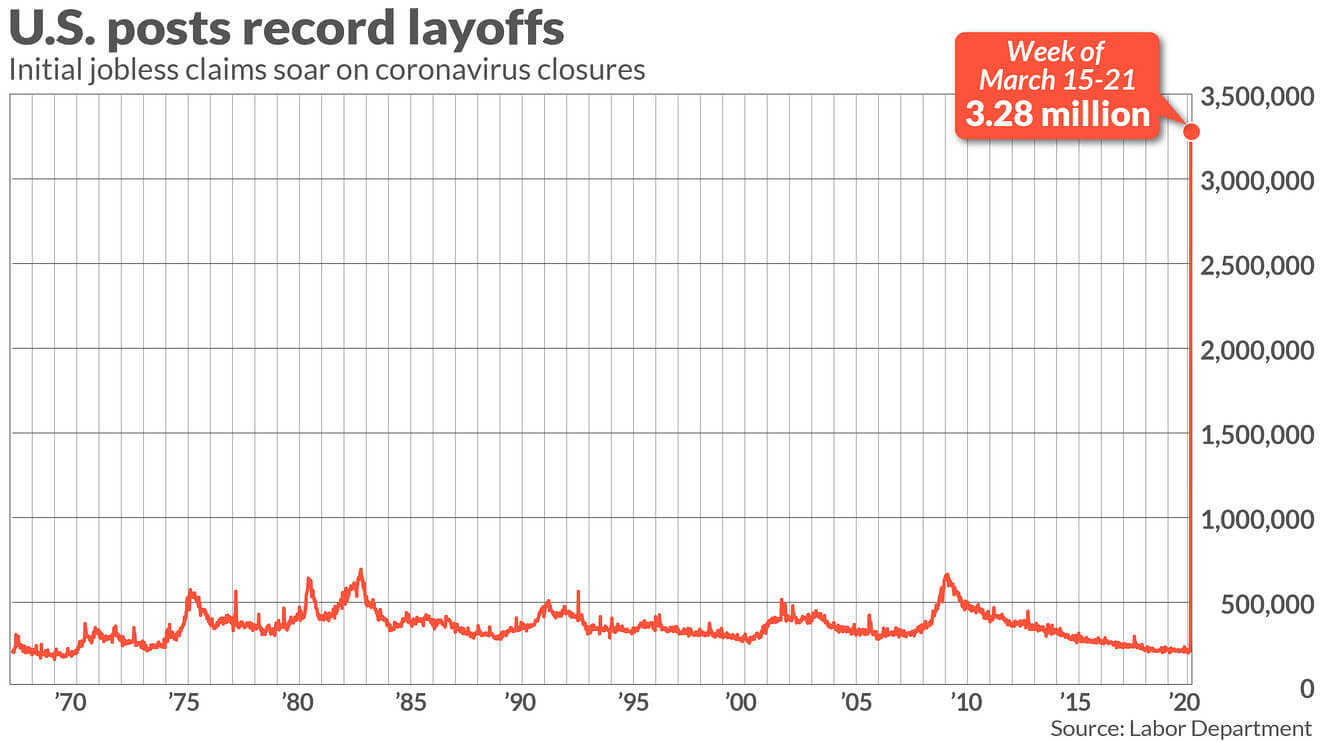

On March 26, 2020, the United States Labour Department announced that 3.28 million Americans applied for unemployment benefits for the first time the week before.

This is a very large number.

To put things into perspective, this was a chart of the history of initial jobless claims:

The previous record rise was 695,000, which happened in October 1982 (which is probably near the start of one of the biggest 17-18-year secular bull run we ever had).

Throughout the country, companies were forced to implement measures to rein in the number of COVID-19 cases. These measures stopped commerce.

According to many experts, the initial jobless claims is an important metric that analyst watches to evaluate the state of the economy.

In the past, a weak jobless claims number would typically negatively affect the stock prices.

If more people are unemployed

- They have less purchasing power

- They consume less

- There is less demand for goods and services

- Companies have less revenues

- They fire more people

- Back to #1

People need to stay employed. This is also one of the main things the Singapore government always wants to ensure: Low unemployment.

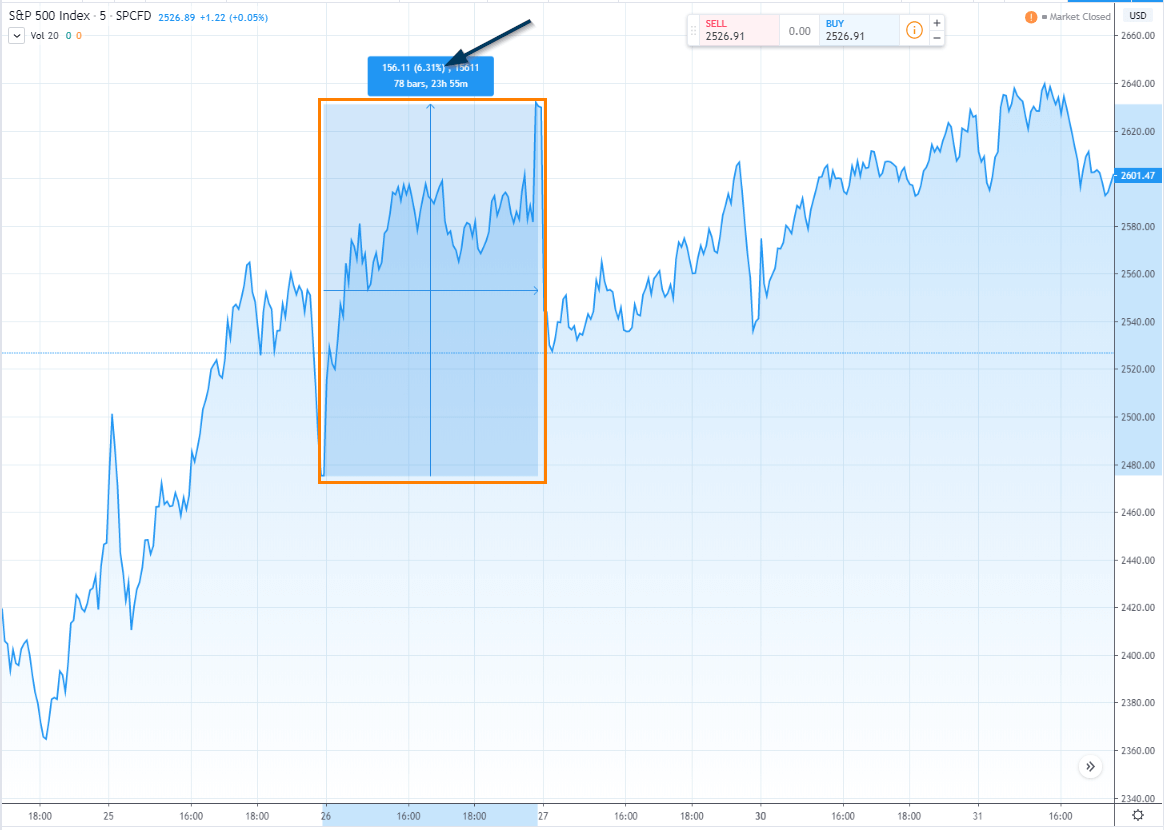

After the announcement this was what happened to the stock price:

The price of the S&P 500 Index went up almost 6% in a single day on the 26th of March. It should be noted that the day before, the share price also went up massively.

The typical daily volatility of a broad market index in the S&P 500 is 1%.

On the day when the department of labor announced an unprecedented number, instead of prices going down in an unprecedented way, the price rose in a 6 Sigma event.

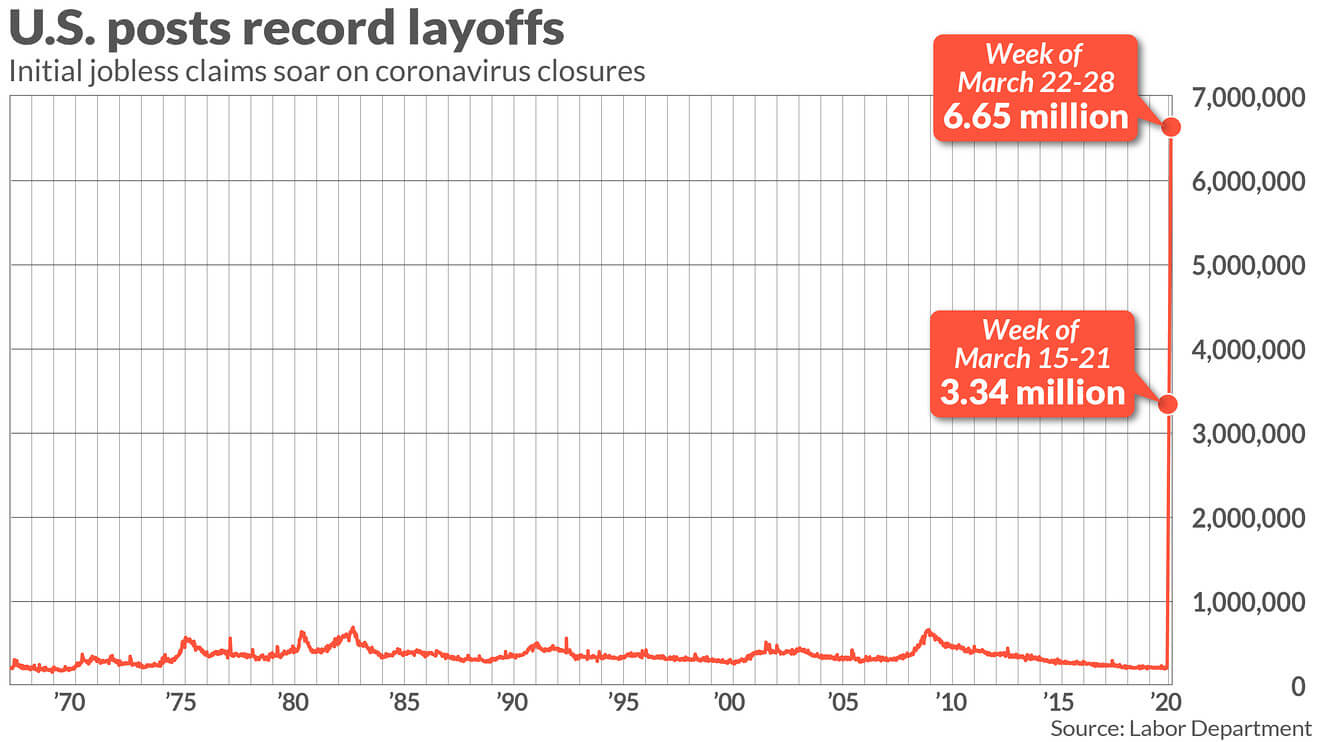

Yesterday, the Department of Labour published the initial jobless claims again.

The number topped the last 3.28 million figure.

6.65 million filed for initial jobless claims the week before.

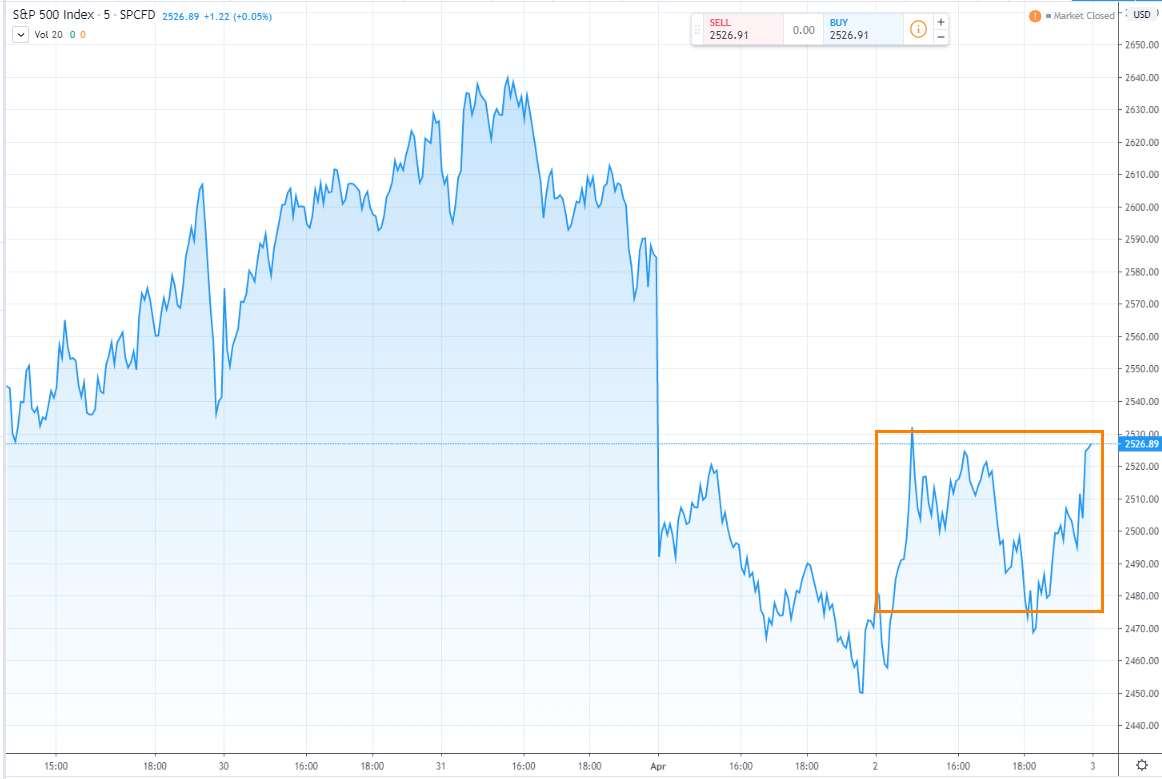

And this is the stock market’s reaction to the news:

The S&P 500 Index went up 2.28% on the date of the announcement instead.

What is the explanation for this bizarre reaction in the markets?

Many investors infer that a poor reading of an important economic metric would mean the stock market should have a negative reaction.

The truth is that the price of the stock market is made up of:

- The fundamental performance of the basket of stocks in the index going forward

- The psychology of the people participating in the market buying and selling

The stock market is forward-looking. Typically, poor market performance indicates that months down the road, the real economy would not do so well.

It would also mean that if you are looking to invest based on signs in the real economy that things are better, most likely, the prices would have reflected the better economic performance down the road.

In the case of the jobless claims data, almost everyone knows that the unemployment figure is going to look ugly. The S&P 500 price has fallen days or weeks prior.

What would usually move the index price is a change in expectation in the numbers. This relates to #2 the psychology of the people participating.

If the unemployment figures turn out to be worse or better than expected, the prices reflect the surprise. The prices also reflect the relief that the unemployment figures are not worse off.

Be Careful of Investing Based On Headlines

What investors need to realize is that:

- Real-world events today you read in the headlines may not affect the stock market today

- In investing, it is not always that if Event A happens, and Event B also happens, then the market reaction will be C

- In the short term, there is much noise in the markets. The market is a voting machine

- In the long term, the market is a weighing machine

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s First Fee-only Wealth Advisory Firm.

–

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.