We just concluded our last Retirement Weekend here at Providend. At this event, we explain the holistic considerations that many may not have considered when they are near retirement.

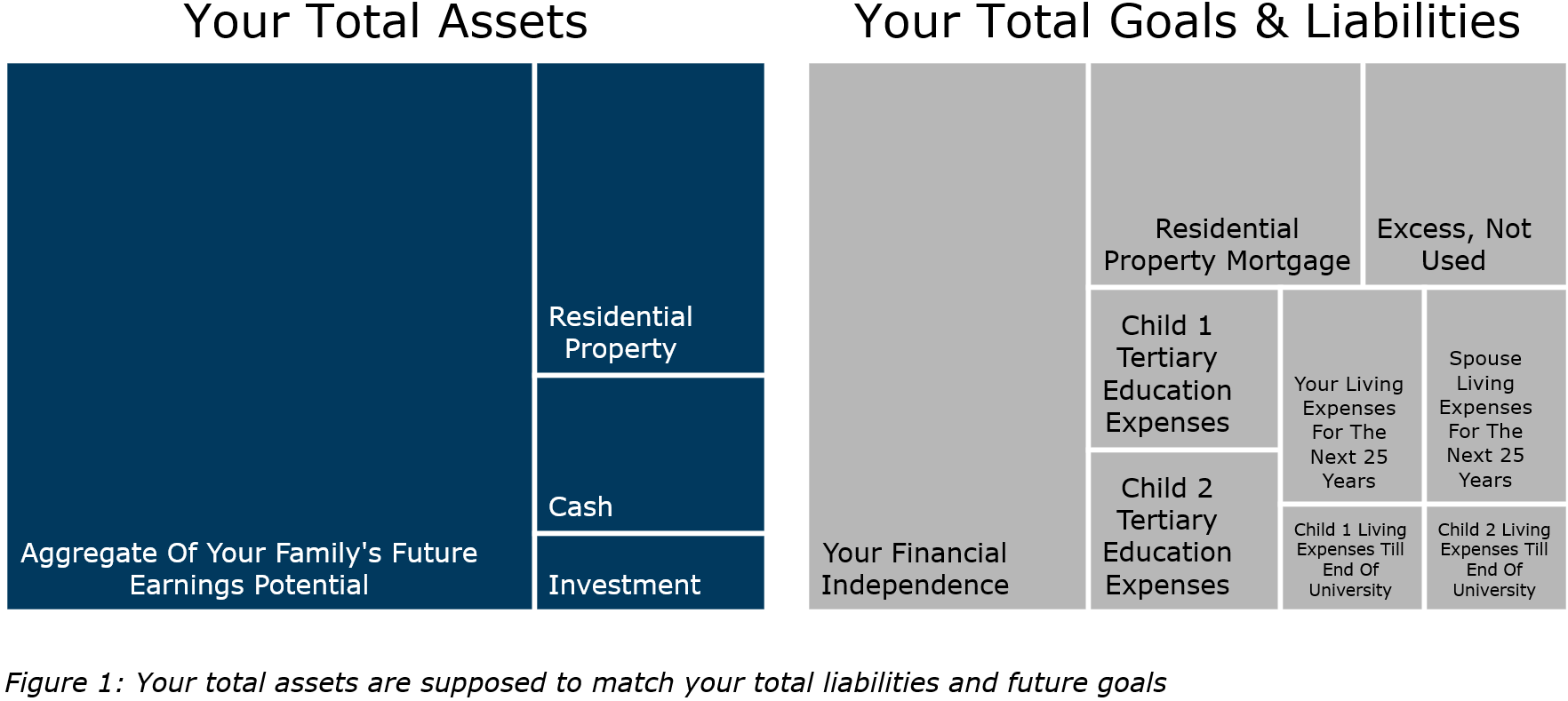

One of the feedbacks that we have received about the Retirement Weekend was that not a lot of talks explained how to conceptualize the various assets and cash flow that we all have. Over the course of 15 to 25 years, it is not uncommon to have accumulated many kinds of financial assets.

You can keep accumulating assets, but has anyone ever shared with you a plan for how all these financial assets pieces together?

A lot of our clients come to us because they could not resolve all the financial assets which they have accumulated along the way.

They do not know whether they have enough for what they need.

Some do not know what they need, let alone whether they have enough.

That is probably a story for another day.

One other fixation we observed is on returns. In this case, what is the compounded average return your investment nets you? Investors pit what they should invest next in, against the compounded returns of their existing investments, or something out there.

When they evaluate what we proposed to them, they would ask “How does this fund compare to XXX?”. If not, some months later, they will indicate an interest in investing in a certain fund and ask whether that is a good idea.

At Providend, we think investment returns are important, but not in the way most think.

Your Goals and Liabilities Drive Many Things

In an article by The Business Times on 16 November, Giuseppe Ballocchi explains that investment professionals should try to provide a return that matches their client’s mission and purpose. Giuseppe is a CFA holder who is a partner at Alpha Governance Partners, specializing in derivative strategies, and sits on a few investment fund boards.

Giuseppe advises investment professionals to design investment plans that meet an investor’s needs and achieve “unique client-directed results”. “Unique client-directed results” is a big phrase but essentially it means that every of your client has unique needs. Every investment professional should need to conduct a detailed analysis of the client’s situation and work out what assets the client has, and what are the client’s goals and liabilities.

“What matters is the focus on the individual client, not generating superior returns, especially in the short term. Portfolios built from beta and alpha components – often by bringing together asset allocation and manager selection – have not served end investors well because they do not directly relate to their objectives.”

Goals-based investing, in essence, allocates assets to match your goals and liabilities.

The rate of return you will eventually earn, may not be what it is projected. If there are no feasible and reliable way to meet the target again, then it may be necessary to either:

- adjust ambitions downwards, or

- increase available assets

The risk to you should not be negative returns on your fund but on not covering your liabilities or goals.

Giuseppe thinks that this will help to shift the client’s perception of risk and would be easier to understand as well.

Effective goals-based investing requires a deep understanding of clients. This provides a sound basis for the adviser/client relationship. Clients are not likely to be disappointed over the long term when they are not promised superior returns and won’t rely on them to achieve their objectives. If they end up beating the market, so much the better, but that’s the icing on the cake rather than the primary value proposition.

Benjamin Graham’s words of wisdom come to my mind: “If the reason people invest is to make money, then in seeking advice they are asking others to tell them how to make money.” That idea has some element of naivete. Businessmen seek professional advice on various elements of their business, but they do not expect to be told how to make a profit. That is their own bailiwick. When they, or non-business people, rely on others to make investment profits for them, they are expecting a kind of result for which there is no true counterpart in ordinary business affairs.

If we assume that there are normal or standard income results to be obtained from investing money in securities, then the role of the adviser can be more readily established. He will use his superior training and experience to protect his clients against mistakes and to make sure that they obtain the results to which their money is entitled.

“It is when the investor demands more than an average return on his money, or when his adviser undertakes to do better for him, that the question arises whether more is being asked or promised than is likely to be delivered.”

What Giuseppe said is not new to us. At Providend, our clients have benefited from this way of planning over the years. It is just that often, the noise in the media have refocused our clients back on to returns only.

If you evaluate our ability purely based on returns, then we have to honestly admit that we may not be the best in the business.

But our value to clients is more than that because all of them have a unique required rate of return.

I call this “a well-fitted rate of return”.

What a Well-Fitted Rate of Return Means

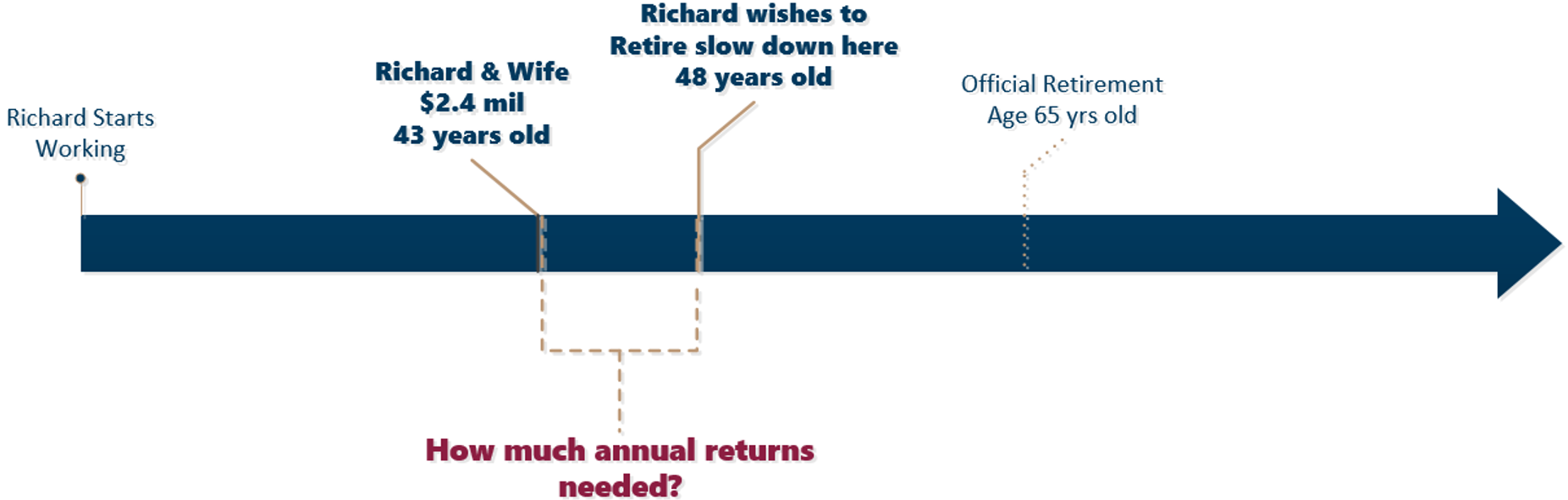

Richard and his wife have built up $2.4 million in investable assets.

This is in the form of cash, managed investments, investment property, net of the mortgage on their investment property. He works as a Director in financial services and his wife works as a marketing executive. They bring in a combined $280,000 a year before taxes and $230,000 after taxes.

Richard is 43 this year and would like to see if he can slow down at 48 years old.

If we do not respect the client’s goals and objectives, we would choose to put Richard and his wife in our portfolio that generates the greatest returns, which is the Index+ Equity Portfolio.

By going through a detailed discovery session with them, we have uncovered a few things:

- The family’s annual expense when Richard reaches 48 years old is estimated to be closer to $50,000 a year

- Richard’s wife has always been rather conservative. On the other hand, he has seen this kind of things daily in his work, but he does hold a more balanced tolerance to risk

- The family has nearly a 70% savings rate (after-tax income – expenses) /(after-tax income)

The key thing for Richard and his family is that even with $2.4 million, given their frugal lifestyle, they do not need to grow their money at all. Even at 0% rate of return, their annual expenses, adjusted for inflation would constitute only 2.4% of their net wealth today.

A conservative portfolio, or a balanced portfolio, looks more appropriate given that both lean towards people who are not so willing to take a risk. Moreover, their time horizon also shows a lack of ability to take the risk.

A focus on returns may jeopardize Richard and his family’s life. A high return fund exposes Richard and family to higher volatility assets. In the short term, the returns may vary from +20% to -20%.

Even if their portfolio becomes $1.2 million, their family’s retirement income may be more or less intact. However, $1.2 million may not last for a 50 years’ retirement duration with high certainty.

The worst thing for Richard and his wife is to see their hard-earned assets be cut in half when they are not comfortable with such volatility.

Returns are important. But we build our wealth so that we can live the kind of life we desired. If you focus too much on the returns, and not how everything fits together, perhaps you have failed to see the big picture.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s Fee-only Wealth Advisory Firm.

For more related resources, check out:

1. Elements Of Wealth And How It Is Built | Investment Series

2. Client Case Study: Pursuing A Work Optional Life

3. How We Ensure Reliable Investment Returns for Your Retirement

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.