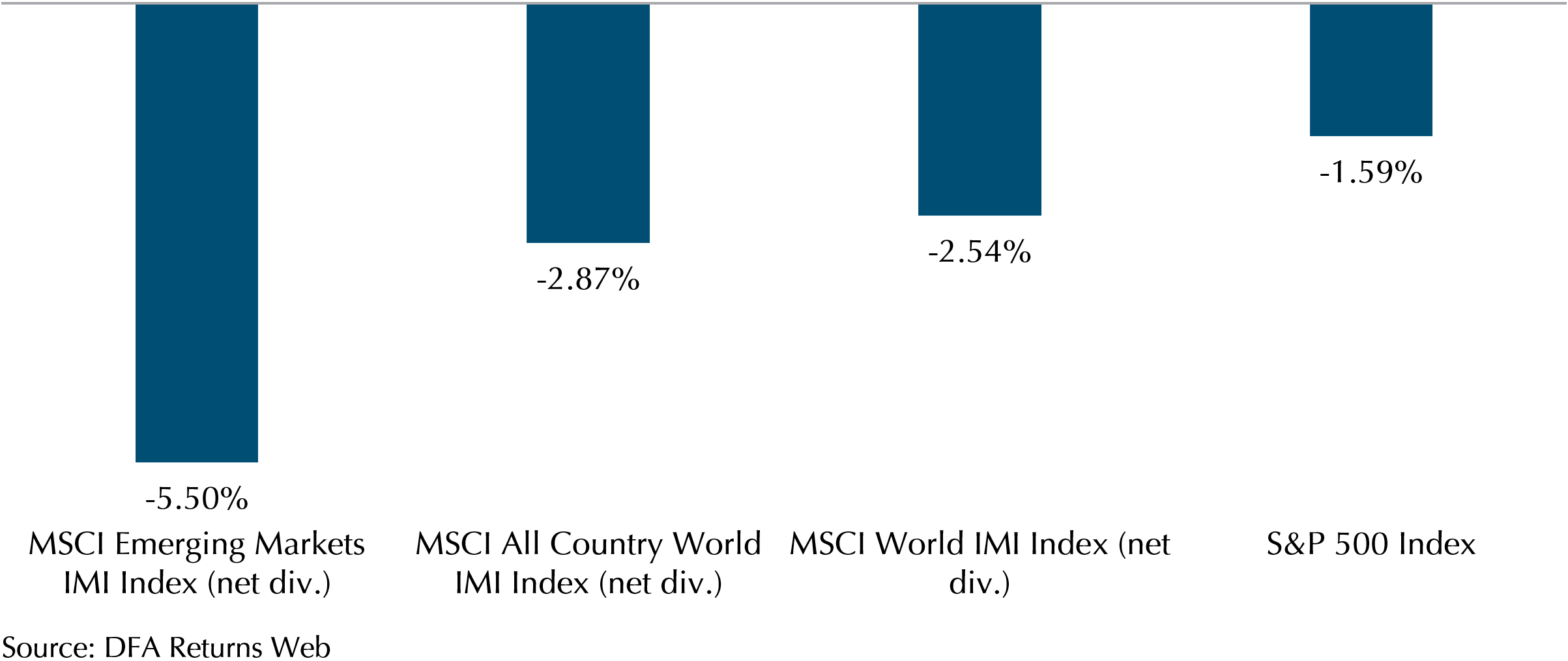

In the year 2023, volatility has been far from absent. Following the market’s rally in July, the equity market experienced a downturn, primarily attributed by a substantial drop in major technology firms during August. Both the MSCI All Country World IMI and the MSCI World IMI indices saw declines surpassing 2%, while the S&P 500 Index recorded a dip of 1.59%. The MSCI Emerging Markets IMI suffered an even more pronounced plunge of 5.5%, attributed by a fragile macroeconomic outlook and the resurgence of apprehensions surrounding China’s real estate sector. This added to the strain on the Emerging Market Index, highlighting the stark contrast between the inflationary concerns gripping much of the world and China’s struggle with deflation, as reflected in its weak economic data.

Exhibit 1: Equity Market (Index) Performance August 2023 (In USD)

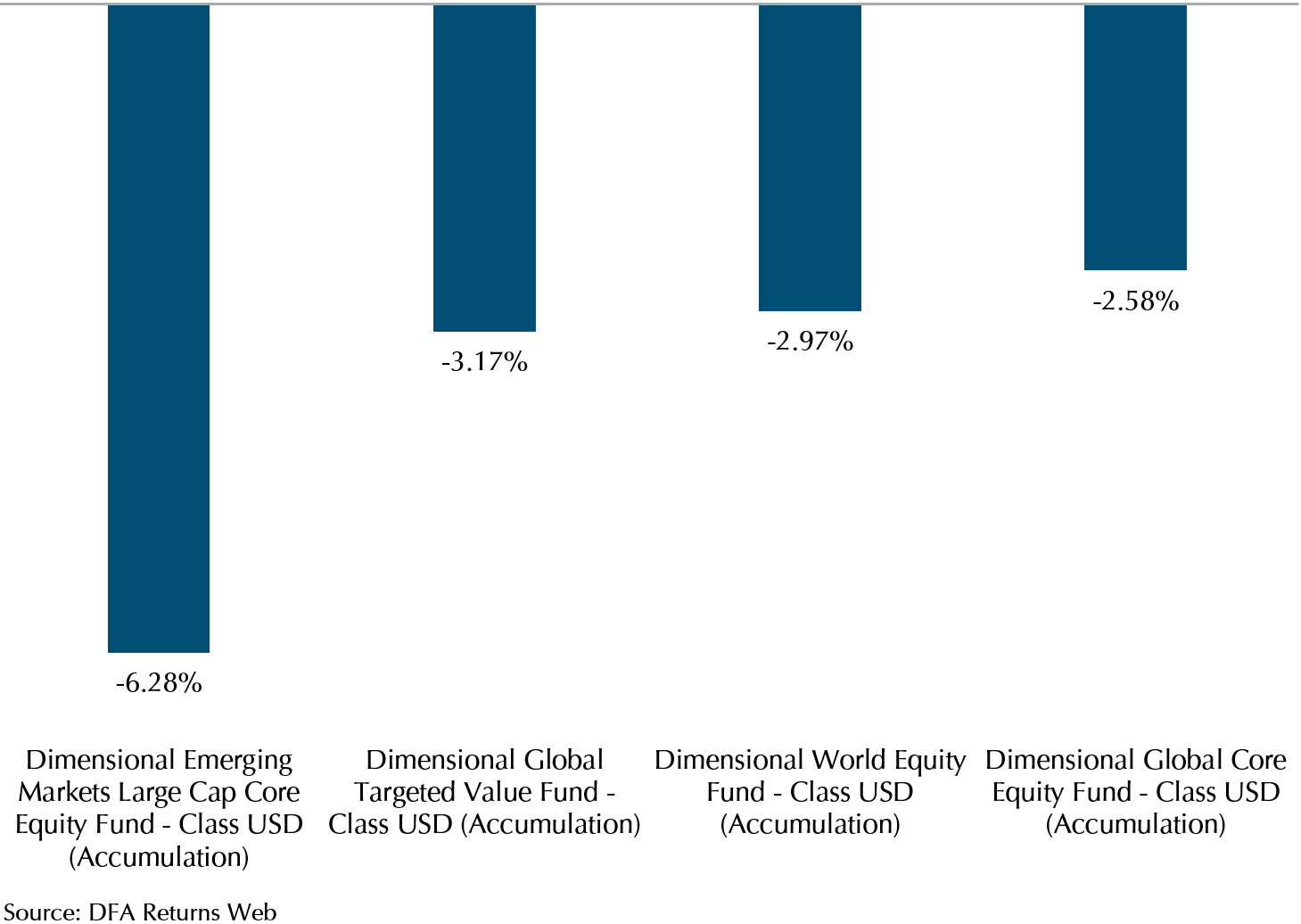

Turning our focus to the Dimensional funds, post the notable performance in July, the Dimensional Global Targeted Value, Dimensional World Equity, and Dimensional Global Core Equity funds experienced a somewhat larger decline compared to the market benchmarks. Particularly, the Dimensional Emerging Markets Large Cap Core Equity fund saw a significant drop of 6.28%. Nevertheless, when considering the year-to-date performance, the Dimensional Emerging Markets Large Cap Core Equity fund continues to surpass the MSCI Emerging Markets IMI Index, boasting a 6.88% return, while the MSCI Emerging Markets IMI Index stands at 6.07%.

Exhibit 2: Dimensional Equity Funds Performance August 2023 (In USD)

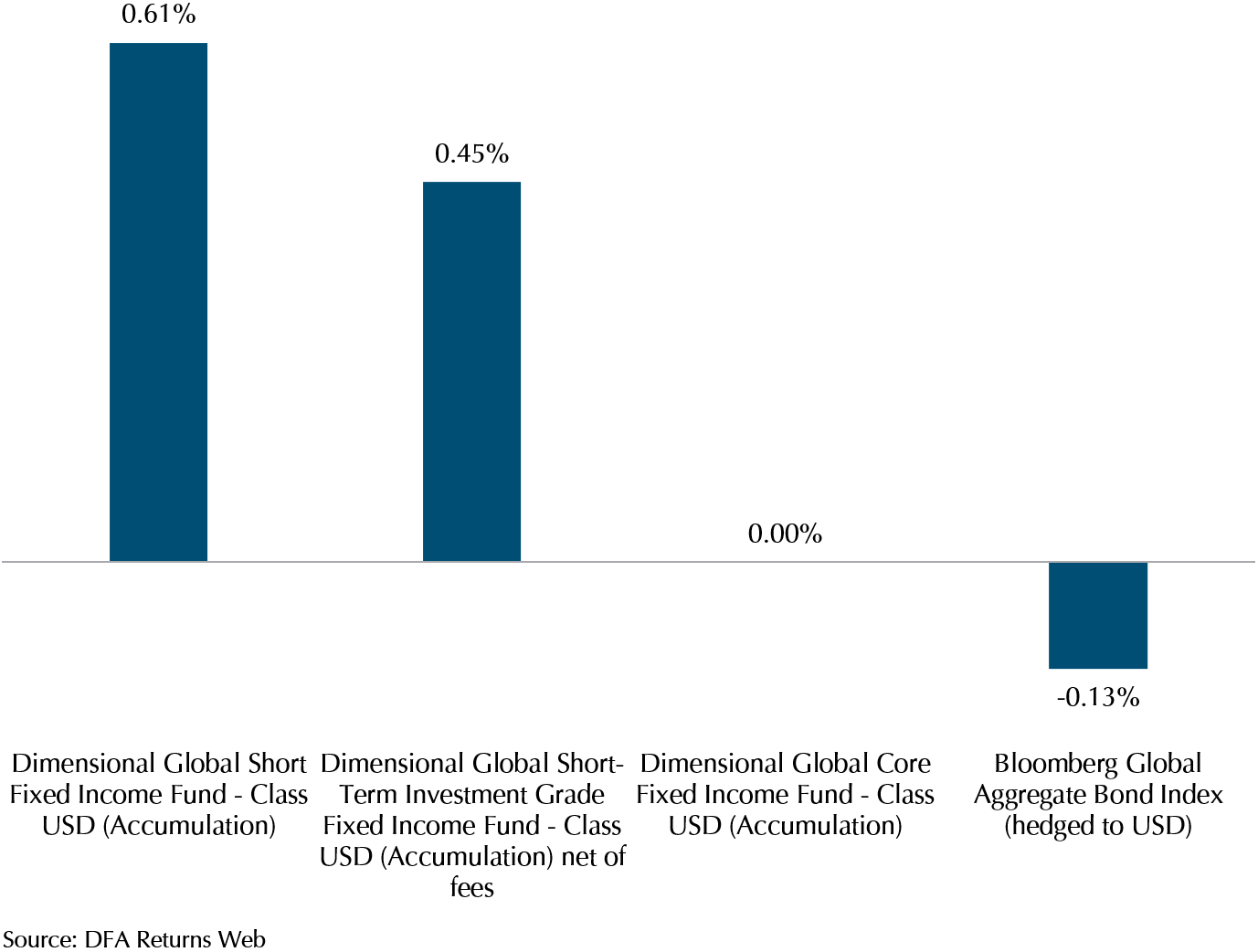

Dimensional’s Fixed Income Resilience Amidst Market Volatility and Inflation Uncertainties

In the midst of a negative performance in the equity market throughout August, Dimensional’s fixed-income funds shone brightly. Despite the Bloomberg Global Aggregate Bond Index experiencing a slight decline of 0.13%, the Global Core Fixed Income fund outperformed this benchmark, yielding a return of 0%. Conversely, both the Dimensional Global Short-Term Investment Grade Fixed Income and the Dimensional Global Short Fixed Income funds delivered commendable returns of 0.61% and 0.45% respectively. These fixed-income offerings, particularly those from Dimensional, continue to fulfill their crucial role in acting as a protective cushion, mitigating the impact of an equity downturn on our clients’ portfolios.

At the Jackson Hole Economic Symposium, Jerome Powell, the Fed Chair, recognised that although there are indications of inflation easing, it still exceeds their 2% target. Moreover, he emphasised, “We are navigating by the stars under cloudy skies,” underscoring the unpredictable nature of US inflation. His remarks indicate that the Fed is maintaining the option of raising rates and may do so if inflation indicators deteriorate. While the market grapples with the aftermath of one of the most substantial rate hikes in U.S. history, inflation persists in exerting a powerful influence on market dynamics causing volatility. This increased volatility further underscores the importance of a diversified portfolio, where the stability offered by fixed-income investments, as demonstrated by Dimensional’s funds, becomes invaluable in weathering the uncertainties of the current market landscape.

Exhibit 3: Dimensional Fixed Income Funds vs Bloomberg Global Aggregate Bond Index Performance August 2023 (In USD)

China’s Deflation and Property Sector Challenges

As global markets contend with escalating prices; China faces a different economic challenge – deflation. Despite the Chinese government’s stimulus measures aimed at bolstering consumption, the Caixin/S&P Global services purchasing managers’ Index (PMI), a pivotal gauge of China’s economic health, dipped to 51.8 in August, down from July’s 54.1. This represents a significant shift, as a PMI score below 50 denotes a contraction. Consequently, China’s services sector witnessed its most sluggish growth of the year. The Caixin/S&P’s composite PMI which reflects China’s manufacturing and services activity also fell to 51.7 in July from 51.9. Additionally, China’s “revenge spending” – a term that defines consumers’ sudden sharp increase in spending after release from covid lockdown, did not materialise. Its retail sales growth faltered from 12.7% in May to 3.1% in June while July was at only 2.5%. These data reflect weak sentiments in both consumers and businesses in China.

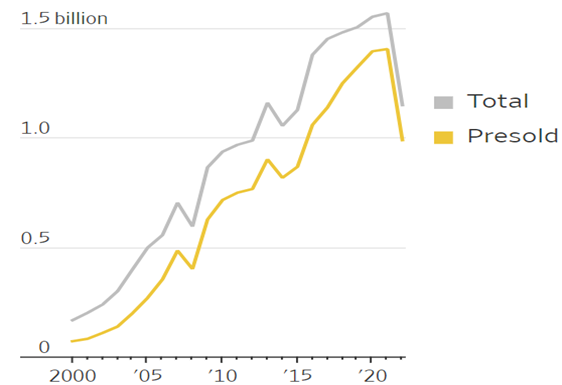

At the same time, China’s property sector is also seeing a resurgence of woes since the Chinese government implemented reforms that negatively impacted developers to curb rising house prices in 2021. As major financially strained developers like Evergrande started failing to meet their commitments to households, buyers reacted by withdrawing from the market and reducing their debt burden. The impact on the demand for property can be seen in Exhibit 4 which sees a sharp drop in residential floor space sales since 2021 China. In fact, individual residential mortgage debt outstanding saw a direct decrease of 200 billion yuan, equivalent to approximately $28 billion, in the first half of 2023. More recently, one of China’s largest developers, Country Garden, narrowly dodged default as the company grapples with liquidity issues. The real estate sector contributes about 30% to China’s GDP, and a deterioration in that sector can have a devastating effect on the Chinese economy.

Against the backdrop of all these uncertainties in China, equity markets, particularly those in the emerging market, may experience heightened levels of volatility in the near future. Nevertheless, the Chinese government is vigilantly observing the developing conditions in both its economic growth and property sector and is prepared to enact measures aimed at maintaining economic stability.

Exhibit 4: Residential Floor Space Sold in China, Square Meters

Markets Continue to Show Opportunities

While there are undoubtedly challenges on the horizon, there are also positive news for portfolios. Inflation rates in the US, Europe, and the UK are showing signs of moderation. This has led the market to factor in a potential halt to interest rate hikes by the US central bank, which could alleviate the burden of escalating borrowing costs for businesses. Concurrently, the developed world’s economy remains robust even in the face of rising interest rates. These indications of resilience in both the developed economy and its business environment suggest that, despite existing uncertainties, the equity market is likely to maintain its historical track record of delivering a yield premium over treasuries over the long run.

Furthermore, ongoing technological advancements and innovative solutions continue to boost productivity and create new avenues for growth. For example, Artificial Intelligence (AI) has exhibited substantial potential in revolutionising sectors like healthcare, banking, and transportation. These opportunities also present potential upside for equities, particularly if AI contributes to improved business productivity and, consequently, earnings growth for equities.

As economies continue to display resilience in an ever-changing environment, there is a basis for confidence that markets will uncover innovative strategies to flourish amidst challenges, just as they have consistently done in the past. This is evidenced by the positive year-to-date returns in market equities.

At Providend, our commitment to vigilance in managing your portfolio remains unwavering. We are dedicated to steering your investments towards achieving your financial goals, even in the face of evolving economic landscapes.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.