A week ago, I was in Guangzhou to participate in a closed-door meeting with the Chinese investment advisory industry leaders and government officials. I also gave a keynote speech to their investment advisers and then took some media interviews. Throughout these sessions, the key concern was how investment advisors can help clients weather through this volatile period in the Chinese market and help them get the needed returns.

But this isn’t just a China problem. In the past five years, the world has gone through the global COVID-19 pandemic, witnessed the Russia-Ukraine as well as the Israel-Gaza wars, experienced a high inflationary and interest rate environment and now, tensions between Israel and Iran. If investors cannot stay invested through short-term volatility, they will not be able to reap the long-term rewards.

I have written and spoken much about the philosophy of sufficiency in wealth planning and investing since 2010 and saw how it has helped investors go through uncertainties and get their required returns. I define sufficient returns as the returns investors need (not want) and can reliably achieve to enable their non-negotiable life goals.

Investors and their advisers should start by examining empirical evidence to determine the asset classes that can reliably give long-term expected returns. For example, global equities and bonds are reliable whereas cryptocurrency is not.

Next, scientifically and conservatively work out the estimated expected returns from these asset classes. Once investors are clear on their non-negotiable life goals and the amount of money they need to achieve them, they would be able to work out their returns need. Their advisers can then put together a mix of asset classes (a.k.a. asset allocation) with the estimated expected returns that matches their investors need. The volatility of curated portfolio must of course be one where the investors are able and willing to stay invested for the long term. Investors’ willingness to take risk is largely influenced by their relationship with money, something I shared in the most recent WealthBT podcast.

But what kind of instruments should be used to execute the asset allocation to give investors the returns in the most reliable manner?

Fund managers as well as financial advisers often sell funds to their clients based on their past performances. But as the saying goes, past performance is no indication of future results. In addition, fund performance and what their investors actually achieved can be quite different.

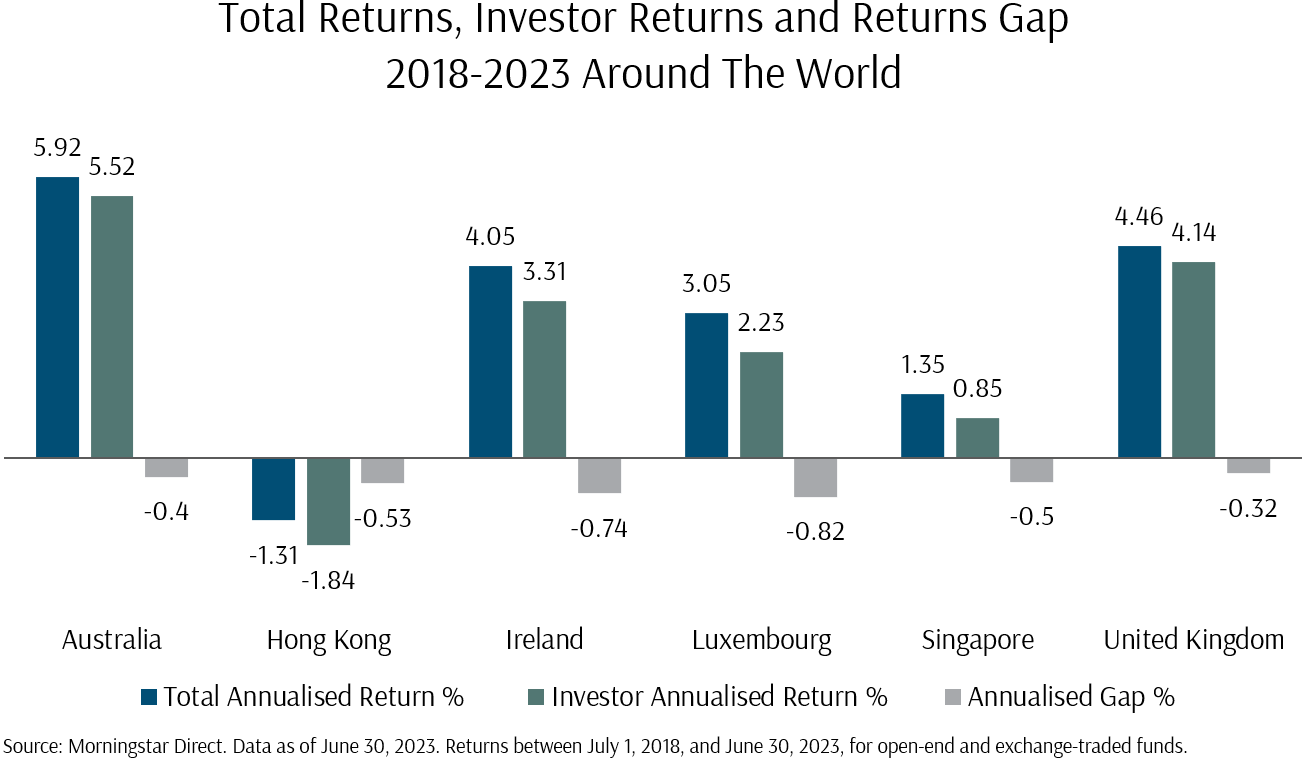

The Morningstar Mind the Gap (MTG) 2023 study which started its first edition in the US in 2005 looks into this “gap” between investor returns and fund returns. In the 2023 – Investor Returns Around the World study, Morningstar looked at how investors in six key fund markets around the world have done in the last five years.

The study contrasts two types of returns to find the “behaviour gap” between them. Total returns reflect the growth of a fund’s value between the start and end of a period. Investor returns show the effect of buying and selling of the fund during the same period. In the chart below, you can see that in all six markets, investors suffered a negative returns gap, i.e. they did worse than the actual fund performance.

In terms of returns gap, you can see that funds domiciled in Ireland and Luxembourg did the worse. Morningstar pointed out that it was because funds in these two domiciles serve a broad range of investors from Europe and Asia, where funds are sold to retail investors based on a retrocession model (i.e. financial advisers collect trailer commissions). This can lead to funds being sold based on the commissions distributors/advisers receive rather than their value for investors. In terms of the returns gap as a percentage of total returns, Hong Kong (41%) and Singapore (37%) did the worse. Investors in Australia and the United Kingdom suffered the smallest gap during this period. Morningstar observed that these two markets are characterised by more holistic financial advice than the other markets included in the study, where funds are sold often as isolated products. Our own experience with our clients is that with holistic advice, they are better able and willing to stay invested and thus the returns gap is reduced. The researchers in Morningstar also noted that across asset classes, the most volatile categories and the most volatile funds within each category typically caused investors to lose more of their returns to the timing of buying and selling.

As an example, in 2020, investors were drawn into the popular energy transition space and saw funds flowed into the iShares Global Clean Energy ETF (INRG). This caused the fund to double through 2020 to over US$ 6 billion in January 2021. After experiencing 140% returns in 2020 (in US$), the ETF experienced two consecutive calendar years in the red and investors stopped investing. As a result, while the fund returns were 17% p.a. over the 2018-23 period, the estimated investor returns were -3% p.a. as most investors had entered the fund only after its strong returns for the fear of missing out (FOMO), just in time to experience the bad returns. This kind of investor behaviour, investing in favoured sectors, regions and themes can be seen in all markets and Morningstar observed that the largest and most pervasive gaps are to be found in the most niche offerings, such as single-country and sector funds.

Morningstar also observed that active managers in equities may change their investment style during different periods which makes them less interesting for a client. Or its portfolio managers may leave, leaving investors with the decision whether to continue with the fund. In this regard, index funds or ETFs are easier to hold on to and thus reduce investors’ temptation to overreact to short-term out- or underperformance. This means the returns gap is narrower. In addition, other studies such as SPIVA research showed that active managers failed to beat their index and for those who do, they don’t do it consistently. This means that the returns gap between an active fund investor and the index is even wider.

From the MTG study, the more reliable way to get returns is to use globally diversified, least volatile, low-cost, non-actively managed funds instead of single-country, region, or a theme sector. The study also concluded that when investors invest based on holistic advice instead of just buying the funds in isolation, they do better.

Recently, someone told me that if she had bought an S&P500 ETF five years ago, she would have done slightly better than our globally diversified equity portfolio. While this may be true, it is not our preferred approach. Our mandate is to reliably deliver sufficient (and not maximum) returns to clients to achieve their non-negotiable life goals. Investing in a single-country index may not be the most reliable because research shows that fund returns do not equal investors’ returns.

The writer, Christopher Tan, is Chief Executive Officer of Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“. He is also a Certified Ikigai Tribe Coach.

The edited version of this article has been published in The Business Times on 22 April 2024.

Being a trusted adviser to our affluent clients for over two decades, we know that our clients need the reliability and sufficiency of investment returns to meet their needs. You can learn more about our purpose-driven approach towards Wealth Management and Investment Management.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.