When I first started my career in the financial services sector in the late 90s, comprehensive financial planning was not widely practised. Most of the time, it was really just product sales. I first learnt how write a basic comprehensive financial plan from some books I found in Hon Sui Sen library in National University of Singapore in 1999. In doing planning for clients, I needed to work out how much clients need for a certain financial goal and how much they need to invest in order to reach that goal. To do that, I would need to assume certain return on investment (ROI) for planning. There wasn’t a lot of guidance back then on how to do so and different advisers used different methods. Some will take the projected returns of an investment-linked policy and back in the 90s, the higher end of the projection was 9% p.a. Others might use the historical returns of financial markets and some others might use the actual annualised returns of the funds they are recommending to their clients as the planning ROI to determine how much clients should be investing. But using these methods to derive the planning return numbers presented a lot of problems.

- The returns that were used for developed market and emerging market equities were not differentiated even though they are different. In a globally diversified portfolio, there is usually an allocation to these 2 markets.

- The past returns from markets or the unit trusts may not be repeated in the future.

- There is cost in using unit trusts, ILPs or even ETFs. Net of their management fees, the returns will be lower. This was not considered in determining the planning returns.

- Whether using direct stocks, bonds, unit trusts or ETFs, there will be platform/custodian cost as well as ongoing advisory. These too were not considered in arriving at the planning return numbers.

- Advisers in the same advisory firm may use different planning returns and so there is no consistency within the same firm.

So when I started Providend in the early 2000s, we decided to be more robust in deriving the planning returns used for constructing our clients’ wealth plan. We first used historical data to estimate the expected returns and risks of developed and emerging markets equities. From these results, we built different portfolios with different allocation to equities and bonds with different expected returns and volatility. We then subtract away all the cost of investing such as the funds’ total expense ratio, the custodian fee as well as ongoing advisory fee that our clients pay us to arrive at the planning return numbers. These numbers are also used by the investment team to monitor if our portfolios are delivering sufficient returns for our clients. However, the challenge of using historical data is that it might not be the best representation of future returns. Thus, we decided to use the Ibbotson-Chen model to derive a forward looking expected return for equities.

The Ibbotson-Chen model was invented by Dr Roger G. Ibbotson and Dr Peng Chen, and was published in the Financial Analyst Journal in 2003. For their work, the inventors won the prestigious Graham and Dodd Awards of Excellence. Although there are different ways to estimate forward looking expected returns of equities, the Ibbotson-Chen model is a robust model in that it is not based on subjective forecasts of market participants. Rather, it is a data focused approach that breaks down the components that contribute to the market returns of equities and use it to estimate their forward-looking expected returns. These components are inflation, current dividend yield of equities and earnings growth. The differentiator of the Ibbotson-Chen model is that it excludes P/E change because P/E is unpredictable and not based on economic outcomes. Also, there is a lot of investors’ expectation on what future stock prices might be that is built into P/E which is something which cannot be quantified.

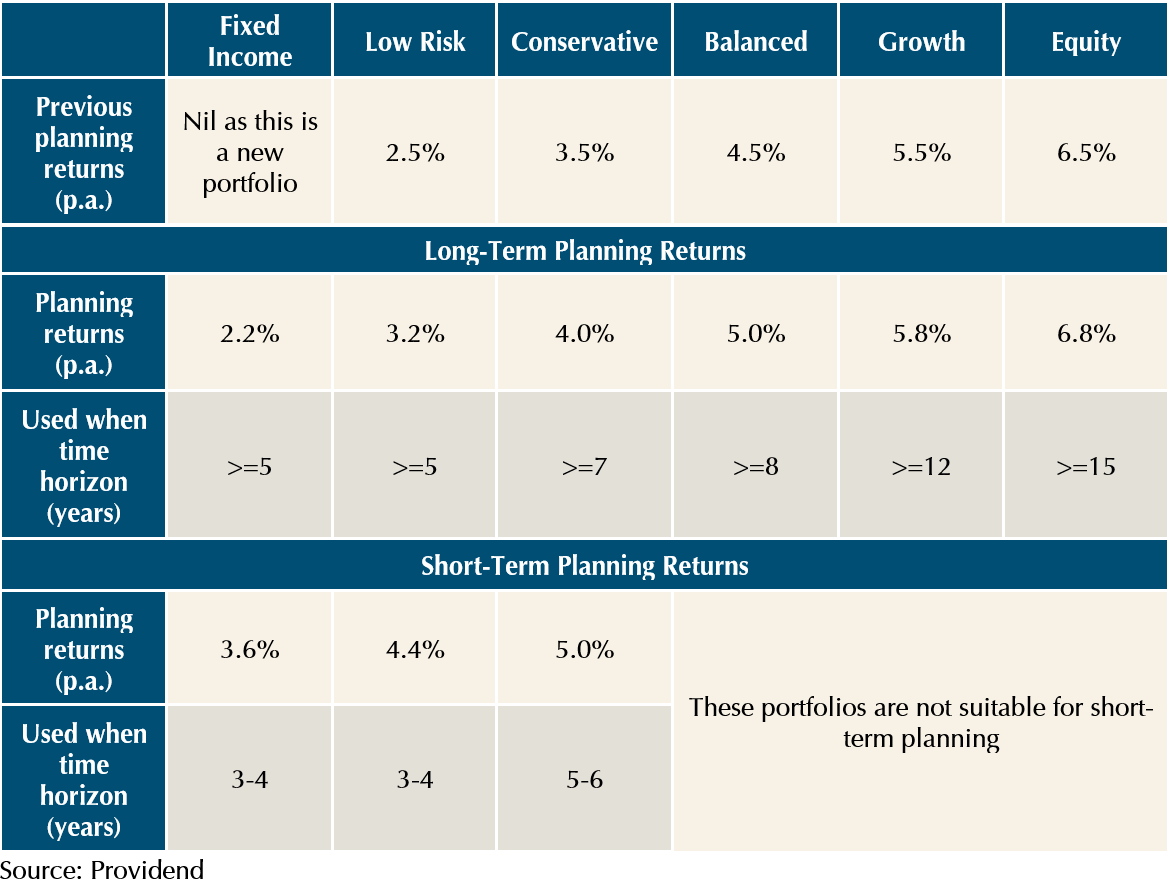

Our investment team worked with Dr Peng Chen to use the Ibbotson-Chen model to estimate a range of expected returns for equities and to be conservative, used the return at the 50th percentile as the returns for our different portfolios of different asset allocation. Similarly, we then subtract all the relevant cost to arrive at the planning numbers (see table). We worked out 2 sets of planning returns. One set for long term planning and another set for short-term planning for the portfolios with a higher weightage in bonds allocation to account for the current higher bond yields.

We are so serious about properly determining the planning returns because they allow our advisory team to determine which portfolio is suitable for clients and the amount they should invest into. Inaccurate planning returns can lead to over or under investing. While planning returns are not our portfolios’ target returns, they are useful in allowing our investment team to know if investment portfolios are delivering the required returns and if not, why.

In a recent public webinar that we did, some attendees asked an interesting question: “what does Providend do after clients invested? If clients are supposed to just buy and hold , then the monitoring should not require too much work?” This couldn’t be more wrong. Wealth planning and investing work hand-in-hand and is not a one-time event. This is because personal circumstances will change, the future world will be different from today and markets have their ebb and flow. This is why besides regular reviews of our clients’ circumstances, regular monitoring of the portfolios’ performances and a constant search for other suitable investment instruments to add into the portfolio to give clients a better investment experience, we have to re-estimate the planning returns on a yearly basis. If the planning returns deviate too much from previous set, then replanning for the clients might be needed.

While staying invested in the right portfolio will give you positive returns in the long run, positive returns do not mean sufficient returns to meet your needs. Being more diligent in the planning and investing process will help you reach your life goals in a more reliable manner.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in The Business Times on 18th September 2023.

For more related resources, check out:

1. Robo-Advisors vs DIY vs Providend’s Fee-Only Model: What’s the Difference?

2. Active Investing That Adds Value to the Client

3. Generating Superior Returns vs Just Enough : Focusing on Your Goals When You Invest

*Providend is very excited to share that we are now ready to extend our service offerings to the younger accumulators who are looking for holistic, independent, conflict-free wealth advice!

For this group of younger accumulators, we know that it is not easy to make retirement planning a priority when other financial goals – buying a first home, for example, or saving for a child’s education – appear more pressing. Learn how we can help here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.