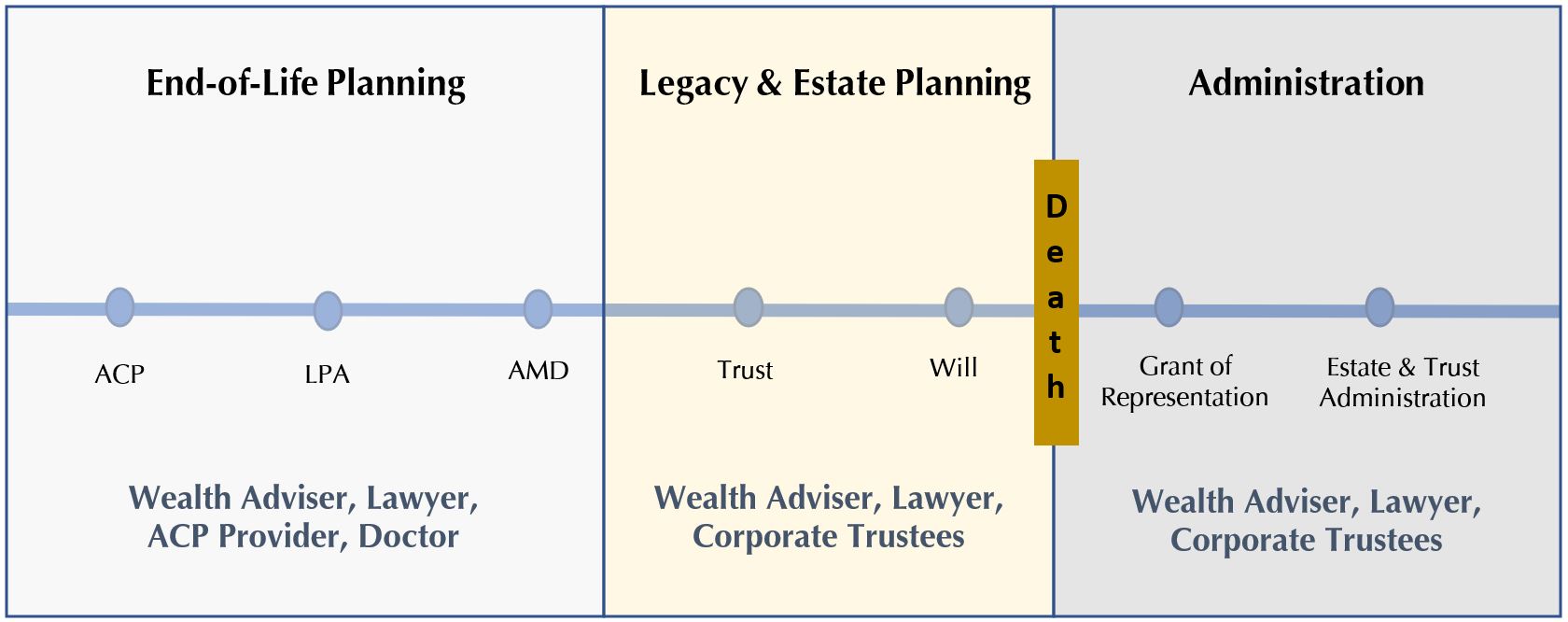

I have a close relative who was recently and suddenly diagnosed with stage 4 cancer. Unfortunately, after one session of chemotherapy, the side-effects caused him to hallucinate and then one night, he fell and fractured his hip. Within a span of a few weeks, his condition deteriorated. He could not feed himself, go toilet on his own to move his bowels and take a shower. He also could not walk and transfer himself from the bed to the wheelchair and vice-versa. Neither could he dress himself. Not only did he lose his quality of life, he also could no longer make sound decisions. The family brought him home from hospital to care for him and this caused a lot of mental stress, physical strain, and misunderstandings in the family. Whilst he has drawn up his will before he fell ill to give instructions on his estate matters upon his demise, he did not make plans on how he would like to be cared for and how his properties should be managed should he be terminally ill or is mentally incapacitated. This part of later-life planning which is commonly termed as “end-of-life planning” is as important as legacy and estate planning (see diagram) but often neglected.

An Overview on Later-Life Planning & the Professionals Involved. (Source: Providend)

An Overview on Later-Life Planning & the Professionals Involved. (Source: Providend)

There are a few areas of planning that my relative could have done before he became so sick. They are:

Advanced Care Planning (ACP)

ACP is the process of planning for one’s current and future healthcare. It helps individuals to communicate to important people and the healthcare team about their values and how these values shape their healthcare preferences. In the event that the individual is no longer able to make decisions or speak for themselves, the ACP guides the decision makers to act in their best interest. If my relative had done ACP, his healthcare received can be tailored to his preferences and values and as such avoid unnecessary and overly aggressive medical treatments. His healthcare team will have a better understanding on the quality of life he expects and can act in his best interest. More importantly, his family can experience less stress, anxieties and be clearer about the decisions to make, especially so when there is a trusted family member (known as the ACP spokesman) appointed by him to make all these decisions. While you can do your ACP with an ACP Provider (ACP Provider Directory can be found at aic.sg), it is more advisable for you to work with your wealth adviser so that he can assist you to reflect on your values, wishes, and even quirks in the context of your wealth plan. This will help you to be clearer and more confident with your choices.

Lasting Power of Attorney (LPA)

LPA is a document that gives legal protection to those who lack mental capacity. The day may come when my relative’s medical condition deteriorates to a stage where he loses mental capacity. If he had done an LPA, his appointed trusted person (known as the donee) can help him make decisions such as how he wants to be medically cared for, run his business as well as manage his bank accounts and real estate. You will realise that there is a slight overlap between LPA and ACP. While the LPA appoints the trusted person, the ACP document provides more clarity on how you want to be medically cared for. Having said that, the appointed ACP spokesman and LPA donee can be the same person. Again, it might be good for you to work with your wealth adviser as you put in place your LPA as part of your wealth plan and if necessary, he can work with a competent lawyer if your LPA needs are more complex.

Advanced Medical Directives (AMD)

One day not too long in the future, my relative may deteriorate to a point where life support may be needed. If that is not what he wants, while he was still of a sound mind, he could have put in place the AMD which is an instruction to doctor not to prolong his life using artificial means (e.g., artificial respirator), where there is clearly no hope of finding a cure. Not only can prolonged life support be expensive, it can also cause physical discomfort to the patient. While having an AMD in place can prevent all these unnecessary cost and pain, it is not a small decision to make. If you want to do it, be sure to speak to your loved ones as once it is executed, they cannot object to AMD being carried out when you are terminally ill, and this decision may cause a lot of pain to them. If you wish to do an AMD, you need to see the doctor for it as one of the witnesses to the AMD must be a doctor.

As I watch my relative suffer in pain and unable to communicate what he really wants, I wonder what his real wishes would be if he had a choice. Would he want to stay at his children’s home, be cared by foreign helpers or would he prefer to be in a hospice instead? How would he want his real estate to be managed and his business handled?

My late father had 5 heart attacks in his lifetime. He died on the last one last year. Prior to his death, he had already done his ACP and made his intentions clear to everyone in my family that he does not want to be put on life support should he suffer another attack. Because of that, my father did not suffer much in his last days and my family remains harmonious today. This is the whole purpose of end-of-life planning. This pandemic has shown us that our health can deteriorate very quickly and unexpectedly. Doing such planning is not so much about planning for our death but rather, after we have done the planning, we can confidently live life knowing that our family will be well taken care of.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in the Money Wisdom Column of The Business Times Weekend on 20th November 2021.

For more related resources, check out:

1. To Live the Good Life, Make Life Decision First Before Wealth Decisions

2. My Reflection on the True Value of Estate & Legacy Planning

3. Critical Illness Coverage – A Critical Need

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.