Critical Illness Coverage, otherwise known as Dread Disease Coverage, is a type of insurance policy founded back in 1983 in South Africa. The coverage was founded primarily and simply with the intention of providing financial protection to individuals following the diagnosis or treatment of an illness deemed critical. Back then, coverage was limited to only four health conditions, namely, cancer, stroke, heart attack and coronary bypass surgery.

We have since come a long way. Today, the schedule of illnesses covered varies across insurance companies and the type of plans which an insurer sells. Some insurers offer coverage only for cancer, while others offer a payout that covers the top 3 diseases in Singapore, i.e., cancer, heart attack, and stroke. More expansive plans cover an extended list of up to 60 conditions and counting.

How should we assess these plans? The Life Insurance Association of Singapore (LIA) maintains a list of 37 severe stage critical illnesses as part of their Critical Illness Framework 2019. This is based on a standard definition, which is important in providing clarity to an assured in assessing if a diagnosed critical illness (CI) qualifies for a valid claim. Clearly defined CIs also make it easier for one to focus on comparing the features (e.g., lumpsum payout vs minimum survival period before a payout is made) of a plan offered by different insurers. So, one can take this as a reference.

The purpose of a Critical Illness Coverage is to provide a lump sum payout in the event of a diagnosis which meets the definition of a valid claim. This lumpsum payout goes towards relieving the assured of the financial stresses of a severe condition where the recovery process may be substantial and prolonged, resulting in one being medically and physically unable to continue working at their previous capacity. Think about a regional sales director whose work requires extensive travelling.

With greater health awareness and the advancement of medical science, some CIs can be diagnosed and treated at an early and even preventative stage before incurring serious financial liability. This is commonly seen in early cases of stroke. As a result, there is demand for protection against early CI.

What is Early CI (ECI)?

Unlike traditional CI policies where claims can only be made upon reaching the severe or critical stages of a CI, the ECI extends the coverage to include patients at the early or intermediate stages. So obviously it will cost more.

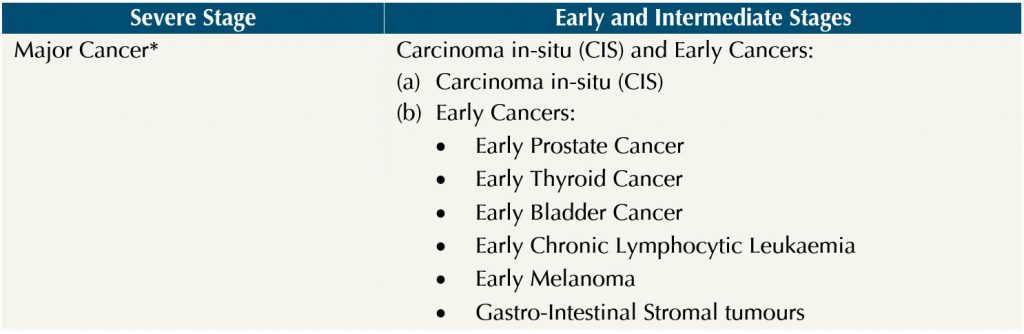

Below is an example of the distinction drawn between the severe vs early and intermediate stages of cancer:

The ECI will pay out a lump sum upon diagnosis of stage zero Cancer Carcinoma In Situ, which is when cancer in abnormal cells have not spread beyond where they first formed. This is as opposed to having a claim that is only considered valid when it is too late – i.e., when the cancer cells are characterised by uncontrolled growth of malignant cells which are invasive and destroy normal tissues.

Planning for Your Protection Needs

At Providend, we look at CI coverage for the purpose of income replacement. Our recommendation is for the payout to be able to cover 2 to 5 years of one’s current income. The amount of coverage to insure for depends on the nature of your work, financial obligation, age, and your financial ability. Because of a higher incidence of claim, the premium for critical illness typically costs more than that of death, total and permanent disability, or personal accident coverage.

The minimum protection coverage one should aim to insure for would be least 2 to 3 years of your income, relieving you of significant worries concerning income loss should you decide to take a break from work, for example to re-assess your life priorities or make the necessary adjustments before returning to full employment.

In addition to this, we will recommend an additional lumpsum of $150K to $250K to cover additional costs that you might incur outside of your inpatient medical expenses. This can be used to alleviate the costs of alternative medication or other miscellaneous expenses, for example, to hire a caregiver. We would usually recommend this additional lumpsum provision to be from whole of life term plans or whole of life plans with limited premium payment that extend coverage to whole of life coverage.

If premium expense is high, another option is to set aside a lumpsum medical sinking fund. This can be conservatively managed post-retirement.

By structuring your insurance this way, you can be more intentional in covering only what is necessary.

As critical illness coverage is for income replacement, the duration of coverage can be until your retirement age. As such, one does not need a whole of life plan where provision is for income replacement objective.

CI Coverage Should Meet Your Needs

Some of you might be wondering: If I already have a comprehensive inpatient medical insurance plan such as an integrated shield plan, wouldn’t it cover the costs of inpatient expended?

In fact, in terms of priority, comprehensive inpatient medical insurance should be the first insurance to buy for both young and old. If the condition is diagnosed at an early stage, treatment will lead to faster recovery and therefore no income will be lost.

If early CI is something you would like to insure against, a sum of $50K to $100K would be sufficient. This could go towards lifestyle expenses e.g., eating organic food or paying towards alternative medication e.g., TCM or just to take a work break.

Just an indication of the premium cost for a male age 35 to 55, ECI premium will be about 2 times higher than that of advance CI. Here I am assuming the tenure of coverage is till the assured is age 65. Another way of looking at this is, if you already have a comprehensive inpatient medical coverage, would you rather have $100K on diagnosis of early CI or $300K payout on diagnosis with major CI should you be medically board out and need a longer time for recovery?

So, if you are on a tight budget, you may want to only look into coverage which is absolutely necessary. Afterall, the purpose of insurance is to Insure and not to make a profit out of a claim.

My Diagnosis: Ductal Carcinoma In Situ

I was diagnosed with ductal carcinoma in situ 5 years ago. The diagnosis came as a shock to me as I am generally a healthy person – I exercise regularly and have breast fed both my children between 2 months to 1.5 years.

My treatment required me to go through a lumpectomy and 30 sessions of radiotherapy. Furthermore, I paid regular visits to the Chinese TCM for alternative treatments to strengthen my immunity. During this period, I also made the personal choice to continue my work as it kept my mind occupied and busy, which I felt was important and beneficial for my own mental wellbeing. Thankfully, I was physically and medically able to do so – for those who know me personally, you would know that I am someone who derives pride and satisfaction from being great at my job.

At the time of this writing, I am on hospitalisation leave as I am undergoing treatment for the relapse of early-stage cancer. While insurance is a product that you buy and hope not to use, I am thankful that the cost of treatment, genetic testing, and doctor’s consultation for a second opinion were fully paid by my inpatient medical insurance.

I am currently insured for 3 years of my income replacement for critical illness coverage. I have also asked myself, in hindsight, what would I have done differently for my own protection coverage? It came down to three things:

- I would have set aside an additional coverage for early CI at about $100K. This goes towards provision of alternative medication and lumpsum provision for expenses otherwise not covered by inpatient medical insurance. This is especially so considering the newer definitions of severe CI coverage, some illnesses may be more difficult to claim.

- I would have layered my severe CI coverage with a cancer-only plan. According to statistics released by the Ministry of Health, cancer is the #1 killer in Singapore, causing approximately 1 in 3 deaths. As the coverage is for cancer only, this would have allowed me to save on premiums paid.

- I would have purchased a multi-pay CI plan. A multi-pay CI plan would have enabled me to make multiple claims for treatment of a relapse or recurrence of an illness. This would give me a peace of mind that my coverage will not drop to zero following a valid claim.

That being said, I am glad both incidents of cancer were detected at the early stages. Where health is concerned, it is important to be vigilant through regular checkups. Early detection also results in better treatment outcomes. It is also important to have a positive outlook and a good support system from family and friends.

This is an original article written by Eleanor Ng, Associate Director of Advisory Team at Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. The Basic Insurance Checklist For Retirees

2. A Stitch in Time Saves Nine – Do Both Annual Health & Financial Screening

3. The Basic Principle of Insurance Planning

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.