There have been a lot of talks about ESG investing recently. Financial institutions have been marketing their ESG investments aggressively to attract investors’ money and there are a lot of expectations that ESG investing is the future and will do well. While it is always exciting from a business perspective to quickly launch the latest theme of the month or year, we took time to research into these investments to find out whether it is just a lot of marketing fluff or ESG investing does gives you a higher expected return.

The term “ESG investing” means using Environmental, Social and Governance factors to evaluate companies and countries on how far advanced they are with impacting sustainability. Once enough data has been acquired on these three metrics, they can be integrated into the investment process when deciding what securities to buy. In order to make an informed decision on whether ESG investing is for us, we first need to consider what is the impact of ESG investing on the long-term investment portfolio’s risk and return. Secondly, we need to examine the broader impact of ESG investing to the overall well-being of the human society beyond pure investment risk and return. Due to limited space, I will just highlight a few of our key research findings to give us a flavour.

Impact of ESG investing on the long-term investment portfolio’s risk and return

NYU-Rockefeller looked at the relationship between ESG and financial performance in more than 1,000 research papers from 2015 to 2020. In their studies that focused on company specific metrics, there appears to be a positive result on either return on equity, return on asset or stock price when a company focuses on ESG. But for studies which focused on whether fund managers are able to consistently pick the right ESG companies, the result is less conclusive, with less than 35% of the studies showing that an ESG focused investment has better performance. In another research, Dimensional Fund Advisors took a look at emissions specifically, across US, developed ex-US and emerging markets, and concluded that emission intensity, emission level or change in emission level does not provide any additional information about future profitability of a company beyond what is contained in current profitability. What this means is that we may not be able to conclude that companies with low emissions can give a higher expected return, even if they can, we cannot accurately predict and pick these companies consistently. In Vanguard’s research, Plagge and Grim took a look at the returns and volatility of US-listed stocks over a 15-year period (2004-2018) and compared them with the FTSE USA All Cap Index. They considered index funds and active funds, funds that use exclusions (means exclude companies that might have negative ESG metrics) and funds that do not (means overweight companies that have positive ESG metrics) and found that ESG funds have neither systematically higher nor lower raw returns or risks than the broader market. While our research shows that there is no direct link between ESG investing and risks and returns, how well an ESG portfolio will do may depend on how the investment process is implemented. This is because, any ESG consideration is similar to adding an investment constraint to a portfolio which will inevitably result in added costs and/or reduction of diversification (as there will be fewer securities in the portfolio). In other words, ESG investing may not improve or reduce a portfolio’s return; but the ESG implementation will likely be costly, thus reducing the portfolio return ultimately.

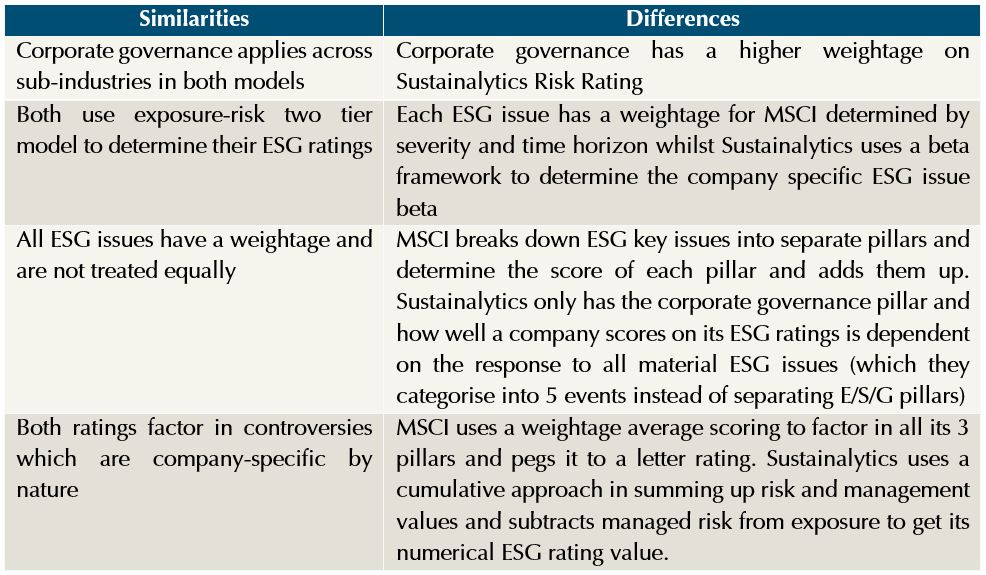

Our research so far reveals that (1) We cannot conclude the ESG companies will give a higher expected return. (2) Fund managers using ESG strategies as their mandate may not consistently deliver higher or lower returns and risks and (3) Cost of implementation matters. One reason for the difficulty in assessing the impact of ESG is also because there are many different ways to assess ESG. To highlight the challenges, we look at the 2 major ESG data providers. MSCI ratings and Sustainalytics (Morningstar). The table below highlights the similarities and differences in how they rate companies on ESG.

Ignoring some jargons, we see the 2 rating agencies have different weights for G (Governance), MSCI has separate weights for each key issue separated in to E, S and G pillars while Sustainalytics considers ESG together. These differences alone, (which are also somewhat qualitative) highlight the challenges of finding consistent data for analysis.

Our research tells us that if we are investing into ESG related investment hoping to get a higher expected return, we may be disappointed. Instead, we should look beyond return on investment, and look towards return on impact.

It is this reason that prompted us at Providend to offer ESG investments to our clients. At the heart of ESG investing, is about promoting positive societal impact and corporate responsibility and hopefully without compromising financial returns. Embedded in Providend’s purpose statement are these 2 phrases:

“We exist to serve our families of clients to fulfil their dreams and achieve their life purpose by providing them with honest, independent and competent advice.

We seek to inspire our clients to first make life purpose decisions before making financial decisions.”

Offering ESG investments to our clients is a natural outflow of our desire to positively impact the world. The lack of space does not allow me to elaborate more about the research but if you are keen to find out, do write to us to join our series of 3 ESG webinars next week. But suffice to say that for investors, ESG investing is more a way for you to express your values rather than to get a higher expected returns. For advisory firms, if we are measured on our ESG metrics, how will we fare? If we do badly, offering such investments may just be another “theme of the month” product offering. There is a disconnect between what we do and what we truly believe in.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation.

The edited version of this article has been published in the Money Wisdom Column of The Business Times Weekend on 18th September 2021.

For more related resources, check out:

1. The Relentless Pursuit of Better Investment Options (Part II)

2. How Providend Helps Affluent Families Have a Good Investment Experience

3. 2 Illuminating Questions to Guide Your Investment Decision Making

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.