The stock market in April displayed high levels of volatility due to multiple factors such as another bank failure, inflation woes, and a decelerating US economy. Despite these issues, the stock market rebounded and ended on a positive note, thanks to the strong earnings report from US firms.

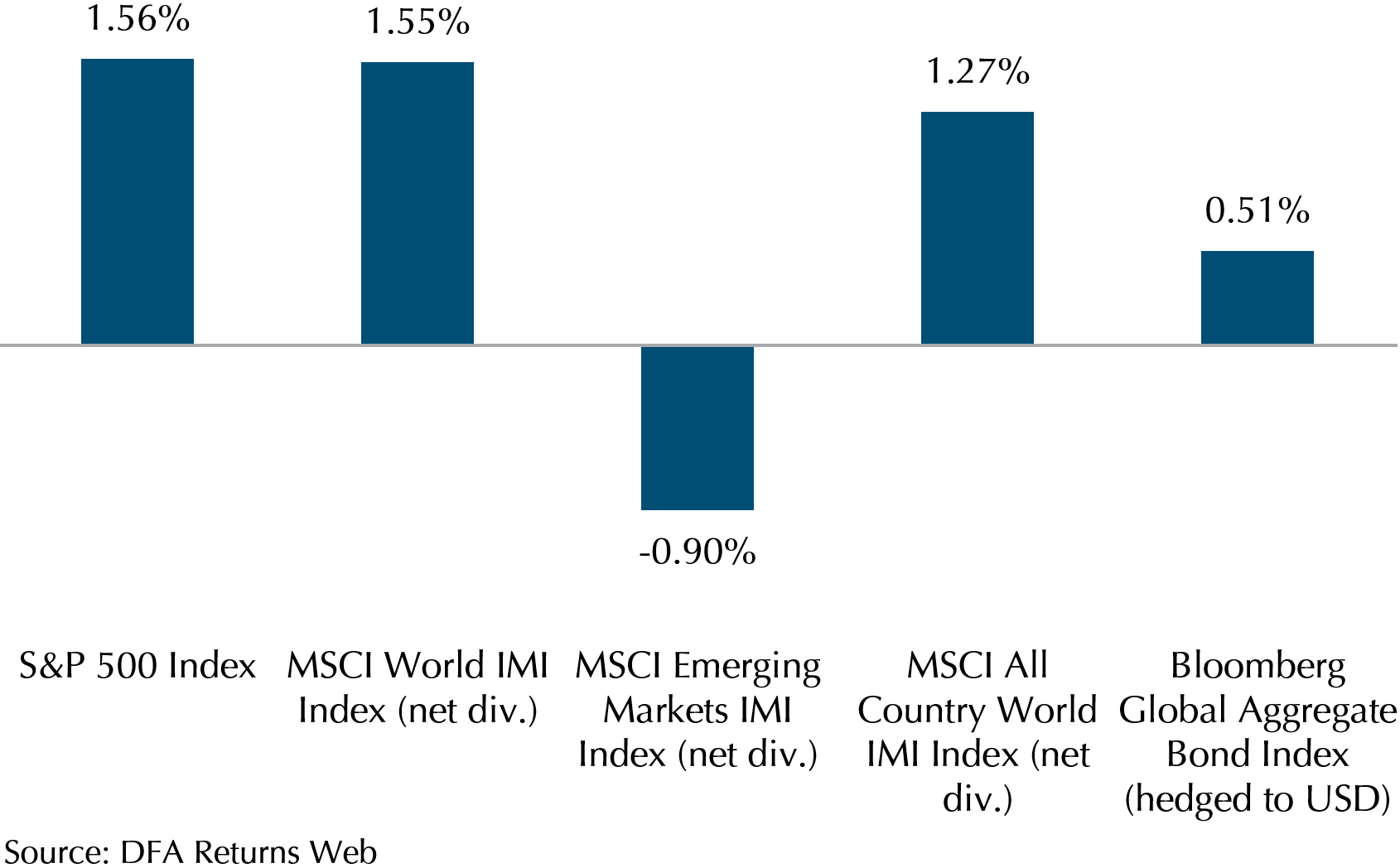

Exhibit 1 demonstrates that the S&P 500, the MSCI World IMI, and the MSCI All Country World IMI indexes all increased by 1.56%, 1.55%, and 1.27%, respectively, in the last week of April.

Conversely, emerging markets fell by 0.90% in April due to increased geopolitical risks in China and other emerging markets that are heavily dependent on exports to China.

The Bloomberg Global Aggregate index, on the other hand, inched up by 0.51% as fixed income provided portfolio support in this time of equity market volatility. In conclusion, despite the wave of negative news, April proved to be a favourable month for both stocks and bonds.

Exhibit 1: Indexes Performance April 2023 (in USD)

A Closer Look at How Our Funds Performed

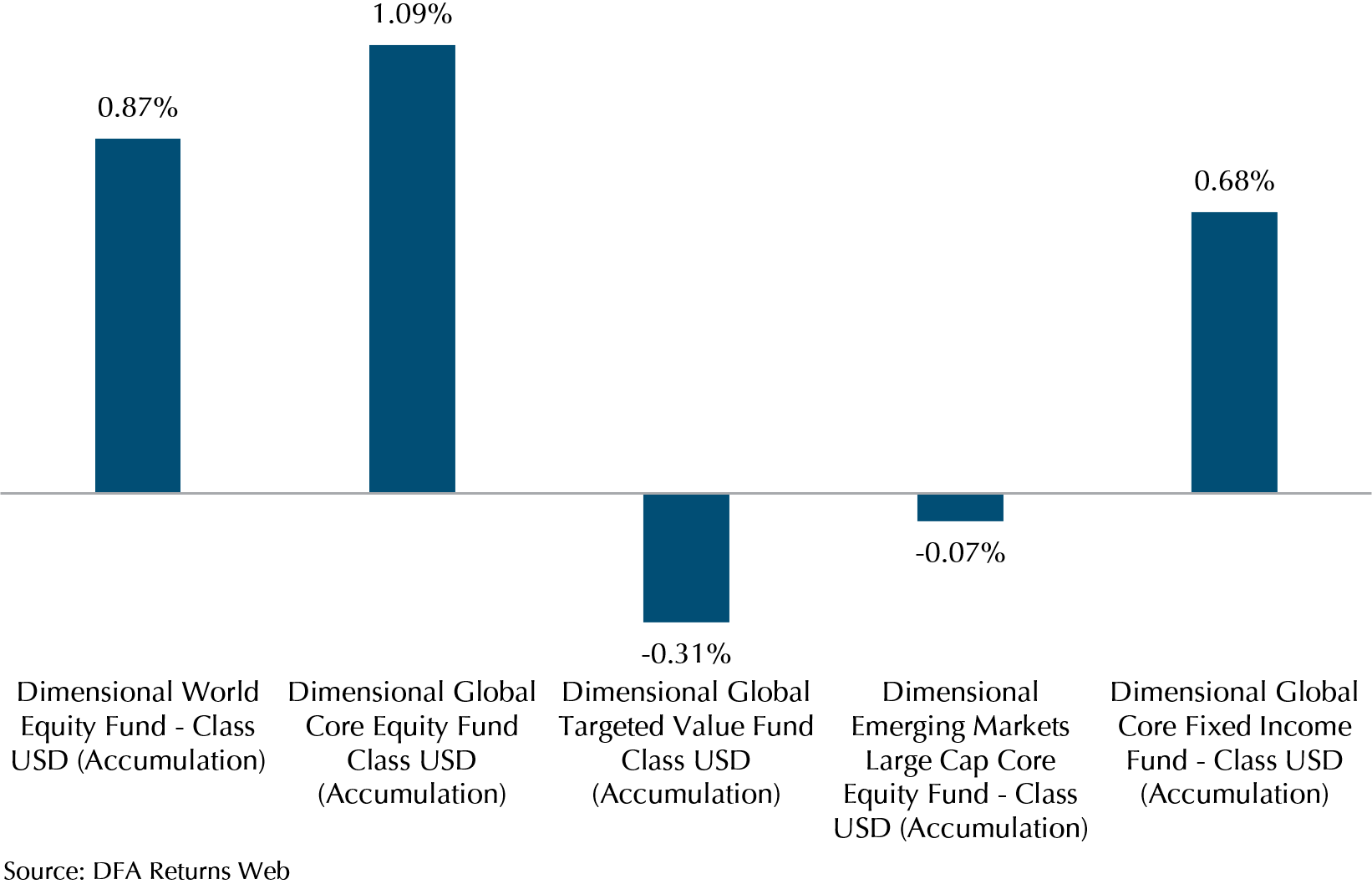

Dimensional equity funds underperformed against the developed market index in April. As shown in Exhibit 2, the World Equity and the Global Core Equity funds rose 0.87% and 1.09% respectively, and the Global Targeted Value fund fell 0.31%. In contrast, the MSCI World IMI index rose 1.55%. The reason is that Dimensional equity funds have heavier weights in smaller-sized US banks which have recently fallen due to concerns about the spread of systemic risks caused by the collapse of First Republic Bank. However, Dimensional funds are highly diversified and have a very small exposure to these impacted banks. The World Equity fund and the Global Core Equity fund hold more than 8000 stocks and have only a 0.006% exposure to First Republic Bank while the Global Targeted Value fund holds more than 4000 stocks and has a 0.034% exposure to First Republic Bank.

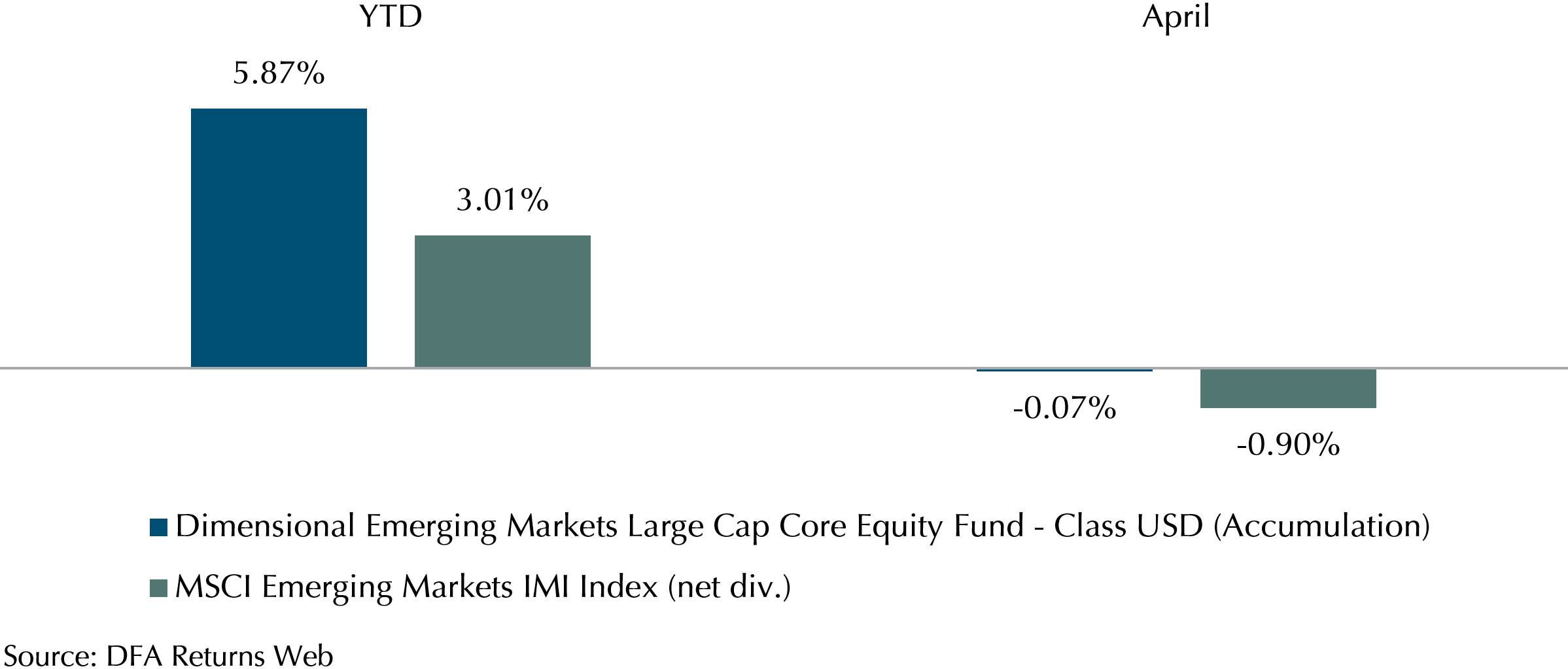

On the other hand, the Emerging Markets Large Cap Core Equity fund was a bright spot on the emerging market frontier, only falling 0.07% in April, as demonstrated in Exhibit 3, and beating the MSCI Emerging Markets IMI index by 0.83%. Year to date 30 April, the Emerging Markets Large Cap Core Equity fund has risen 5.87%, while the MSCI Emerging Markets IMI index has risen 3.01%. A possible reason for this outperformance could be due to the Emerging Markets Large Cap Core Equity fund’s overweight in the energy sector. The Emerging Markets Large Cap Core Equity fund has a weight of 9.24% in the energy sector while the MSCI Emerging Markets has 4.94%. For example, the weight of PetroChina Limited in the Emerging Markets Large Cap Core Equity fund is 0.39% (vs 0.23% in the MSCI Emerging Markets) which has appreciated more than 50%.

The Global Core Fixed Income fund increased by 0.68% for fixed income, outperforming the Bloomberg Global Aggregate by 0.17%. The outperformance is likely attributable to the overweight in European government bonds.

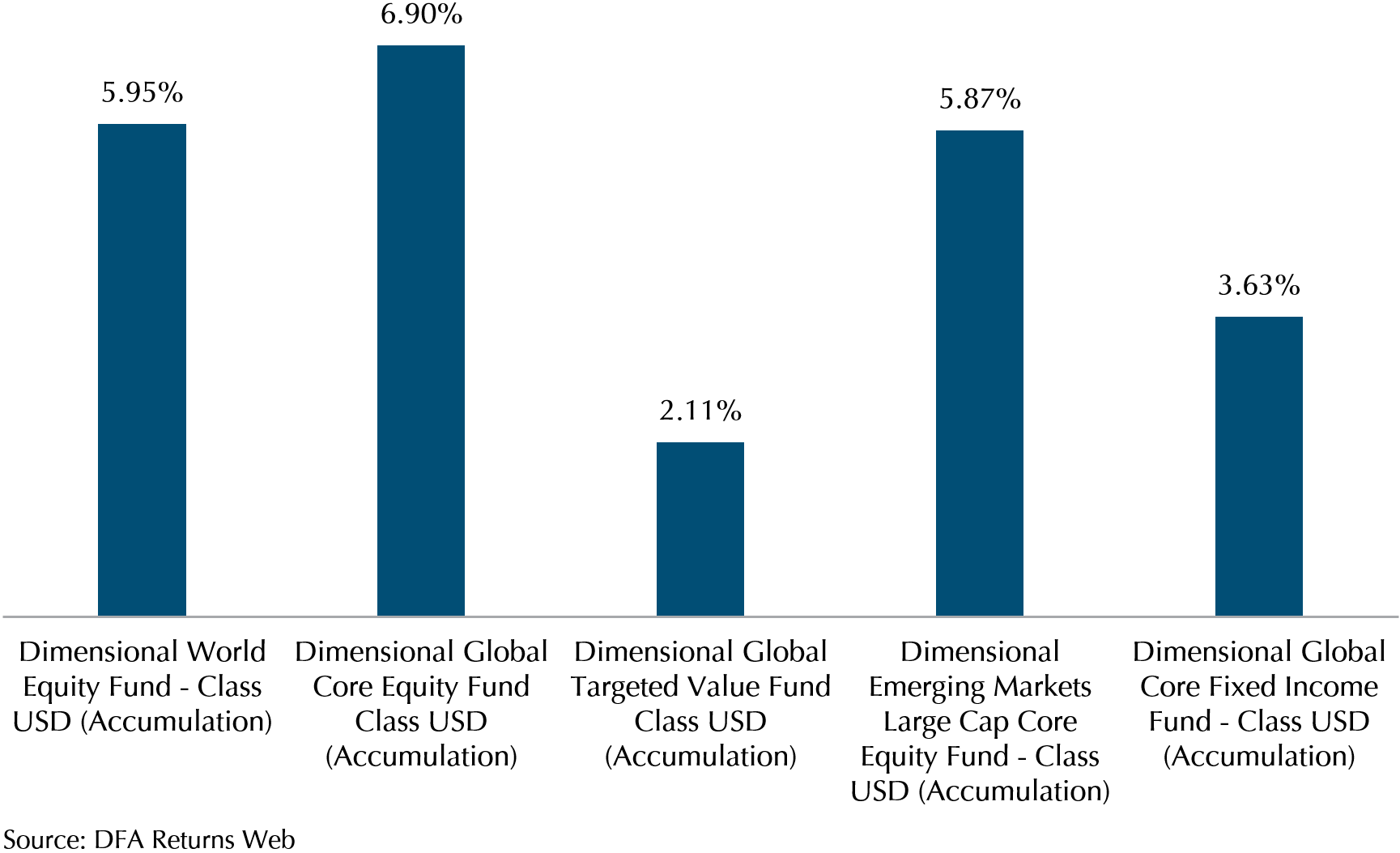

Our funds continue to demonstrate positive returns year to date 30 April, as demonstrated in Exhibit 4. The World Equity, Global Core Equity, Global Targeted Value, and Emerging Markets Large Cap Core Equity funds have delivered returns of 5.95%, 6.90%, 2.11%, and 5.87%, respectively, while the Global Core Fixed Income fund has delivered a return of 3.63%.

In the sections below, we look at the causes behind the volatile fluctuations of the stock market in April.

Exhibit 2: Dimensional Funds Performance April 2023 (in USD)

Exhibit 3: Dimensional Emerging Markets Large Cap Core Equity Fund vs MSCI Emerging Markets IMI Index Performance Year to Date 30 April 2023 (in USD)

Exhibit 4: Dimensional Funds Performance Year to Date 30 April 2023 (in USD)

Why Did the US Regional Banks’ Stocks Fall?

As mentioned in the previous section, our exposure to these banks is very low.

One of the big reasons for the market volatility is because of a fall in US regional banks’ stocks in April. First Republic Bank faced similar problems to Silicon Valley Bank and Signature Bank when the Federal Reserve Bank raised interest rates to control inflation. The rise in rates caused the values of the loans and assets on the bank’s balance sheet to fall.

As the real value of these assets became clear, there were fears that First Republic Bank may fail so customers quickly withdrew their money and investors sold off its shares. Eventually, the bank was bought over by JP Morgan. This incident triggered uncertainty around the health of small, mid-sized US regional banks, leading to a selloff in that sector.

The Market Is Caught Between Rising Prices and Slowing Growth

The US Core Personal Consumption Expenditures, which is the Fed’s preferred gauge, rose 0.3% month on month in March for the second time. Additionally, the unemployment rate fell to 3.5% in March, down from 3.6% in February. As inflation and unemployment data are lagging indicators, this implies that price levels may remain elevated, and strong demand for labour will keep wages and spending high. Consequently, the Fed may need to maintain higher rates for an extended period, tightening the market and impeding economic growth.

In addition, the US economy is already showing signs of sluggishness as the March ISM Purchasing Managers’ Index (PMI), which indicates the economic health of the manufacturing and service sectors, indicated that service growth had dropped to its lowest level in three months. Moreover, the US Bureau of Economic Analysis (BEA) estimated that the US economy expanded by 1.1% in the first quarter of 2023, which is slower than the previous quarter’s 2.6%. This indicates that the US economy is slowing down amid an inflationary environment.

As a result, there may be more volatility ahead as the Fed cautiously navigates the direction of rates, avoiding raising them too high, which could cause a credit crunch and crash the economy. At the same time, the Fed cannot signal that it is soft on fighting inflation, which could cause price levels to spiral out of control. The market will digest forthcoming data, how the Fed will respond to it, and any developments that may arise along the way.

However, despite the pessimistic economic data in April, the market performed positively due to robust earnings reported by US firms.

Positive Earning Surprise from US Firms

In the last week of April, the stock market rebounded with the help of strong corporate earnings. According to FactSet, 79% of S&P 500 companies exceeded earning expectations, which helped offset the renewed struggles of regional banks. The five largest tech companies, Apple, Microsoft, Google, Amazon, and Meta, all reported impressive results, resulting in stock gains of 2.58%, 7.20%, 3.73%, 1.94%, and 13.69%, respectively. The Big 5 tech companies beat revenue expectations on their latest earning report despite a tighter economic environment. As a result of the rally, developed market indexes ended April in the green, indicating that many companies are still able to thrive in an inflationary environment.

Navigating an Inflationary Environment: An Example of How Strong Companies Overcome Inflation and Improve Profit Margins and What It Means for Shareholders

During its earnings call, Procter & Gamble, the world’s largest household goods maker, reported an increase in net sales to $20.1 billion, driven mainly by higher prices on their products. The company was able to pass on inflation to consumers, resulting in a 10% rise in prices across its portfolio of consumer products. Despite a 3% drop in sales volumes, the company’s profit margins improved for the first time in two years. As a result, Procter & Gamble climbed 5.2% in the month of April.

Companies like Procter & Gamble can pass on higher costs to consumers by raising prices on their products. This allows them to maintain or improve their profit margins, despite a drop in sales volumes. To operate in this inflationary environment, companies are implementing productivity initiatives to help offset the cost increases. In summary, strong companies can increase prices and improve productivity by passing on higher costs to consumers and maintaining their profit margins.

By allocating our client portfolios to globally diversified equity funds, we can help clients to achieve their life goals by reducing investment risk and capturing returns from companies with strong pricing power even during an inflationary environment.

Thinking and Acting for the Long Term

The unpredictability of market movements was exemplified in April. An investor who sold off equities in response to news of a slowing US economy and rising inflation would have missed out on the earning rally that occurred during the last week of the month. By maintaining a long-term investment strategy, and holding a well-diversified portfolio, one can capture market returns that ultimately outpace inflation.

Warmest Regards,

Investment Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.