In February 2020, my wife and I decided to take my mom and two-year old daughter on a road trip in Australia. After our own backbreaking campervan adventure in 2019, we had always wanted to experience what it is like to live and travel in a bigger motorhome.

While our first campervan experience has prepared us well for travelling in a motorhome, I realised that there are just some things that you could never imagine you will need to prepare for.

Things like shortage of toilet paper in Australia’s largest supermarkets at Coles and Woolworths.

You see, our trip unfortunately coincided with the period where Australians started panicking about COVID-19 lockdown. My challenge turned out to be more of scavenging for adequate supplies during the Australian trip.

The stock market around the world started to react negatively due to the fear of supply chain disruption, caused by COVID-19 pandemic. While I was on a holiday, enjoying the sunset at Port Macquarie with my family, I was also aware that during exceptional times like this, my role is to help my clients make sense of what is going on and navigate through investing situations like this which they may struggle with.

At Providend, every adviser has undergone rigorous training to reach a level of sophistication in coaching our clients when such an event occurs. This crash was the first major crash I have experienced as an adviser and I came to realise that I needed every ounce of those training, as well as the collective wisdom of Providend’s team of resident specialists to guide our clients to be calm and to stay invested so as to capture the returns.

One year on since the market hit rock bottom, I was glad that all the clients under my care were able to stay invested. I believe you would be able to draw some good learning points from the personal case studies experienced by some of my clients.

“With such fantastic returns after one year, does it mean that I can definitely retire 5 years ahead of my plan?”

The first client I will share began implementing his wealth plan from March to April 2020. Let us call him Steve.

Steve was in his mid-50s when he became our client and has never invested before. To me, it was a remarkable achievement for him to follow through with our advice, to deploy his hard-earned monies into the stock market during such uncertain times.

The market crash added a layer of trickiness to the implementation, which otherwise, would have been a straightforward execution. I am very grateful to him for trusting our process and sticking to the wealth plan we worked on together.

A year later, Steve came in for his annual progress meeting. During the meeting, I presented that his average annualized returns for a mix of 60/40 and 80/20 equity to bond portfolios were at about 25% after one year. Steve was not surprised at all. During the year, he had been monitoring his portfolio value and we have been in touch on a regular basis as he eased himself into this investing journey.

What really surprised him was what these returns meant to his retirement plan.

The fantastic past-year returns, in fact, “put” him 5 years ahead of his retirement goal.

I had no intention to extinguish his exuberance, but at this point, I had to share with him some finer details about how returns are captured in real life.

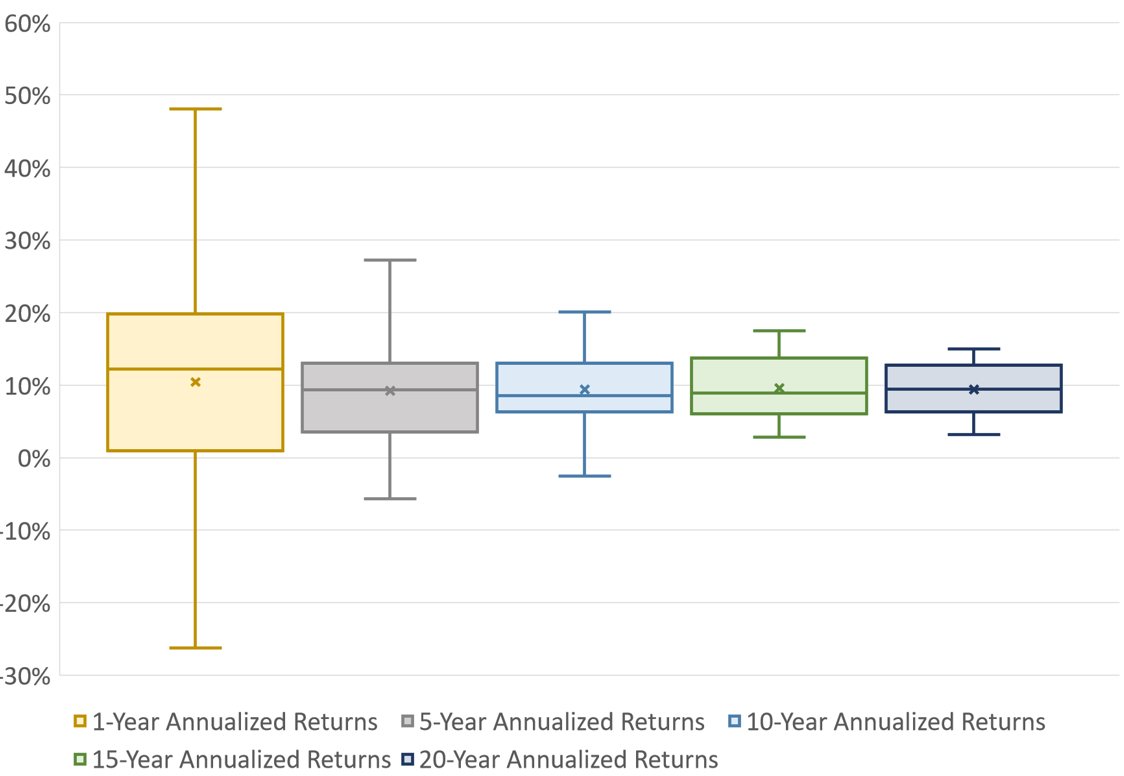

Exhibit 1: MSCI World 1970 to 2020, Range of Annualized Returns Over Different Periods

Imagine that Steve had invested in a 100% equity portfolio that tracks the MSCI World index, which is a broadly diversified index containing more than 1,600 developed market companies.

By tabulating the different annualized returns each Steve will earn, across different time periods, I tried to help Steve visualise time-travelling back to different points of history so he can experience the different market situations.

For example, in the diagram above, the yellow bar shows the range of return ‘different’ Steve will earn across every 1-year period. There were 600 instances of 1-year period from 1970 to 2020. Some Steve would have earned nearly 49% a year, while some unlucky Steve would have lost close to 25% in a year.

The other coloured bars represent ‘different’ Steve living through numerous 5-year, 10-year, 15-year, 20-year periods. While history may not repeat, they do rhyme. By studying rolling returns of a 100% MSCI World, Steve and I can have a strong sensing of the range of returns he could earn.

Steve’s 25% return in a year was fantastic but from the range of 1-Year Annualized Returns, we know it is not abnormal to achieve this within a year. Had he come in at a different time, his 1-year return might be very negative and that would become a negative experience for Steve.

The fact that he is at the upper range is something we can be thankful about.

I further explained to Steve that the longer we stay invested, the narrower will the range of average annualized rolling returns get, and eventually, the higher the certainty of his annualized returns.

What it means to him here is that there is a high possibility that his annualized returns might go lower from here onwards, but his returns will become more reliable if he can stick to the plan to invest for the long term. He might not be able to retire 5 years ahead as he had hoped, but if you ask anyone, his current position is already enviable.

“Do you think that I should cash out now and re-enter when the market goes lower? If I don’t, these are just paper gains. What if the market crashes again?”

In February 2021, I received a phone call from a client who wished to ask for my candid views. Let us call my client Claudia.

Claudia, who is in her mid-30s, was wondering if she should sell her investments and sit out because the market is very “hot”.

We had designed and implemented a 100% equity portfolio so that Claudia can capture the required return to retire in 20 year’s time. She had initiated a lump-sum with us and would be required to add her future surplus from work to the portfolio to reach the financial target. Aside from the money with us, Claudia still had cash on hand that she had not invested yet, right from the start. I believe this amount has been growing as she is a pretty good saver.

Since the start of her investment with us in May 2020, Claudia’s portfolio has grown by 25%.

There are two questions that I discussed with her:

1st question: Should she realise her fantastic gains and wait for another crash to re-enter the market?

As humans, we are wired to be more affected by our losses than our gains, even if the amount is the same.

In the world of behavioural finance, this tendency is called loss aversion. I felt that it is natural for her to feel obligated to “protect” her gains from another potential market crash.

However, it is important to first ask ourselves if there is an easier way to achieve enough returns to meet her goals, rather than having to constantly worry about whether she has made the right decision to get out and then get in.

There are sufficient evidence to show us that time in the market is more important than timing the market. If she stays invested in the right portfolio for the long term, there should be enough, while not maximum, returns to help her in meeting her goals.

Additionally, I felt that the size of the investment amount discussed also matters.

A $50K investment decision is definitely easier to make as compared to a $500K investment decision.

Constantly having to make such big decisions that have consequences on our future weigh heavily on the investor’s emotional capacity. We have to ask ourselves if we want to put ourselves in this position, in view of other important priorities in our life.

2nd question: She needs to invest more money to reach her retirement goal, how can we encourage her?

From now on, the market will more often look on the higher side than where she started. Given that she still has idle cash which she should be adding into her retirement pot but has yet to do so, the discussion is on how to start easing her in again?

Logically, we know dollar-cost averaging, when compared to a lump sum investment, is worse off because in general, markets eventually end up higher. But, we also know that emotionally, it is very hard to invest in a lump sum. I had to find a way to connect the head and heart to ease her back into the market somehow. In the end, we agreed to meet in the middle with Claudia splitting her lump sum savings into a few tranches to invest at fixed intervals.

Building shared experiences between client and adviser while having lifelong conversations

We believe that having rich and diverse experiences living with their investments are essential for our clients to be comfortable with their investments in the long run. This V-shape decline and subsequent recovery may have added some critical experience points for my clients such as Steve and Claudia.

However, each of their experiences are not the same. The lessons that both the client and adviser learnt are also different.

The past one year has been nothing short of a self-discovery journey and many important investing lessons were reinforced to us. At Providend, we had the golden opportunity to demonstrate to our clients that we do not waver from our investment philosophy even during times of uncertainty. I am just thankful that I emerged this battle with these shared experiences with my clients which we can build upon as I continue this lifelong conversation to support them to achieve their life goals.

This is an original article written by Loh Yong Cheng, Lead of Advisory Team at Providend, Singapore’s Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. How Providend Helps Affluent Families Have a Good Investment Experience

2. Moods and the Market: How to Invest and Keep Investing

3. RetireWell Part 10: Stock Markets Always Rise Over the Long Term

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.