In its recent report, The Global Savings Gap, the International Longevity Centre UK (ILC-UK) compared the adequacy and sustainability of pension systems across 28 OECD countries, as well as Singapore and Hong Kong. It reported that our system did not perform well relative to other countries in terms of retirement income adequacy since there is no basic pension or significant safety net for the poorest. The report seems to suggest that our system will not be able to prepare Singaporeans adequately for retirement. However, they do not recognise the unique features of Singapore’s retirement system and I have to disagree with this conclusion.

At the most basic level, we need to have 3 “things” in retirement

- A house

- Medical plan to pay for medical expenses

- Lifelong monthly income

In Singapore, this is achieved not through our pension scheme alone, but holistically and together with other schemes.

Home Ownership

Today more than 90% of Singaporeans own our houses and more than 80% of the lowest income group (those in the bottom 20% of income) also own their own homes. We have one of the highest homeownership rates in the world. This is made possible via the Home Ownership Scheme where government-subsidised public housing (HDB flats) are made available to Singaporeans at an affordable price and below market rate. In addition, there are various government grants made available for the purchase of these flats. Furthermore, these HDB flats can be paid using CPF under the Public Housing Scheme. This means that in retirement, a big part of the expenses (rental or mortgage) is already taken care of. In contrast, retirees in other countries who do not own their own homes would require a higher retirement income to pay for rental expenses.

Medical Plan

In order to ensure that Singaporeans are able to pay for huge medical expenses, since November of 2015, all Singaporeans are covered under Medishield Life and the premiums can be paid from our CPF Medisave account. In addition, Medisave can also be used to pay for Eldershield (a severe disability insurance plan) and also the excess amount that might not be fully covered under insurance. This means that in retirement, huge medical expenses are taken care of.

Lifelong Monthly Income

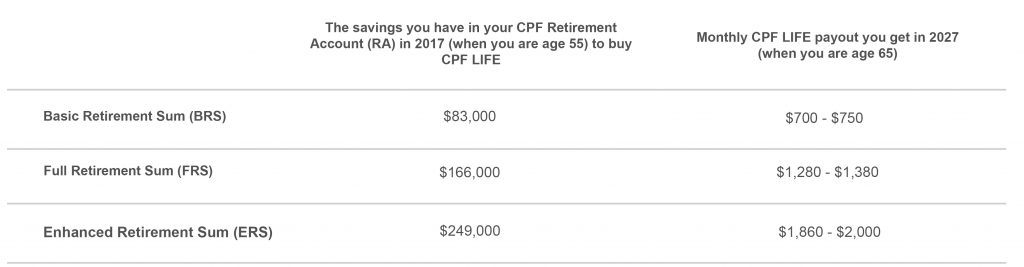

One of the best instruments to give us a reliable income stream for life is the annuity. CPF LIFE is the national annuity programme.

So, is the monthly payout adequate for retirement in Singapore? According to the department of statistics, the average monthly household expenditure (excluding housing needs) per household member for the 21st to 40th expenditure quintile (2nd lowest income group) is about $700 in 10 years’ time. So, the BRS will provide sufficient payout for this group. For those who are financially more able, they will get more payout if they have FRS and ERS. As an example, a couple who has $249,000 each in their RA in 2017 will have about $4,000 per month for life in 10 years’ time and living in a fully paid house. And if needed, one can also monetise their property (which by retirement would have appreciated in its value) by either renting out a room in their house or downgrade to a smaller unit in their retirement, or for those living in smaller HDB flats, sell the remaining of the lease back to HDB under the Enhanced Lease Buyback scheme. All three ways will allow them to have a higher monthly income.

To help Singaporeans accumulate towards their retirement sums, our CPF interest rates range between 2.5% to 6% p.a. across the various accounts. This interest is currently guaranteed which not many countries can do. Another point to note is that in Singapore, employees and employers are required to make mandatory contributions into the CPF. Many countries find it difficult to get employees and employers to participate in such retirement savings schemes. In Singapore, the CPF has been in place since 1955. So, although Singapore has no universal basic pension, with housing and medical took care of, our CPF should provide adequate retirement income for us.

For the low-income elderly who currently still fall short of having enough CPF savings to meet the Basic Retirement Sum at 55. The Silver Support Scheme kicks in. It is meant to help this group of people when they turn 65 and also people in similar situations in the future. With an average payment of $200 per person added to their own CPF payouts and perhaps, some giving by their children, they should still be able to retire today. In addition, we have other social assistance schemes such as GST vouchers and ComCare.

The report by ILC-UK must be taken with a pinch of salt. Firstly, these reports are often funded by financial institutions who may have a vested interest. In this case, the ILC report was fund by Eastspring Investments, an arm of Prudential. There are many other such reports funded by banks and insurance companies here. Secondly, to simply focus on retirement income is too narrow. The report also uses a common international benchmark which states a retiree needs about 70% of his pre-retirement income in old age (also known as income replacement rate or IRR). This is at best a rule of thumb, which does not take into account how different countries manage major expenses like housing and healthcare, in old age. In my 20 years of providing financial advice to families, I have never used this assumption. It is too simplistic and impractical. Singapore has designed a retirement system that is sustainable, something that many countries with a universal basic pension are struggling with. In addition, our system encourages the behaviour of self-reliance.

During a one-on-one interview by BBC Hardtalk presenter Stephen Sackur, at the St Gallen Symposium in Switzerland earlier in May. Mr Sackur asked DPM Tharman Shanmugaratnam whether he believes in the concept of a safety net. After much sarcasm and pressure, DPM Tharman answered: “I believe in the notion of a trampoline.” He further elaborated by saying that “if you provide help for someone who is willing to study hard; if you provide help for someone who is willing to take up a job and work at it, and make life not so easy if you stay out of work; if you provide help for someone who wants to own a home . . . it transforms culture. It’s not just about transactions. It’s not just about the size of grants. It’s about keeping alive a culture where I feel proud that I own my home and I earn my own success through my job. I feel proud that I’m raising my family. And keeping that culture going is what keeps a society vibrant. This pretty sums up Singapore’s retirement system. As a Singaporean growing up in the 70s, I never had the mindset of depending on the government for my retirement. It is my own responsibility. And I think it is about time foreign institutions leave us to do what has worked for our little island.

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-only Wealth Advisory Firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation. The edited version has been published in The Business Times on 29 July 2017.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.