It has been a month since changes made to the CPF were announced and it has sparked many discussions on retirement planning which are still ongoing on mainstream media, digital media channels and various finance chatgroups. So how do you look at CPF LIFE and what should a person who is age 55 and above do when Special Account (SA) closes next year? These decisions cannot be taken in isolation without considering retirement planning holistically.

Start with crafting a good spending plan by first listing down all your assets which can give you an income. Based on the meaningful life that you want to live, carefully estimate your expenses at different stages in retirement. For example, in the first 5 years of retirement, you may need $10,000 a month, going down to $8,000 a month in the next 5 years before reducing it to $6,000 a month for the rest of your life.

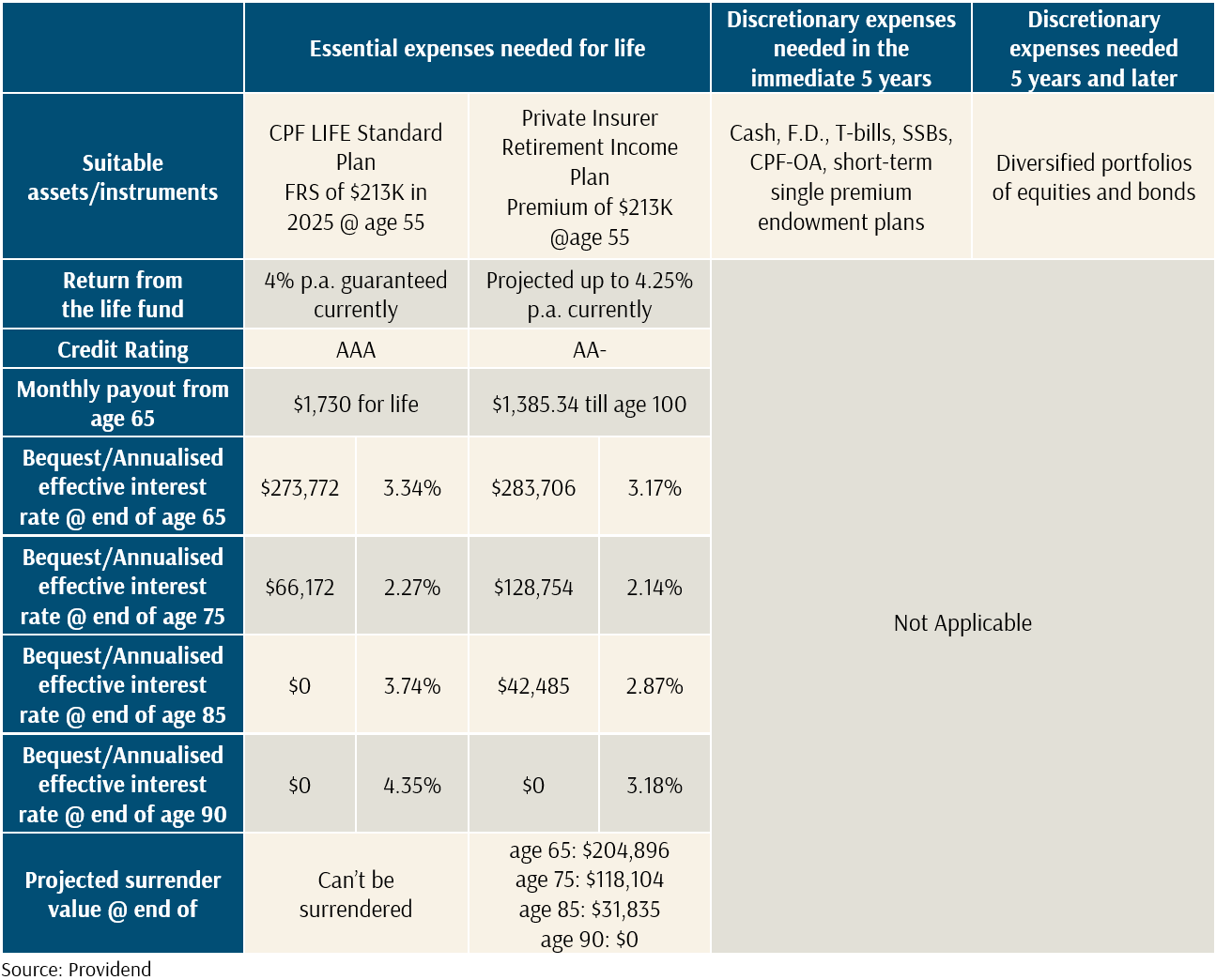

From these estimated expenses, decide what amount is absolutely necessary (essential) with the remaining amount being good to have (discretionary). The next step (which is the most complex) is to match suitable assets/instruments from your list and at sufficient amounts with the different expenses needed at various stages in retirement. Generally speaking, to fund essential expenses throughout the lifetime of the retiree, assets that are safe and reliable regardless of financial market volatility as well as able to mitigate longevity risk should be used. CPF LIFE, private annuities, retirement income insurance plans, investment grade bonds and sometimes even real estate are examples of such assets.

For discretionary spending, you can use riskier asset classes such as equities and bonds. But at appropriate times, you need to gradually convert portions of these investments to cash or cash-like instruments for discretionary expenses that are needed in the immediate 5 years. Cash, fixed deposits, Treasury Bills (T-bills), Singapore Savings Bonds (SSBs), money in CPF Ordinary Account (OA) after age 55 and short-term single premium endowments are such instruments.

The table summarises how assets can be allocated. With a spending plan done up, you can then make better decisions with regard to the recent CPF changes.

What Should I Do With My OA After SA Closes in 2025?

Next year, when the SA closes for those aged 55 and above and money is transferred to OA, how you should respond will depend on what the money was earmarked for in your spending plan. If it is meant to fund discretionary expenses in the immediate 5 years, you can consider placing portions of it in other cash/cash-like instruments if they are meaningfully higher than the 2.5% p.a. offered by the OA. Otherwise, you can just leave it in the OA and it should not affect your retirement income too much. But if the money in the OA is not needed for discretionary expenses until much later, you can consider investing in riskier assets to potentially get higher returns.

How Much Should I Put in My Retirement Account (RA) to Buy CPF LIFE?

Because of space constraints, I only compared CPF LIFE with one of the popular retirement income insurance plans in the market. Given that all insurers have to use the same projection rates on their benefit illustrations, the results wouldn’t deviate too much except for the different frills offered by different product providers. For comparison, I used the CPF LIFE Standard Plan and the Full Retirement Sum (FRS) for 2025. For the retirement income insurance plan, I used the higher end-of-the-life fund projection of 4.25% p.a.. Even at the higher end of the projection, you can see quite clearly that CPF LIFE is superior. Although the insurance plan’s bequest amount is higher, it is because the monthly payout is lower. But you should not be buying an annuity/retirement income plan for its higher bequest. That is also why CPF LIFE’s effective interest is still higher all things considered. The one advantage of private insurance plans is that you can surrender the policy if you need to and get some money back whereas you cannot do the same with CPF LIFE.

So, first top up your RA up to the amount (subject to the maximum of the new Enhanced Retirement Sum in 2025) that will give you the CPF LIFE monthly payout you need to fund the essential expenses in your spending plan. If the maximum monthly payout from CPF LIFE is still insufficient, you can use other suitable instruments to supplement it. Alternatively, if you can find private annuity plans which can provide the same or higher monthly payouts for life, you can buy private annuities instead of using CPF LIFE and apply to be exempted from setting aside the retirement sum and withdraw all your CPF retirement savings. Unfortunately, it is quite difficult to find such policies these days. And if you want some liquidity, you can just buy CPF LIFE with your cohort’s FRS and supplement the rest of your essential expenses with other instruments such as retirement income insurance plans. But you have to accept a possibly lower monthly payout or pay a higher premium to get the payout you need.

Having a wealth plan to accumulate towards retirement or spend in retirement spans many decades. Many things in the world will change and government policies will have to adjust to adapt. So make sure your plan is robust enough to mitigate life uncertainties.

The writer, Christopher Tan, is Chief Executive Officer of Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“. He is also a Certified Ikigai Tribe Coach.

The edited version of this article has been published in The Business Times on 18 March 2024.

For more related resources, check out:

1. How To Make The Most Of CPF LIFE For Your Retirement

2. Assets That Cannot Be Distributed Via A Will | CPF Monies & Joint Assets

3. RetireWell™ Part 2: A Tale of Two Retirees and Their Fortunes

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.