On Tuesday, 16th Feburary 2021, Deputy Prime Minister Heng Swee Keat announced that Budget 2021 will shift “from containment to restructuring” as Singapore’s economy continues to reopen.

With the theme Emerging Stronger Together, Budget 2021 combines measures to help families, workers and businesses weather the COVID-19 crisis in the immediate term, with measures to accelerate structural adaptations for the long term.

We have done a summary on the 4 key implications on personal finance which could be helpful to you.

1. Relief for Families – Household Support Package

Amid economic uncertainty, more financial support will be given to families to help defray expenses in the following areas:

(a) GST Voucher – Cash Special Payment of $200

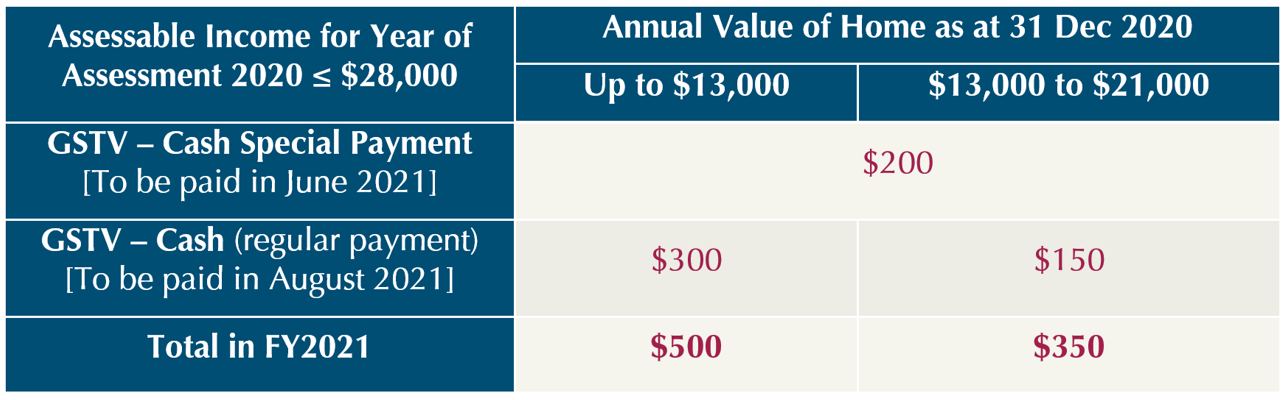

Lower-income Singaporeans who are eligible for GST Voucher (GSTV) – Cash (paid every August) will receive an additional GSTV – Cash Special Payment of $200 in June 2021, which is on top of the regular GST Voucher – Cash payment. In total, lower-income Singaporeans will receive up to $500 this year.

This GSTV – Cash scheme is given to Singaporeans who are at least age 21 and satisfies the following criteria:

i. Assessable Income not more than $28,000 for Year of Assessment 2020;

ii. Annual Value of home (in NRIC) at 31 Dec 2020 of not more than $21,000; and

iii. Not owning more than one property.

Table 1: GST Voucher (GSTV) – Cash and Cash Special Payment

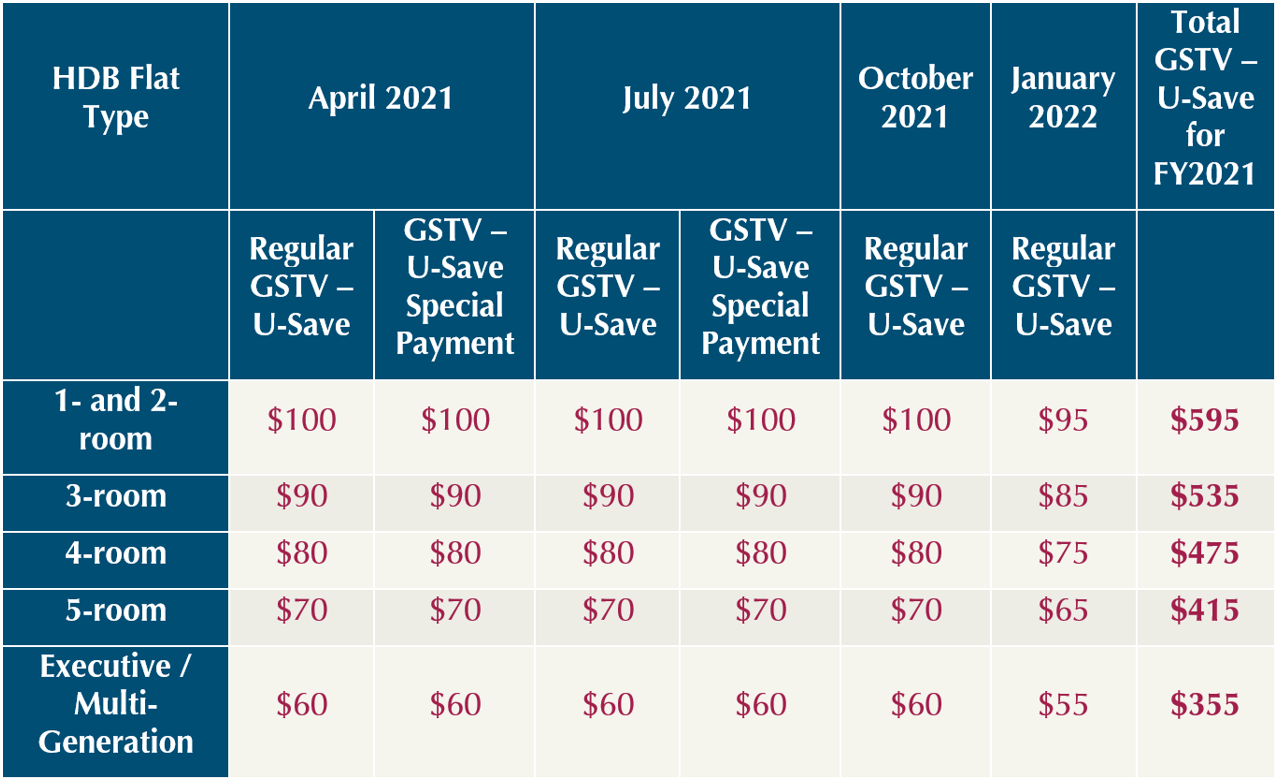

(b) GST Voucher – U-Save Special Payment of $120 to $200

Eligible HDB households will get additional utilities rebate of between $120 to $200 which is 50% more than their annual rebate. This payment will be credited in April and July this year under the GST Voucher – U-Save Special payment.

Households whose members own more than one property will not be eligible for GSTV – U-Save.

Table 2: GST Voucher (GSTV) – U-Save and U-Save Special Payment

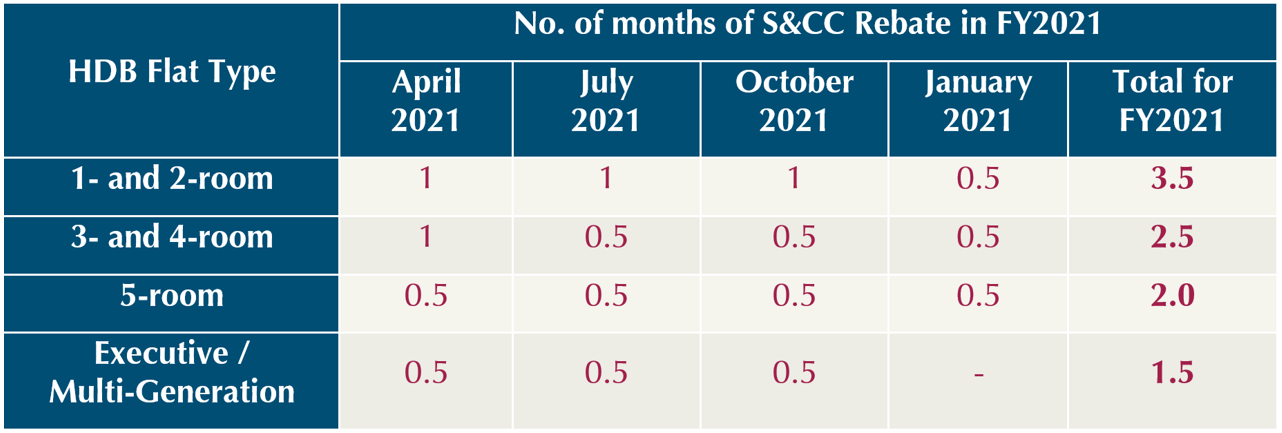

(c) Service and Conservancy Charges Rebate Will Be Extended

Eligible Singaporean households living in HDB flats will enjoy rebates to offset between 1.5 to 3.5 months of their Service and Conservancy Charges for another year. The rebate will be given in April, July, October of this year and January 2022.

Households with a member owning or having any interest in a private property, or have rented out the entire flat, are not eligible for this rebate.

Table 3: S&CC Rebate for FY2021

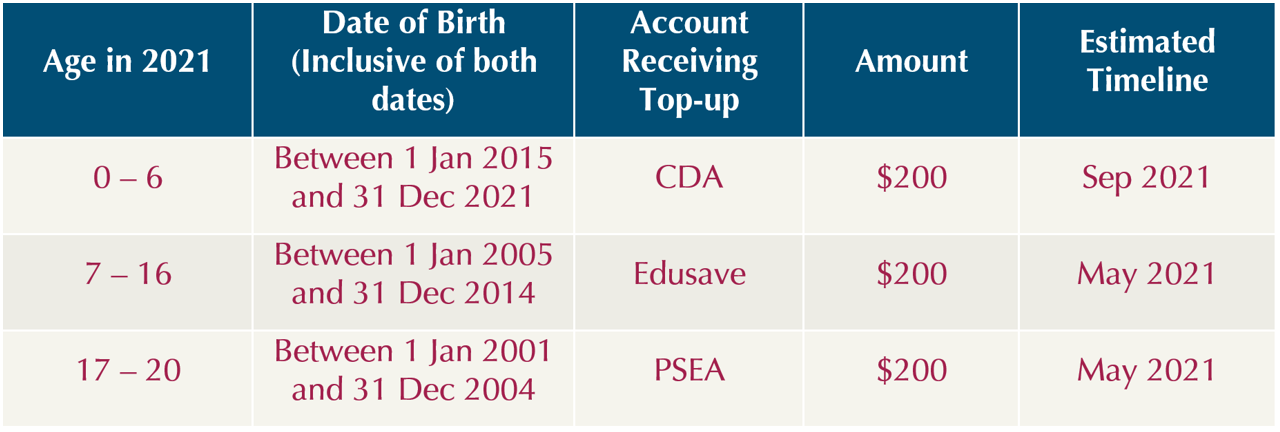

(d) Additional $200 Top up for Each Child to Support Their Education

Families with Singaporean children below the age of 21 will be given additional top-up of $200 per child through the Child Development Account, Edusave Account, or Post-Secondary Education Account, which is in addition to the annual Edusave contribution that the government makes. This contribution is to support parents as they invest in their children’s future.

Table 4: Top-ups to CDA, Edusave account, and PSEA

Children studying in Government-funded special education (SPED) schools will receive the top-up in their Edusave accounts, regardless of age. Other children with special needs will also receive the top-up in the relevant accounts based on age.

(e) $100 Community Development Councils (CDC) Vouchers

In support of heartland businesses and hawkers, all Singaporean households will receive $100 worth of CDC vouchers that can be used at participating heartland shops and hawker centers.

2. Impact on Motorists

(a) Petrol Duties Hike

It now costs more to pump your vehicle as Singapore moves to become a car-lite country. The duty for intermediate grade petrol (92-octane and 95-octane) will be increased by 10 cents to 66 cents per litre, while the premium grade petrol (98-octane and higher) will rise by 15 cents to 79 cents per litre.

(b) Lowering the Cost of Electric Cars

To encourage the early adoption of electric cars, the cost difference between electric cars and internal combustion engine cars will be lowered. From January 2022 to December 2023, the minimum Additional Registration Fee (ARF) for electric cars will be dropped to zero, which currently all car buyers would have to pay at least $5,000 in ARF. In addition, the government is committed to deploying more charging stations from a previous target of 28,000 to 60,000 by 2030.

(c) Transitional Road Tax Rebate for Singaporeans

Motorcycles using petrol will receive a 60% road tax rebate for one year and an additional $50 to $80 for individual owners of smaller motorcycles of up to 400cc.

Taxi and private hire drivers will be given a petrol duty rebate of $360 over 4 months and a one-year road tax rebate of 15%. Petrol-cars will be given a one-year road tax rebate of 15%.

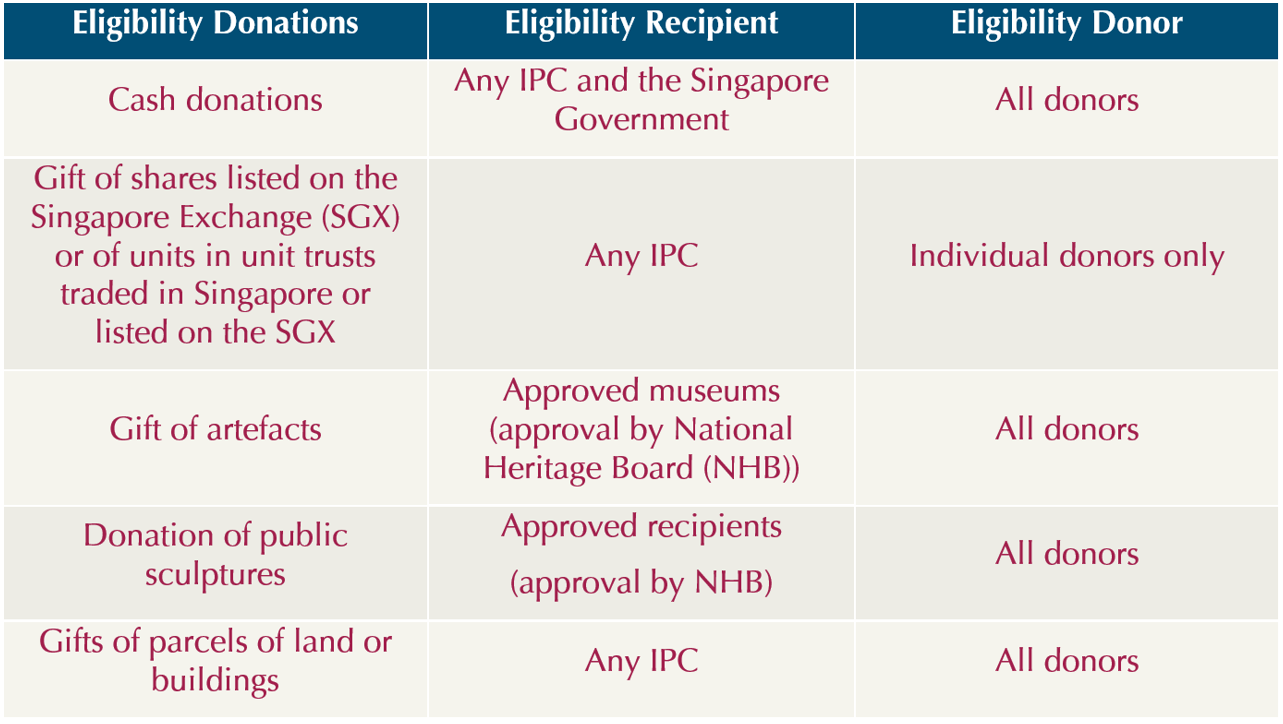

3. Tax Deduction for Qualifying Donation Extended for 2 Years

To encourage philanthropy, the current level of 250% tax deduction on donation to Institutions of a Public Character (IPCs) and other qualifying recipients will be extended for another 2 years to 2023. One good deed deserves another!

Table 5: Eligibility Criteria

4. More Taxes on the Horizon

(a) Goods & Services Tax (GST) Hike Around 2022 to 2025

GST hike from 7% to 9% will take place sometime around 2022 to 2025, and depending on the economic outlook, it would be “sooner rather than later”. This is to fund rising spending needs, especially in healthcare.

(b) GST for Imported Low-Value Goods Bought Online

Currently, low-value goods (less than $400) which are imported via air or post are not subject to GST but come 1 January 2023, GST will be extended to these low-value goods. Similarly, GST will be extended to B2C imported non-digital services such as live interaction with overseas providers of educational learning, fitness training, counselling and telemedicine. This will level the playing field for our local businesses to compete effectively.

This is an original article written by our Solutions Team at Providend, Singapore’s First Fee-only Wealth Advisory Firm.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.