Our Client’s Needs Drive Our Investment Philosophy

At the very tip of wealth building, what we think drives investments is what our clients need their wealth to accomplish.

Finance professionals call this goal-based investing.

We are comfortable with that term as well.

Your wealth is a means to some end. It allows you to have a better quality of life.

You exchange part of your wealth to give something meaningful to your family and friends.

We believe that the return you get from your investments should match your goal and purpose.

Our clients’ goals drive what our client adviser will re-allocate their wealth into. For some clients, their financial goals are less challenging while for others, their financial goal requires their wealth to perform well.

This would require their wealth to grow at a greater compounded rate of return in order to be closer to their target.

At Providend, we design our investment portfolios that can be applied to different results our clients are looking for.

Richard And Eva Do Not Need A High Rate Of Return

Some clients can achieve what they wish without the need to push for a high return. Richard and Eva fall into this category.

Richard and Eva are in their early 40s and would like to see if they can be financially independent between 55 to 60 years old.

They have not thought if they would stop working at that point but would like to have the flexibility and financial security of the option not to work.

Currently, they have $250,000 in stocks and unit trust, which they manage themselves and $300,000 in cash equivalents. They bring home $380,000 in income last year (net of taxes) and spent $150,000 a year all in.

We call clients like Richard and Eva accumulators.

They are at a stage of their lives where they need to convert their valuable human capital into wealth assets. These wealth assets will eventually provide the cash flow if they wish to be financial independence or other needs.

In order to generate an income of $10,000 a month at 55 years old for their financial independence (FI), Richard and Eva’s client adviser worked out that they would need $4.5 million.

Richard and Eva’s wealth needs to be allocated into an asset allocation that realistically will provide a compounded rate of return that can grow their wealth close to $4.5 million.

Our advisers can choose to allocate all their wealth into a 100% stock portfolio. Is this the most appropriate asset allocation?

Allocating their wealth this way will give Richard and Eva a high possibility of a high compounded rate of return necessary to reach their financial goal. Given a horizon that is long enough, there is a high possibility for a high stock portfolio to get a high compounded return.

A high returns expectation often means that the volatility of returns in the short time frame is volatile. There are certain time periods where the portfolio’s compounded return may fall short of the expected return that Richard and Eva require to hit their FI milestone. It may take the high equity portfolio longer to provide that average return they need.

As an example, based on history, in some extreme cases (where the possibility of it happening is less than 1%), it may take longer than 12 years to break even.

Richard and Eva do not have a long-time horizon as a client in their early 30s. We need to risk manage their investments to ensure that the portfolio’s volatility is lower and that within 14 years, there is a high probability the returns target can be achieved.

With a starting capital of $550,000 (stocks + cash) and an annual injection of $210,000 a year, Richard and Eva can grow their wealth to achieve the $4.5 million they need for their financial independence in 13 years.

Mathematically, the compounded rate of return they need to achieve their financial independence milestone is 4.5% a year.

This can be achieved by allocating their stock, cash and annual injection into a low cost, diversified, balanced stock and bond portfolio. This portfolio provides a historical rate of return of 6.3% a year with much lower volatility than a 100% stock portfolio.

Richard and Eva do not need to take excessive risk with their money, to get a high rate of return, to achieve their goals. Thus, a more appropriate allocation their adviser should allocate their wealth to is a more balanced stock and bond allocation.

We aim for a conservative compounded returns expectation and recommend a portfolio that allows them to achieve that returns expectations.

Dora And Evan Needs A Higher Rate Of Return

In contrast, Dora and Evan are in a different phase of their lives. They are where Richard and Eva will be if they reached their FI milestone.

Dora and Evan were 55 years old when they came to us and wishes to transit from small business owners to not working.

They need their wealth to generate a retirement income.

Over the years they have managed to accumulate $2 million in assets, aside from their residential home. The majority of their assets are in savings and deposits. If not, they are in good quality bonds.

Dora and Evan would like to have an income of $60,000 a year when they stop work. It would be better if the income keeps up with inflation.

Based on their age, we think they need to plan for the money to last for at least 30 years.

Their average compounded rate of return based on their current asset allocation is 2.38% a year.

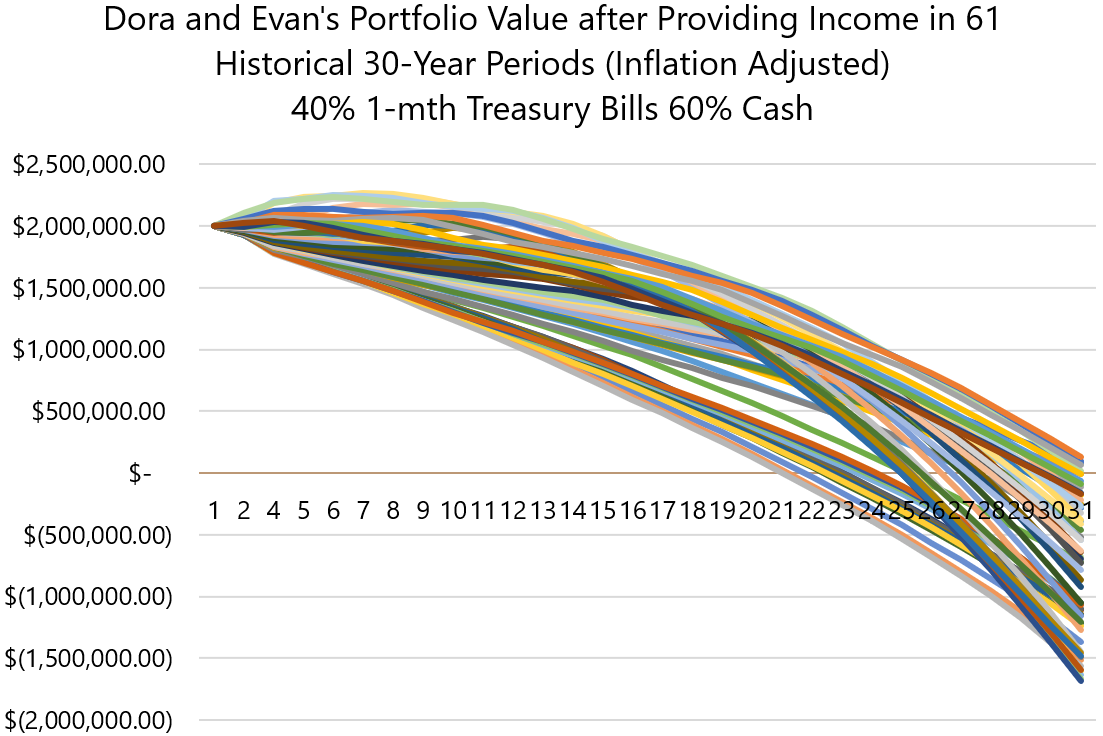

With our tools, we can simulate Dora and Evan’s current asset allocation over 61 different historical 30-year periods and see if they will have a successful retirement money-wise. These periods have various inflation rates from deflation, low inflation, to high inflation.

If Dora and Evan retain this asset allocation, under 56 of these 61 historical situations, their wealth would not last 30 years (all the lines dip below $0 before year 30).

Dora and Evan’s income expectations are modest and not unrealistic at all.

However, due to inflation, and that they are withdrawing consistently from their wealth at the same, they needed their asset allocation to have a higher rate of return for their wealth to last longer.

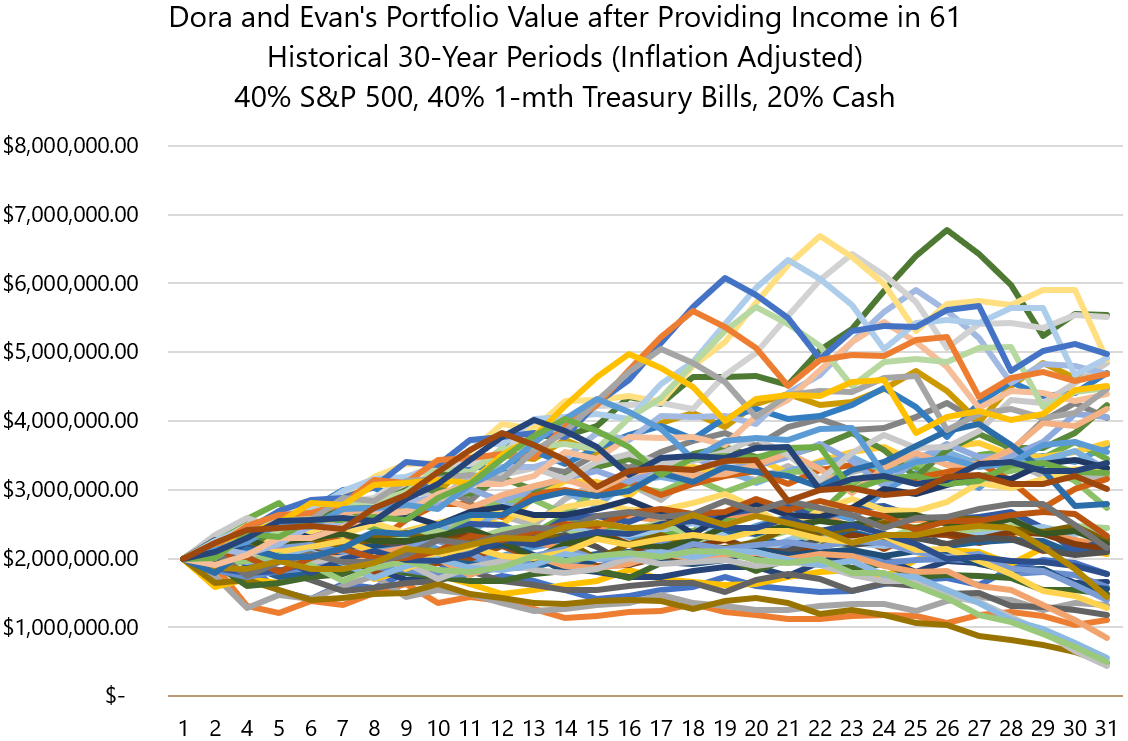

We can allocate 40% of their cash to broad-based large cap US equities and for the rest to remain as it is. This will bring their overall asset allocation to 40% equities, 20% cash, 40% short term bonds.

Here is a simulation of their portfolio value if we allocate Dora and Evan’s portfolio this way:

We can observe that almost all the portfolio value lines are above zero. This means that if Dora and Evan lived through 30-year periods that are very similar to the 61 historical periods here, their wealth will have a much higher probability of lasting the full duration. This is even after taking an annual inflation-adjusted income of $60,000 a year.

Key Takeaways

As a wealth management firm, our main aim is to provide realistic financial solutions so that they can achieve their life goals.

Our investment philosophy is primarily driven by our client’s needs. We evaluate and seek out the financial assets that give our clients the highest probability of reaching their financial milestones.

We create model portfolios that our client adviser can use easily to address their client’s specific goals and liability matching. These model portfolios have different returns expectations and different volatility ranges.

The model portfolios encompass our investment philosophy that good investments

- Let you can stay invested for a long time to reap the power of compounding

- Allow you can soundly deploy a large part of your net wealth into without worrying too much at night

- Is simple enough to communicate across

- Relatively easy to execute

- More passive and less tactical inputs

- Allows you to deploy large amounts of your wealth and not be limited by size or liquidity

Goal-based investing means not blindly chasing the highest rate of return. It means to ensure that Richard & Eva, Dora & Evan stay invested long to reap the benefits and fulfil their financial goals.

Richard & Eva can get close to their financial independence milestones in an asset allocation with less volatility. They do not need to chase high returns, worry about whether their vast wealth built up painstakingly is going down the drains.

Dora & Evan will need a higher returns expectation so that they would realistically not run out of money for the duration they need.

Figure out the goal. Assess what you have now. Then, we can see if you can get to your goal.

All names and figures are used for illustrative purposes.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s Fee-only Wealth Advisory Firm.

For more related resources, check out:

1. Let Your Financial Decisions Enable Your Life Decision

2. How To Be A Successful Investor And Not A Gambler

3. Lump Sum vs Dollar Cost Averaging Strategy

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.