In my last article, Our Non-linear Life Affects How We Plan for Our Wealth, I shared that many of us underestimate how much and the degree to which our lives can change.

One of the financial planning philosophical shifts that we need to adopt, if we know we live in a non-linear world, is to accept that a range of economic and market scenarios can happen. These shifts will affect whether our portfolio can hit a compounded return of X% in Y number of years so that we can have $Z for the important goals in our lives.

The more senior Providend clients would remember how inflation used to be higher during the 80s and 90s. In those higher inflation and economic growth times, the interest rate that you can earn on your savings accounts in Singapore can hit 7% a year.

Those days are long gone, and we have also entered a lower inflation regime, which makes it more conducive for us to accumulate wealth with equities and bonds. However, there are signs that the economic tides may be shifting in a big way.

Some investors may live through economic regimes that are more conducive to build wealth while other investors may have to navigate economic regimes that are less favourable.

Amid these uncertainties, how can wealth planning help you improve your odds of achieving your financial goals, with less emphasis on your investment outcome?

In this article, I will explain how you can improve the certainty of reaching the financial goals you are accumulating towards. Increasing the odds for your retirement income to last as long as you live is also important, but I will leave that to a future article.

Jane and Andy Have a Goal to Be Financially Independent

It will be easier for me to explain if I relate what Jane and Andy faced.

The couple planned to be financially independent in 20 years’ time. They reckon that for their retirement, they will need $1.3 million more.

By investing in a balanced portfolio that is low-cost, and tracks equity and bond market indexes, Jane and Andy can achieve an annualised compounded rate of return of 5.7% a year after cost.

Their wealth planner calculated that if they commit $500,000 of their capital today, the capital should grow to $1.3 million in 20 years’ time.

What May Go Through Your Head as You Leave the Meeting with Your Adviser?

Some investors would leave a meeting with their planners, and go about their daily lives with a lingering thought:

Will I really be able to get that rate of return used in my wealth plan?

This is a very common and sensible question to ponder about and especially so if you are new to investing in broad-based managed investments that are based off equity and fixed income.

If you have not experienced earning the return successfully in the past, everything that you learn from your adviser or the book would be artificial or less real in your eyes unless you have experienced how it works.

Unfortunately for some, their earlier experience was tainted with poor returns and that will make them sceptical about whether they could achieve the returns.

Let me be candid about planning returns and actual returns in the next section.

We Don’t Earn Average or Median Returns in Real Life

If you go to different wealth planners, you will realise that they use different planning returns or investment returns.

Some use a rate of return that is rather sensible. However, our observations are that investors or advisers would use planning returns based off the returns from the past 5 to 10 years.

We had a rather good run in the equity markets in the past 10 years. This would mean that if you are using a rate of return based off the average returns of the past 10 years, it will show that:

- You need to put in less capital

- You can reach your life goals earlier

Investors accumulating towards their financial goals in the past decade have been relatively lucky. But what if you are an unlucky accumulator?

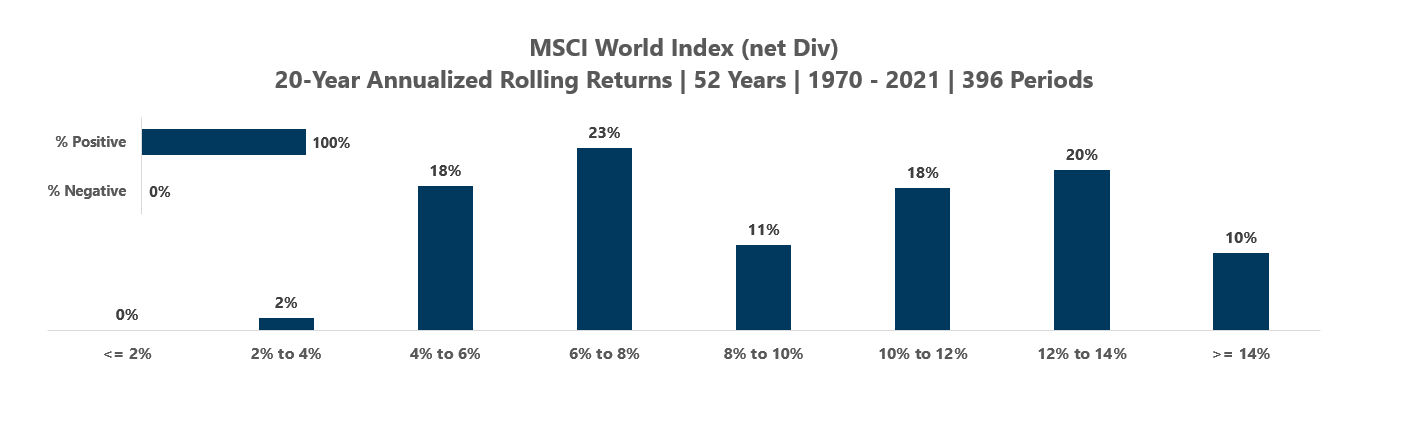

The chart below shows the 20-year annualised rolling returns if we invest in a low-cost fund that tracks the MSCI World Index, which is a basket of more than 1,600 developed market companies.

We have 52 years of history and within this period, we can get 396 twenty-year compounded average growth rates if we calculate month by month.

The median compounded return during these 52 years is 9.2% a year.

This return, after cost, should be the compounded return used in your planning. However, if we use the average from a decade before, which is 6.0% a year, you would be very happy about the returns you get as you would be able to reach your financial goals earlier.

As you can see from the chart, only 11% of the time do the compounded returns hit somewhere close to 9.2% a year for a twenty-year period (in this case, between 8% to 10%). For 23% of the time, they are between 6% to 8% and for 20% of the time, the returns are between 12% to 14%.

The data shows that an unlucky accumulator could earn less than 4% a year return for the 20 years they had.

In real life, the returns that you will earn will not be 5.7% every year.

If your planner uses 9.2% a year in your wealth plan but your actual portfolio only achieved 6.5% a year for 20 years, you will have a shortfall against the original amount that you plan for.

You may blame your wealth planner or yourself for not investing well, and now you need to save up more or delay attaining your financial goals.

The reality is that luck plays a much larger role in whether we reach our financial goals on time with the amount we need. It has less to do with investments. Had you gone to another planner and they recommend you some other investments, those investments go through the same economic regimes as yours too.

Having said that, can we then make our financial goals less dependent on luck?

Revisiting Jane and Andy’s $1.3 million Financial Independence Goal

Here is Jane & Andy’s situation again:

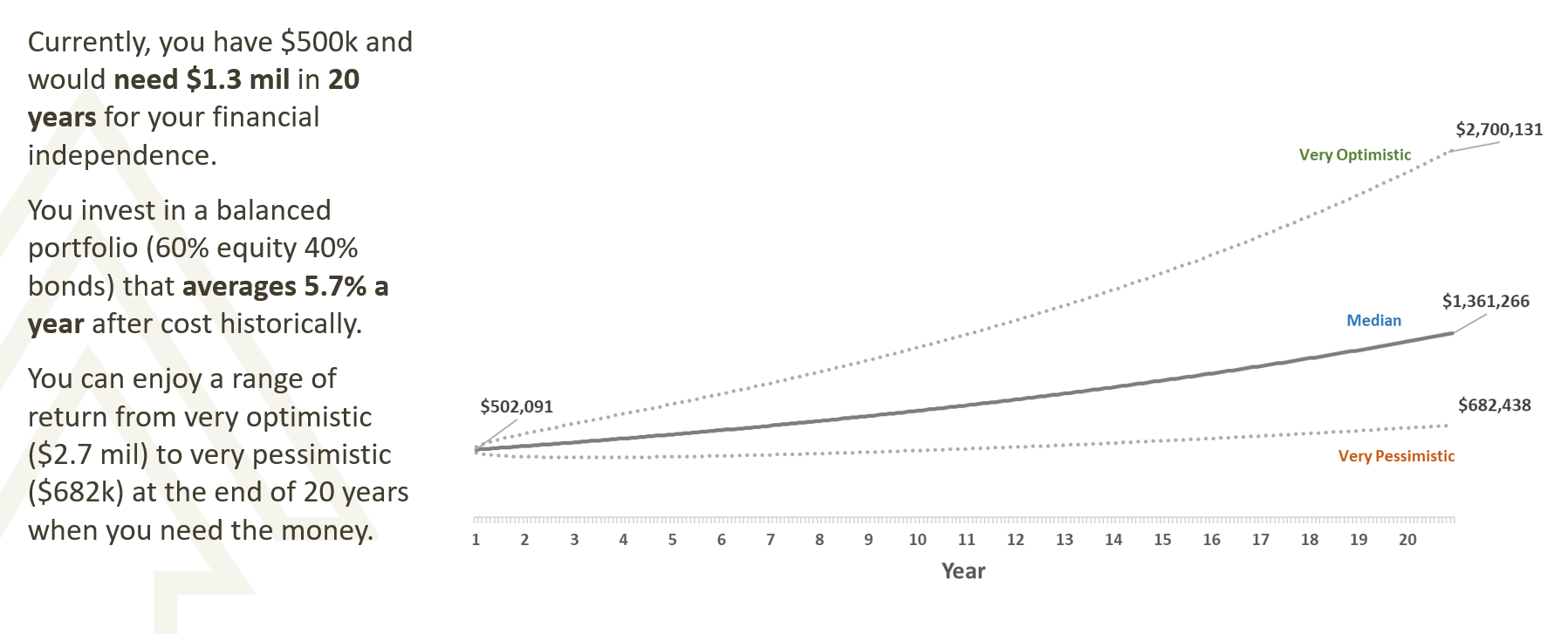

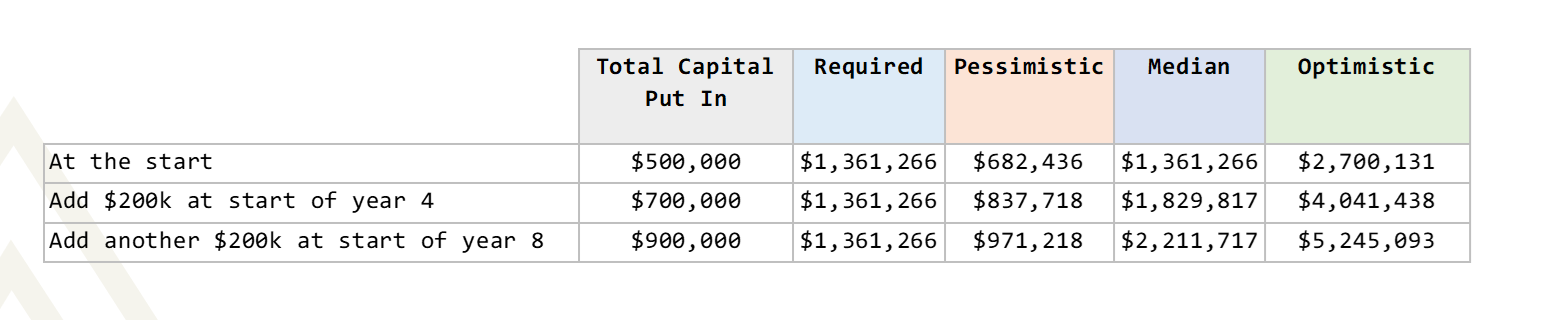

They have a $1.3 million target and they have committed $500,000 to their financial independence goal.

Depending on the sequence of returns that the couple will enjoy in the next 20 years, what they could accumulate will be within a range of $2.7 million to $682k. If they do accumulate to $2.7 million, they would have a lot of excess but most likely be able to hit their goals earlier. However, if it is $682k, it would be as if their wealth had not grown. Not just that, they would have fallen short of their financial goal.

Adding Additional Accumulated Savings from Work to Their Goal

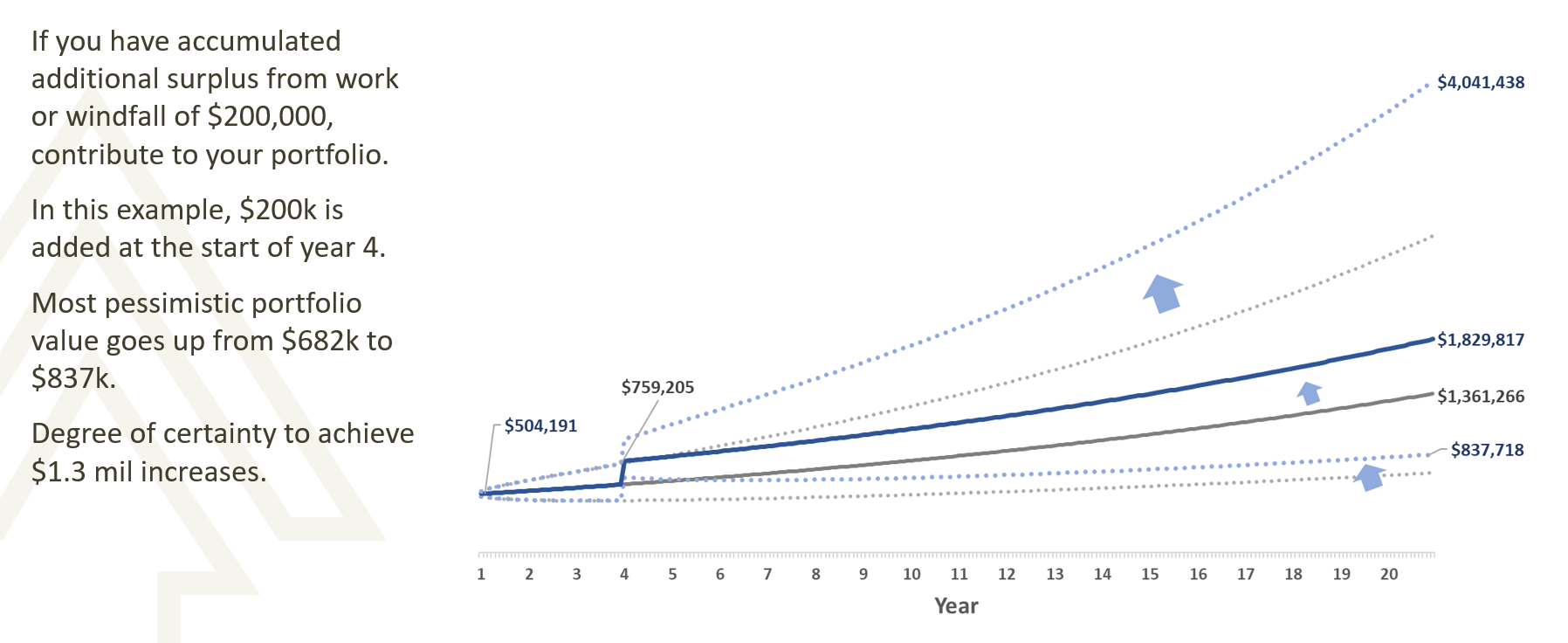

Over the next 4 years, due to their bonuses and job changes, Jane and Andy manage to accumulate an additional $200,000.

Jane and Andy have the choice of spending this money, committing to a new financial goal, or they could inject more capital into their financial independence goal.

If they inject this $200,000 into their financial independence plan, this is how their goal projection will look like:

Their new range of portfolio values are depicted by the dark and light blue lines.

What you will notice is that the range of portfolio value curves has shifted upwards with the injection of $200,000.

The median returns go up from $1.3 million to $1.8 million and the lower bound goes up from $682k to $837k.

The important thing to note here is that the goal is still $1.3 million (but this may change if the income requirements change from time to time) and when the lower bound goes up, there is likely lesser shortfall.

By committing more capital, it does not mean that we are expecting the portfolio to earn less. The potential portfolio value is higher now, with an upper bound of $4 million.

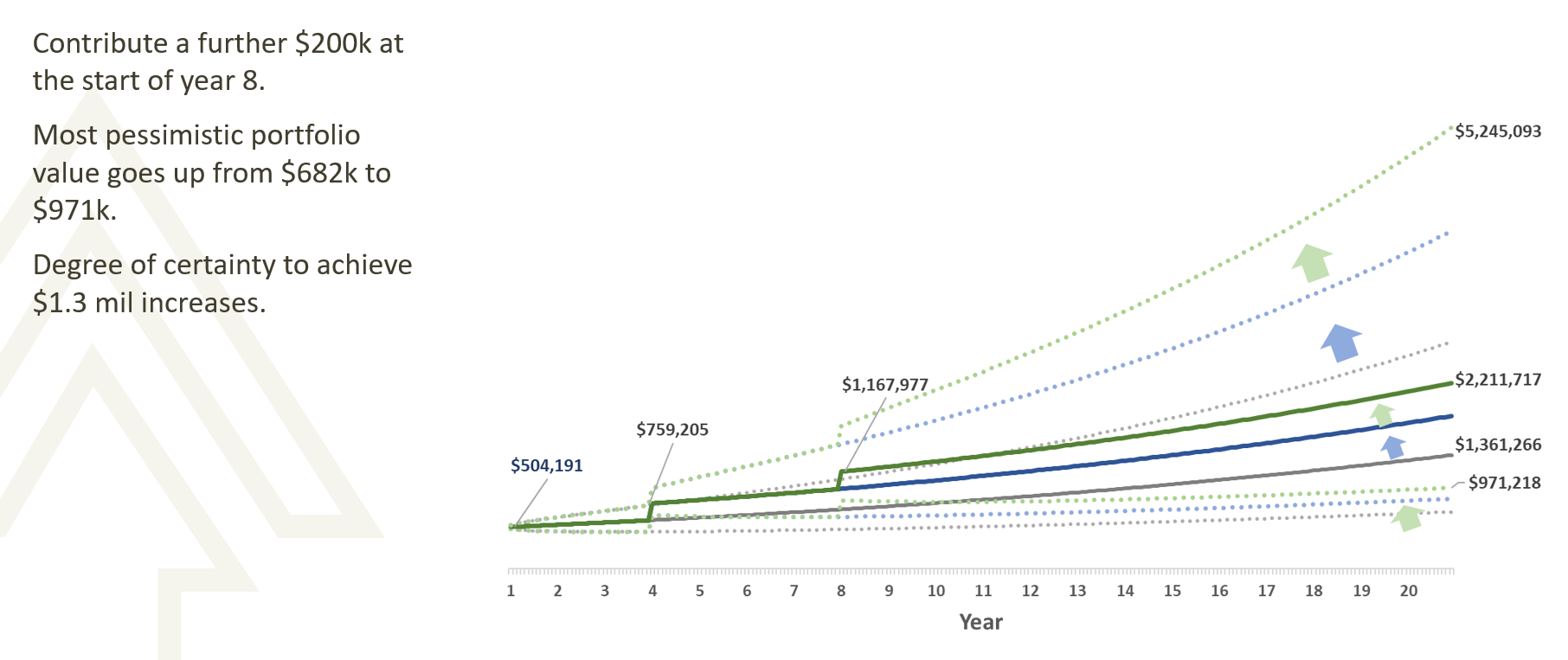

4 years later, Jane and Andy decide to commit another $200,000:

Their new range of portfolio values are depicted by the dark and light green lines.

The median return goes up from $1.3 million to $2.2 million and the lower bound increases from $682k to $971k.

While $971k may not meet their target of $1.3 million, it gets them closer to their goal as compared to when they started 8 years ago.

Below is a summary of the capital committed and the range of portfolio projections 20 years later.

What Is the Point of Investing if My Capital Doesn’t Grow Much at All?

This may be a question on your mind upon seeing the amount that was put in and the relevant portfolio value if the investor is quite unlucky.

The main difference is that you have positioned your portfolio in financial assets that have the potential to earn a higher rate of return.

This basket of stocks and bonds have sound economic drivers to produce cashflows and interests as a group. Empirically, if you hold a well-diversified basket of stocks and bonds, you will build greater wealth than leaving your money in cash.

However, some of us may live through periods where it may take longer than usual to capture the return. If you read our articles on the history of returns, you would observe that the markets do come back.

One of the reasons is that the market oscillates between relatively cheap to relatively expensive. If an investor experiences a bear market, a depressed basket of stocks would have a higher than historical average future return, due to the earnings they are still producing, relative to their price.

Eventually, market participants will find equities very attractive and bid up the stocks.

If you have not invested at all, you would have zero probability of capturing the higher returns.

What Is Most Important to You?

The planning strategy of committing additional capital into our financial goal may not sit so well with some.

If you had engaged an adviser, you might feel that “if this is so easy and you cannot even deliver decent return, then why do I pay you the money at all?”

I think that is a fair question to ask.

I find that the value of advice is more than just the investment return. We have a duty to construct sound investment portfolios that implement our investment philosophy, curate applicable investments that go into our portfolios, and choose the right portfolio that matches our client’s risk profile.

A big part of the value of advice is to make sure you can achieve your financial goals.

There will always be either a shortfall or a surplus to your financial goals because the amount needed, in reality, will change due to your changing needs. For example, if you plan to accumulate $120,000 for your kid’s education but it will cost you $138,000, what would you do to tackle that shortfall?

In Jane and Andy’s case study, the range of portfolio value is wide, but think about this: Suppose the original planning compounded return used is 5.7% and the actual return is 4.0%. 4% is not too far off from 5.7% but 1.7% a year over 20 years is still a $200,000 difference!

If the return difference is not too big but you still have a shortfall, the result would still be that you will need to delay attaining your financial goal.

Ultimately, Jane and Andy have a decision to make with the additional $400,000 they accumulated over the 8 years: Do they spend it on something, carve out a new financial goal and fund it, or commit to their financial independence goal?

The value of advice is explaining the trade-off, facilitating discussions to gain clarity about the degree of importance in reaching financial independence compared to their other goals, and how much more to commit into the goal but not over-commit that they compromise other aspects of their life.

We accumulate our wealth to spend in the future. How we get there whether through a planning rate of return of 4%, 5.7%, or 8% is a mean that is important but should not be the most important.

Use a Two-level Target to Implement and Fund Your Life Goals

Now it may sound quite challenging to inject so much more resources to all your goals so as to increase the degree of certainty of reaching them.

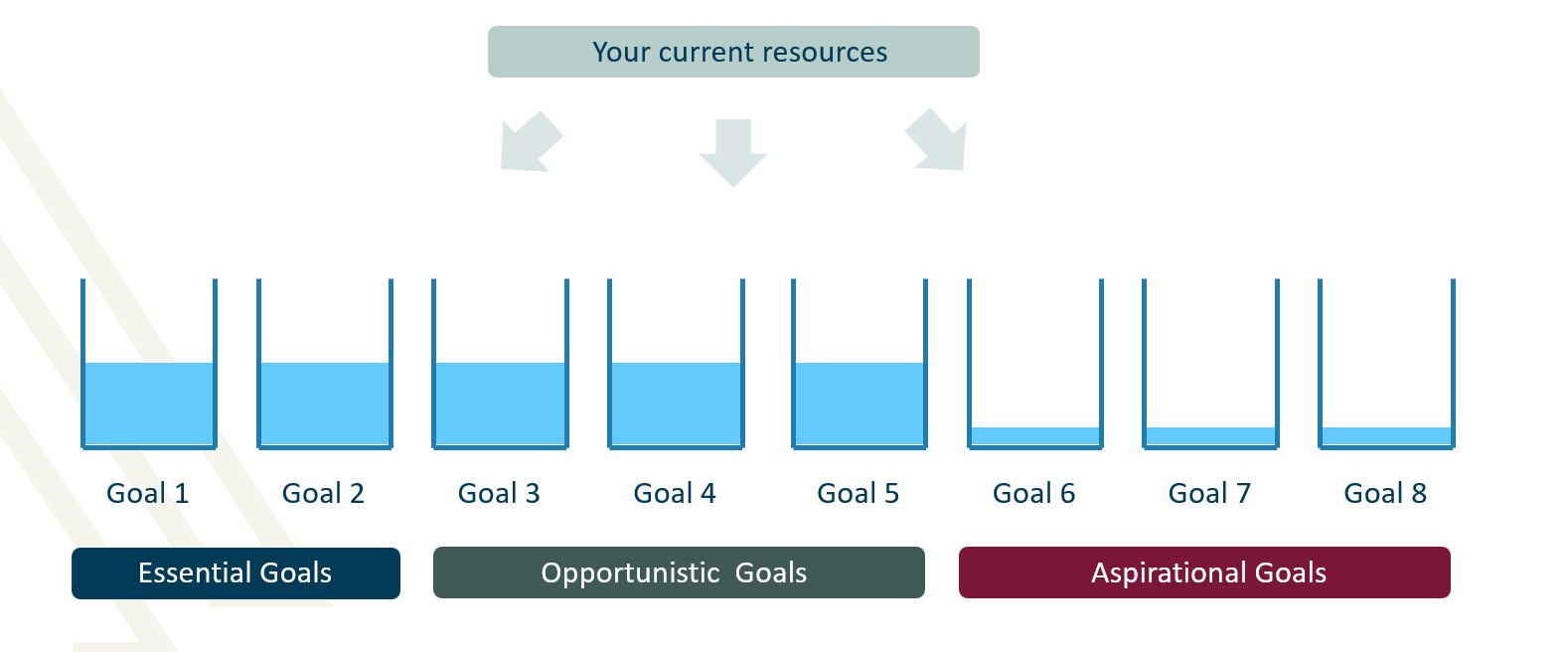

I am going to show how you can implement them systematically. The first step is to prioritise and categorise your goals into the following three buckets:

- Essential goals. These are goals that is the most important to you. The goals in this bucket absolutely have to be funded well. Example is the retirement income for your survival spending. Without this retirement income, your family will go hungry and may not survive.

- Opportunistic goals. These are the goals that you would like to fulfil but if they fall short of your expectations, you are open to adjust or compromise. Examples that fit here are the retirement income on basic spending not so much for survival as well as discretionary expenses. Your kid’s university education may go under here if you are willing to compromise it by borrowing part of the money if it falls short.

- Aspirational goals. These are goals that are fun for the family and something to make everyone look forward to. Most likely, these are goals that are difficult to hit unless you have a windfall, or the returns did very well.

It is important to split your goals based on the level of certainty you require of these goals because most of our resources are scarce. Our experience working with high-net-worth shows us that even with $20 million, you will still need to make trade-offs between your goals. If you aspire to live in a GCB (Good Class Bungalow), that will leave you with fewer resources for other areas in your life (which may be as important as the GCB!)

You can break up the funding for each of your goals into two levels of capital commitment.

With your current financial resources, divide the capital so that each of the goals are well funded. The aspirational goals would be the least funded (or not funded at all) because you would prioritise the essential and opportunistic goals.

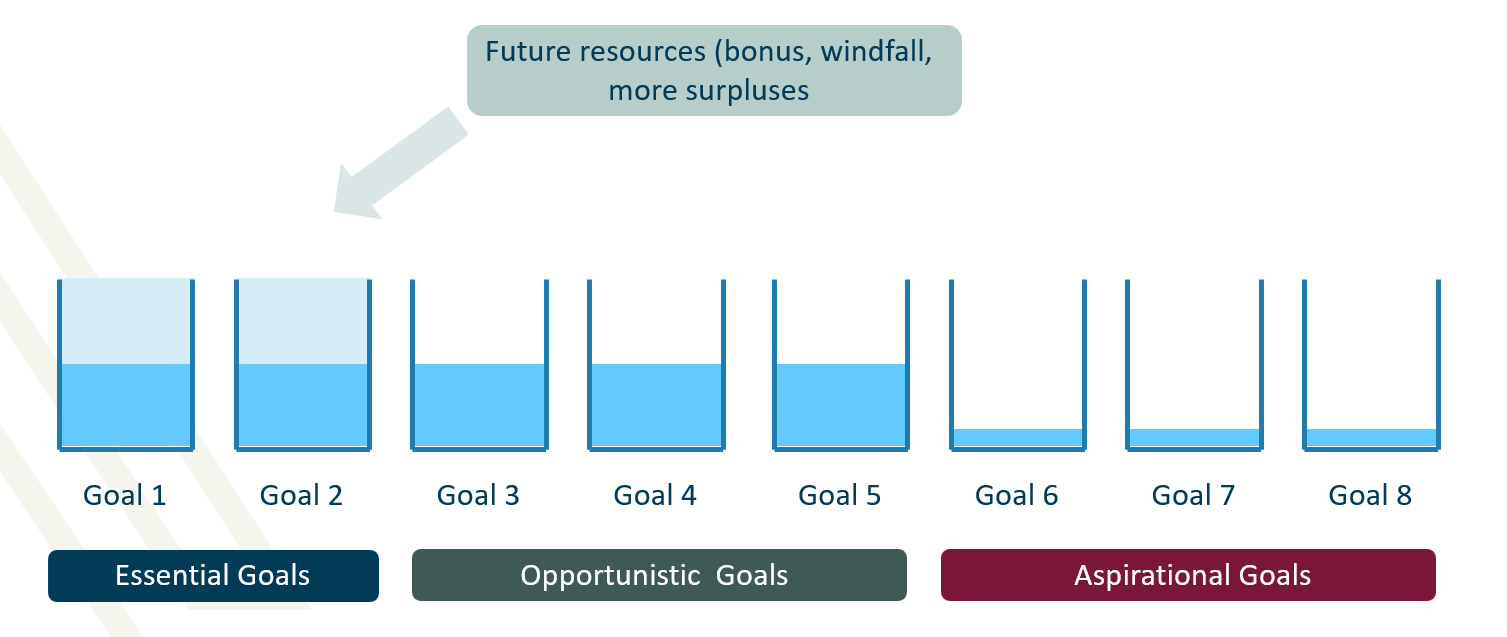

As you get more surplus from work, seek to fund the essential goals so they hit the second level earlier. By committing more funding to the goals you need the most certainty, it improves the likelihood of securing those goals in a conservative manner.

As you get more surplus from work, seek to fund the essential goals so they hit the second level earlier. By committing more funding to the goals you need the most certainty, it improves the likelihood of securing those goals in a conservative manner.

An alternate approach would be to commit more of your initial resources to your essential goals and not have too many opportunistic goals.

The advantage of this approach is that you really do not know whether you will experience a normal, good or poor market return sequence. Why not just let the market do its magic and if you are less unlucky, most of your goals still get fulfilled.

Unless you are immediately retiring, we know that you will have additional surplus coming in and it is not too late to commit more capital then to the more essential goals.

If you are retiring, perhaps it would make more sense to fund your essential goals to the second level immediately, at the expense of your opportunistic goals. At some point, you will need to have a conversation with yourself on how much of a peace of mind you want versus funding other goals that are less important.

Conclusion

The title of this article may have made you curious about the kind of investment product or solution out there that can improve the odds of reaching your financial targets.

Some might be a bit let down by what I have shared.

The truth is that if there are products out there that give you this level of certainty that is sound, I would let our clients and my readers know.

One of the reasons Bernie Madoff was able to get many rich and famous people to invest in his fund is because everyone seeks the good, positive, consistent returns his fund seems to generate.

In every investment solution, there will be weakness in some forms, be it greater volatility, higher sophistication, mastery of behaviours, greater time management, or a low (but very possible) risk of ruin.

“The most reasonable plan is planning on your plan not going according to plan.”

– Morgan Housel

You could discover and come across the best performing fund that did well in the past 10 years but I would have a question for you: What is your plan if the best performing fund decides to underperform during your tenure?

When we hear clients speak, we would indirectly detect how much they wish to achieve their goals and why it means so much to them to live their life with peace of mind.

If that is the most important thing our clients want, and we can help them through our resource allocation expertise, then I think that is good enough for me.

I may have more in my tank to write about life planning with good-performing funds and increasing your retirement income odds in the future. Do let us know which one you would like to read first.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s first fee-only wealth advisory firm, and Chief Editor of Investment Moats, Singapore’s most well-read financial blog.

For more related resources, check out:

1. Why Rolling Returns Could Increase Your Investment Conviction

2. To Live the Good Life, Make Life Decision First Before Wealth Decisions

3. How We Ensure Reliable Investment Returns for Your Retirement

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.