I have seen this question asked in conferences and seminars again.

And Again.

And Again.

And somehow, I felt the people asking that question never got a satisfactory answer.

The question:

If I have a lump sum of money, should I invest the lump sum in one shot, or should I split them up into tranches?

Mathematically speaking, if your investments have a positive expected return, you should put your money in all at once. We should not be splitting it up.

Although this is the question being asked, one usually has a deeper concern:

I do not want to put in $3 million of my hard-earned money and see it cut to $2 million in a few short months. It will look very embarrassing on me and I do not know how to answer my spouse.

If they are so afraid of losing money, why do they wish to invest in the first place?

They wish to invest because, frankly, they also do not know what to do with their wealth, and deep down, they are afraid that their money is being eroded by inflation. Or they have missed out on making their wealth potentially work harder.

Fear of losing money and fear of losing to inflation are two very contrasting fears.

- If you have held everything in cash, you would have missed out on keeping up with inflation

- If you are invested, you would be afraid of losing a chunk of your wealth.

I can empathise with this feeling because I am also human. I feel the pain of seeing my hard-earned wealth lose a large part of its value as well.

There are some things you should know:

- If you invest in a diversified portfolio made up of assets that have positive expected returns, you will build up wealth

- In the short term, the portfolio value may be volatile. To earn that positive expected return, you must stick to it for a period

Think of your diversified portfolio as a “volatile savings account” that earns a good compounded return. This savings account can be rather volatile from time to time, tempting you to sell out.

Therefore, to build wealth successfully with this “volatile savings account”, you need to win a psychological battle with yourself.

Fortunately, some techniques can aid you in winning these mind battles with yourself.

Today we are going to go through one of them.

A Tale of Three Wealth Builders

Traditional portfolio management techniques have a way to make wealth accumulation more liveable, but seldom see it being illustrated. The below then is an example.

Three wealth builders happened to start investing one year before the Great Financial Crisis. They might want to build wealth for a lot of reasons. In this case, their main goal is to have enough wealth for their retirement.

These three wealth-builders are different from each other in terms of:

- Age and phase of life they are in

- Level of net wealth

- Level of after-tax income

Let us assume that all of them are in the accumulation stage, so they are not looking to spend their wealth during this period.

The Great Financial Crisis is perhaps one of those financial events that occur once every few decades.

Here is how some of the major equity indexes, which the equity funds tracked, did during the Great Financial Crisis:

- The MSCI World Index fell 40.71%

- The MSCI Emerging Markets Index fell 53.33%

- The MSCI All Country World Index (ACWI) fell 42.19%

- The S&P 500 (US) fell 37.00%

A lot of wealth builders swore off investing in equities because their wealth fell drastically due to it.

In the midst of the carnage, here is how bond indexes, which bond funds tracked, did during the same period:

- The Bloomberg Barclays Global Aggregate Credit Bond Index 1 to 5 years hedged to USD rose 0.40%

- The FTSE World Government Bond Index rose 10.90%

- The Bloomberg Barclays Global Aggregate Bond Index rose 5.57%

For a lot of wealth builders, their goal is to get greater returns. However, they have not thought about the greater volatility that comes with allocating their money to equities.

However, we must also take into consideration our client’s ability and need to take risks.

For those with lower risk tolerance, their wealth would be deployed in a portfolio of both equities and bonds. The eventual portfolio volatility is smoothed, and more bearable.

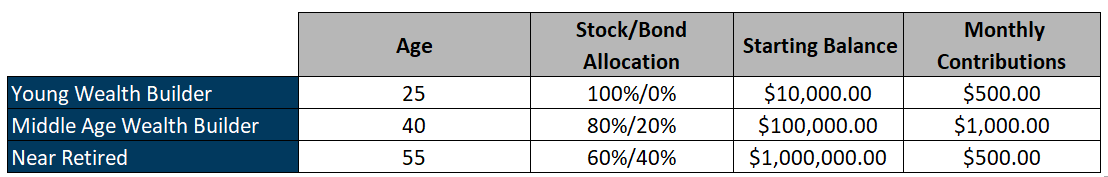

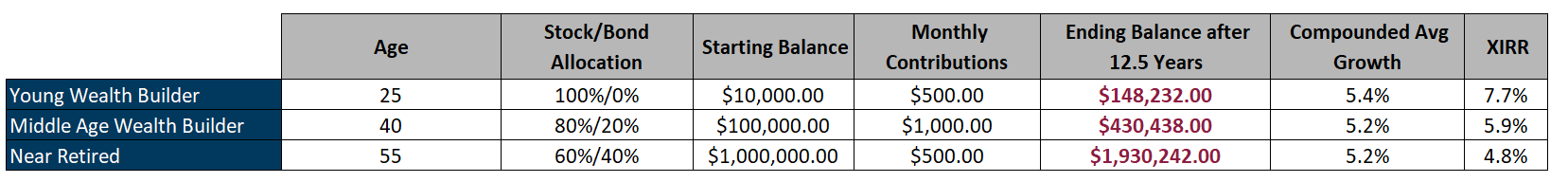

All three wealth-builders have the following initial portfolios and contribute a fixed amount per month to their portfolios to build wealth:

Their contributions, starting balances and allocations are different as suggested by the adviser based on the client’s time horizon, ability to take a risk, and need to take a risk.

The clients’ funds are invested in Dimensional funds with an annual wrap fee:

- Equities: Dimensional Global Core Equity Index

- Bonds: FTSE World Government Bond Index

- Fee: 1%

In 2008, Dimensional Global Core Equity Index returned -40.4%. The FTSE World Government Bond Index returned +10.9%.

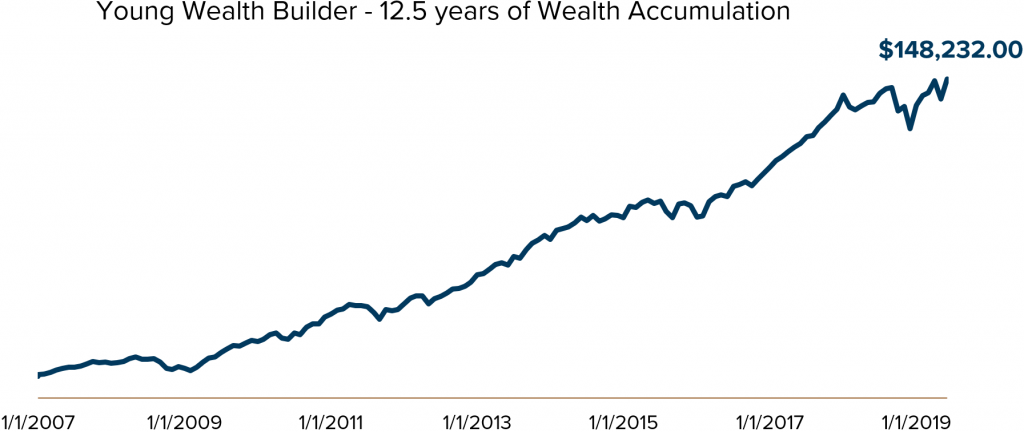

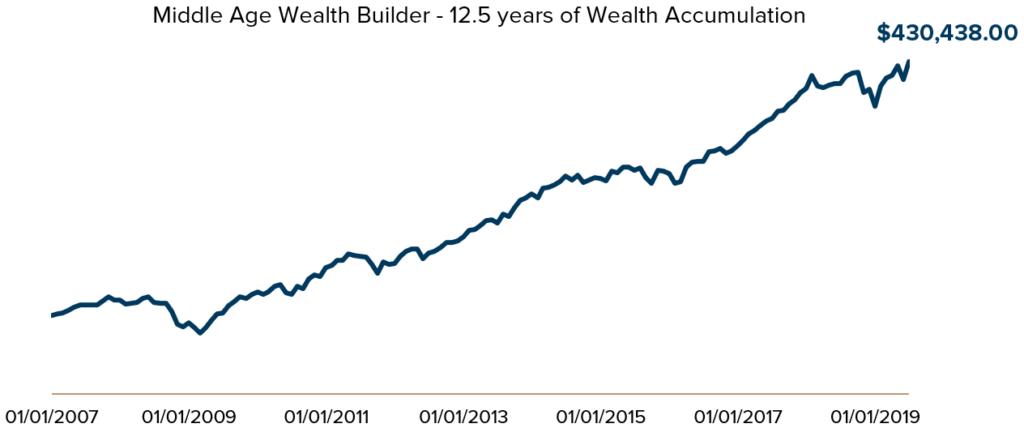

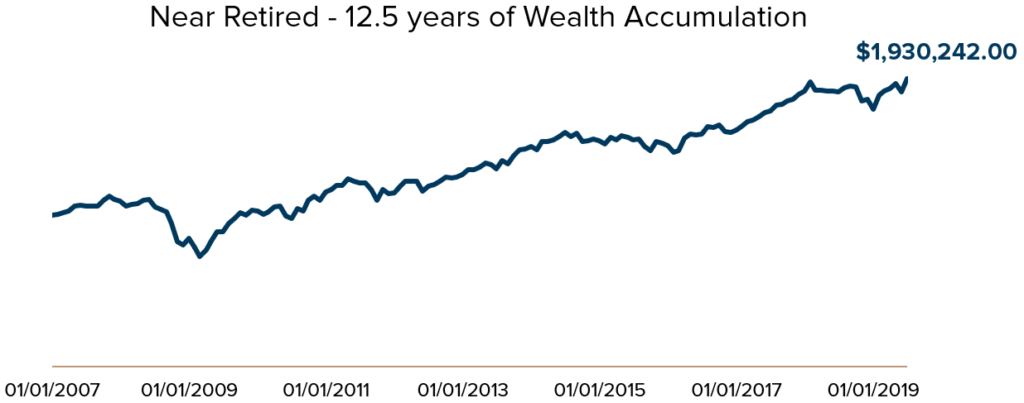

Let us look at their wealth-building experiences over these 12.5 years.

The wealth accumulated by the young wealth builder:

The wealth accumulated by the middle age wealth builder:

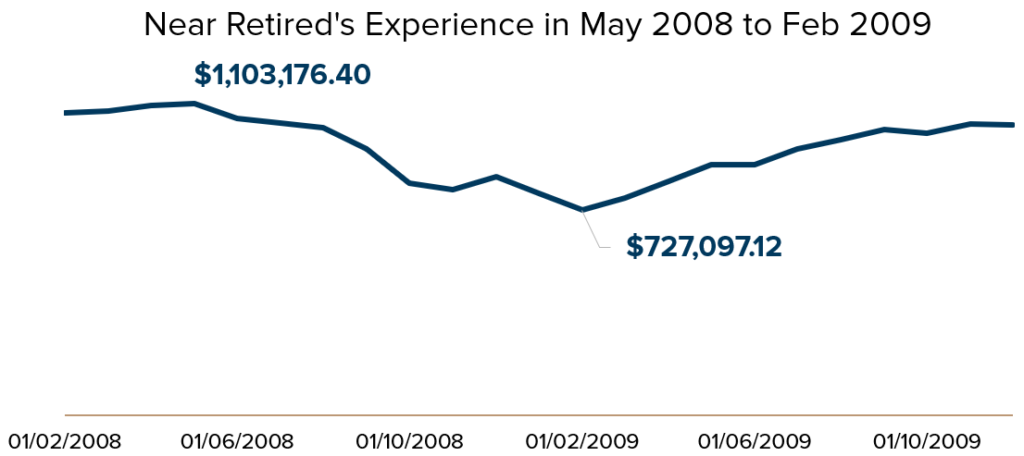

The wealth accumulated by a near retired:

Here is the summary of the wealth that they built up:

All three wealth builders saw their wealth position improved over 12.5 years. This is evident. But how was their experience through the challenging period of 2008?

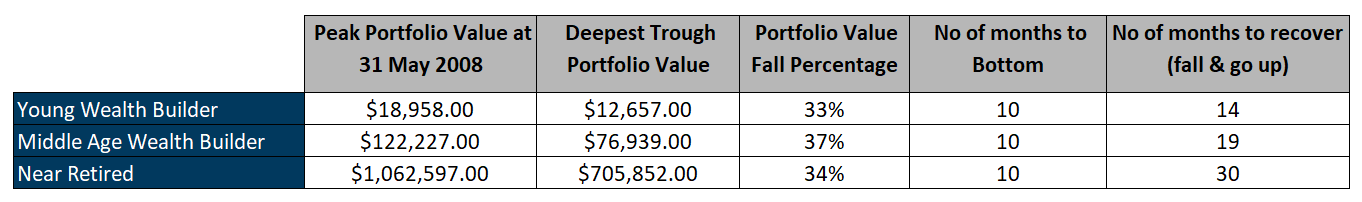

The following table shows the degree the portfolios fell from their peak values in 31st May 2008 to the deepest trough in 28th Feb 2009 for the wealth-builders:

All three wealth builders saw their portfolios declined by 33% to 37%.

To put this decline into perspective, the Dimensional Global Core Equity Index fell by 49.5% over the same period.

It is one thing to say you can withstand the huge decline in your wealth. It is another to live through one. For the majority of us, our TRUE ability to take risk is lower than we think.

As an investor, your experience is likely to match one of these three wealth builders.

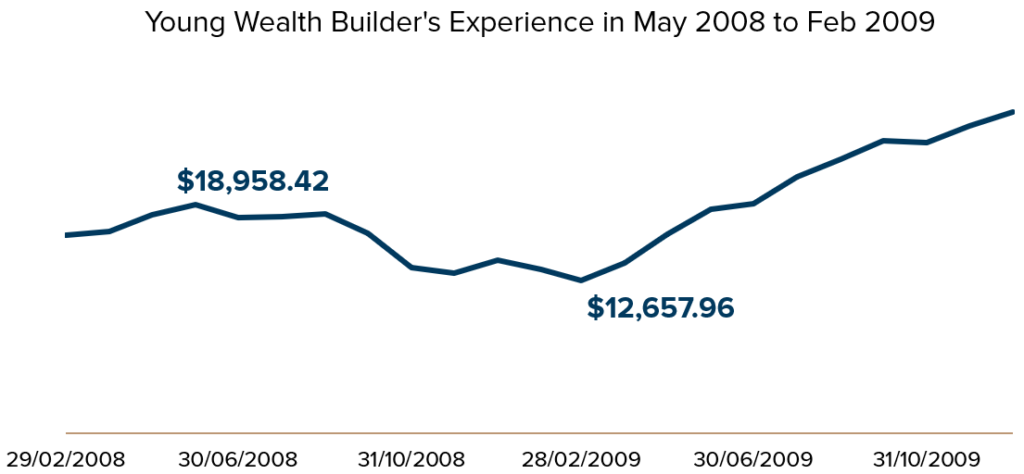

What Made The Young Wealth Builder’s Accumulation Process More Liveable?

The young wealth builder deployed 100% of what he had into a 100% equity portfolio.

When the markets start to fall, his initial wealth bore the full brunt of the drop in value. He would have endured the full 49.5% fall in those 10 months.

The interesting thing is that at the lowest, his accumulated value of $12,657 is still higher than the initial $10,000 invested. This is mainly due to the monthly capital injection into his portfolio over the 10 months.

The young wealth builder is at the peak of his future human capital. This is when he is the strongest in:

- Learning

- His mental and physical capabilities

- Getting income increments

- Getting re-employed if he gets unemployed

- Having the longest time horizon before he needs the money of

The young wealth builder would need to think about this: What is the utility of his entire financial net wealth of $10,000?

Chances are that this entire net wealth is not going to be useful for him. For example, to fulfil certain goals such as retirement, he would need at least $400,000 or more in his portfolio.

In order to get there, he must grow it.

He, therefore, has to be conscious to convert his labour capital to financial capital when his labour capital remains strong.

A market destabilisation is beneficial when the young wealth builder is accumulating. The longer the market stayed low, the more the young wealth builder can accumulate at these attractive prices.

Focus less on the financial net wealth he has. Focus on converting labour to financial capital.

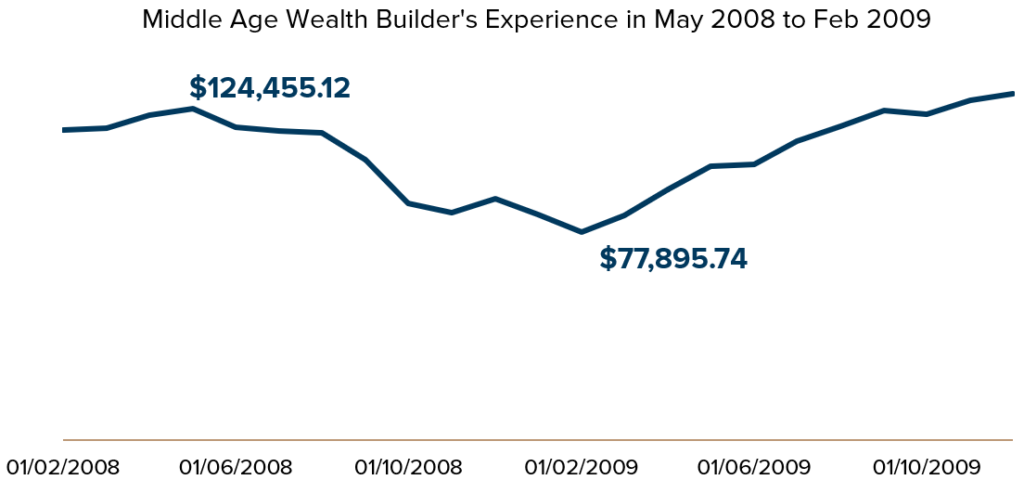

The Middle Age Wealth Builder Has A Strong Earnings Income

Our middle age wealth builder has more money deployed compared to the young wealth builder.

However, in terms of where she wants to accumulate to, it is still not where she wants to get to.

She has a shorter period in terms of the time horizon to when she needs the money. Thus, her adviser would recommend her to reduce exposure to market volatility by having a 20% allocation to bonds and 80% allocation to equities.

Compared to the young wealth builder, she is in middle management and has a higher income. Thus, she is likely to channel more of her after-tax income into her portfolio.

Her initial $100,000 would also fall 49.5% as well over the ten months but she has cushioned some of this unrealised loss on her wealth through her after-tax income into her portfolio.

For some of you who are in the same phase, you might also have higher income and be able to channel more to the portfolio.

When you follow up with a review of your portfolio, your experience with the decline in your portfolio value is better.

The Near Retired Would Feel The Greatest Anxiety

Compared to the younger and middle age wealth builders, the almost retired

- Have the shortest time horizon. She needs the money soon.

- May have the highest earning income or the lowest if she cannot get re-employed

- Her future labour capital may be the lowest since she is going to stop work soon. However, some continue to have high labour capital due to their competency and a great network.

What she is most afraid of is that if she loses the majority of her money now, she would most likely never earn them back.

In terms of planning for retirement spending, an adviser will have to take care of the volatility of their client’s portfolio during

- The few years before retirement

- The few years after retirement

A negative sequence of returns in the portfolio would negatively impact the client’s retirement funds. Her retirement funds would run out faster.

This may not be a problem if the client has accumulated a much larger retirement fund. Your adviser should be able to tell you how much is large enough that a negative sequence of returns is less of a problem.

Due to the psychological and technical retirement aspects, it is often recommended that we have a greater bond allocation versus equity allocation as we approach our retirement.

For our client here, she has a 60% allocation to equities and 40% allocated to bonds.

The large bond allocation in her portfolio has mitigated what would be a 49.5% decline in value to 34%. This would make her experience much more liveable.

Having Good Competence & Sophistication Will Help In Your Psychological Battle To Trust The System

Not all Investors will realise that traditional portfolio management, as mentioned in books, works the way they said it would.

You have to apply it, live through some volatile investing periods, to gain a conviction.

I have friends who take a similar approach to wealth building:

- They understand the wealth equation and can identify the levers that everyone can pull to build their wealth

- They spend effort educating themselves on how low-cost index investing is done. They know what the considerations and risks are, and how it gels with their wealth-building journey and lifestyle

- They invest in a simple portfolio of low-cost funds

- They focus on their jobs and tries to convert more of their human capital to investment capital. They also get on with their life.

When you have a deep understanding of how this system of wealth building works, you tend to live with it better.

You will realise that:

- Markets do not always go up, they go sideways and go down as well

- There are times you will look at your portfolio and it seems like you are the biggest loser

- You deeply understand why this method of wealth-building yields a positive expected return over time, and what you should do now based on the system

- What information you should focus on, and what you should tune out

I do have to stress: It is very difficult to overcome our human instinct.

I do find a lot of investors have subconscious thoughts that they do not have control as a result of lacking a deep understanding of how their wealth is built. They think they know enough. However, they do not.

Many times, what you are afraid of is that,

- What you are doing is wrong

- You are making the biggest mistake of your life by how you are executing things (be it selling, or holding on to your investments)

- There are too many noises, cross-currents that are confusing you

Your psychological battle in your subconscious is won by having more evidence that

- This is the right way to build wealth

- Your risks are managed

- Your life goals are still on track

We are also aware that not many of our clients can develop this deep understanding of wealth management at the start. Their efforts are much better spent on their businesses and their day jobs.

We think clients should know enough about how their wealth is managed.

Risk coaching is an integral part of our financial planning framework.

The promised land is where your wealth supports your life goals. To reach there, you would have to live through periods when it is psychologically challenging. You have to be equipped to live through this psychological battle.

If not, do find someone and have a support group that has great collective competency to go to the promised land with you.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s Fee-only Wealth Advisory Firm.

For more related resources, check out:

1. To Do Well In Investments, Don’t Focus Too Much On Forecasts

2. Retirewell® Part 2: Offering Retirees Security and Peace of Mind

3. Why Rolling Returns Could Increase Your Investment Conviction

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.