At the dinner table some months back, my daughter suddenly blurted out that she wanted to watch a concert by Ed Sheeran. As many of us will probably know, it cost a few hundred dollars just to watch a concert like this. My son who was listening in then went on to tell her why she should not waste her money. His reasoning was that it is so silly to spend so much money just for a few hours of fun when the same amount of money could be used to buy a 3-year subscription with Spotify where she could listen to many songs (including Ed Sheeran’s songs) many times over. Not surprisingly, the sister rolled her eyes and told her brother that there is a difference listening to Spotify and being in a live concert and that he needs to live for the moment and have a life! My son retorted and said she should be prudent and save for the future! Thankfully, they decided to stop the debate then and we could continue with our steamboat dinner peacefully. But as I later on reflected over the conversation between my children that evening, I realised that it reflected the 2 ideologies that have become popular in recent years.

The first ideology is known as YOLO – You Only Live Once, which is along the same lines as the Latin “carpe diem” (“seize the day”). It is a call to live life to its fullest extent, even embracing behaviour which carries inherent risk. This acronym was most popularized in the 21st century by rapper Aubrey Drake Graham. The positives of this ideology are that it challenges us to live a purposeful life, giving our best in all that you do, knowing that “I shall pass through this world but once”. But If we adopt this ideology to the extreme from a personal finance perspective, it might entail us spending frivolously just to live for today, for the moment. But the result of it is that we might save nothing for tomorrow and become financially irresponsible.

The second ideology is the FIRE ideology – Financial Independence, Retire Early. The FIRE movement is a lifestyle movement towards living a life of thrift so that one can, as the acronym implies, achieve financial independence and retire early. Those seeking to FIRE will intentionally maximise their saving rate by finding ways to increase income or decrease expenses. The main ideas behind the FIRE movement originated in the 1992 best-selling book Your Money or Your Life written by Vicki Robin and Joe Dominguez as well as the 2010 book Early Retirement Extreme by Jacob Lund Fisker. The positives of this ideology are that we are financially prudent and achieve financial freedom early. But If we adopt this ideology to the extreme, then we might scrimp and save so much for the future that we don’t live life today. We might say that we can live life when we have achieved FIRE. But as we all know, some things in life are time-sensitive and once you passed them, we lose them forever. Some of these things involve spending time and money in activities that build memories with children when they are young or our parents while they are still healthy. And if unfortunately, life hands us a bad card and we expire early before we retire, we might not have live at all.

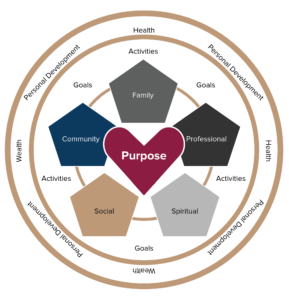

So instead of going either extreme, perhaps the wiser way is to have a balance. But what is the balance and how do we live out this balance? The balanced approach is to use our money to allow us to live a life of purpose as if life will end tomorrow and yet set aside enough, well expecting us to live until tomorrow. To do that, we need to first make a life decision and then let our financial decisions enable our life decision. Many years back, I developed a model called the Finishing Well Framework to allow us to do that. The framework starts with us deciding our purpose, what we exist for or what do you want to exist for? Once you make that life decision, we then list out our roles and responsibilities and make sure by fulfilling them, we achieve our purpose. We can generally categorize these roles and responsibilities under 5 areas:

- Family – A father, a mother, a son or daughter, a son and daughter-in-law etc

- Professional – A brand executive, an accountant, an engineer etc

- Spiritual – Member of a church, leader in a mosque etc

- Social – Relationship to a few closer friends, or the recreational activities that we really enjoy doing

- Community – Member of a voluntary organization etc.

How do we know we are fulfilling our responsibilities and living out our roles well? We set goals. They are like our key performance indicators (KPIs). If we achieve them, we know we are “performing”. After that, we list out the activities that we need to do to achieve these goals for setting goals without activities is “NATO” – No Action Talk Only. Finally, you will notice from the outer circle of the model that there are 3 enablers:

- Personal Development – These are the self-improvement activities such as further education, courses or reading appropriate books to help us better achieve our goals.

- Health – These are the health activities such as exercises, lifestyle habits or routines to help us be physically stronger to allow us to better achieve our goals.

- Wealth – There are the financial decisions we make to better allow us to do our activities and help us achieve our goals.

So as we can see, money is not a goal. It is an enabler to help us live our “YOLO” or purpose-centred life, not tomorrow, but today and every day, in the activities that we have decided on so that we can achieve our goals, fulfil the responsibilities of our roles to achieve our purpose. At the same time, we set aside enough money to save towards financial independence. We may not FIRE but we will definitely be able to be responsible for ourselves financially.

Over the years, I have coached many people using the Finishing Well Framework. At the start of writing what we call the Finishing Well Blueprint, it is always difficult for them to determine what they exist or want to exist for. But once we get that down, it becomes easy for them to know the regular activities and the enablers that they should focus on and to allocate financial resources to support these activities. The result of a person living a purpose-centred life is contentment, gratitude and not sweating the small stuff.

I think I will be having a conversation soon with my children. One of them needs to consider FIRE more and the other YOLO. And I believe both of them can achieve this balance through Finishing Well.

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-Only Wealth Advisory Firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation. The edited version has been published in The Straits Times on 21st July 2019.

For more related resources, check out:

1. How The Rate Of Return Is Driven By Your Goals | Investment Series

2. Why Your Initial Financial Plan Is Guaranteed To Change

3. Here Are The Top 5 Financial Best Practices To Follow Now

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.