Here we are, a few days after National Day and we have had quite an eventful year.

We have clients who remained invested.

When the markets came down, we explained to them that markets eventually will head up. We just do not know when that will be.

The lower market presents attractive levels for them to add on to their investments if they have the time horizon to hold on and their goals require them to capture the returns.

There are also clients who were incredulous where the markets are currently.

After a once in a hundred years pandemic, the S&P 500 is positive 4.92% for the year. The MSCI World Net Total Return index is positive 0.95% for the year.

There is surely going to be a disconnect between what the stock market doing and the real economy (we called this the Mainstreet).

They are waiting for the next leg down before adding.

Here are some things to think about.

Markets are Forward-Looking.

I often liken the market to a mixture of two things:

- The aggregate psychology of the people participating in the market

- The constant re-valuation of what all the companies in the index are worth

Number 1 is volatile.

As a collective, we go into periods where we are wildly not rational. When we are fearful. When we are calm. When we are confident. When we are uncertain.

Number 2 is also volatile.

The value of a single company such as General Electric is the discounted stream of future cash flow that General Electric can earn.

If you aggregate all the companies in the index, you will obtain an intrinsic value of the index.

However, the nature of each company’s future cash flow changes over time, and thus the value of each company changes over time. If you aggregate all the companies in the index, you get a system that always revaluing all the companies in the index.

The intrinsic value of an index like the S&P 500 or MSCI World changes consistently.

When you mix number 1 with number 2, you really have a wild party.

It does not mean the markets are not rational. At times it is, at times it isn’t.

What this means is that markets are consistently trying to value the future cash flow of all the businesses.

What you are seeing in the main street on an everyday basis is what is happening today.

However, the market is valuing what the cash flow will be like in the future.

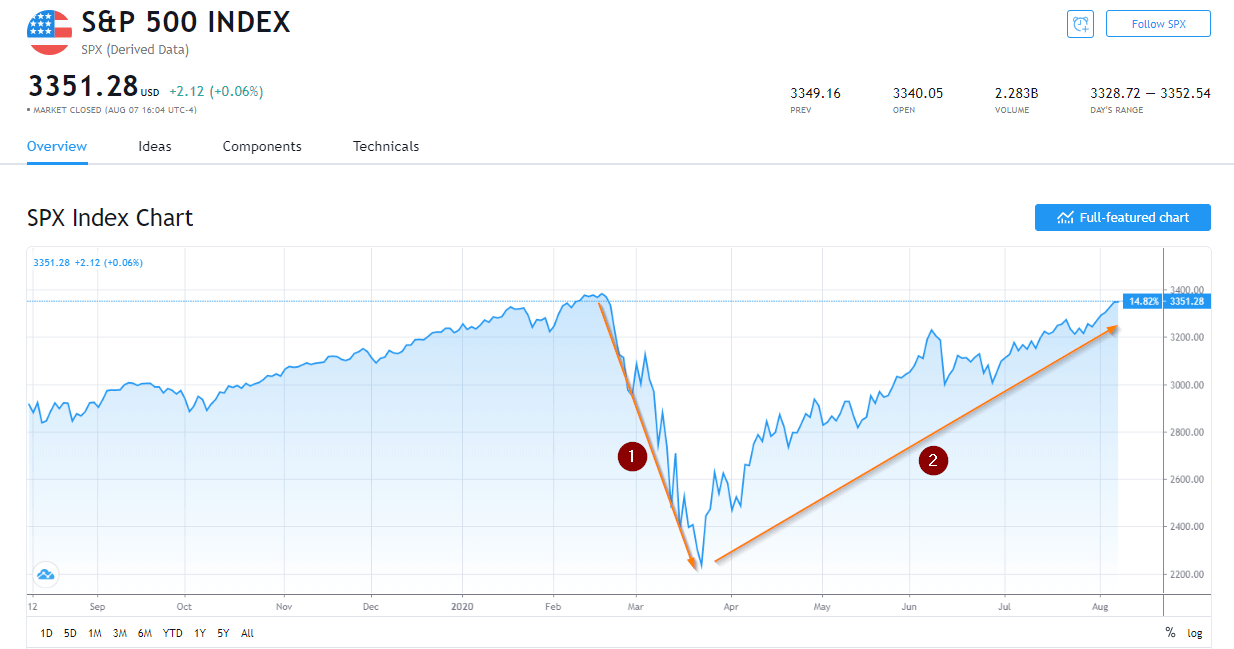

Here we have a chart of the S&P 500, which represents the biggest companies in the United States.

#1 is rational in that there was tremendous uncertainty. The crowd has a problem figuring out how long this pandemic is going to last. Businesses must shut down and when they cannot function, they cannot earn revenue, and their cash flow is going to be affected.

Everyone is guessing that the pandemic will last for a long, long time and the aggregate future cash flows of businesses are going to be much lower. Everyone is trying to guess how much lower.

#2 is also rational. March 23 was the recovery, and it coincides with the biggest fiscal stimulus announcement by the government. Markets gain confidence that these businesses are going to survive. I will expand on #2 later.

If you invest when things are calm in the main street, then it is likely the fattest returns have already passed you. Some researchers have indicated the stock market precedes the real economy by six-months.

The Markets Recovered Because Future Earnings Are Strong

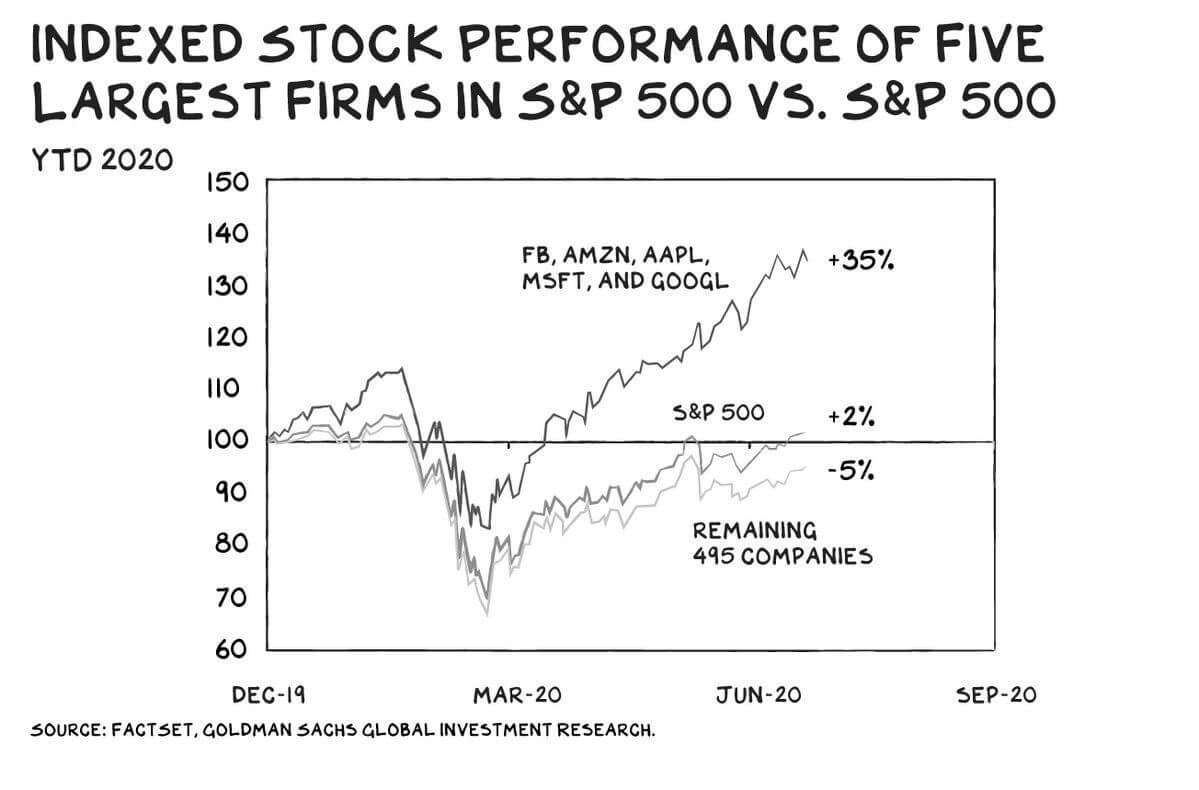

The above illustration is taken from Goldman Sachs Global Investment Research. It shows the performance of the top 5 stocks in the S&P 500 versus the S&P 500 and the remaining companies.

Without the top 5 stocks, the rest of the 495 companies as a collective is below the S&P 500. This shows that these businesses are struggling still.

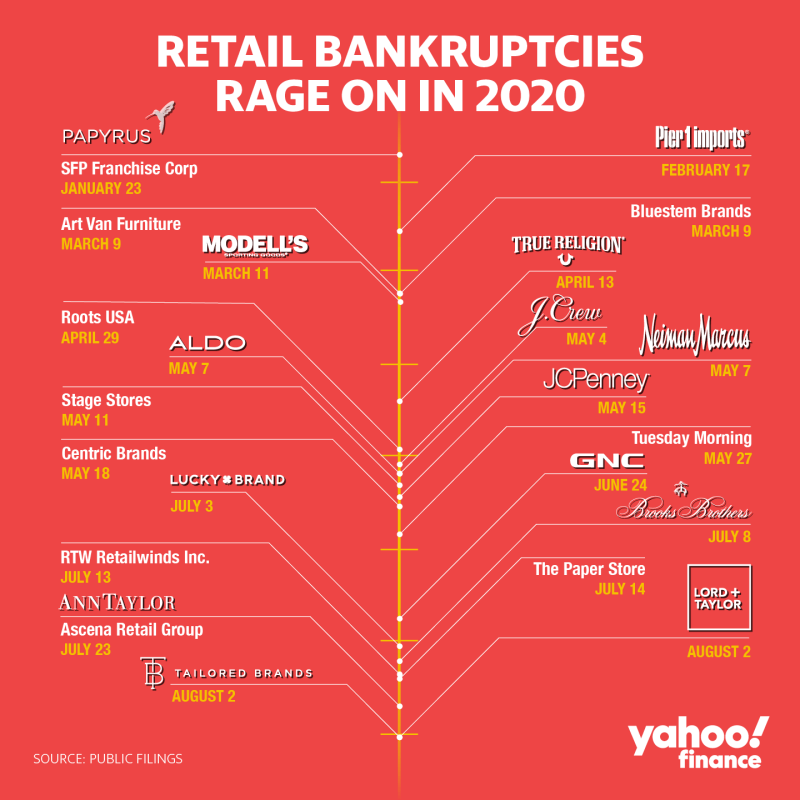

This coincides with what you see in the main street. You see restaurants, bars, and apparel shops not able to operate and declaring bankruptcy. For those who survived, there is uncertainty whether they will be able to pull through successfully.

Hotel occupancy reached a low of 22% as an aggregate. The theme parks, convention cannot operate because social distancing needs to be practised.

In contrast, there are businesses that are doing well and thriving at the same time.

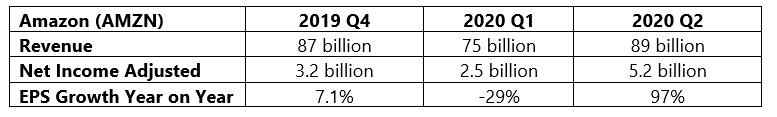

Here is a snapshot of Amazon’s quarterly financial results:

If you cannot get your things in person, you need to get it online. Amazon’s Q1 and Q2 revenue remain very robust.

The 2020 Q1 and Q2 figures reflect the performance during the pandemic period.

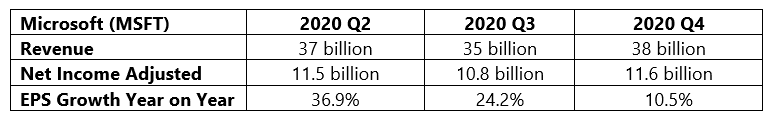

Here is a snapshot of Microsoft’s quarterly financial results:

Microsoft’s productivity and business processes (your Office 365, Microsoft Teams) are helping you remain productive during work from home. Their Intelligent Cloud and Business Processes are essential in small, medium businesses as well as large businesses to ensure the business continues to function.

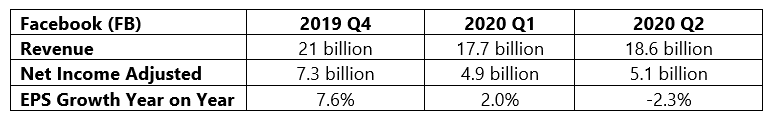

Here is a snapshot of Facebook’s quarterly financial results:

Facebook earnings growth, while tepid, shows that their business is still in demand. Businesses are rushing online in this pandemic, and to reach the right segment of the audience for leads, people continue to turn to Facebook advertising on their major virtual real estate Facebook and Instagram.

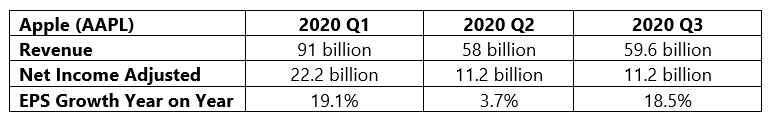

Finally, here is a snapshot of Apple’s quarterly financial results:

While Apple’s Q2 and Q3 looks weak compared to Q1, the first quarter traditionally is Apple’s stronger quarter. Apple’s second and third-quarter results in this pandemic have been much better than a year ago.

As a cohort, the top 5 biggest companies have guided optimistic outlook for their respective business in the future.

This signals to market participants that future discounted cash flows for these quality businesses will remain strong.

Market participants afford them with stronger prices.

The Main Economy is Dominated by Unlisted Small Medium Businesses Whose Performance is Less Reflected in the Stock Market

We tend to extrapolate what we see in our daily lives with what should happen in the stock market.

A lot of those businesses that we see struggling, closing down, may not be listed at all.

Businesses need to fit certain criteria before they can list on the stock exchange. There is a likelihood that businesses that remain unlisted may not be as well-capitalized.

Businesses that are listed may have more reserves, and may also have a greater option to tap the capital markets to shore up their capital to survive better.

Lastly, the stock market indexes tend to be capitalization-weighted. This means that larger companies that are performing well dominate the index.

So we will have our Microsoft, Apple, Google, Amazon, Netflix doing better and driving the index performance. The companies facing challengers such as Wells Fargo, JP Morgan, Bank of America becomes smaller.

As they become smaller their performance matter less.

The capitalization-weighted index is a “survival of the fittest” index.

Society is Very Resilient

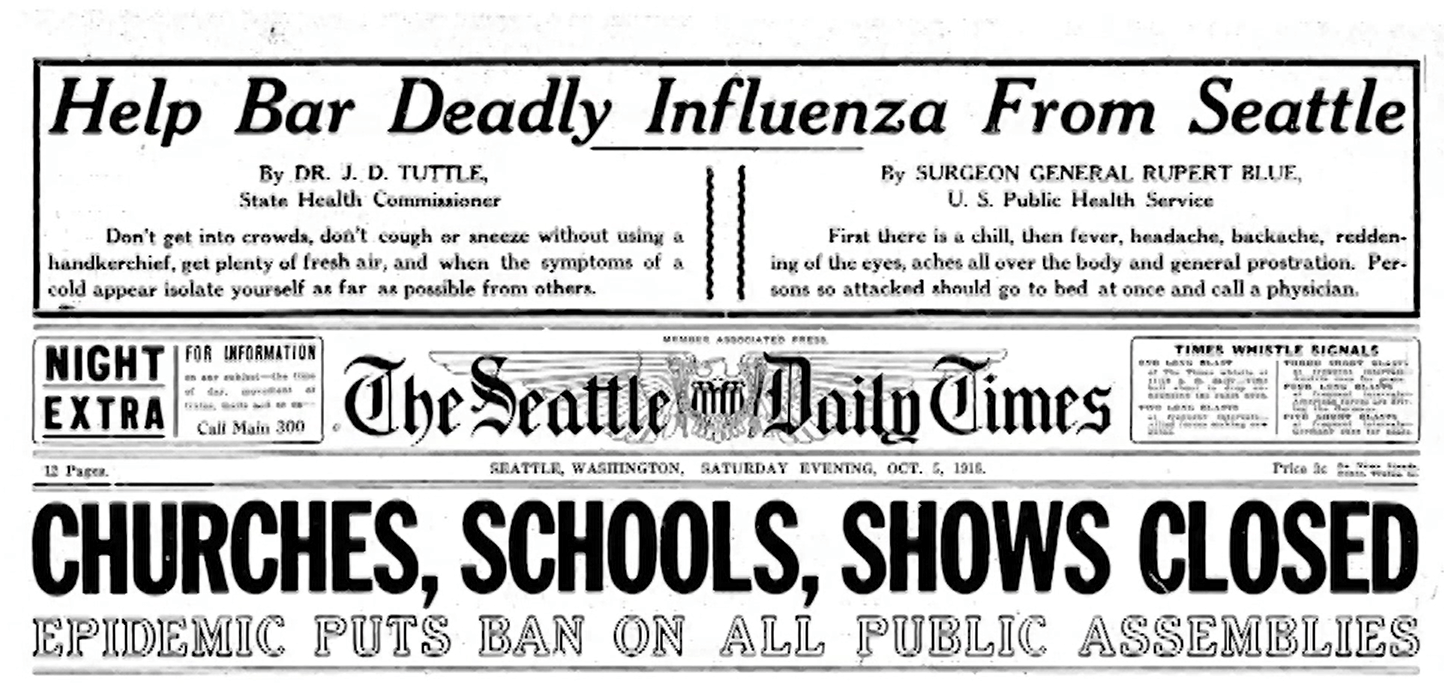

Apollo Lupescu, a Vice President at Dimensional Fund Advisers, recently did a presentation where he draws parallels to 2 periods where we experience similar conditions.

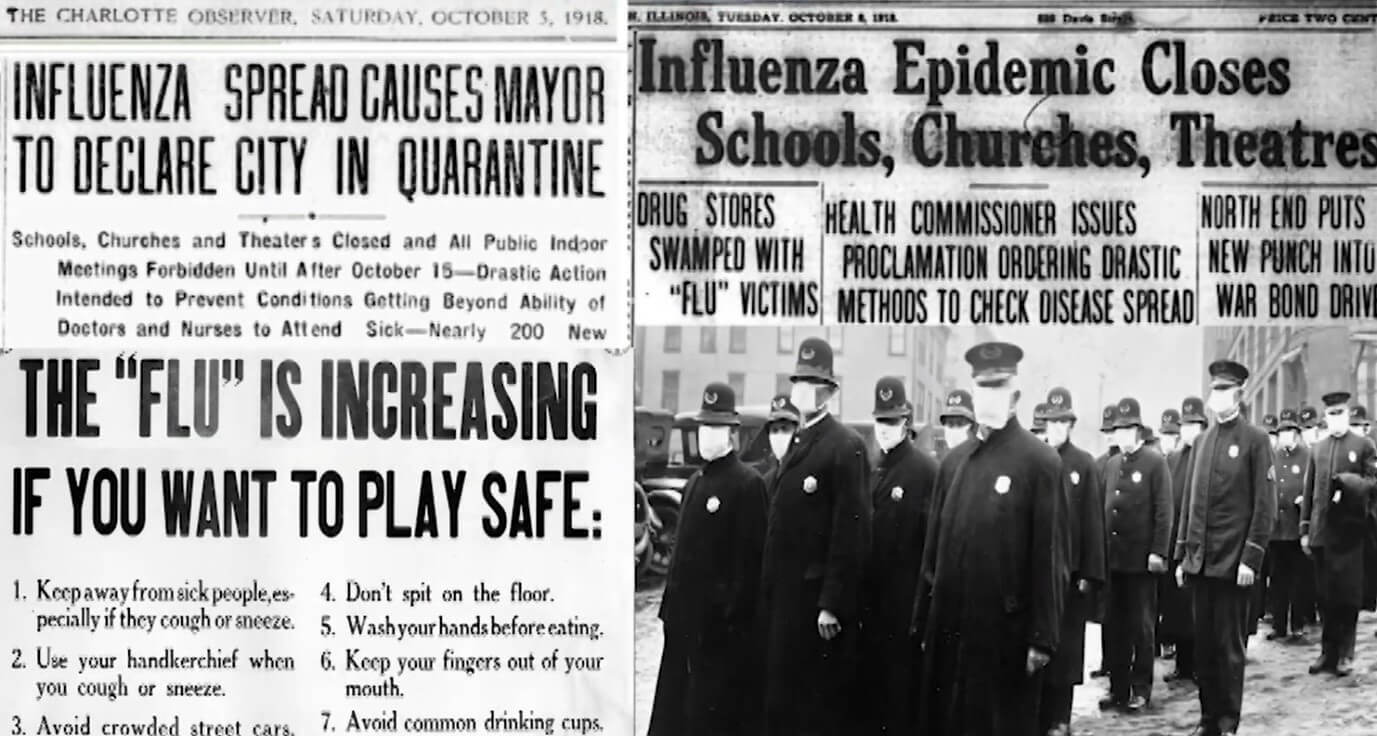

One of them was during the Spanish flu in the 1910s.

What you will observe is that what we are doing now… is not so different from that challenging pandemic, which wiped out more people.

Drug stores business was brisk, and theatres had to shut down.

They were told to adhere to basic sanitary advice such as avoid crowded areas. Masks were encouraged!

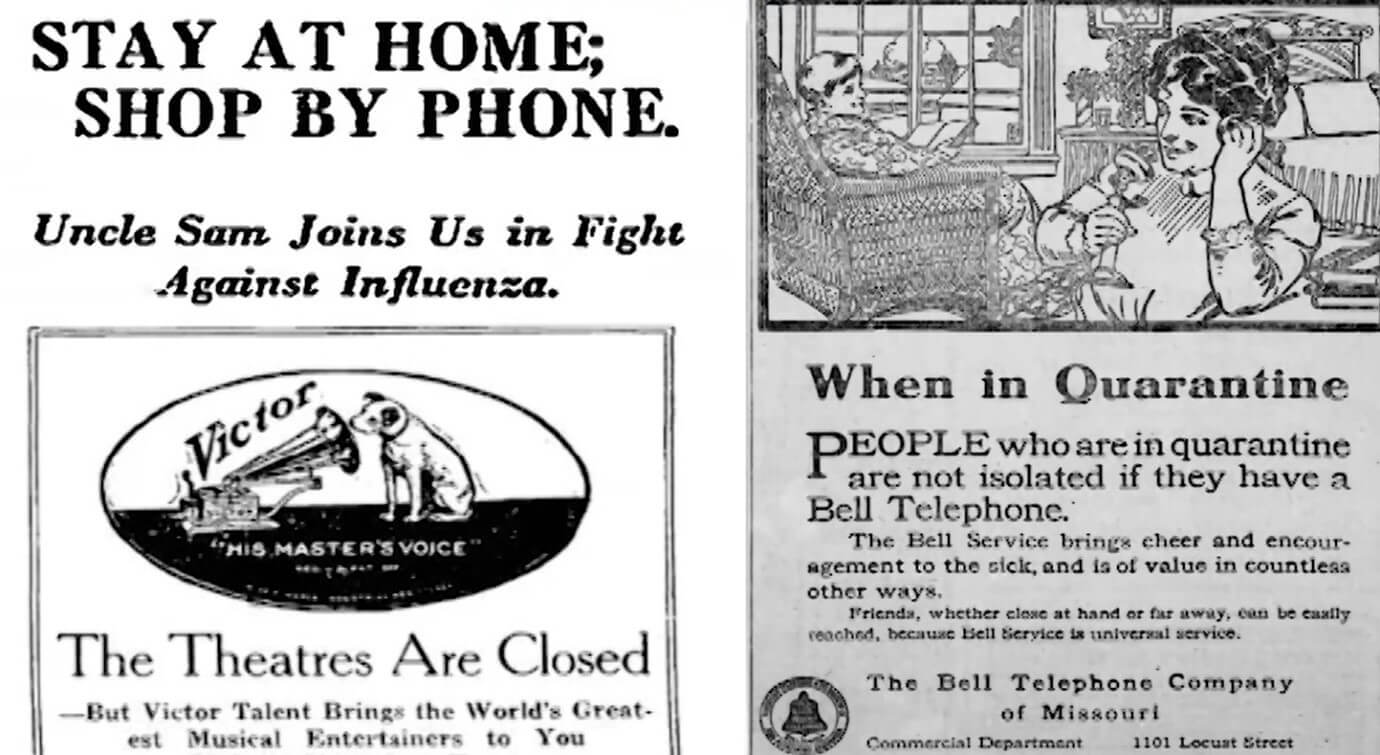

They do not have the internet back then (and sometimes we wonder how we would survive this crisis without Zoom, our smartphones, and our software as a service) but human ingenuity tweaks the services they offered.

If you have a Bell telephone you can buy your groceries by phone.

Survive they did, and this gave way to a period of prosperity in the 1920s.

What Will Happen from This Point On?

Honestly, we do not have any idea if markets will forget these few months and continue to hum along.

Or the markets will take a nosedive upon the resurgence of the second wave of the pandemic in various countries.

You have to get a few things correct:

- The series of events to happen (e.g. If A happens then B & C happens then D & E happens)

- What the stock market will do

- When the impact will happen

You can try to compute the probability of #1 x #2 x #3 happening. It may be rather low.

If I am right, you will not be tuning just to Providend for guidance on how you should invest your money.

If that is the case here are some questions to ponder when evaluating what investment managers say:

- How many fund managers, mainstream media financial experts, economists predicted that exactly in 2020 we will be hit by a pandemic of a global scale (to be fair Bill Gates the former Chairman of Microsoft did warn us that this was a very likely possibility but he didn’t get the timing right)

- How many have predicted the recovery would take less than a year?

- How many have predicted, and taken a position and executed successfully?

- Could you gain access to that fund?

We design portfolios that allow you to capture the returns of the market:

- If gold miners become the dominant companies, you will benefit

- If US dollar weakens and it benefits the emerging markets, the portfolio gives you exposure

- If a vaccine works and propagated, and businesses return to normal, the beaten-down companies recover, the portfolio gives you exposure

- If the 2020s heralded the age of tech-enabled firms, the portfolio gives you exposure

Perhaps the focus would be on things we can control:

- What goals in life do you wish to achieve?

- How much net wealth do you have now?

- How much realistically do you need for these goals and how much future income you may need? How do we model the needs in a fundamentally sound manner?

- What is the minimum rate of return do you need to achieve those goals in time?

- You have been through this volatile period, how is your risk tolerance like?

- How flexible are the timeline and nature of your goals?

The greatest risk is for us to focus too much on short term uncertainty and we do not have enough for our goals next time.

The article you have just read is part of Providend Curated Insights, a selected repository of content that we research about and reflect upon for the best recommendations to our clients.

Providend Curated Insights is narrated currently by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s First Fee-only Wealth Advisory Firm, and Chief Editor of InvestmentMoats, Singapore’s most well-read financial blog.

For more related resources, check out:

1. Principles for Successful Investing

2. Retirewell Part 10: Stock Markets Always Rise Over the Long Term

3. Stay Invested for The Long Term? Think Again!

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.