As we approach the year end, I cannot help but to reflect on the journey we have been through over the past 2 years of pandemic that has impacted every one of us. The financial markets had been no different, where it has been a rollercoaster of a 30% drop in March 2020 and ending up 16% positive by the end of the year, while continuing to grow 13% year-to-date (as of November) in 2021.

Throughout this period of working with clients, seeing the range of emotions and concerns from them also serves as a good reminder that putting in place an initial wealth plan is just the beginning of the journey. To ensure a successful long-term investing experience requires viewing this journey as a marathon and not a sprint. Hence, I thought to put together my top list of timeless principles for investing to help us stay on track.

1. Markets are efficient

The most common question that I get is whether it is the right time to invest, especially so when markets are at an all-time high.

The first thing to be aware of is that the financial markets are live, meaning that they are made up of market participants with billions of dollars in trades, both looking to buy and sell, that come together and agreeing to transact at a price that both sides deem fair. Think of it as a giant Carousell platform selling various products, and in the example of the equity markets, the instrument that is getting traded are ownership in companies. Every participant would have an expected return in mind for their transaction and while individually they might not be perfectly right, evidence showed that collectively, the vast number of trades aggregated together have been highly efficient in incorporating all available information at that time and determining its fair value with an expected return.

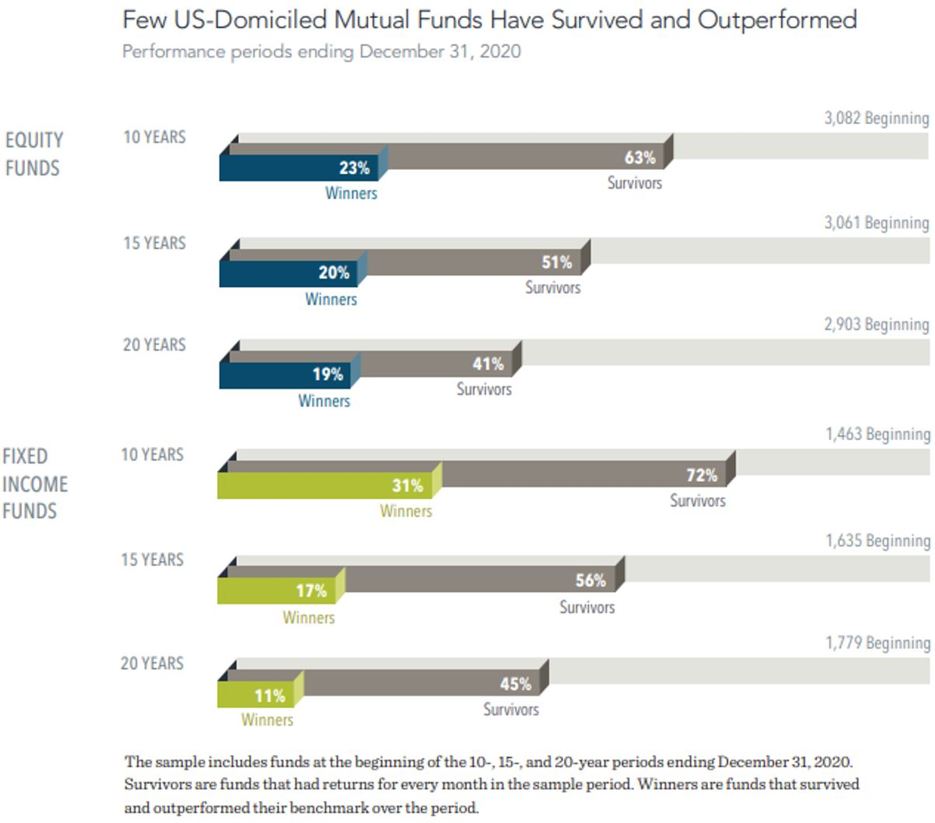

Think of how difficult it is for even professional fund managers with all the resources available to try to bet against the wisdom of the markets. If we look at the track record of US mutual funds, only 19% of equity funds and 11% of fixed income funds has outperformed the markets for a 20-year period.

2. Diversification

It is hard to ignore the news these days that highlights exciting growth from the likes of Tesla, Solana (cryptocurrency) or even iFAST closer to home. While it is true that we would have become exceedingly wealthy if we had concentrated our wealth in just a few single counters (congrats to you if you are one of those!), it is extremely hard to spot the next big thing and for every one that succeed, there are many others who have failed.

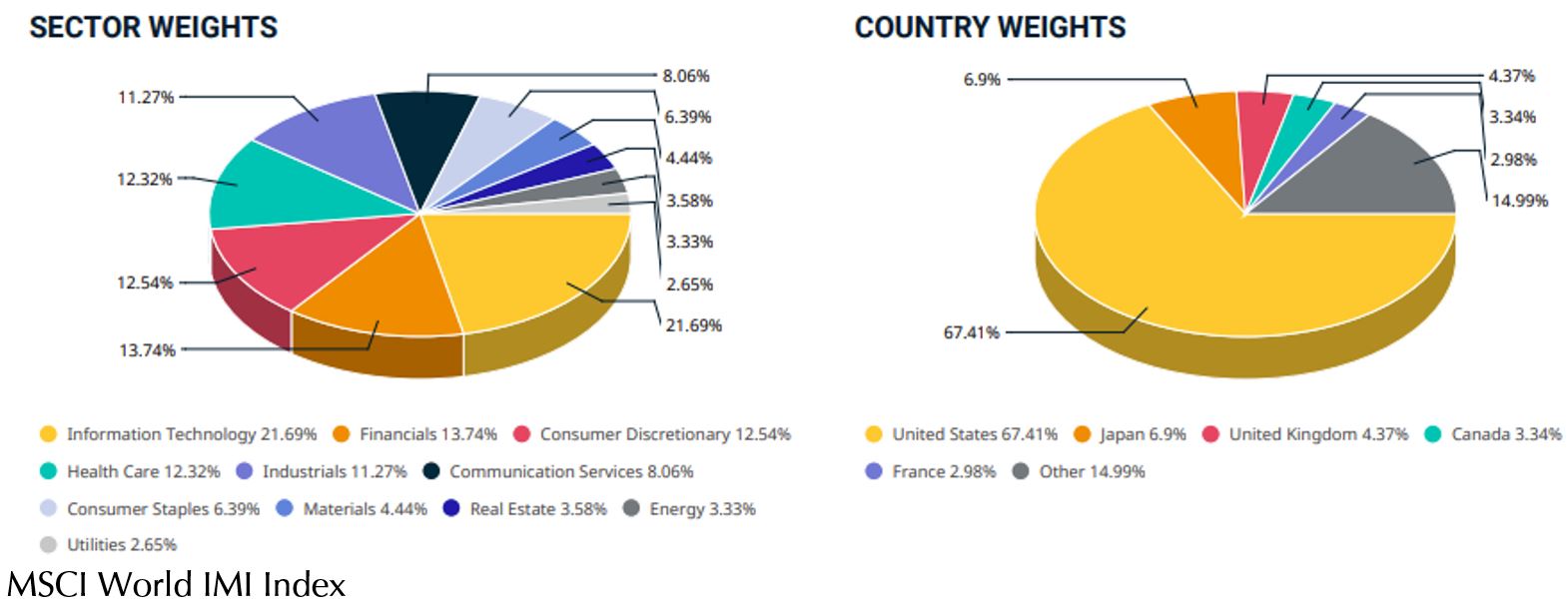

Ensuring that we are adequately diversified across geographies, industries and asset classes not only helps mitigate risks by avoiding being significantly impacted by the collapse of a single company, it also helps to capture returns if a certain sector or company does very well. This is especially important, considering that historically, only a small handful of companies drive a large proportion of market returns, and therefore you do not want to end up missing out.

3. Markets always go up over the long run

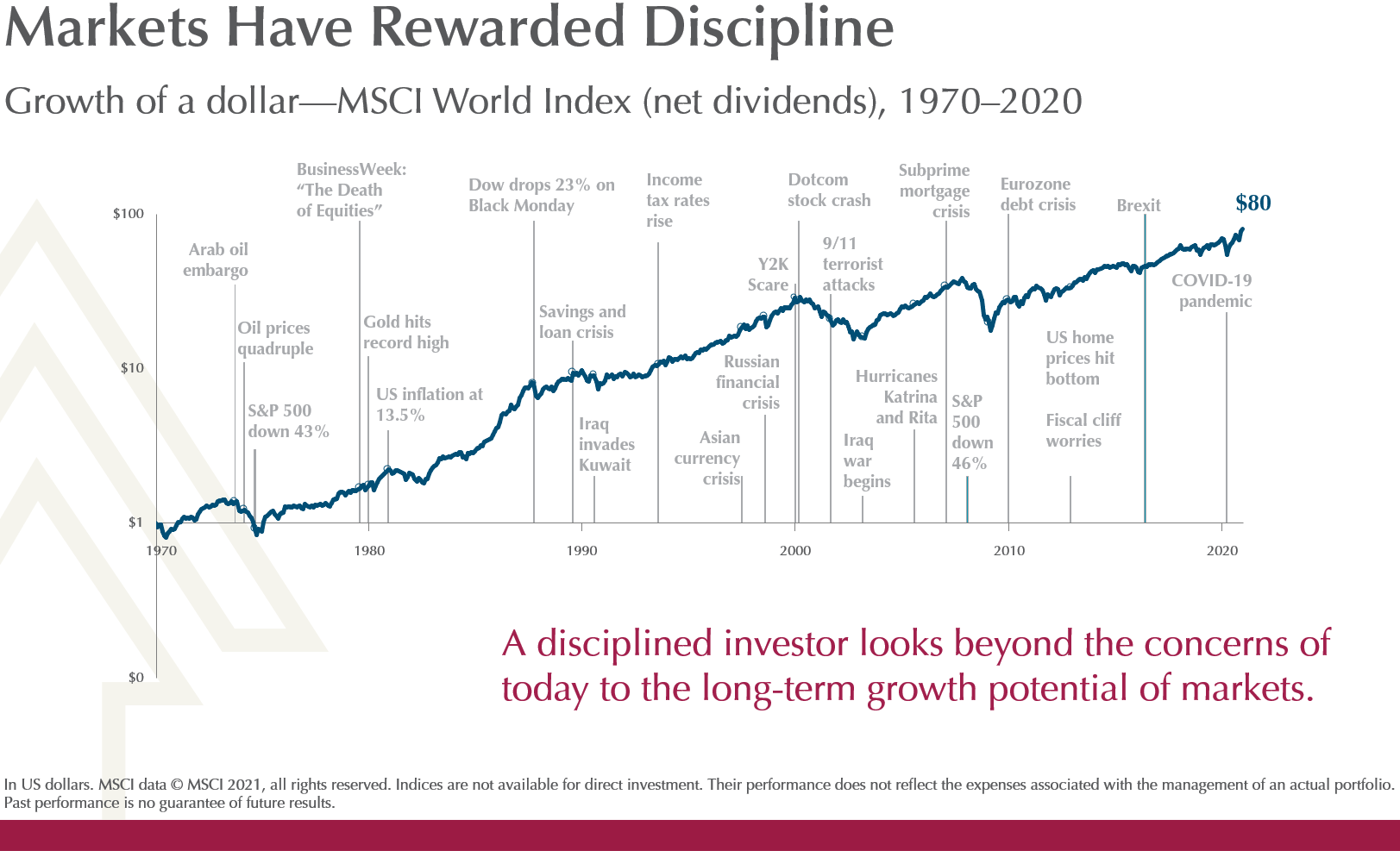

During times of market distress when it often feels like the world is crashing, it is a good reminder that throughout history, the markets always recover and go up over the long run.

Before we dive into why this is so, it is important to first understand and remind ourselves what exactly is the “market”? Usually, when we see news about the markets being up or down, it typically refers to the movements of an index such as the S&P500 or the MSCI World Index that you saw earlier. And this index basically measures the performance of a large basket of companies across multiple market sectors.

Hence the question is, why does the aggregate of all companies in the world, go up over the long run?

Inflation – The first reason is due to inflation. We all have a basic understanding that inflation means that the cost of goods and services rises over time. While it erodes the purchasing power of a consumer, it also means that the revenues collected from companies increase and that is beneficial to a shareholder owning part of the business. At the same time, companies own assets such as buildings, factories and inventory, which inflation also increases the value of these assets.

Population Growth – The current global population today (as of November 2021) stands at 7.9 billion which drives demand for the goods and services sold by companies. This population is projected by the United Nations to reach 10 billion by year 2057. An increase in population over time translates to increased demand, which then equates to again higher revenues for companies all around the world.

Innovation – If we look back in history, it is quite amazing how much innovation and technology has evolved along the years. The industrial revolution has evolved from mechanisation of labour to technological advancements, then moving on to the digital world due to the birth of the internet, and finally developing into greater use of Artificial Intelligence today.

Productivity is the key source of sustained long-term economic growth and with greater innovation comes greater productivity. Even during periods of market downturns, we have seen time and time again how humanity has triumphed against major challenges and recovered from its setbacks. While it may always feel like war (whether it is trade wars or pandemics) when we are in the middle of the downturns, we maintain the faith of our resilience and ability to overcome just like how we have always done before.

Self-Cleansing Mechanism – Lastly, the markets as part of being so diversified, has a self-cleansing mechanism. What this means is that while individual companies do rise and fall, and even disappear over time, being invested across the broad markets and owning every single company out there naturally means that newer and better companies replace the ones that drop out as the years go by.

4. Ignoring the noise

Be it whether it is about inflation, oil prices tanking or rising, reverse yield curves or wars, you will find that more often than not, there is always a reason that makes it seem that the economy or the stock markets are collapsing. And it does not help that there is a natural tendency for the media to put these news front and centre of our attention. However, if you are invested for the long term, you will realise that the short-term noise should not impact your long-term investment results.

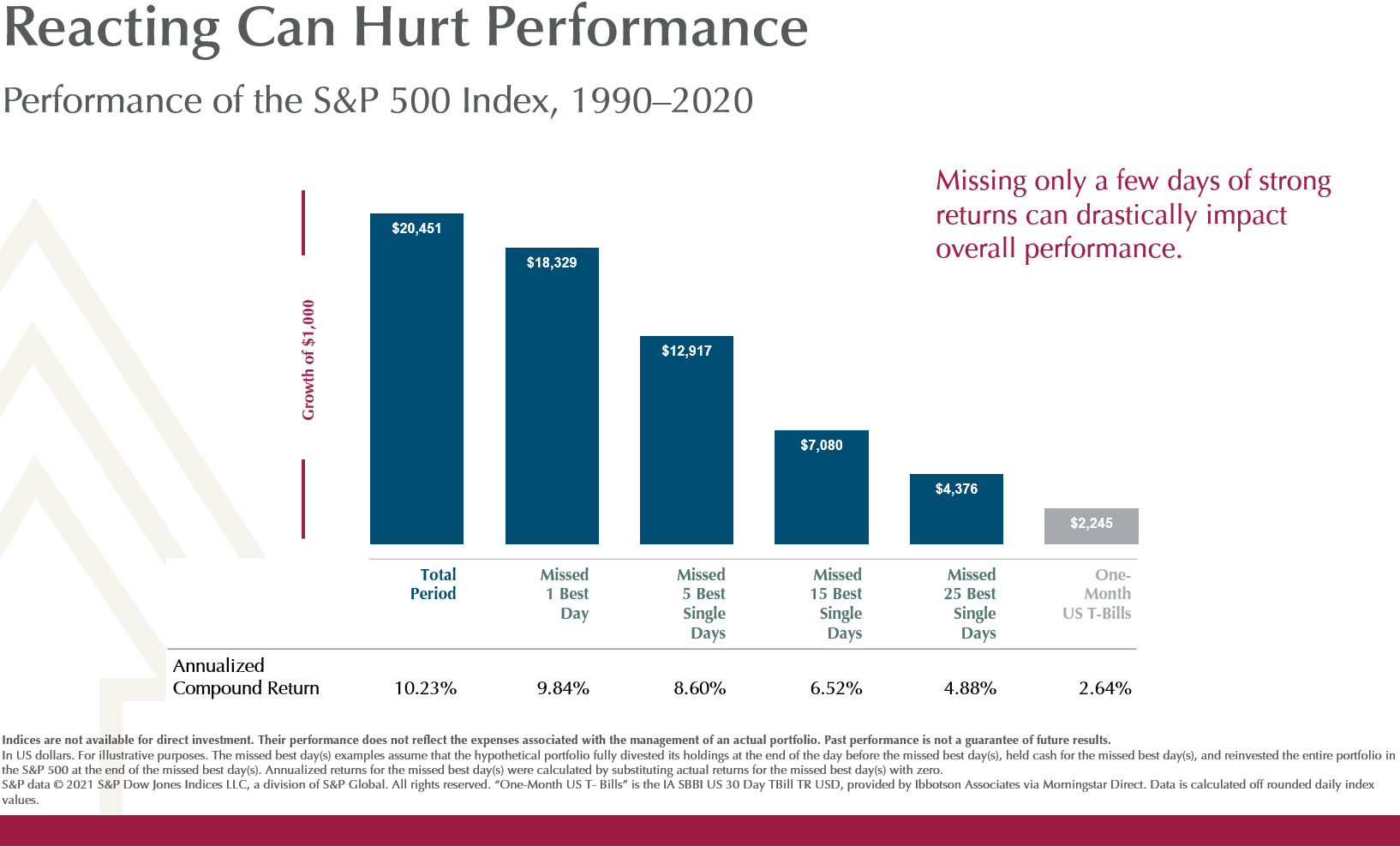

Why it is important to ignore the noise is because reacting to noise can hurt performance. If you look at the data, the S&P500 Index has returned 10.2% p.a. despite all the things that had happened over the past 30 years if an investor had been disciplined and stayed invested across the entire period. However, if he or she had just happened to be out of the market during the best 1-day gain in the entire period, the returns would have fallen to 9.8% p.a., ending up with a final amount of about 10% lesser. And it goes all the way down to 4.9% p.a. if we had missed the best 25 days, which equals to having a whopping 78% lesser! While staying on the sidelines at certain times does feel more assuring when markets are in a turmoil, the biggest risk is not capturing the recovery when it happens.

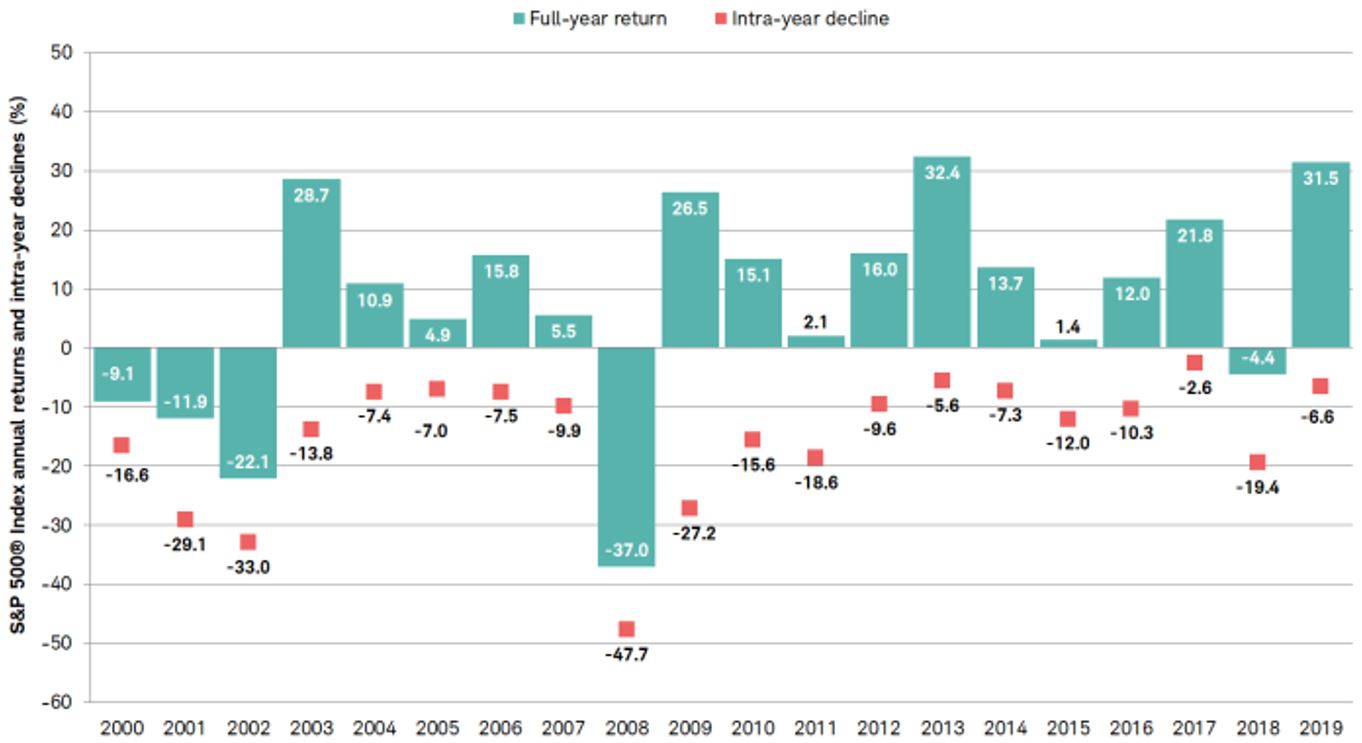

The key is to accept volatility and noise as part and parcel of investing, and understanding how common a market pullback is. If we look at the performance of the same S&P500 Index over a 20-year period from 2000 to 2019, we can see that more than half of the time, we would have encountered a drawdown of 10% or more!

(Source: https://intelligent.schwab.com/article/stock-market-corrections-not-uncommon)

(Source: https://intelligent.schwab.com/article/stock-market-corrections-not-uncommon)

5. Patience

The last point that I think deserves mention is regarding patience. Investment success does not happen overnight and it requires long-term discipline and patience. It has been told that Albert Einstein once said that “compound interest is the eighth wonder of the world”. And why it is often considered a “wonder” is because our brains are not wired to think in exponential terms. $1m invested at 7% p.a. return for 5 years would have grown to $1.4m while 25 years would result in a final sum of $5.4m. Hence, the biggest factor in compounding is time and letting it do its work for you.

As a Conclusion

I hope that this has been useful in providing context when it comes to investing. Even the most seasoned investors often forget these principles when markets turn shaky, hence what I hope this can do is to serve as a reminder for us whenever we encounter uncertainties. I wish all of us happy holidays during this festive season and a great 2022 ahead!

This is an original article written by Tan Chin Yu, Client Adviser of Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Can You Trust Your Head When You Invest?

2. How Can I Invest Confidently?

2. What is Value Investing?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.