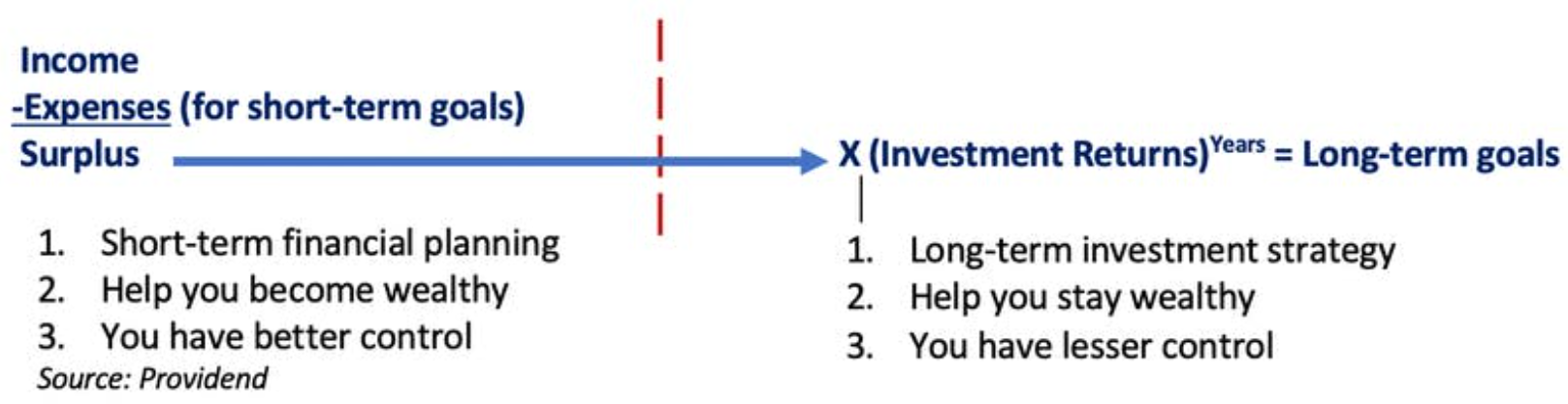

As we enter into the last day of an unprecedented year, I thought it would be good for me to take this time of the year to reflect on the past 12 months and share some of my key takeaways with you. So, I decided to do so from what I termed as our wealth equation (see picture).

No matter how wealthy you are, whether you are a high-income executive or a successful business owner, the complexity of your wealth can be described by this simple equation. There are 2 sides to your wealth equation – the left side and the right side. The left side is the boring, short-term financial planning side and the right side, the more exciting long-term investment strategy side. So, what lessons have I gleaned in 2020?

The “Boring” Left Side

Lesson 1: Always protect your income and mitigate the risk of losing it.

2020 has reminded us that life is uncertain. We can lose our income suddenly, either due to losing of our jobs, the slowing down/ceasing of our business or when we are met with unexpected life risks such as death, a disability or a medical condition. Whether in business or in our jobs, we need to protect our income by always staying relevant and being the best in what we do. We also need to set aside sufficient cash to cope with such an emergency. There is also a need to make sure that we have enough & suitable insurance to mitigate life risks. When the pandemic started this year and the global economy came to a standstill, I was not worried about Providend’s or my personal financial situation. This is because both the company and me have over the years set aside enough cash for a time like this, if we suffer an income drop. Thankfully, that did not happen, and we never had to dip into our reserves. But we were prepared for it if it did.

Lesson 2: Always Focus on Your Surplus Rate

As the saying goes, it is not just how much we earn that makes us wealthy, it is also how much we save. Our surplus rate is the key to building wealth. We have seen people earning $1 million a year and are unable to achieve financial independence and yet at the same time, one of our staff who does not make six figures achieved it at age 38. It is all about surplus rate. In addition, 2020 has shown us that having a healthy surplus will allow us to set aside cash for emergency fund as well as for “dry powder” to be invested, especially when the markets came down in March. This also apply to business. In a year like 2020, not only do we have enough emergency fund, but we also had good surpluses to set aside for investment. So, no matter how high our income is and no matter how much revenue our business makes, keep our expenses low. Do not just live within our means, live below our means. Avoid buying things that we don’t need, with the money that we don’t have, just to impress the people we don’t even know. Also, businesses that burn cash just for revenue worries me.

The “Exciting” Right Side

Lesson 3: Ignore short-term noise & invest for the long term

When the S&P500 was falling at the start of the pandemic (and it fell 30% from its peak in March), there were plenty of panic. While many investors were rushing to sell, we were busily asking our clients to buy. At this time of writing, the S&P500 is up about 14% year to date. If we had listened to the short-term noise, our clients would have missed out in this run up. In every stock market crash, the so-called experts will tell you that “this time is different”. While it is true that the cause of every crash could be different, the one thing that has never change in history is that the stock market always goes up in the long run. But you can only participate when you have managed the left side (the boring financial planning side) of your wealth equation well. So, does that mean that economic forecast is useless? Far from it. Just that the forecast is not meant for you to make adjustments to your long-term strategy but rather warn you of the impending storm, so that you can adjust your financial planning to strengthen the left side of your wealth equation.

By now, we would have realized that there is a trade-off that we need to make between spending on short-term goals now and achieving the long-term ones. So how do we balance them? There are things that we need to spend on today that we cannot delay it to the future. For example, bringing our family for a good holiday (when this whole lockdown is over). This is an important short-term goal because they build memories that may not be replicated in 20 years’ time. Sometimes, once you lose this opportunity, you may lose it forever. 2020 has reinforced this unpredictability of life as we witnessed many deaths around the world. So, how do we balance between what to spend now or save for the future. It is all about determining the purpose of your life and how your wealth is used to support it. This is what your wealth adviser and you should have a conversation on, not just the money part. So perhaps, take these last few days of the year to do some planning, have a conversation with your wealth adviser, so that you are better prepared for a brand new 2021.

Happy New Year!

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-Only Wealth Advisory Firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation.

The edited version of this article has been published in the Money Wisdom Column of The Business Times Weekend on 30th December 2020.

For more related resources, check out:

1. How You Should Hope in 2022

2. Stay Invested for The Long Term? Think Again!

3. How Providend Helps Affluent Families Have a Good Investment Experience

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.