Executive Summary

October 2025 saw global markets reach new all-time highs despite a volatile start marked by trade tensions between the US and China. Swift diplomatic efforts helped restore investor confidence, while US and Asian equities, particularly in technology and AI-related sectors, led gains. Fixed income markets remained resilient, and Singapore’s SGD continues to attract attention amid long-term parity projections against the USD. Investors are advised to stay diversified, mindful of potential volatility and currency developments.

October’s Performance

October 2025 started with a rockier ride than what investors experienced in recent months but ultimately ended at the same destination of new all-time highs. The month kicked off on a positive note despite a US Government shutdown which began on 1 October. Global markets were positive across the board early in the month, until a shock social media post by President Trump declaring an additional 100% tariff on all Chinese goods hit newswires on 10 October. This announcement sent global markets tumbling in the largest one-day decline since April 2025, bringing the spectre of the trade travails of the second quarter back into investors’ minds.

This time, however, the outcome was quite different. Despite the aggressive protectionist rhetoric leading up to the event, resolution towards a more amicable settlement began to build that very weekend. On Sunday, the Chinese Ministry of Commerce made conciliatory statements regarding the newly announced rare-earth mineral export controls, which likely triggered President Trump’s announcement in the first place. Over the course of the next week, both parties refrained from further escalation, and by 17 October, markets had recovered all losses accumulated over the past week.

Resolution efforts culminated in a meeting between President Trump and President Xi in South Korea on 30 October. At the meeting, a broad agreement was finalised between the two countries, with markets already making new highs in the trading days prior.

The whirlwind nature of the October trade storm was, while briefly unsettling for some market participants, both insightful with regard to the motivations of each party as well as a testament to the robustness of markets. After April’s bout of volatility, both China and the US were cognisant of the negative outcomes associated with an escalated and prolonged conflict and moved swiftly towards achieving an acceptable outcome for both parties. Financial markets also adapted well, recognising positive signals rapidly and pricing assets accordingly as a benign conclusion emerged.

Equity Market Performance

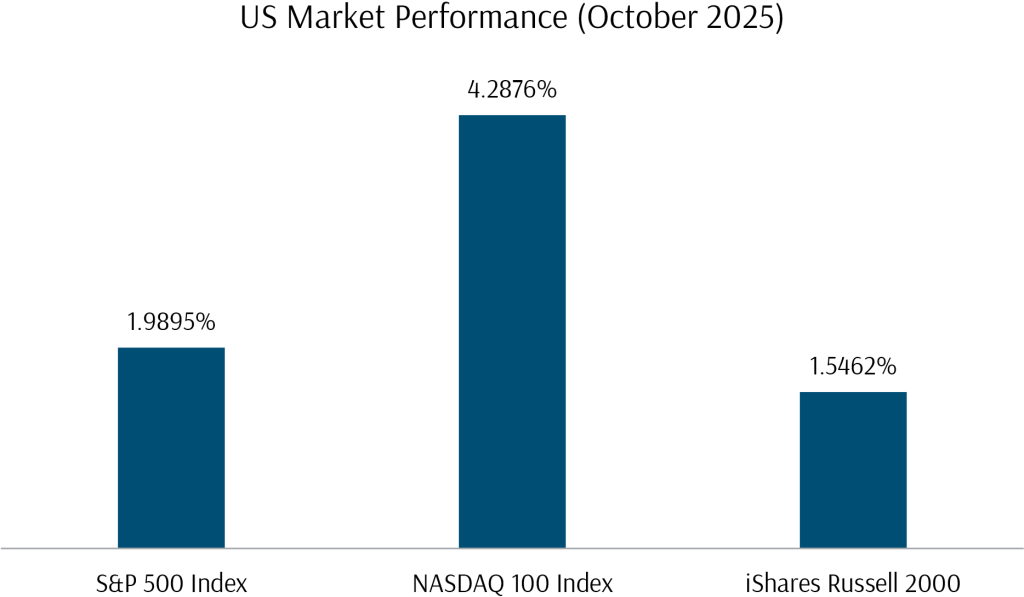

US equity markets kept up their recent winning streak, with the S&P 500 returning 1.99% and the Nasdaq 100 returning 4.28%. Returns were propelled by the positive resolution between the US and China, as well as largely positive earnings announcements from big tech companies like Apple, Amazon, Alphabet and Microsoft. The AI investment theme remained solidly in the mix, with key players announcing new AI infrastructure deals worth hundreds of billions of dollars over the month. Along with their earnings announcements, mega-cap tech companies also revealed AI capex expenditures totalling almost 100 billion USD over the financial third quarter.

Elsewhere, the Russell 2000 small-cap stock index managed to turn in a positive performance of +1.54%, despite a few large constituents in the small-cap space experiencing pullbacks after stellar gains over the past months. The US regional banking sector also saw a mini credit scare mid-month, with regional banks falling heavily after announcing loss provisions due to fraudulent borrower activity and default events.

On the macro-economic front, announcements were limited as various agencies withheld data releases due to the US Government shutdown. Notably, September year-on-year core inflation came in at 3.1% versus an expected 3%, with the month-on-month rate returning to 0.2% after two consecutive months of being higher. The data reinforced market optimism on inflation finally returning to a level more consistent with Federal Reserve targets, sending US 10-year yields below 4% in the aftermath. However, this optimism was blunted at the end of the month, when the Federal Reserve cut interest rates by 25 basis points as expected, but with Chairman Powell making a number of hawkish remarks at the press conference, casting some degree of doubt on market expectations for further rate cuts through the end of the year and into next year, causing a reversal in bond markets and leaving yields almost unchanged for the month.

Exhibit 1: US Stock Market Performance October 2025 (USD)

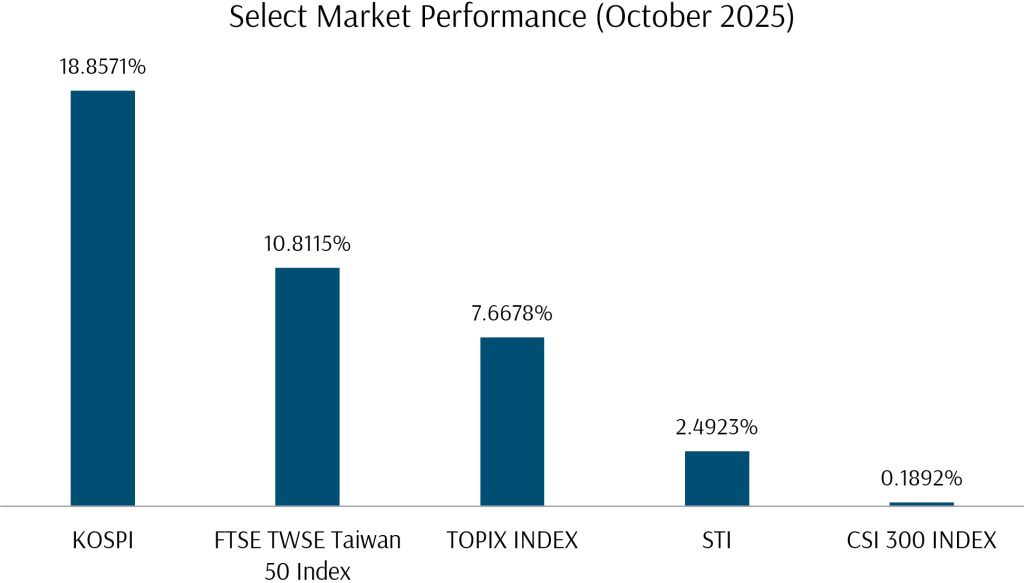

Elsewhere in the world, Japanese markets finished the month with a flourish, with the Topix Index gaining 7.66% as optimism around the appointment of Sanae Takaichi as the leader of the ruling LDP and Prime Minister of the country reverberated through the market. Investors are expecting more aggressive fiscal stimulus, looser monetary policy and structural reform to follow this political development.

Locally, the STI index returned a respectable 2.5%. Positive sentiment and strong investor interest persisted over the month, buoyed by a decent performance in REITs, a bullish equity market report from a local bank, and the launch of the first fund under MAS’ Equity Market Development Program. On the interest rate front, after falling from 3.017% at the start of the year to 1.45% last month, the 3-month SORA rate continued its downward trajectory, finishing October at 1.33%.

While developed markets performed well, the stars of the month were undoubtedly in Emerging Markets, with some countries pulling off mind-boggling returns over the month. China A-share markets were flat, while the Korean markets gained an astounding 18.85% in a single month. North Asian markets were a key beneficiary of the AI capex announcements over the month. Gains in Korea were mainly driven by heavyweights Samsung Electronics and SK Hynix, as investors piled in after positive earnings announcements and a sharp spike in RAM memory prices prompted upgrades from analysts.

Exhibit 2: Other Market Stock Market Performance October 2025 (Local Currency)

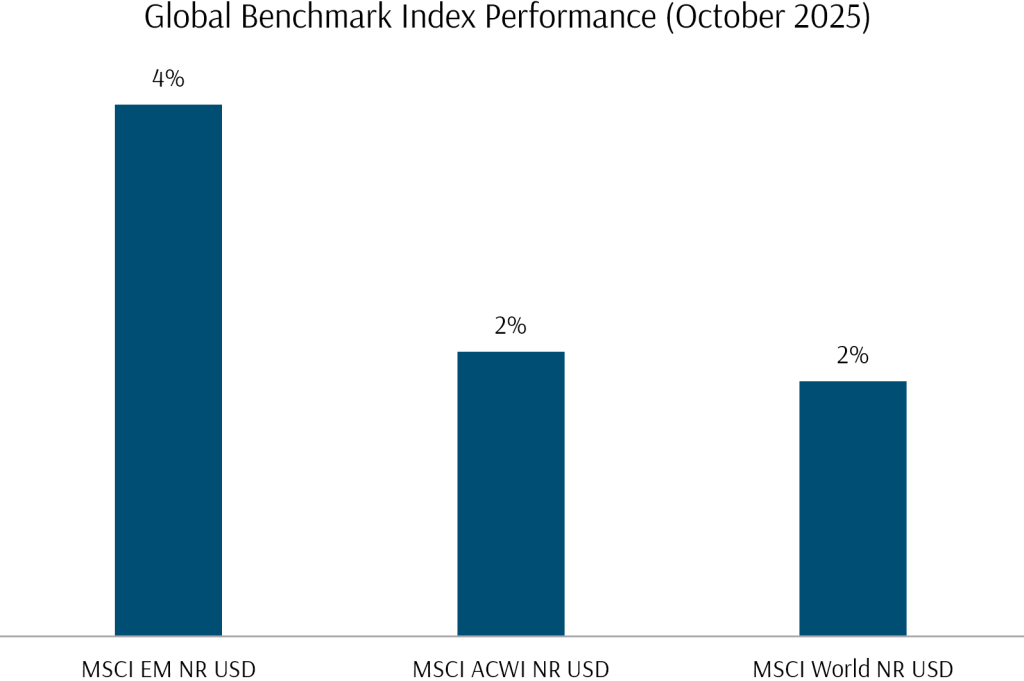

October market performances continue to reflect the shift in global market dynamics, with superior gains outside the US driven by specific catalysts, in addition to a narrowing valuation gap between the different markets. Investors have homed in on North Asia’s high-tech manufacturing prowess and companies as key beneficiaries of the AI capex spend, viewing them as safer options to play the AI theme, as concerns over the return on investment for US-based AI capex spenders persist.

Exhibit 3: Global/Regional Market Index Performance October 2025 (USD)

Fixed Income

Fixed income markets lost modest ground over the month, with yields experiencing a round-trip as a benign September CPI report was almost entirely offset by the Federal Reserve delivering a “hawkish cut” and casting doubt on rate cut expectations. Early in the month, a flight-to-safety response to trade tensions also sent rates sharply lower, but this move was also reversed as an uneasy truce was eventually reached.

Through October, fixed income markets showed resilience and have delivered strong positive returns year-to-date, also performing well through the trade tensions early in the month, significantly mitigating equity market volatility for diversified portfolios.

How Did Our Portfolio Funds Do in October?

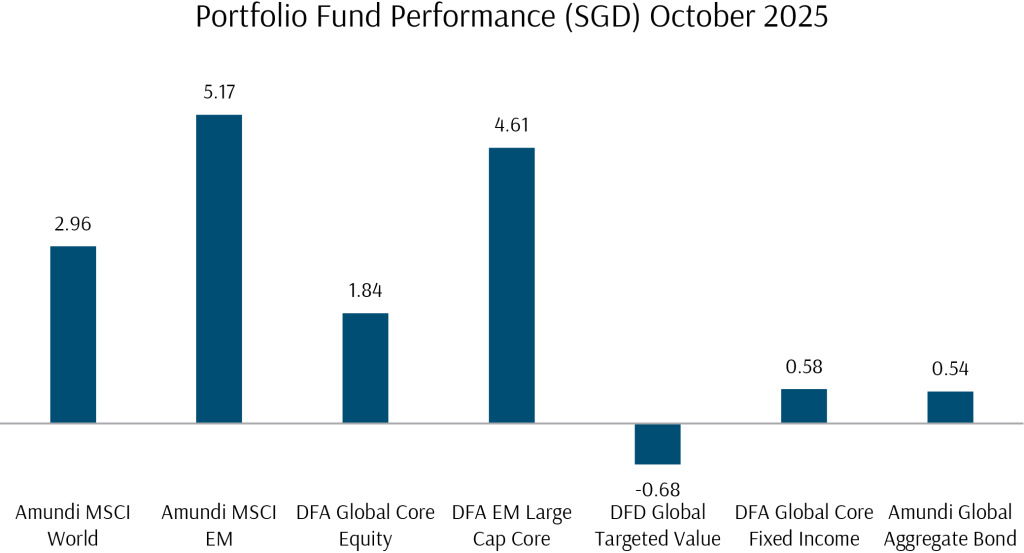

Exhibit 4: Fund Performance October 2025 (SGD)

Most of the funds in our portfolios delivered positive performances in October. SGD-hedged portfolios performed better through the month, as the USD largely gained against other currencies.

As highlighted above, positive equity returns in October were driven in part by large capitalisation growth technology stocks in both Developed and Emerging Markets. At the same time, small-cap growth segments also outperformed. Value factor performance was weak for the month.

The Amundi MSCI World Index Fund, which tracks the developed world index, returned 2.96% over the month, supported by the strong US stock market performance in October.

The DFA Global Core Equity Fund also turned in a positive performance, but returns were slightly impacted by its exposure to value and size factors. Returns in the DFA Global Targeted Value Fund were also weakened by the softness in the value factor.

Emerging market funds did extremely well, with the Amundi MSCI EM fund delivering a 5.17% return over the month, and the DFA EM Large Cap Core Equity fund returning 4.61%.

For the fixed income funds, the DFA Global Core Fixed Income performed strongly over the month, turning in a positive return. The Amundi Global Aggregate Bond Fund was up 0.54%.

*All returns specified above are SGD Fund Class returns

Topic of Interest – USDSGD Parity by 2040?

On 22 October, DBS, Singapore’s largest bank and listed company by market capitalisation, released a research report titled “Singapore 2040 – The Next 15 Years of Quality and Inclusive Growth”. Having read the report, we can attest that it is an excellent publication which provides a comprehensive summary and roadmap of Singapore’s multi-faceted growth strategy for the next decade and more. It presents a positive and optimistic vision of Singapore’s world-class developmental status and progress, which we believe is something all Singaporeans can be proud of. This report is publicly available, and we encourage clients and readers to review it if time permits.

Amongst the various subjects covered in this report, DBS Research laid out a few seemingly ambitious targets for Singapore-focused asset classes, which have grabbed the headlines and garnered the attention of investors and media alike. The most prominent of these asset targets was a call for SGD to reach parity with the US Dollar by 2040.

Despite the recent strength of the Singapore Dollar, USD/SGD parity would represent uncharted territory, as well as a psychological milestone for investors. Singaporean or SGD-based investors investing in diversified global portfolios may understandably have concerns about the implications for their portfolios should parity come to fruition. Hence, it would be worthwhile for us to delve a little deeper into this call and consider the case that for Singdollar parity.

What Is the Primary Basis for the Call for Parity by 2040?

In their report, DBS’ thesis revolves around 4 key forces/factors:

- An overvalued US Dollar falling on a reversion to the mean.

- Expected continued gains in labour productivity in Singapore.

- Safe haven flows into Singapore’s financial sector, driving capital flows into SGD.

- Sustained current account surplus driving continued currency appreciation.

These 4 factors are fundamentally sound, well-researched and well-used in quantitative models.

In currency model building, investment banks and academics often start off with a model based on Purchasing Power Parity (PPP), then augment the base model with various external factors such as productivity, terms of trade, inflation differentials, etc. As you may have expected, these are the very forces mentioned by DBS in their thesis.

Models also may differ in any number of ways, for example, in the specific factors used, the methods through which factor data is processed, as well as the statistical methods used to infer sensitivities to various factors.

What Do Currency Models Aim to Do?

Regardless of design and specification, each currency model aims to achieve the same purpose:

- Estimate a long-term “fair value” for each currency, then, based on the derived fair value, determine if a currency is overvalued or undervalued

- If the model allows, attempt to approximate a chronological period over which the currency should converge to its “fair value”.

- In the estimation process above, future factor inputs such as productivity, terms of trade, etc, would also need to be estimated with their own mathematical models.

What Are the Limitations of Currency Models?

With the general guidelines for the design and implementation of a currency model now established, it would be appropriate to focus on the limitations of such models.

- Firstly, models are prone to specification errors, where factors used may not be sufficiently informative, or informative factors may be omitted. The informational value of factors may change over time.

- Data and measurement errors may occur, as good model outputs are dependent on the selection of good input data, which is then measured and processed appropriately, which is a complex task.

- Estimation errors are another pitfall. Models which estimate future factor inputs face similar issues listed above.

- Predicting the endpoint or future fair value is difficult, but predicting the convergence path borders on the futile and impossible.

- Lastly, and most importantly, are limitations which stand outside of model specifications, beyond the grasp and predictive capabilities of the most robust and renowned research academics and analysts alike: Structural and regime changes, like currency peg-breaks, or changes in managed currency regimes like the CNY and even the SGD (ironically, DBS has excluded SGD from fair value estimation in the past publications, stating in a report dated January 2020 that “we have no fair values estimates for the SGD, which is almost wholly determined by MAS policy anyway”)

- Non-fundamental capital flows, such as a flight to safety scenario away from EM currencies, are another example of an event which can cause the predictive ability of models to be disrupted. Even events such as the implementation of tariffs, can cause entropy in FX markets, resulting in the possibility of increased noise in markets, requiring analysts and investors alike to be cognisant of the structural change in uncertainty across currency markets.

As such, currency models are generally not able to account for unpredictable, large-scale events that are likely to have the most sizeable impacts on currency returns over any given period. Long-term fair values calculated by models are likely to be approached in a world without large-scale, regime-shifting events. In other words, these predictive models are predictive mostly during times when unpredictable events don’t happen.

This is in stark contrast to the real world, where, well, unpredictable events not only happen, but happen quite frequently. As a matter of fact, in financial markets and specifically in currency markets, regime shifts and structural breaks practically shape developments for years to come (think “Bank of Japan shifting from quantitative easing to yield curve control”, or “MAS moves from a light-handed stance to persistent tightening bias”, or “Hedge Funds break the Thai Baht/USD peg”).

What Can We Take Away From This Research?

With a closer understanding of the factors and models driving this call for parity 2040, we objectively review the call and consider how it may impact investments in global diversified portfolios.

- Fundamentally, the four qualitative factors of: weakening USD, superior productivity in Singapore, sustained current account surplus, and persistent safe haven/FDI flow, are sound and consistent with valuation logic. However, as Singapore’s development becomes more mature, the growth of these positive factors may be difficult to sustain.

- The thesis fails to address the elephant in the room – the Monetary Authority of Singapore. It does not account for the specific dynamics of the trade-weighted NEER band, which MAS uses to manage the SGD. Under the regime, movements of other currencies outside of the USD would also matter. In addition, for such a large cumulative move to occur, MAS policy would need to be consistently appreciation-biased for over a decade. Consequences may include, but are not limited to: a decline in export competitiveness, importing deflation, diminishing competitiveness as a regional hub, capital instability/hot money flows, etc. These are not consequences that MAS will take lightly.

- In fact, in an interview with The Business Times published 5/11/2025, MAS director Chia Der Jiun made a clear statement that MAS “does not seek for the Singapore dollar to become a reserve currency”, adding that while “strong market confidence in the Singapore dollar was underpinned by Singapore’s macroeconomic and political stability, rule of law, active management of its exchange rate and triple-A credit rating”, however, “Singapore lacks the large, deep and liquid asset markets that are necessary to supply safe assets for the world”

- To be sure, the predicted direction of USDSGD is consistent with current conditions and even consistent with the MAS stance, i.e. all else being equal, it is reasonable to adopt a view that the SGD is more likely to appreciate in the years to come.

- While the directional forecast is reasonable and coherent, the quantitative pathway to parity isn’t presented in the research report, making parity more of an aspirational target rather than a quantified forecast. Even if the parity forecast was precisely quantified, it would be subject to severe qualification and uncertainty over the next 15 years.

Hence, the call for parity by 2040 is not so much an actionable high probability forecast, as it is an impactful aspirational threshold which might inspire emotional responses in the process of championing Singapore’s rise to prominence.

Despite the reasonable fundamental case made for continued appreciation of the SGD, the actual realised outcome is subject to high uncertainty, and any pathway towards the outcome would be fraught with volatility. With that in mind, investors should avoid taking drastic measures to front-run any such outcomes and instead manage their foreign currency risks in a more measured manner.

For Singaporean and SGD-based investors, the best way to handle unpredictable events in the world and in markets, including any potential currency moves, is to remain invested in globally diversified portfolios. If necessary or desired, clients can elect to invest in SGD-hedged share classes to minimise any residual currency risk.

Looking Forward to November 2025

October has picked up where the third quarter of 2025 has left off. Despite various challenges to the business environment, AI-related news flow continues to be strong while company earnings have been resilient. The combination of easing trade tensions, strong corporate earnings, and easing monetary policy has maintained a favourable environment for risk assets across multiple categories.

However, several important considerations remain for investors going forward. Markets have priced in more good news, and valuations remain elevated. From a top-down level, earnings are increasingly dependent on AI-related expenditures. At some point, the law of large numbers dictates that this rate of spending cannot be extrapolated indefinitely. Any change to these capex trends to the downside might lead to some potential market volatility.

Additionally, after the hawkish change in tone in October, uncertainty has risen with Federal Reserve rate cut expectations, which have previously provided support for markets. In commodity markets, while falling oil prices have mitigated inflation, a further decline in prices is less likely at this level. On the other hand, base metals such as zinc, copper and aluminium have seen rapid price rises in the past month, and this may result in inflationary impact down the road.

While the portfolios are well diversified, it does not mean that they will be immune to volatility. Through the first week of November, we have observed a sharp pullback in markets which were exuberant in October. Although volatility in financial markets is a fact of life, it is nevertheless a good reminder for investors to remain grounded at all times.

With a comprehensive plan already in place with your Client Adviser — covering near-term spending needs while allocating capital at a level of risk suitable for your longer-term goals — you can have the peace of mind to navigate market volatility and stay invested for the long term, allowing your wealth to compound and fulfil your ikigai. If you have any questions, please do not hesitate to reach out to your Client Adviser.

The writer of this market review, Glenn Tan, is Portfolio Manager at Providend Ltd, Southeast Asia’s first fee-only comprehensive wealth advisory firm. He is also a CFA Charterholder and a Certified Financial Risk Manager (FRM).

For more related resources, check out:

1. Active Investing That Adds Value to the Client

2. Staying the Course: Investing With Confidence in Uncertain Times

3. Here’s Why We Charge a Higher Fee Than Robos

Download our Investment eBook titled “A More Reliable Way to Get Enough Investment Returns: Even During Times of Market Uncertainty” here.

With a minefield of financial misinformation out there, we promise to be a safe pair of hands and a second pair of eyes to help you avoid costly financial mistakes. Learn more about our investment philosophy here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.