Whether you are accumulating towards retirement or spending in your retirement years, having your investments reach their planned returns is crucial in ensuring you achieve your goals. When it comes to equities, evidence shows that in the long run, equities always give positive annualised returns. Evidence also shows that it is a futile attempt to try to beat the markets by guessing which stocks, asset classes or markets will do better in certain periods. In the end, this kind of active management will yield worse results. Even most professional investment managers cannot consistently do it. All you need is to stay invested and you will get positive returns. But that is really the first half of the story. Because the untold half is that positive returns may not mean enough returns for you.

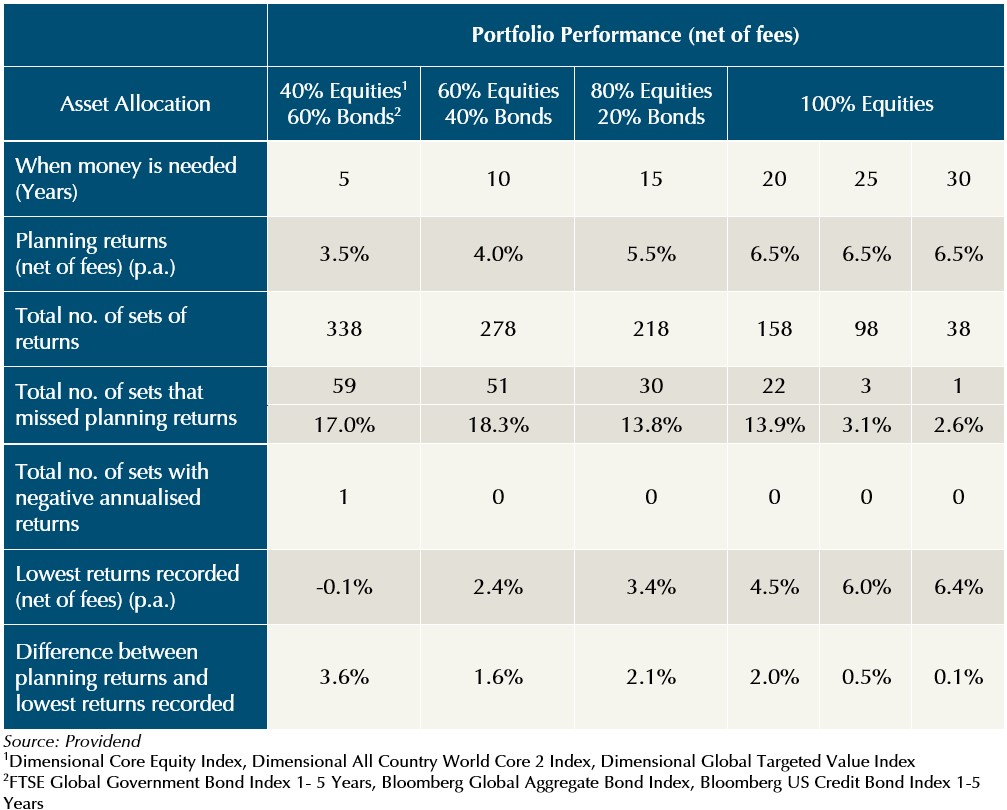

The table shows the performance of 4 portfolios with different asset allocations. Each portfolio is suited for different people depending on when they need the money. Generally, the lesser time you have, the lesser equities you can have. That is because, equities need enough time to ride out the short-term volatilities. Bonds are often included in the portfolios to cushion the turbulence of the portfolios so that investors can stay invested and not “bail out” in the short run and thus lose money. The performance of the portfolios is based on monthly rolling returns calculated between Jan 1990 to Jan 2023. Before we look at the data, let me explain 3 things: What are rolling returns? Why do they tell a more complete story? And why this period between Jan 1990 to Jan 2023?

What are rolling returns?

Suppose we want to calculate the monthly 5-year rolling returns between Jan 1990 to Jan 2023, the first period of these returns would be from Jan 1990 to Dec 1994. The second period would be from Feb 1990 to Jan 1995 and the last period would be Feb 2018 to Jan 2023. In this way, you will find out that there were 338 sets of 5-year annualised returns. Using the same approach, there were 278 sets of 10-year returns, 218 sets of 15-year returns, 158 sets of 20-year returns, 98 sets of 25-year returns and 38 sets of 30-year returns, all on an annualised basis.

Why do they tell a more complete story?

Let’s say you are presented with the 5-year annualised return of a portfolio between Jan 2017 to Dec 2021 and it looks good. But the thing is, unless you are invested in the same period, you will not get the same returns. If you have invested in the same portfolio between Jan 2018 to Dec 2022, your number may look very different. Rolling returns give you a truer picture of how an investment has performed.

Why this period between Jan 1990 to Jan 2023?

For one, this is more recent and therefore more applicable to investors today. But more importantly, this period contains many volatile market events such as the Dot Com bust, 2000-2002 bear market, the European crisis, the 2008 GFC as well as the recent pandemic. Including events like these will make the analysis more robust.

So, what does the data tell us? The good news is, just as what we have always known, equities do give positive returns in the long run. Across the portfolios over different time periods, except for 1 isolated period for the 5-year portfolio (which has more bonds than equities), none of the portfolios lost money in any periods over their time horizon. However, positive returns do not mean enough returns. Every portfolio has periods during its investment time horizons where it did not meet the planning returns and the difference can be between 0.1% p.a. to a whopping 3.6% p.a. But just as the data have shown, the longer you stay invested, the higher the probability of meeting your planning returns.

Implications

So, what do all these means? In all our years of planning and advising clients, we came to realise that there are at least 7 things that must be done.

- The first is really to not lose money. Thus, you need to ensure that the strategic asset allocation of the portfolios is suitable for you to stay invested for your portfolio’s time horizon. You really should not get out before you need the money.

- Besides having a suitable asset allocation for your portfolio, you need to have strong financial health to stay invested. At the least, ensure that you are comprehensively and adequately insured, have sufficient emergency funds, and not be overly in debt.

- You also need to continuously monitor the instruments used in the portfolios to make sure they behave in the way you expect them to behave to deliver the returns you need.

- It is easy to stay invested when times are good, but during periods of high volatility, like in 2022, you need to fight your fears and not jump out of your investment roller coaster.

- In your planning, use conservative net of fees planning numbers.

- As part of planning, set aside enough reserves at the onset just in case you are invested in a period where the returns are just insufficient.

- Be prepared to adjust your plan in years where returns are insufficient.

In today’s advanced capital markets and with technology, getting access to suitable instruments is easy. Getting positive returns is also not impossible. It is being able to achieve your goals when you need to that is difficult. Because getting positive returns and enough returns are two very different things. If you cannot do the 7 things above, work with a trusted adviser who can.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in The Business Times on 20th February 2023.

For more related resources, check out:

1. The Best Way to Get Investment Returns

2. Investment Philosophy for a Retiree Client

3. Buying Term Insurance Is Not So That You Can ‘Invest the Rest’

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.