There are a few things that could speed up an affluent person’s financial independence. But if we want to narrow to the most realistic, what would it be?

After much consideration, I would say it has to be your savings rate or in our financial dictionary your surplus rate.

If you are able to master and have a great surplus rate, you may be able to be financially independent much earlier than someone with a poorer surplus rate.

The Unique Relationship Between Your Savings/Surplus rate and Your Pace to Financial Independence

Your Surplus Rate is calculated as

- Your Surplus = Total Annual Income minus Total Expenses

- Your Surplus rate = Your Surplus / Total Annual Income

Your surplus is the difference between what you earn and what you spend. A high surplus shows a high-income relative to your own expenses or that your expenses are low relative to your income.

Your Surplus Rate determines how fast a person can accumulate enough wealth so that he or she can be financially independent.

Let me explain.

I did a poll among our client advisers, asking them based on their experience, what is the average surplus rate of their clients.

When clients engage Providend to plan out their lives, we want them to share with us their assets, liabilities, and how much they make and how much they spend. The more they share, the clearer and less erroneous is their wealth plan.

The ball-park surplus rate for our high net worth clients is around 25% to 50%. Likely, there are more around the 30% mark with the odd few that hit as high as 50%.

I have written an article at Investment Moats explaining the simple Wealthy Formula I had used to enable me to be financially independent. This is not rocket science. If you listen to a lot of financial gurus, they will roughly say the same thing. If you are interested, you can take a look at it.

In the article, I explained that your surplus rate and your wealth rate of return matters a lot to when you can reach financial independence.

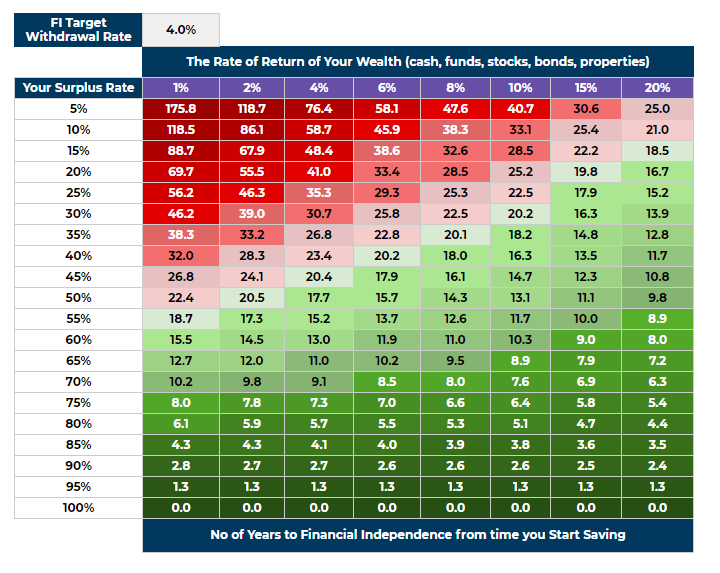

I provide the table below to show the relationship between your surplus rate, the rate of return of your wealth, and the time it takes for you to accumulate enough to be financially independent:

- The horizontal axis shows the range of rate of return your wealth assets may average at, from 1% to 20% a year.

- The vertical axis shows the range of surplus rate that you could save, from 5% to 100% (100% surplus means you will spend 0%. This is not very possible)

- In each of the cells coloured red and green, it shows the number of years it takes for you to be financially independent, all else being equal.

I assumed that in financial independence, you will spend based on the popular 4% Safe Withdrawal Rate. This means that if you have $1 million, you can spend $40,000 in the first year. The income to spend for subsequent years adjust based on the inflation rate the year before. Based on the 4% safe withdrawal rate, you will not run out of money. (The 4% safe withdrawal rate has its critics, and they may be right about it, but it is still a good rule of thumb to use especially if we are estimating whether we have accumulated enough for financial independence.)

Claudia and Jeff could be financially independent in 26 years in Singapore

Claudia and Jeff typify our average high net worth clients that would earn a combined $400,000 a year (after CPF) and spend $280,000 a year. They will have a surplus of $120,000 a year that they can invest in their financial independence.

Their surplus rate is 30%.

Based on the table above, depending on the rate of return of their wealth, they can roughly be financially independent in 46.2 to 13.9 years. If their rate of return is 1% a year, it will take them roughly 46.2 years. If the rate of return is 20% a year, then this shortens to 13.9 years.

The gap between the different rates of return is huge.

In wealth planning, based on our client’s risk tolerance, we help them recalibrate their average rate of return of their wealth upwards to the region of 4% to 6% a year. This would put them in the 26 to 30-year range.

What if Claudia and Jeff’s Surplus Rate is 50%? How Much Would their Financial Independence Speed Up?

If Claudia and Jeff spend only $200,000 a year and have a surplus of $200,000 a year to put towards their financial independence, the situation could change a fair bit.

The surplus rate is 50%.

Based on the table above, depending on the rate of return of their wealth, they can roughly be financially independent in 22.4 to 9.8 years. If their rate of return is 1% a year, it will take them roughly 22.4 years. If the rate of return is 20% a year, then this shortens to 9.8 years.

The gap between the different rates of return narrows drastically.

Through our recalibration of their rate of return, their financial independence timeline can be narrowed to 15.7 to 17.7 years.

The Rate of Return of Your Wealth Matters Less to Your Financial Independence Timeline as Your Surplus Rate Goes Up

When you are privilege to be compensated with a good income and can control your spending well, your surplus rate could go up above 50%.

When the surplus rate goes above 50%, you will start seeing that the rate of return of your wealth matters much less.

I have friends who do not earn this level of income but were able to have a surplus rate of 70% and above, by virtue of optimizing their expenses very well.

Their timeline to get closer to financial independence is between 6.3 to 10 years.

If they invest reasonably well, they can aim to be financially independent for nearly 9 years.

The Advantage of Early Financial Independence is Not Reserved Only to the High Net Worth in Singapore

This “superpower” to be financially independent early is not reserved only for those who earn more.

However, it is immensely easier if your income is higher.

In different countries, there tends to be a baseline essential expense. This means there is a limit to expense optimization. If your income is barely above your essential expense, this would limit your ability to have a very high surplus rate.

In recent years, we have seen many in Singapore influenced by articles and videos documenting early retirement experiences.

They were able to have a surplus rate greater than 60% while earning less than $100,000 a year by leading very intentional lives.

They

- know what they value a lot and what are optional in their lives

- control their expenses as their income increases

- start investing early

- motivated to do well in their career and business to increase the income

By living the wealthy formula, they intentionally set their lives up to be financially independent early.

Being Affluent or High Net Worth does not Mean an Automatic Free Pass to Financial Independence

In a recent article profiling the plight of pilots facing the prospect of being let go from their job, I observe that there was a small uproar over a particular account:

For one pilot, having to take a pay cut has forced him to resort to borrowing money to keep his children in overseas universities. He is also trying to sell his car.

The 50-year-old pilot who declined to be named has been with the airline for 27 years. He told TODAY that he is cash-strapped because the money he has earned during the span of his career has been invested in properties, stocks, and bonds.

On average, he used to earn S$23,000 a month compared with S$13,000 these days.

“My monthly expenses add up to over S$19,000 a month and it’s not the right time to give up my stocks and bonds and sell my properties because I’ll get nothing. I’ll get a second job, I’ll sell my clothes if I have to,” he said.

There was a range of comments but largely people felt that for pilots who earn such a high salary, there are no excuses for them not to have build up adequate financial reserves to weather surprising storms like Covid-19.

Earning a great income with a good job does not automatically mean financial independence retirement is guaranteed.

In the course of our work, our client advisers have met many prospects who we will struggle to create a wealth plan to get them to be financially independent in the timeframe that the desired.

We encounter clients and prospects earning $500,000 a year but their surplus rate is less than 10%.

If you reference back to the Years to Financial Independence table, it will take 40 to 50 years to get their wealth to such a state that they can think about financial independence.

If not, they need their wealth to grow at 20% a year to really be close to financial independence in 21 years.

The affluent could have high income but their commitments can be rather high. This can be made up of

- Multiple mortgages

- The highest tax bracket income tax is nearly $80,000 – $100,000 a year

- A lot of insurance savings plans, investment-linked policies, universal life policy that they need cash flow commitments from their income

- Essential expenses that are of higher grade

- Savings for children’s overseas education

- Non-Essential expenses

Some of these expenses will go away at retirement (most of the mortgages, income tax, insurance savings plans) and in reality, some of these are not considered expenses as they contribute to their asset accumulation as well (some of the property mortgages and insurance policies).

However, if their commitment is made up largely of essential expenses of high grade, non-essential expenses, it will be difficult to create a satisfactory retirement outcome for them.

At times, we have made the decision to only onboard clients if they were willing to commit to optimizing their spending.

Making Meaningful Changes to Hasten Your Timeline to Be Financially Independent

Many got to where they are by doing very well in their career or their business. The issue is less of just increasing their income from work or their business.

If increasing the income is the solution, then there might not be a problem in the first place when their income steps up from $300,000 to $400,000 in the first place.

Families struggle to find greater surplus due to ever-increasing commitments as the income rises.

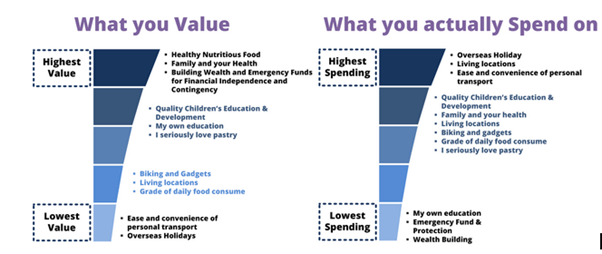

To make a change, a question to ask is: What do you value more at this point in your life? Spending today or a future goal such as financial independence?

An intentional life is one where you will allocate your income based on what you value more.

If you allocate your income based on your values, and if you value health, family, security, and financial independence, the budget of your income should reflect accordingly.

If you put what you value side by side with your spending and they are at odds with each other, you would need to relook and learn to spend based on your values.

Not everyone needs to speed up their journey to be financially independent. If you cherish the experiences with your family and wish to prioritize that over financial independence, then make sure your budget reflects those important areas of your life.

What I would challenge you to think about is how much those experiences will cost you.

Many families have great experiences to look back upon on a smaller budget.

There may be an acceptable grade of non-essential and essential spending that you didn’t know your family can live with.

Optimizing in those areas could yield increases in surpluses.

Start by Calculating Your Surplus or Savings Rate (and maybe your Initial Withdrawal Rate) Today

If there were some nights where you felt that you are on some sort of a hamster wheel and pondered about whether you could get off the wheel, the very first step is to compute your surplus rate.

The formula is at the start.

Your surplus rate will give you a good rule of thumb your pace to financial independence.

If you have accumulated financial assets, I will urge you to go one step further to compute your initial withdrawal rate.

Your initial withdrawal rate is a good rule of thumb to see if you have accumulated enough financial assets to be financially independent. This is like the 4% safe withdrawal rate which I have explained earlier.

To calculate your initial withdrawal rate:

- Tabulate the annual expenses you potentially need in financial independence. For some, you may wish to think about your lifestyle when you no longer need to work and what you will spend on. (you may need to eliminate some income taxes, mortgage, allowance for children, work-related expenses)

- Tabulate all the financial assets that can potentially be used to generate income for you. If not the assets that you are willing to re-allocate to create income. These would typically be

- your cash, fixed deposits,

- unit trusts

- stocks in brokerages

- employee stock options, vesting shares

- insurance savings plans, investment-linked policies

- investment properties (for investment properties deduct the mortgages)

- residential property (add this if you are open to the option of downgrading them to free up excess financial resources)

- Calculate your initial withdrawal rate = Annual Expenses (#1) / Total Financial Assets (#2)

For example, if your annual expenses are $240,000 a year, and the total financial assets tabulated is $5,500,000, then your initial withdrawal rate is $240k/$5,500k = 4.2%.

Your initial withdrawal rate is a good rule of thumb for us to assess if you can be financially independent.

If your initial withdrawal rate is:

- Greater than 10%: There is still some distance away. You will have to ensure you have a healthy surplus rate so that you can hasten the pace.

- Less than 5%: You may have accumulated enough financial assets to seriously consider the prospect of not having to work within the next 4 to 8 years. The amount may not be adequate to conservatively say you do not have to work again but if you continue to maintain your surplus rate, or even hasten it, you may get there

- Between 3% to 4%. You have accumulated enough such that in a lot of stress-tested financial scenarios, your wealth may last you for 25 to 30 years. However, to last longer than that (30 to 50 years), you may need to either reduce your expense or accumulate more assets so that the withdrawal rate touches 3%.

- Between 2% to 3%. Conservatively, you should have adequate assets to not work again under almost all historical simulations.

- Less than 2%. Your wealth should last you a long, long time

These are good rules of thumb to let you know where you stand in your financial independence readiness.

To retire and stop work, there is a need for greater fidelity in your plan such as how your financial assets will be allocated to provide income, whether you have enough contingency assets, whether another aspect of your life is planned out well.

You may already well on your way to being financially independent without you realizing it.

Start by calculating two ratios today.

Let me know if you need help in the comments below or you can write to us at [email protected] and we can help clarify some matters.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s First Fee-only Wealth Advisory Firm.

For more related resources, check out:

1. Thoughts & Reflections From Hong Kong: Why Is Investing So Difficult?

2. Stocks Can Be Less Risky Than Bonds

3. How to Decide if You Need Bonds in Your Portfolio

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.