Global Equity and Bonds See the Worst October in Years

The equity and bond markets experienced their worst October performance in years following September’s decline, as Treasury yields continued to creep up. The MSCI All Country World IMI saw its largest drop in October since 2018, while the Bloomberg Global Aggregate Bond Index had the most significant decline since 2016.

The main reason for this decline is higher yields on the long end of the curve. Fears about increased supply, a larger deficit and higher for longer rates have contributed to the rise in yields. This rise in longer term yields has had an impact on equity prices because, in most pricing models, the 10-year treasury is a key risk-free assumption, so a higher discount rate has brought equity prices lower, assuming all other factors remain constant.

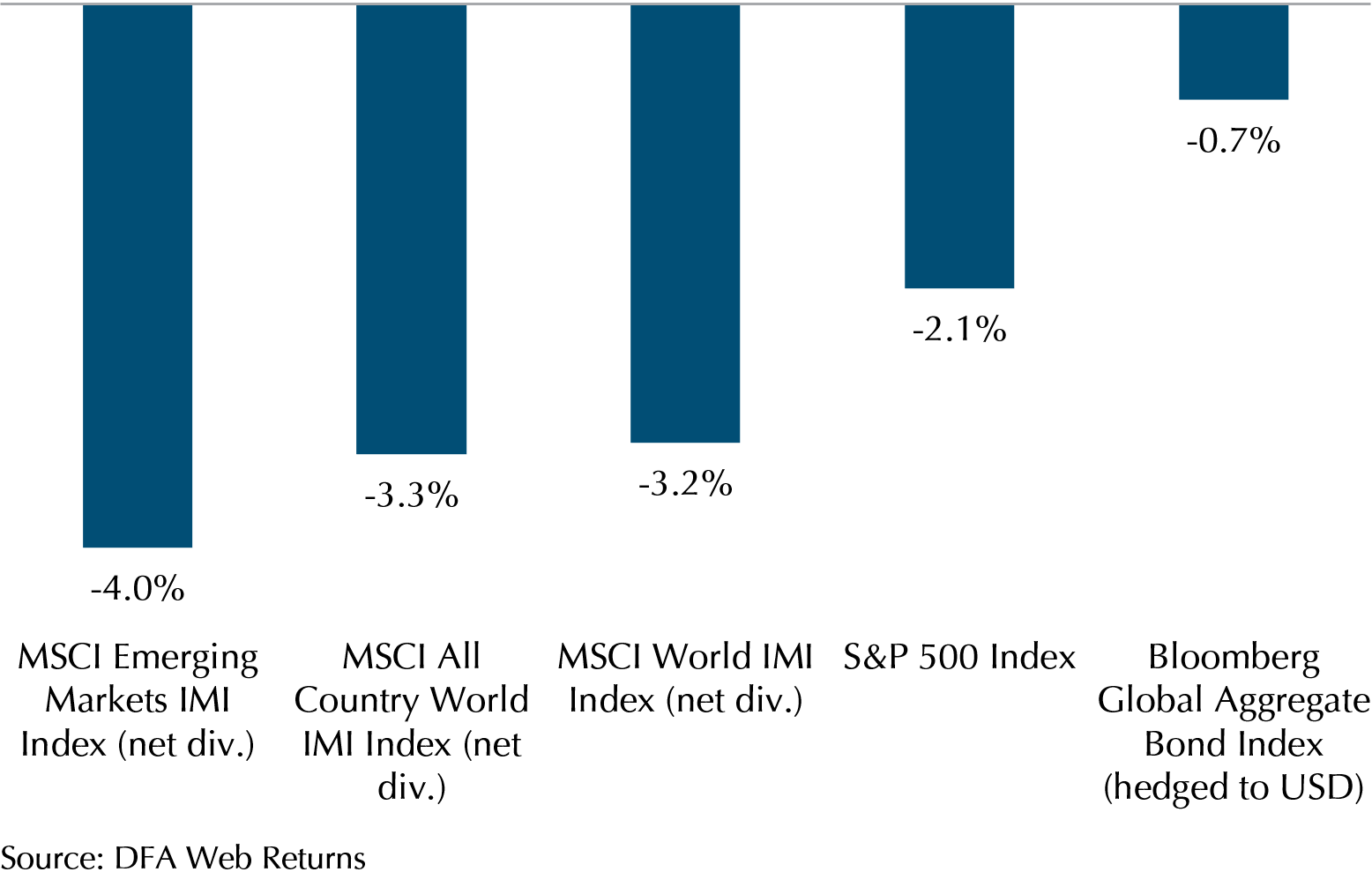

Exhibit 1 illustrates the performance of market indexes in October. The Bloomberg Global Aggregate index fell by 0.7%. The S&P 500, representing the largest 500 publicly traded companies in the United States, fell 2.1 %. The MSCI World IMI, which represents the stock prices of large, mid, and small-sized developed market companies, experienced a decline of 3.2%. Similarly, the MSCI All Country World IMI, encompassing both developed and emerging market stocks of large, mid, and small-sized companies, saw a drop of 3.3%. In comparison, the MSCI Emerging Market IMI, reflecting stocks of large, mid, and small-sized companies from emerging markets countries, saw a decline of 4.0%.

The S&P 500 outperformed the MSCI World Index, as overall US stocks fared better than European and Japanese stocks. For instance, the top three holdings in the S&P 500 – Apple, Microsoft, and Amazon demonstrated strong performance with returns of -0.26%, 7.08%, and 4.70% respectively. This performance contributed to the S&P 500’s more modest decline of 2.1% in October, compared to the Stoxx Euro 600 and Nikkei 225, which fell by 3.68% and 3.14% respectively.

Emerging market stocks continued to struggle in 2023, as investors kept allocating capital away from riskier assets towards fixed income, driven by rising yields. According to JP Morgan’s October Monthly Market Review[1], they see that “continued weakness in the real estate sector, and reports of new US restrictions on AI chip exports to China further dampened market sentiment. This likely contributed to the weak performance of the MSCI Asia ex-Japan Index and the MSCI Emerging Markets Index, which both declined 3.9% on the month.” These factors may explain the ongoing challenges faced by emerging market stocks in October.

Exhibit 1 – The Market Indexes October Performance (In USD)

Dimensional Funds: Resilience in Fixed Income

While the increase in yields continues to exert pressure on the equity market, the impact has been uneven. Small-cap stocks have borne a more pronounced negative effect compared to their larger counterparts, as they tend to be riskier and more susceptible to the rising costs of borrowing in general. This discrepancy in performance becomes evident when comparing the MSCI All Country World Index, which encompasses companies of large, mid, and small-cap companies in both developed and emerging markets and experienced a 3% decline, with the MSCI All Country World Small-Cap index, which specifically focuses on small-cap companies and saw a steeper 6% decline.

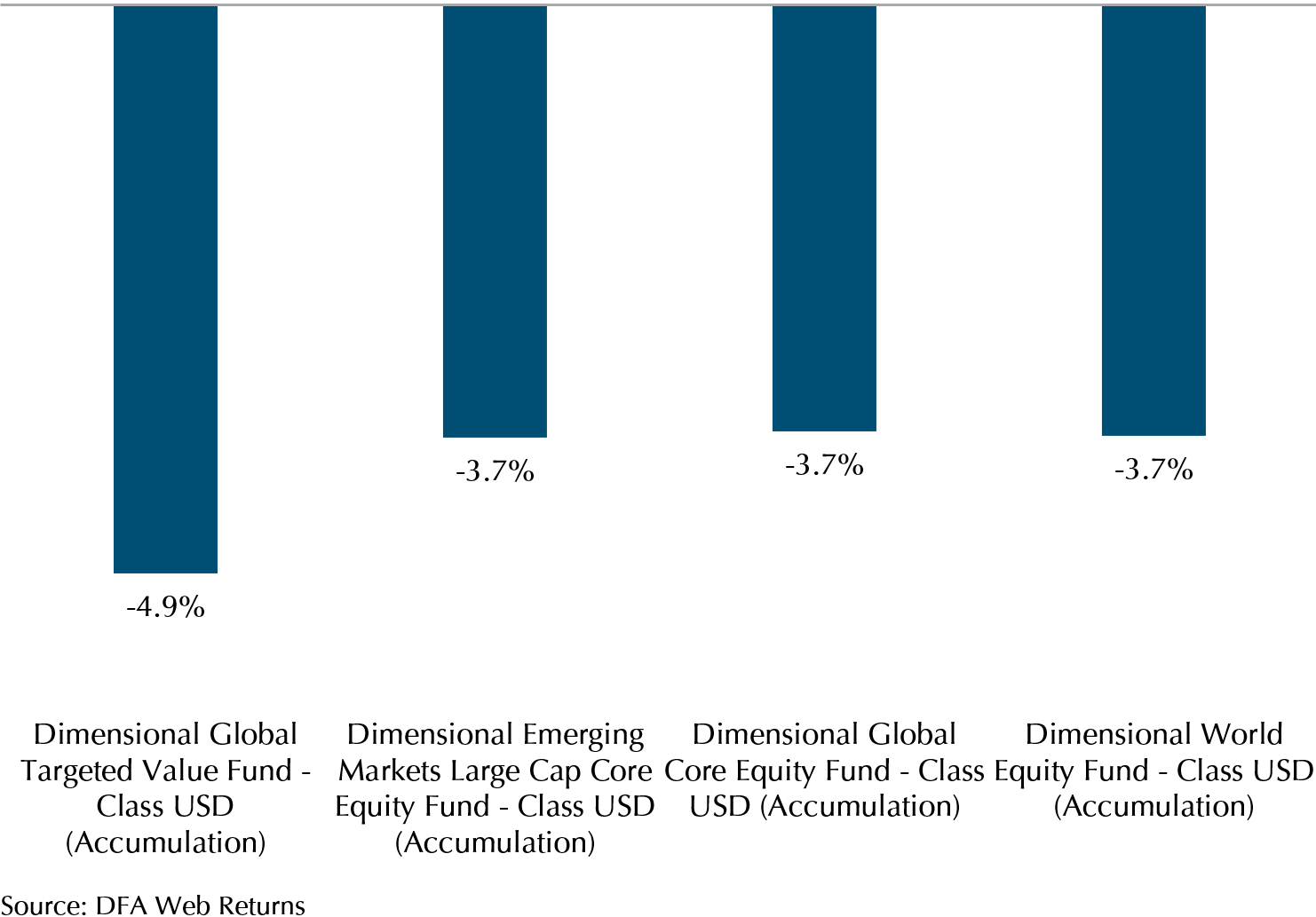

Similarly, Dimensional equity funds, which are tilted towards smaller-sized companies and allocate less weight to larger ones, experienced more significant declines compared to market indexes (refer to Exhibit 2). For instance, the Global Core Equity fund fell by 3.7%, more than its comparable index, MSCI World Index, which declined by 3.2%. This can be attributed to its higher exposure to small-cap stocks and lower allocation to large-cap companies, such as the aforementioned Apple, Microsoft, and Amazon, which performed better in October.

Exhibit 2 – Dimensional Equity Funds October Performance (In USD)

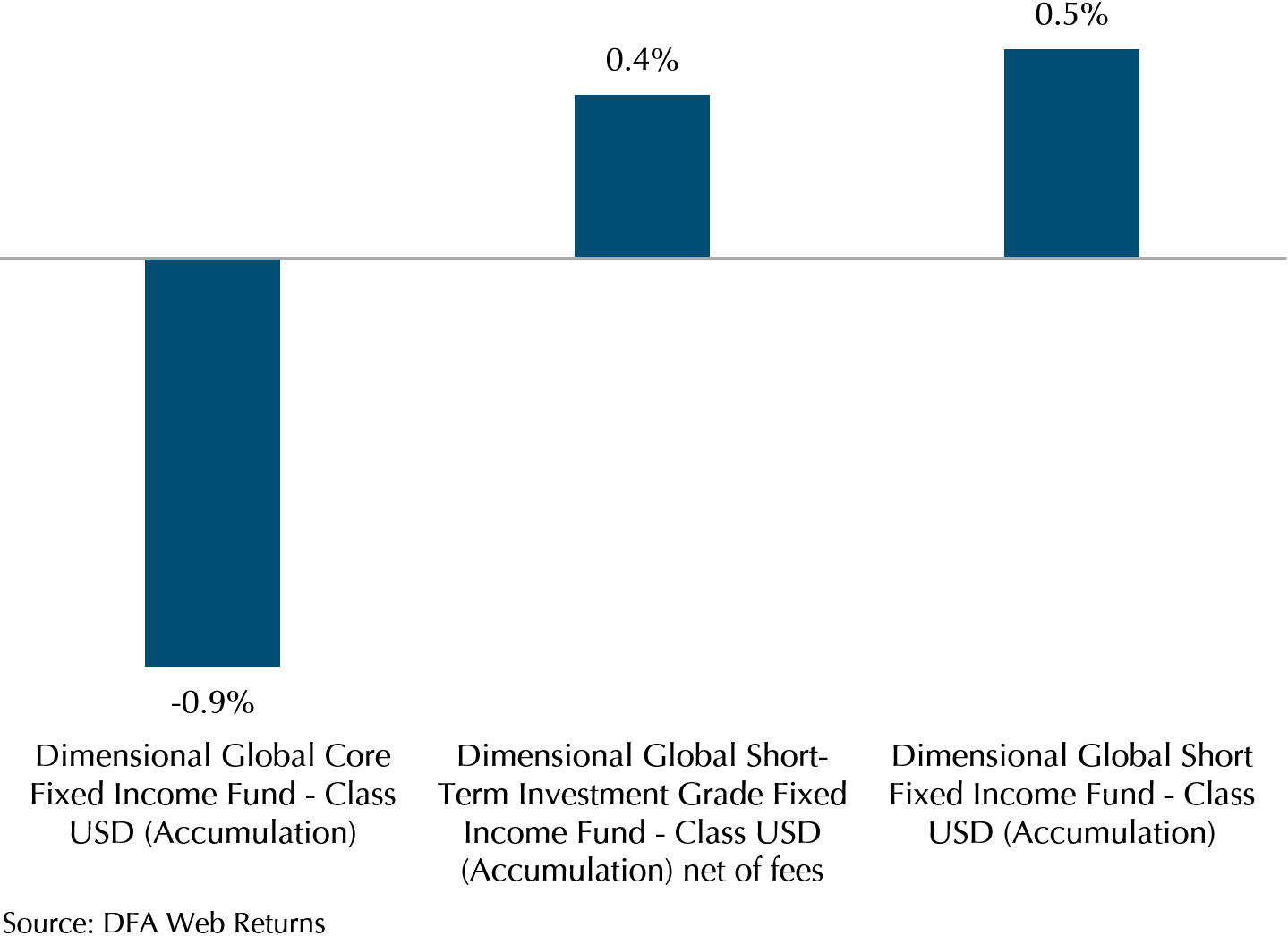

In contrast, the Dimensional Fixed Income funds continue to exhibit encouraging performance. While the Global Core Fixed Income Fund experienced a decline of 0.9%, both the Global Short-Term Investment Grade Fund and the Short-Fixed Income Fund demonstrated positive gains of 0.4% and 0.5% respectively. The reason for this improved performance is Dimensional’s variable term strategy for fixed income, which involves shifting their allocation to the part of the yield curve that delivers the highest expected return. Currently, both the Global Short-Term Investment Grade and the Short-Fixed Income have a weighted average duration of 1.42 and 0.52, respectively. This is because short-term bonds yields are higher than the long-term bond yields, prompting the fund to hold shorter-term bonds since investors are getting less return for holding long-term bonds. The shorter duration means that these bonds do not experience significant price drops if yields rise, allowing the two short -term Dimensional Fixed Income funds to perform better this month.

While Dimensional’s value and size-tilted equity funds may have faced challenges in recent months, it’s important to note that the premiums associated with these strategies often take time to manifest. Investors should consider a longer-term perspective and remain patient, as these strategies have historically demonstrated their worth over extended time horizons.

Exhibit 3 – Dimensional Fixed Income Funds October Performance (In USD)

How Uncertainty Around Inflation Is Driving Market Volatility

While the market, particularly in equities, has encountered difficulties in recent months, the year-to-date performance remains positive, primarily due to a strong start in the initial two quarters. Nevertheless, this period of heightened volatility can pose challenges for clients. Thus, gaining a deeper understanding of the underlying factors driving this volatility can provide valuable insights into market dynamics. This knowledge empowers investors to make well-informed decisions and position themselves for long-term success, rather than succumbing to the temptation to sell prematurely.

Referring to a statement from Professor Aswath Damodaran, a renowned finance professor at NYU known for his expertise in valuation, from one of his blogs[2] on May 6, 2022: “The good news is that the culprit behind the volatility is easy to identify, and it is inflation, but the bad news is that inflation remains the most unpredictable of all macroeconomic factors to factor into stock prices and value.” Even though this blog was authored over a year ago, we continue to observe that uncertainty surrounding inflation remains the primary driver of market volatility.

Furthermore, Professor Damodaran emphasised that inflation is the most challenging macroeconomic factor to consider when determining stock prices and value, and this is a major cause of the recent market volatility. One of the complexities of predicting inflation arises from the fact that shifts in commodity prices are not immediately reflected in inflation data. Changes in commodity input costs require a gradual period to impact inflation. Recent research by Minton and Wheaton (2023)[3] demonstrates that changes in commodity prices exhibit a delayed effect on inflation data. This delay implies that shifts in commodity prices take time to influence price levels, contributing to the unpredictability of inflation. Consequently, significant fluctuations in input prices, such as commodities, contribute to sustained uncertainty in inflation rates. Given ongoing geopolitical events like the Russia-Ukraine conflict and recent disruptions in the Middle East affecting supply chains, crucial commodities like oil have experienced notable volatility. For instance, Brent Crude Oil prices have oscillated from above 95 dollars to as low as 85 dollars over the past two months. In accordance with Minton and Wheaton’s (2023) findings, this volatility indicates that inflation is likely to become more erratic in the coming months, as these price changes gradually permeate the supply chain, affecting inflation at varying intervals.

Echoing Fed Chair Jerome Powell’s famous quote from the annual Economic Policy Symposium in Jackson Hole: “We are navigating the stars under cloudy skies”, the Federal Reserve continues to make policy decisions amidst uncertain economic conditions. Striking the right balance in interest rates is crucial, as excessively high rates could potentially harm businesses by increasing borrowing costs, while setting rates too low may fuel an inflationary cycle. The market closely watches the Fed’s actions, relying on data like unemployment rates, the consumer price index (CPI), personal consumption expenditures (PCE), the purchasing manager index (PMI), and more to gauge inflation expectations. As a result, clients should be prepared for a potentially turbulent market environment and remain focused on the long-term, where market returns have historically outperformed risk-free returns.

Making the “Right” Decisions in an Uncertain World

Indeed, October has been a difficult month for investors, with both stocks and bonds experiencing declines, and in some cases, significant ones. While it may appear to be a difficult period, the markets continue to provide their function of price discovery, providing investors with an opportunity to capture higher returns in risky assets as we observed longer-term yields approaching 5%, and stocks undergoing corrections from their July highs.

The ongoing uncertainty surrounding inflation and the central banks’ reactions is contributing to the volatility in prices, along with also uncertainty around how inflation feeds into stock price valuations, as mentioned in Minton’s and Wheaton’s research.

However, these factors are beyond our full control. What we can focus on are decisions we can make regarding our investments. In an article written by our Lead of Advisory Team, Chin Yu, “The Art of Decision Making in an Uncertain World[4]”, he emphasises the significance of embracing uncertainty and skilfully navigating through it by gaining a thorough understanding and making sound decisions. Rather than fixating on a singular outcome, it is advisable to contemplate how consistently making a particular decision over time will impact you in the long-term. The positive effects of sound decisions accumulate and ultimately lead to rewards.

At Providend, we are here to help you with making the right decisions for your wealth plan. If you do have any concerns over the recent market volatility and how it might affect your plans, do reach out to your Client Adviser to have a discussion. We want to thank you for your continued trust and support and would also like to wish all our clients a very Happy Deepavali/Diwali celebration in November.

– Footnotes –

[1] You can read more about JP Morgan October Monthly Market Review in this link.

[2] You can read more on Professor Damodaran’s May 6th blog in this link.

[3] You can find Minton and Wheaton’s (2023) research in this link.

[4] You can read more on Chin Yu’s article in this link.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.