It is Saturday evening, January 28th, and I find myself sitting with a group of close friends in one of their homes. It is still the Lunar New Year season, and we are having a game of Texas Hold’Em over food and drinks. The mood is slightly competitive, although I try my best to make casual conversation while focusing on my cards at the same time.

“All-in!” I confidently declare as I look at the pair of Jacks in my hand, along with a board of Jack, Ten, Ten, completing a full house. To my delight, the player opposite me calls and reveals his Nine, Ten, making three of a kind. I am prepared to claim the pile of chips in the middle, with a slight smug look on my face. The next card, a Five, changes nothing but boosts my already huge confidence. The last card comes out to be another Ten, which completely erases any hint of smugness in me. It is the last Ten, the only card in the deck that can win me, giving my opponent four of a kind. I feel sick in my stomach as I lose all of my chips in this devastating loss.

If you are not familiar, you could look up the rules of Texas Hold’Em, but basically, it is being played through a series of bets of various sizes, depending on how confident you are of the outcomes. You could also bluff your way through by representing a strong hand, in hope that your opponents back down. And a major component of poker is the uncertainty that is always present, and unlike games like chess, you could make perfect decisions in any single hand in poker and still lose the pot eventually. What I just described earlier is what is known in the poker community as a “bad beat”.

In one of my previous articles, I shared about my fascination with cognitive biases when it comes to investing. Today, I hope to continue on a similar vein through a game that I am equally fascinated with – poker.

Thinking in Bets

Annie Duke, a former professional poker player and an author in cognitive-behavioural decision science described it very well in her book (Thinking in Bets), that life is a lot more similar to poker than chess. While chess is well-defined and contains no hidden information and very little luck, poker is a game of incomplete information, with a significant element of luck and uncertain outcomes. It is a game of decision-making under conditions of uncertainty over time. And while we cannot control single outcomes, consistently making good decisions does favour you in the long run. Every decision that we make in life is a “bet” to try to optimise our life, ranging from small ones like what to have for lunch, to larger ones like deciding which career to pursue.

Resulting

So, you might be thinking, “I get it, the world is uncertain, no surprise. So, what can we do about it?”. Well, the answer is to focus on what you can control, which is your decision making, instead of the outcome. Generally, we have a very strong tendency to relate the quality of a decision with the quality of the outcome. Poker players call this tendency “resulting”, which is a very common beginner’s mistake. If you win, it means that you have played well, and if you lose, you have played poorly. But is that really the case?

Probabilistic Thinking & Range of Outcomes

Uncertainty also means a range of possible outcomes, and because the world is uncertain, we have to think in terms the probability of different scenarios happening. Unfortunately, our brains are also wired to think in terms of black-and-white judgements regarding “success” or “failure”.

To give an example, imagine if the weather forecast says that there is a 90% chance of rain today, and it did rain, was the forecast accurate? What if it did not rain instead? Would it still be accurate?

Having what we call, a deterministic thinking means that there is a correct and wrong answer in this situation. However, because we are looking at it from a probabilistic angle, the outcome does not determine whether the forecast was accurate or not, because even if it did not rain, it could very much fall within the 10% chance of no rain. And that is how the world typically operates.

Annie Duke also explained that what good poker players and good decision-makers have in common is their comfort with the world being an uncertain and unpredictable place. They understand that they can almost never know exactly how something will turn out. They embrace that uncertainty and, instead of focusing on being sure, they try to figure out how unsure they are, making their best guess at the chances that different outcomes will occur in order to make good decisions. And more experience will allow the player to narrow down the possibilities and better plan the appropriate responses and next steps from there.

Source: Thinking in Bets (Annie Duke)

Having a Good Process

Instead of focusing on areas beyond our control, we should seek to have robust processes in our decision making, and to be able to objectively audit the quality of our decisions. While the outcomes does factor into the evaluation, you want to be aware of the role of luck in the outcome. And as long as you have a consistent and robust approach in making good decisions, you are better able to, as the saying goes, “let the chips fall where they may”.

What also helps in arriving with a robust process is to be very honest with yourself and avoid getting overly attached to your past decisions that happen to work out well. Even in the scientific world, theories often get updated because they are in the business of the pursuit of truth. And anything that is accepted today, can only be considered as “the truth for now”. And we can all benefit by thinking like a scientist.

Decision Making in Investments

Now, the same applies when we invest, because we need to have a strong investment philosophy and approach to guide our decisions when investing. Particularly so when there is a sea of investment options out there, so how do we decide?

We had previously written about the four pillars of Providend’s investment philosophy when deciding what instruments meet our criteria in crafting portfolios for our clients. Furthermore, we also need to decide how the various investments and asset allocation fit one’s individual needs and situation.

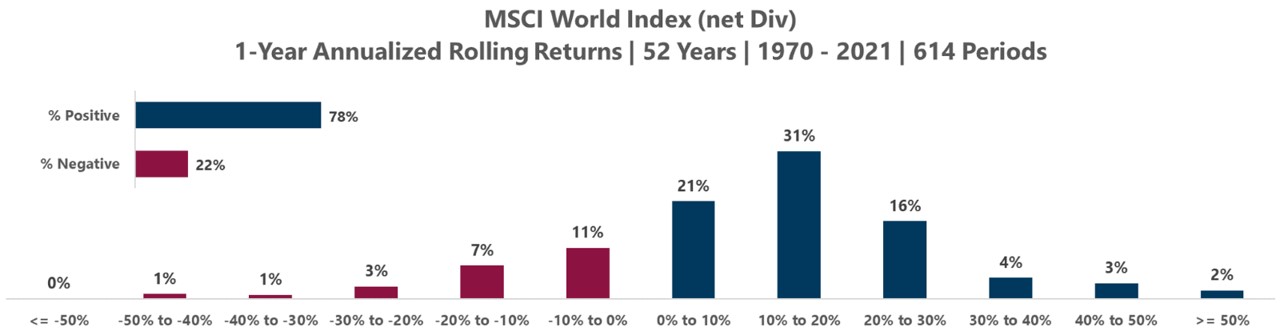

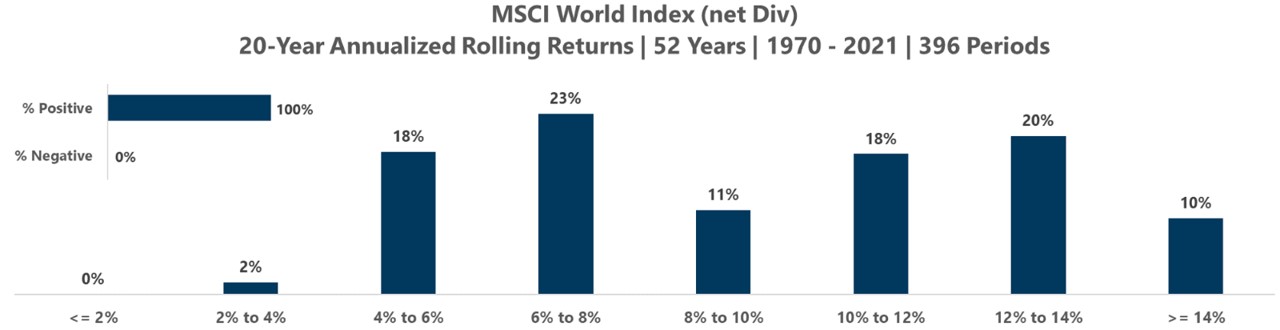

Once that is put into place, we have to accept that uncertainty will always be present and cannot be eliminated completely. At the same time, more experience helps us understand the range of possible outcomes better and assess whether outcomes fall within expectations. Take the investment returns of the MSCI World Index for example. We all know that even if a robust investment portfolio is put in place, negative returns do happen from time to time, which can range as much as from -50% to +50% in a single year. It does not mean that the investment is a poor one when you encounter a negative return, but what it means is that we should avoid investing in equities unless we have at least 10 years to sit through the volatility. Even for a 20-year period, where the markets have never seen a negative return in history, the outcomes also fall within a range, which has been about 2% to more than 14% annualised return.

Source: Dimensional Returns Web

Source: Dimensional Returns Web

Even cash has risks, while not in terms of nominal returns, but in terms of real returns where it is almost certain to lose money in the long run. So making good asset allocation decisions to balance between inflation risks and market volatility requires a good process as well. Improving decision quality is about increasing the chances of a good outcome, instead of trying to guarantee them.

Putting Everything Together

I hope to end this off by saying that risk and uncertainty is always present, whether in the field of investments or simply in our daily lives. And it is important to be comfortable with uncertainty, and navigate around it by understanding it, and making good decisions.

Understand that things happen in a spectrum, and hence planning with a range of outcomes, and determining whether your outcomes are falling within expectations would be beneficial for you. The same goes for poker, even if you have a 98% chance of winning, there is still that 2% possibility of someone hitting the single last card in the deck to give them the win instead. A good poker player understands this possibility.

When making decisions, try not to focus on the single outcome, but think about how it will impact you if you consistently make the same decision over and over again in the long run. And the effects of good decisions compound and will reward you eventually. Lastly, having a robust review process means that you disconnect your decision making from the quality of your outcomes.

So the next time you see a poor performance in your investments, ask yourself whether this is within the expected range of outcomes despite having a solid portfolio, or if it is due to a poor investment decision. Because the last thing that you want to do is to make changes to a strong portfolio just because of a poor short-term outcome.

This is an original article written by Tan Chin Yu, Lead of Advisory Team at Providend, the first fee-only wealth advisory firm in Southeast Asia and a leading wealth advisory firm in Asia.

For more related resources, check out:

1. S2E9: The Mindset of a DIY Investor Who Achieved FI by Age 38 Ft. Investment Moats

2. Don’t Make Long-Term Decisions Based on Short-Term Information

3. Sound Wealth Planning Does More Than Help You Reach Your Goals

*Providend is very excited to share that we are now ready to extend our service offerings to the younger accumulators who are looking for holistic, independent, conflict-free wealth advice!

For this group of younger accumulators, we know that it is not easy to make retirement planning a priority when other financial goals – buying a first home, for example, or saving for a child’s education – appear more pressing. Learn how we can help here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.