On 18 February 2022, Finance Minister Lawrence Wong gave his maiden Budget Speech that served to “chart a new way forward together” as Singapore continues the fight against Covid-19, investing in new capabilities and strengthening our social compact while advancing our Singapore Green Plan. Besides the various supports for workers, households, and businesses, what stood out in the Budget must be the highly anticipated wealth tax and the timing of GST hike.

The wealth tax serves a dual purpose of financing the growing budget and mitigating social inequalities by having the rich to contribute more. Even with the latest round of tax changes, the government continues to explore options to tax wealth more effectively.

We put together a summary of the key implications on personal finance which could be meaningful for you.

1. Increase in Taxes and Wealth Tax

- GST to increase from 7% to 9% over 2 years starting next year

The first 1% increase will be on 1 Jan 2023 and the second 1% on 1 Jan 2024. While purchases will become more costly from next year onwards, certain items such as publicly subsidized healthcare and education will continue to be exempted from GST.

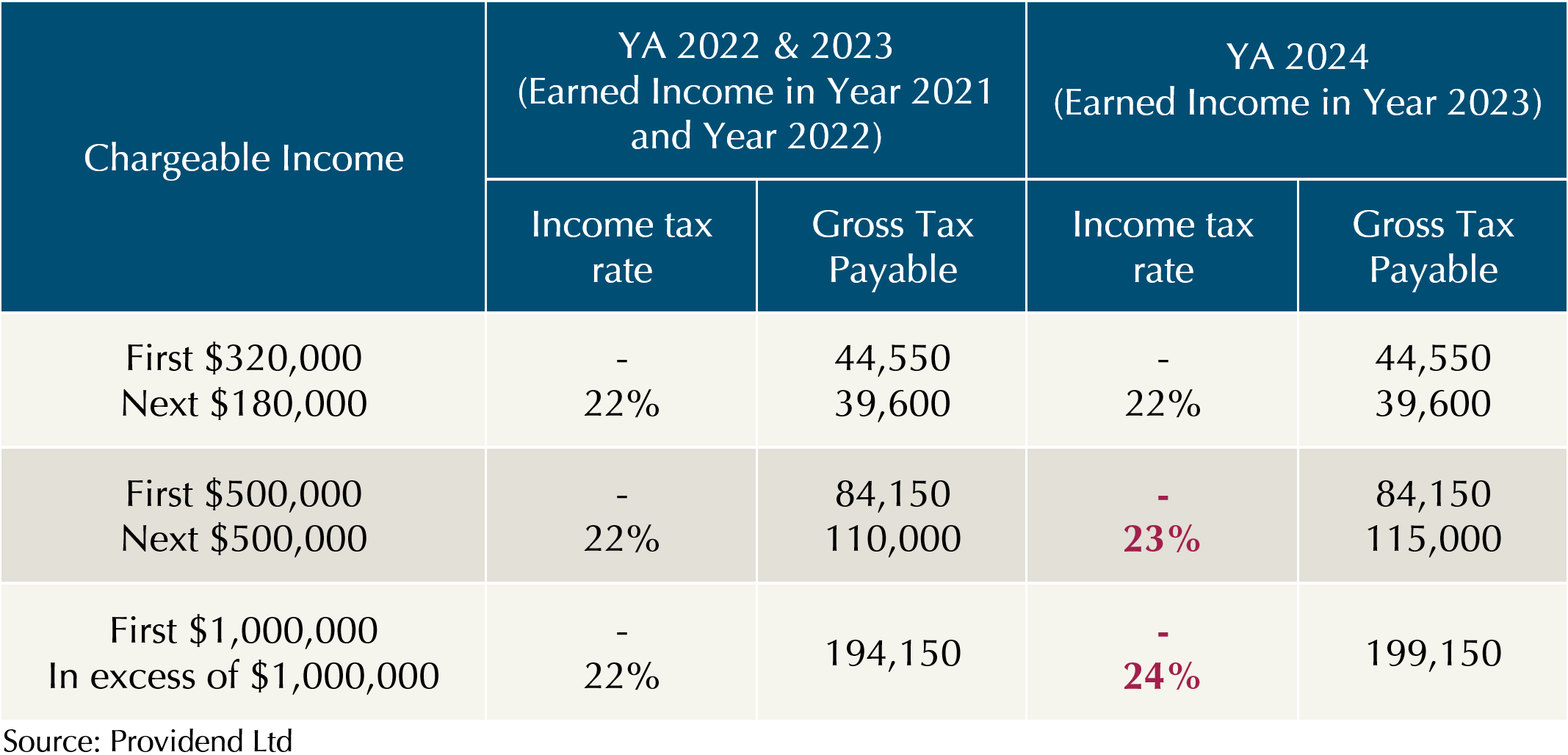

- Top marginal personal income tax to increase from 22% to 24% with effect from the Year of Assessment (YA) 2024

This applies to the top 1.2% of personal income taxpayers, where income earns in 2023 will be taxed progressively more. Chargeable income (i.e., assessable income after deducting personal reliefs) in excess of $500,000 will incur more taxes, with those above $1,000,000 paying even higher.

The outcome of these tax change is that top income earners could see their personal income tax increase by up to 9%.

Top income earners who are non-resident taxpayers are also impacted, as they are taxed at a flat rate of 15% or the progressive income tax rate, whichever higher.

- Wealth Tax 1: Property tax on residential properties to increase in 2 steps from next year, more significantly for higher-end properties

New changes to the property tax on residential properties, be it owner-occupied or non-owner-occupied.

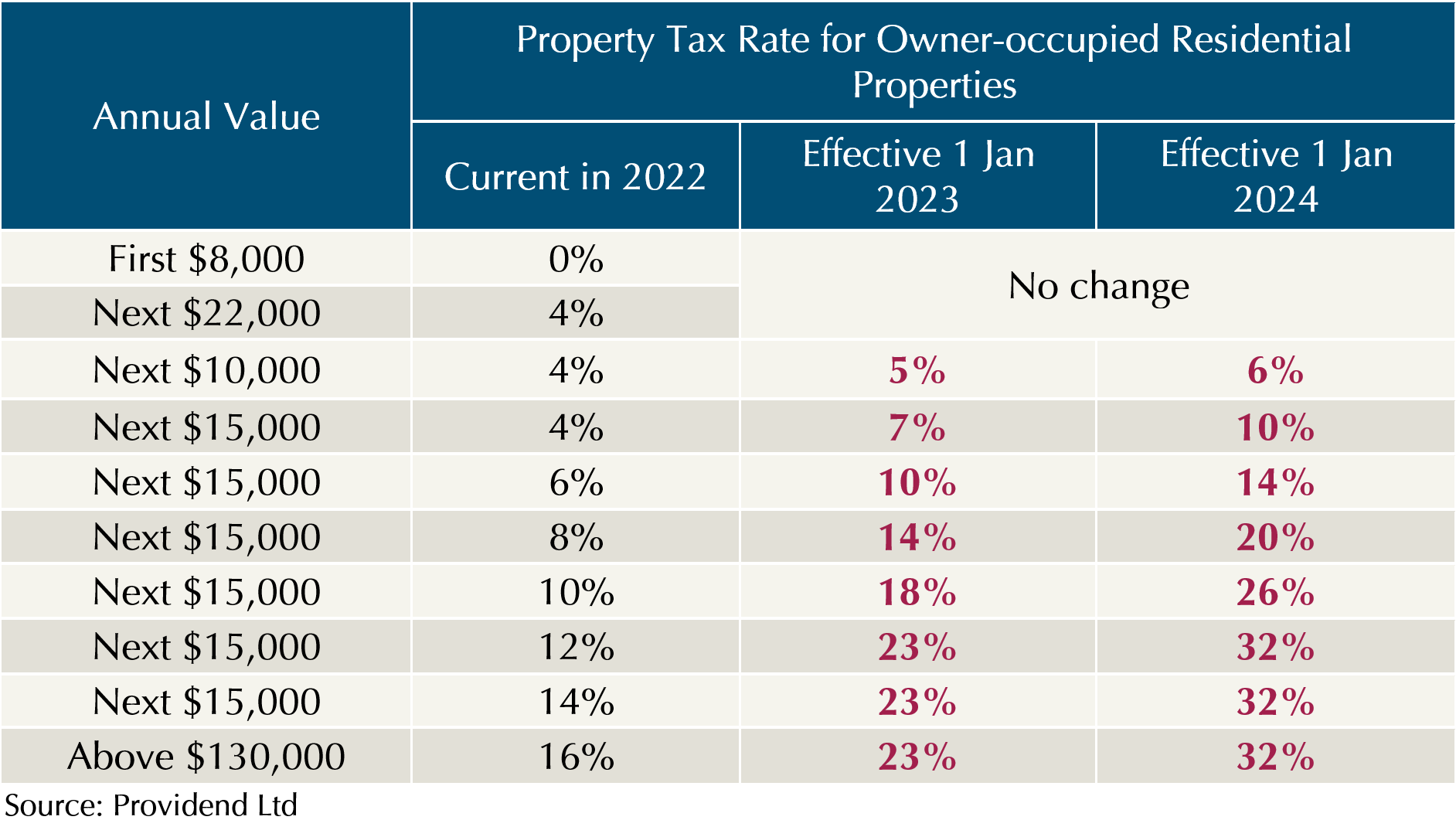

Owner-occupied residential properties

Owner-occupied property of annual value in excess of $30,000 will face higher property tax from the current of 4% to 16% to 5% to 23% from 2023 and 6% to 32% from 2024. The top 7% of owner-occupied properties will be affected by this change.

The following table illustrates the property tax payable for properties of different annual values. A condominium in central location with annual value of $40,000 could see the eventual property tax increase by 16% in 2024, whereas a more expensive, large landed property of $70,000 in annual value attracting a 83% increase in property tax.

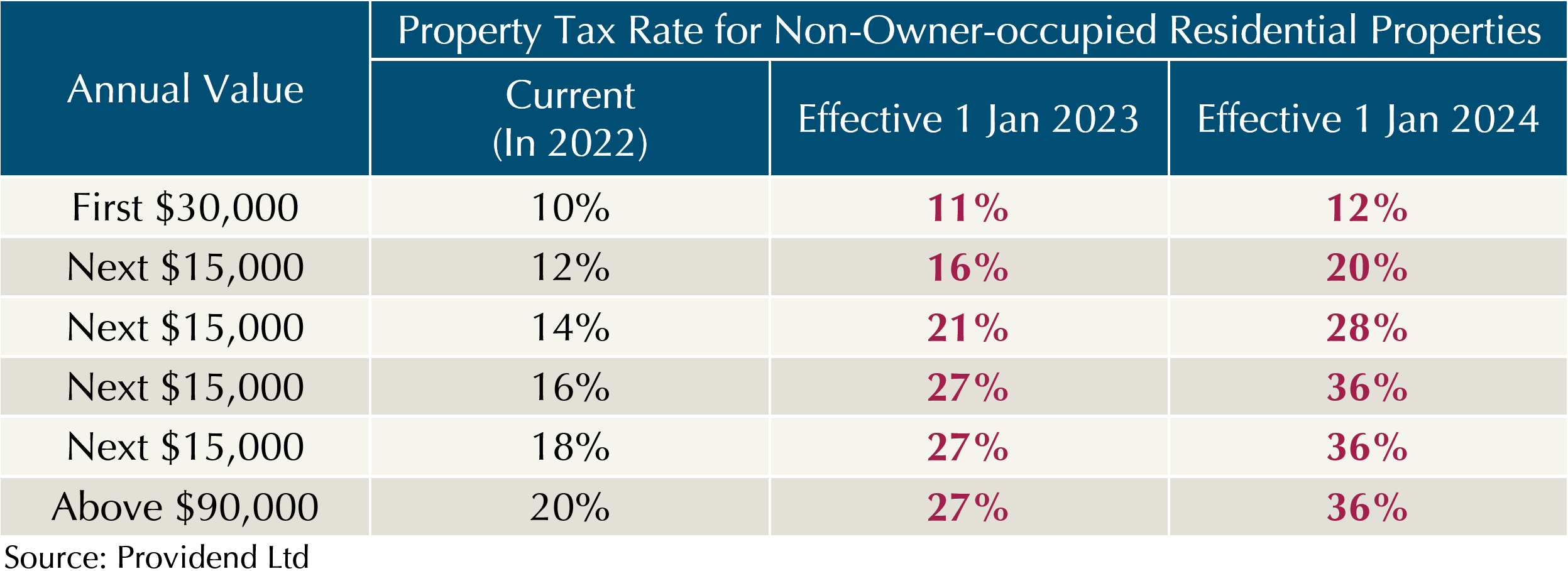

Non-owner-occupied residential properties

From next year onwards, higher property tax will also apply to non-owner-occupied residential properties, including investment properties. The increase will be phased in over two years, from the current of 10% to 20% to the final tax rate of 12% to 36% from 1 Jan 2024.

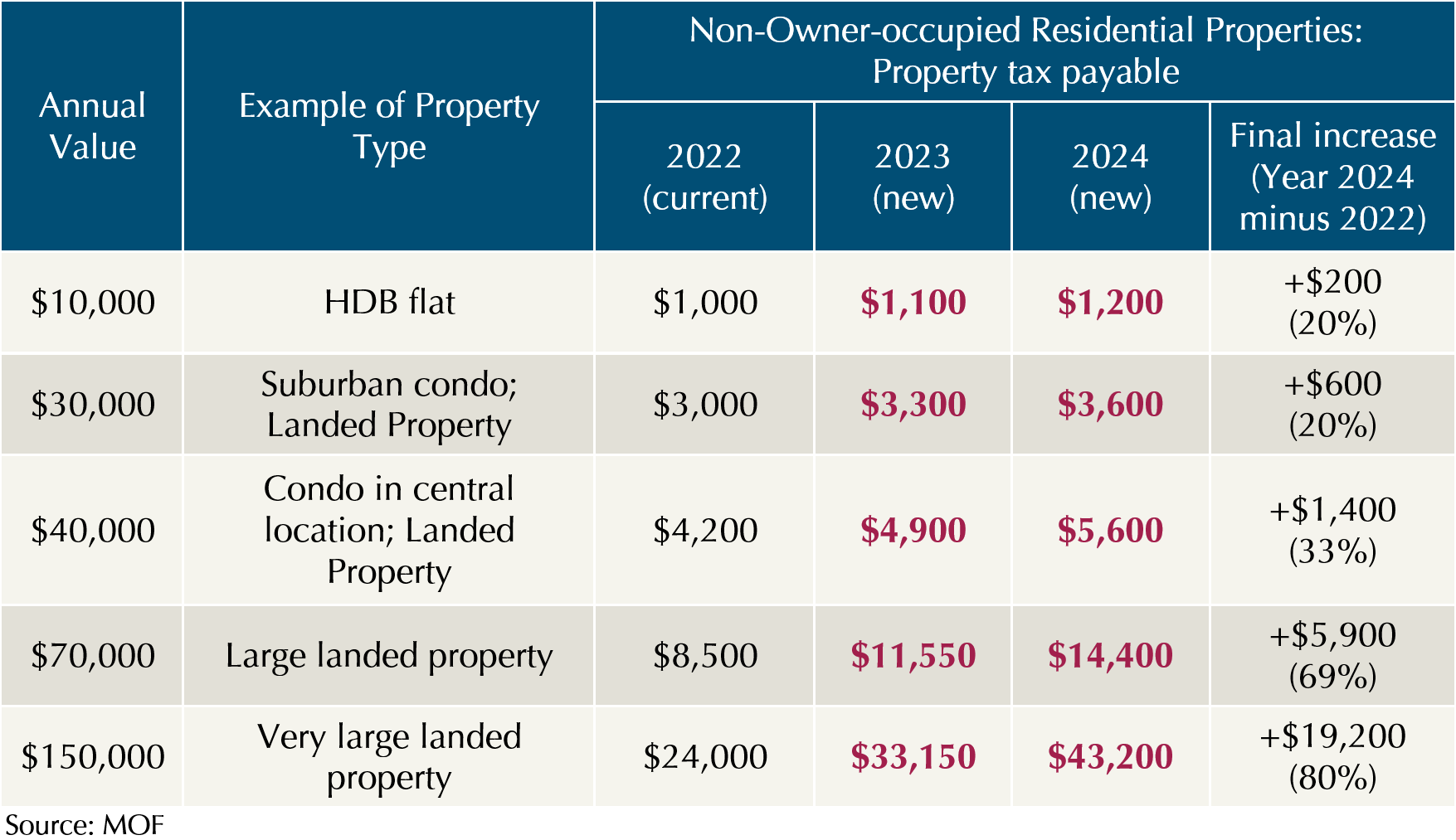

The impact on non-owner-occupied residential properties of various annual values as illustrated below.

Whether property investors are able to maintain their net rental yield from investment properties will depend on their ability to pass on the extra tax bill to tenants.

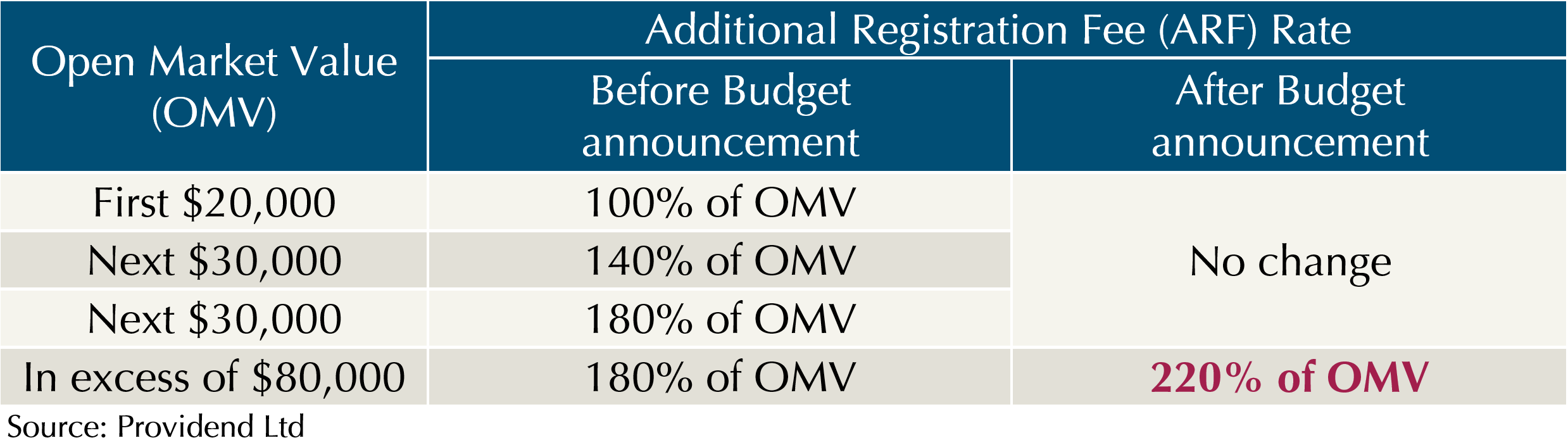

- Wealth Tax 2: Higher tax on luxury cars with immediate effect

A new tax tier on Additional Registration Fee (ARF) for cars will be added. Cars with Open Market Value (OMV) above $80,000 will now be taxed at 220% (previously 180%) which makes luxury cars like Porsche, Lamborghini and Bentleys even more exclusive.

OMV is the estimated cost of vehicle before tax and ARF is the main tax for vehicle.

The revised rate will apply to all cars, including imported used cars, registered with Certificates of Entitlement (COE) obtained from the second COE bidding exercise in February 2022 onwards.

2. Boost Retirement Adequacy

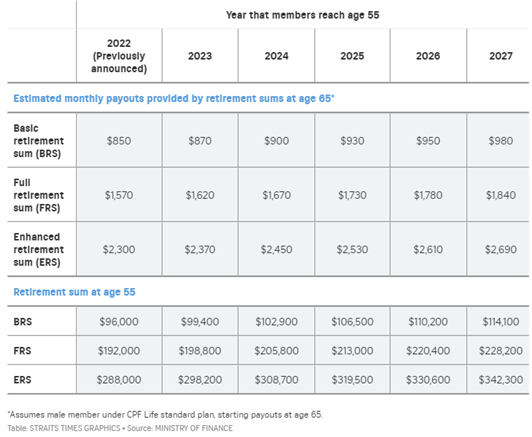

- Increase CPF Basic Retirement Sum (BRS) limit by 3.5% yearly from 2023 to 2027

The BRS is the amount CPF Board uses to determine the monthly income one needs to maintain basic living expenses in retirement, i.e., from age 65. For those with more CPF money, they can opt for Full Retirement Sum (i.e., 2x of BRS) or Enhanced Retirement Sum (i.e., 3x of BRS), which means a proportional increase in monthly payout for a better retirement.

With the new 3.5% annual increase in BRS (previously 3% annually), this means more money can now be channeled into the CPF Retirement Account (CPF-RA) which will translate to higher CPF LIFE annuity payout (retirement income) to keep up with rising cost of living. The effect is not significant on retirement income, but it does help to mitigate the pressure on rising cost of living.

As an illustration, a CPF member who turns 55 in 2023, having set aside $99,400 (2023 BRS) into his CPF Retirement Account, can expect to receive a monthly payout of $870 for life when he reaches 65. If he can set aside $298,200 instead (ERS), his monthly payout at age 65 could be about $2,370.

Likewise, a younger CPF member who turns 55 in 2027 with $114,100 (2027 BRS) in CPF Retirement Account can expect $980 monthly payout at age 65. Setting aside $342,300 (2027 ERS) into his CPF Retirement Account could further increase his monthly payout to $2,690 at age 65.

No top up is required if one is unable to set aside his BRS. However, topping up yours or loved ones’ CPF could entitled you up to $8,000 in annual tax relief, if certain eligibility criteria are met.

3. Support for Households

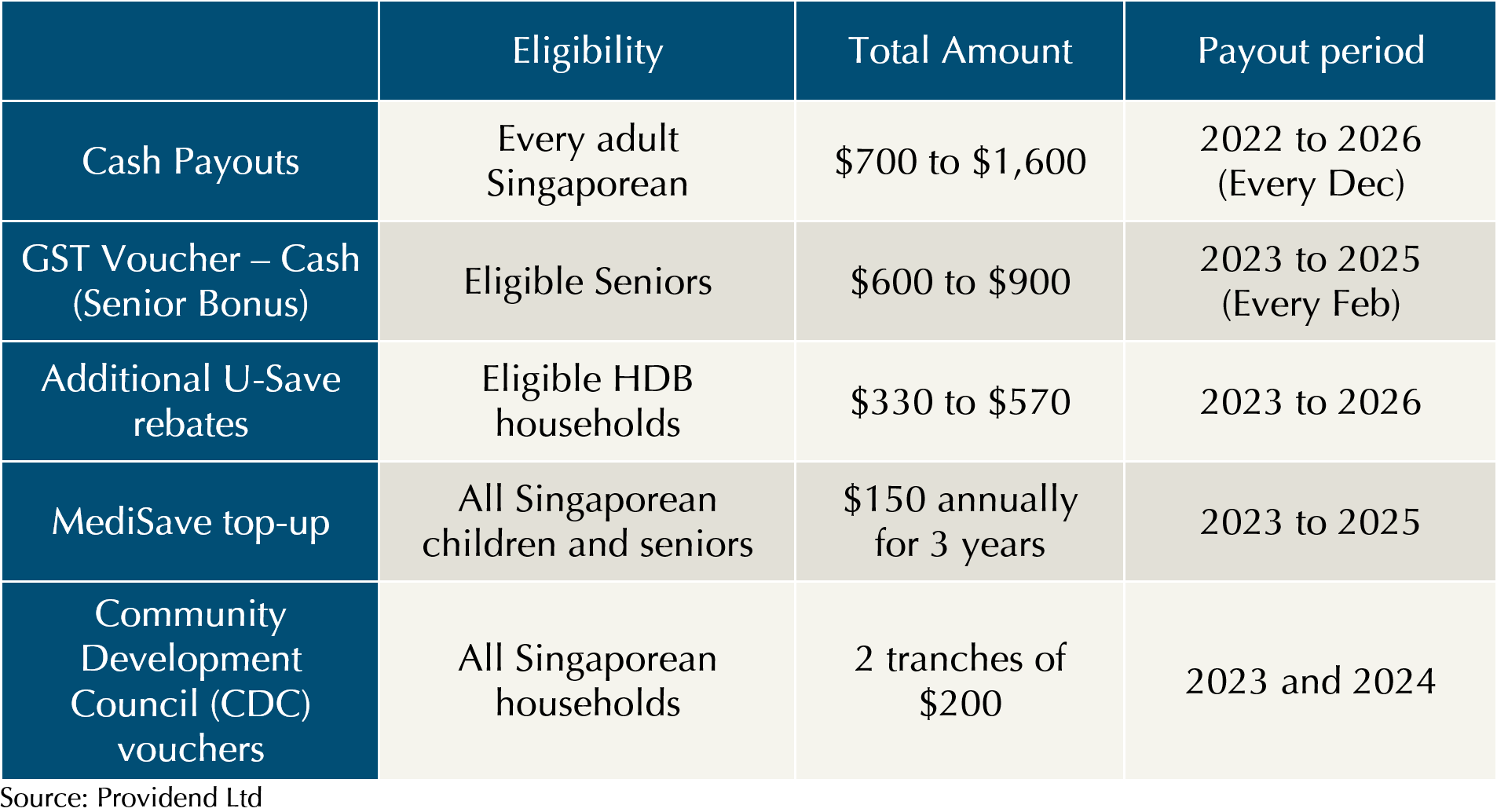

- Enhanced Assurance Package for GST

The Assurance Package, first introduced in 2020 to cushion the impact on GST, is further enhanced in this Budget. The enhanced package will provide the following add-ons to Singaporeans over the next five years. In the vein of fairness, lower- and middle-income households will be supported with higher payouts.

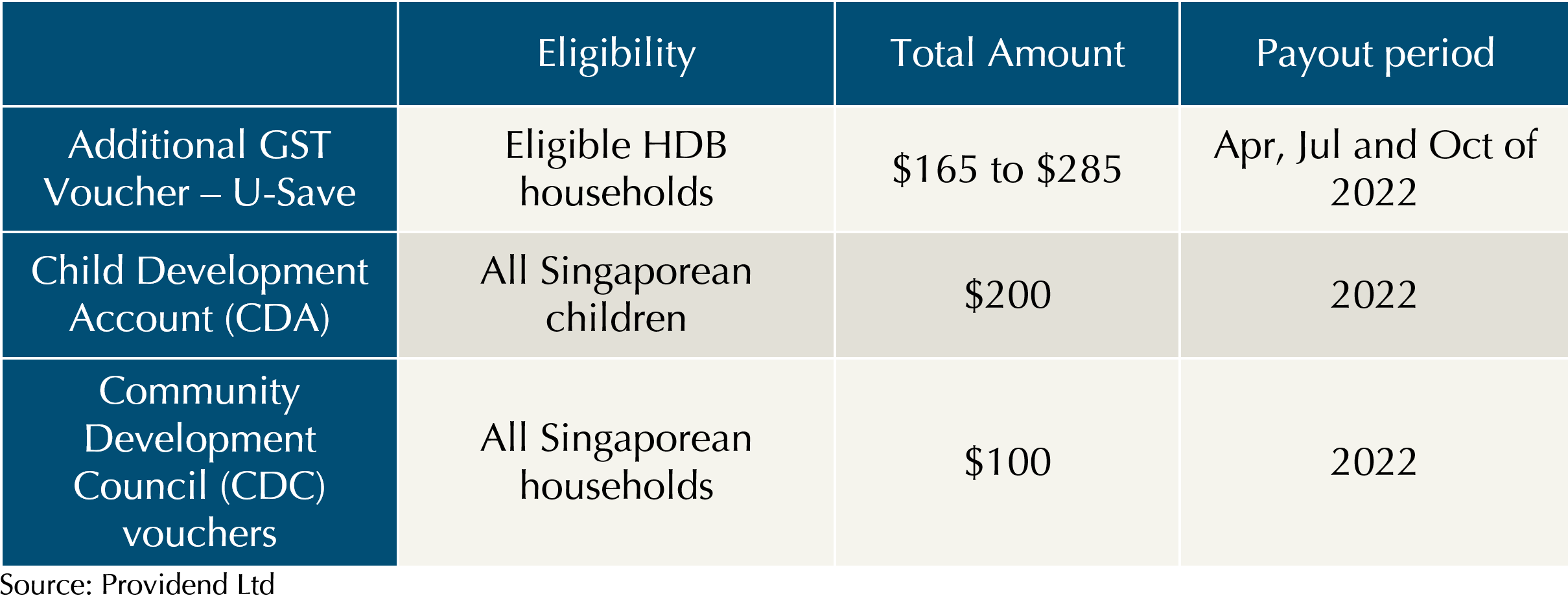

- Immediate additional support to manage cost of living

This is to provide financial support for daily essentials and will be given out this year.

Warmest regards,

Solutions Team

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.