March 2020 is a bit of madness.

March Madness is also the name given to National Collegiate Athletic Association Division 1 Men’s Basketball tournament in the United States.

It is no surprise that this very popular grassroots tournament has been cancelled.

This sent a very strong message to the people in the United States that COVID-19 is a serious matter.

If you have not been paying attention to the markets, I think you have all the hallmarks of a very good buy and hold investor.

However, chances are, your lives would have been disturbed by the disruption caused by COVID-19 and be at least aware of what is happening in the financial markets.

As we ended March, we are also to review some of the data coming out of the financial markets about this very volatile period.

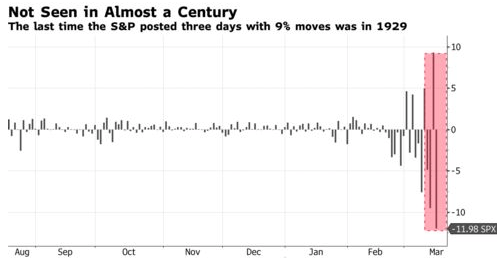

One of the charts that illustrate the extent of volatility is the one above. The last time we have three 9% moves consecutively was in the Great Depression.

The average monthly volatility in the MSCI World index is 4.2%. The index moved -13.2% in March. This is an almost 3 Sigma event. This is a very rare event.

Not too long ago, Michael Burry, a brilliant and well-known financial figure alerted the public about his concerns that we may be inflating a big bubble by concentrating too much of our money in passively managed index funds.

His comments sparked off an online debate among financial commentators overseas and locally whether we should be concerned about putting our wealth in passively managed index funds.

We also had clients asking us whether there is cause for concern.

A stock market event that happens in February to April is the kind of event that is most susceptible to the unwinding problems Michael talks about. Many derivatives interplay with index funds and exchange-traded funds that are traditionally more buy and hold investments.

In mid-March, the Federal Reserve had to take drastic actions by injecting liquidity into the markets to provide liquidity and currency swap. Had they not moved fast enough, there might be greater distress in the markets.

Throughout this time, what did investors do?

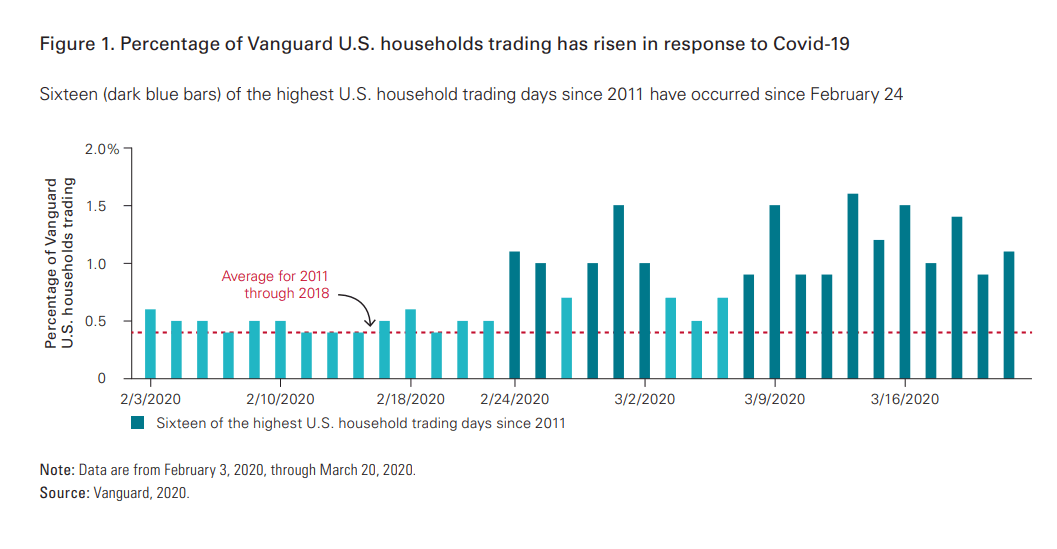

Vanguard published a report that reveals the behavior of the investors in their funds.

The market started falling from 19th February onwards. From the chart, we can see that the Vanguard funds experienced some of the highest trading days since they started tracking in 2011.

The majority of the households were making trades.

7 out of 10 households since February 19 have been moving money into equities than cash or fixed income.

However, those who are wealthier have been selling into declines, moving into fixed income.

Another statistic that we may miss from the bar chat is that despite the increase in trading activity, the percentage of Vanguard U.S households trading remains less than 1.5%.

This seems to indicate that majority of the US Vanguard household does nothing during this period.

Eric Balchunas, senior exchange-traded fund analyst at Bloomberg tweeted this chart on the outflows from unit trusts during this period.

Many commentators were questioning the fortitude of passive index investors. They question whether they would suffer from the same behavioural tendency as normal investors when volatility in the market picks up.

The result does show that Vanguard investors can be a rather unique bunch who seemed to have stronger holding power.

Why is this the case? I am not sure.

Perhaps the advisers recommending them to clients have coached the clients well on how they should look at investing. Perhaps the investors buy into the Vanguard philosophy.

For some reason, Vanguard investors are a resilient bunch.

During the European debt crisis, the S&P 500 lost 20%. Here is an extract from Vanguard’s look at the data back in 2011:

In the first eight trading days of August [2011], including two of the most volatile days since 2008, just under 2% of 401(k) participants at Vanguard made a change to their portfolios. In other words, over 98% stayed the course. Ninety-eight percent took no action. Ninety-eight percent took the long-term view.

There are some lessons that we can learn from Vanguard investors:

- The system to invest can be very simple if you have a long-term mindset and can stay out of your way.

- If you have a plan in place, not doing anything is a reasonable course of action to make. For many investors, they find that they have to do something, which may get themselves into trouble.

The majority of our clients are either in Vanguard or Dimensional funds. The strategy we asked of them is not too different from these Vanguard investors.

The question is whether you would do the same thing as them.

The article you have just read is part of Providend Curated Insights, a selected repository of content that we research about and reflect upon for the best recommendations to our clients.

Providend Curated Insights is narrated currently by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s First Fee-only Wealth Advisory Firm, and Chief Editor of InvestmentMoats, Singapore’s most well-read financial blog.

For more related resources, check out:

1. How Can I Invest Confidently?

2. Returns of a Portfolio of World Equities Through Good Times and Bad Times

3. The Importance of Liquidity in Your Investment Portfolio

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.