Like many people during this pandemic, my husband and I started to go on more and longer cycling trips together over the past 2 years. Usually we will check the skyline before we leave the house. On several occasions we would observe that one side of the sky is covered with gloomy rain clouds. But on the other side, the sky would look fairly clear.

We would then deliberate, walk towards the different “views” and ask ourselves “should we go?”

What if we are caught out (and risk our precious bicycles getting wet)?

What if we have to make a disappointing detour back early in our journey (past experiences certainly does not help)?

In most of these occasions, we decided to play it safe, and not go.

And guess what? It did NOT rain!

I would then be so frustrated with myself, for being overly safe and “kia-si” (Singlish word for “scared to die”).

Since the start of the year, the S&P 500 Index is up 22.5% year-to-date. The MSCI World Index is up about 18.4% year-to-date. If we look at the price chart of both indexes this year, it looked like equities only go up in a straight-line. Most interestingly, it has been about 200 days since the S&P 500 corrected at least 5%.

The good stock market performance seems to present a totally different picture from what is happening in the “real world”.

Many countries are still struggling to open. We are all struggling to deal with the Delta variant of the COVID virus. Elsewhere, Taliban managed to take back control of Afghanistan, 20 years after the war started.

In China, the Chinese ruling party is exerting greater influence in various domestic areas. They have started clamping down on excessive youth tuition and gaming culture, “996” work culture, the flow of data out of China. This has put enormous pressure on the dominant large Chinese corporations such as Alibaba, Tencent, Meituan, DianPing and TAL Education.

Experts are also divided on whether the inflation we are observing currently are transitory or we will be in a prolong period of higher prices.

The questions that I commonly get are:

- Should we hold off our investments till things are more certain?

- Or should we take the plunge and just invest?

- Is there a right time to invest?

Investing right now feels like my husband and my deliberation over whether we should go cycling. What we are experiencing from what we hear and read on the news are the dark clouds, and what we are seeing in the markets are the sunshine.

Now I am under no illusion and understand that whilst there may be some similarity between the wealth allocation decision and our hesitation to go cycling, the impact of the decision is drastically different.

If my husband and I made the wrong decision, both of us get drenched, we may catch a cold and be out of action for two to three days. But if we make too many wrong wealth allocation decisions, we may lose a large chunk of our wealth and for most of us, these are wealth that we have worked hard to accumulate over the years.

Yet I do find the framework to make sound decisions to be rather similar on a high level. This framework can allow us to make better decisions especially in situations when there are uncertainty and certain parts are not within our control.

Our investment time frame is important

At Providend, we believe planning precedes investing.

There are 2 key questions that should be considered:

- What are you trying to achieve with this set of monies?

- How soon will the money be needed?

It is only after we have sat down with our clients to have a thorough understanding of their aspirations, concerns and obligations, map out their cash flow needs in the immediate, intermediate and longer-term time frame, that we recommend the investment portfolios that are suitable for them.

This does not mean that our clients’ investments do not go through the ups and downs.

But it does give them the mental framing to stay invested, having the assurance that the probability of loss goes down with longer time frame, and with a higher certainty that they can reap positive returns to achieve their goals.

For example, as part of our coaching process, we will take our clients through slides like the following to explain how the investing experience will feel like.

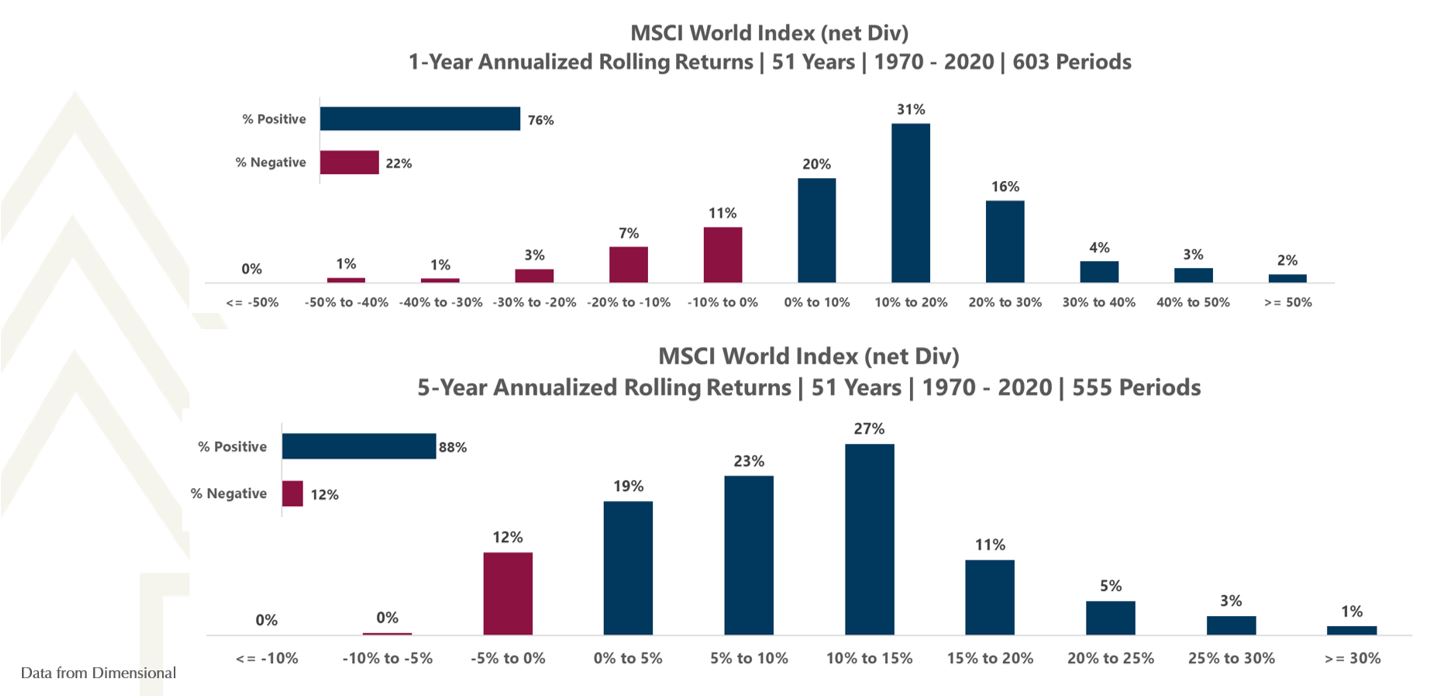

The two charts above show the 1-year and 5-year rolling returns for the MSCI World Index from 1970 to 2020.

Between 1970 to 2020, there are 603 different 1-year periods. Some of these 1-year periods will produce -30% to -40% returns, some 40% to 50%. A larger portion of these 1-year periods will produce between 10% to 20% of returns. 22% of these 1-year periods produce negative returns, not a very pleasant investing experience for most of us.

However, if we extend the time periods to 5-year periods, the results look quite different. The lower chart shows that there are 555 period of 5-year annualized rolling periods between 1970 to 2020. There are now fewer rolling periods with negative returns, with more than half producing positive returns of 5% to 15%.

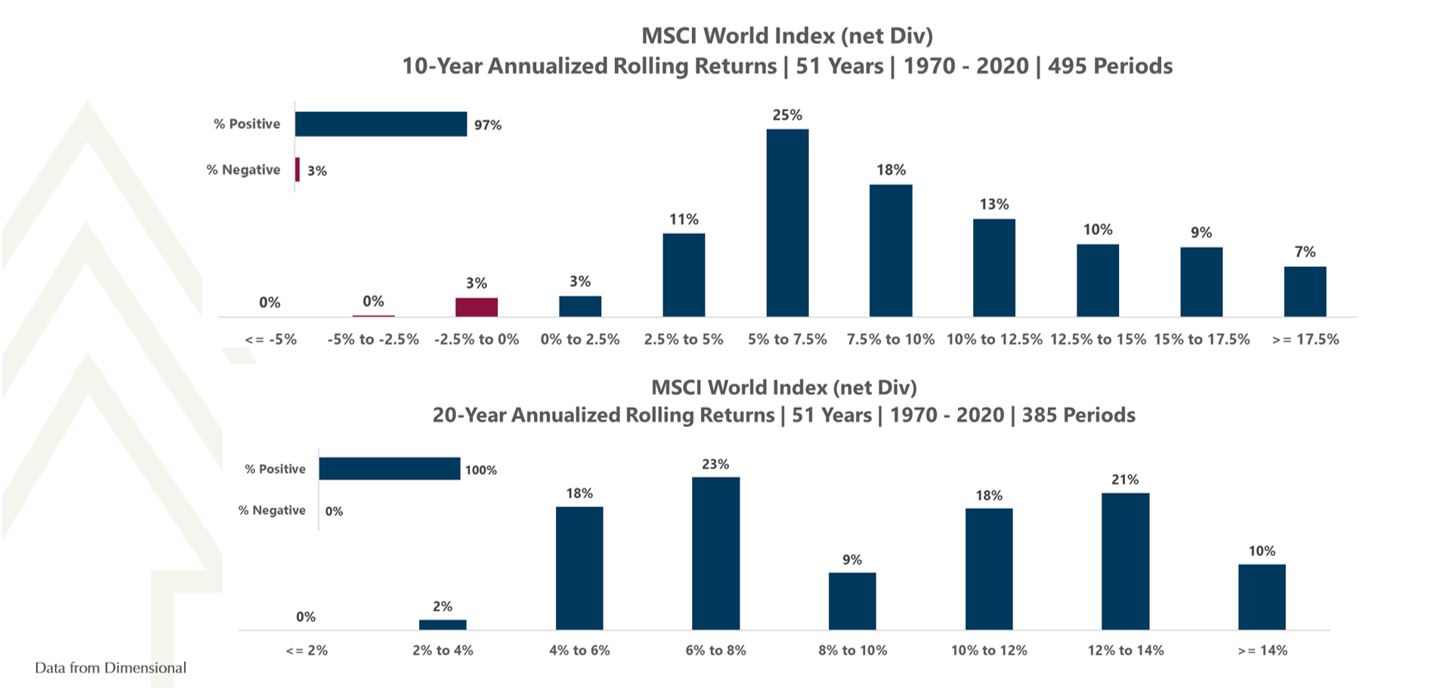

When we lengthen the time period further to 10-year and 20-year rolling return periods, one will observe that the percentage of negative long-term annualized returns dramatically reduces.

Perhaps it is important to emphasise that while the negative periods are dramatically reduced, the range of returns experienced can be wide. Whilst more than 80% of the time the annualized returns are 6% and above, some could get between 2% to 6% of annualized returns even with a holding period of 20 years.

The type of investment instruments and how it is used is important

Many times, we have prospective clients coming in telling us, “I did stay invested, but I still lose money!”

This is not unlike another hobby I picked up during the pandemic: baking. My initial bakes did not turn up like the pictures:

- I used the wrong ingredients

- I used the wrong amount of each ingredient

- I combined things we like into tried-and-tested recipes. Some things just do not taste well when combined.

- Some recipes were overhyped

- Some recipes just do not suit us

Overtime, I was able to identify the right recipe that better suit my family’s tastes and most importantly, through practice (and perseverance), I was able to bake some yummy cookies and breads that we liked.

The basic building blocks to create a portfolio to grow your money are fundamentally similar (equities, bonds, cash, commodities) across different investment managers and wealth advisers.

What is different is each manager’s investment philosophy, which eventually affect the strategies they implement.

Some of the investment strategies are not well-backed by strong evidence that they work in different time-periods, or across different regions.

There are those strategies with strong evidence but proved to be challenging to implement and execute in real-life.

Providend endured our own growing pains with investments as well. Through this all we developed a strong conviction in our investment philosophy that guides the strategies in our creation of the core portfolios which in turn are the cornerstone of the wealth plan for our clients.

Our core portfolios are:

- Made up of globally diversified equity and bond funds

- Well-weighted to allow our wealth adviser to tailor to your needs depending on your risk capacity and tolerance

- Performance backed by evidence of a long history of returns

- Implemented and executed by partners with reputation of great execution

- Low-cost and estate tax-efficient

If you would like to learn more about our investment philosophy, you can read this piece written by our Senior Advisor and Director Dr Peng Chen.

Our phase in life is important

As a retirement specialist, our more senior clients look to us to provide them with a wealth plan that will give them the peace of mind of a reliable and sustainable income stream.

We recognise the concerns of clients who are worried about not having a long enough time frame for their investments to ride through the market cycles.

10 years ago, Providend researched on the different planning methodologies for draw down strategies and developed our proprietary RetireWell methodology (you can read more about RetireWell here).

By segregating expenses into essential and discretionary spending, breaking down their cash flow needs into different time blocks, clients are more confident investing (and thereby enhancing overall returns for a better lifestyle) as only the much later time blocks are invested in portfolios with higher allocation to equities.

Our perspective is important

Not many can fully detach their emotional or cognitive biases to have a successful investing experience and one of our key roles is to help protect clients’ investments from excessive emotions such as panic selling during major market dips.

My colleagues Chin Yu and Bryan conducted a webinar on the psychology of investing recently and they expounded on how we think affects how we invest (and our success in investing).

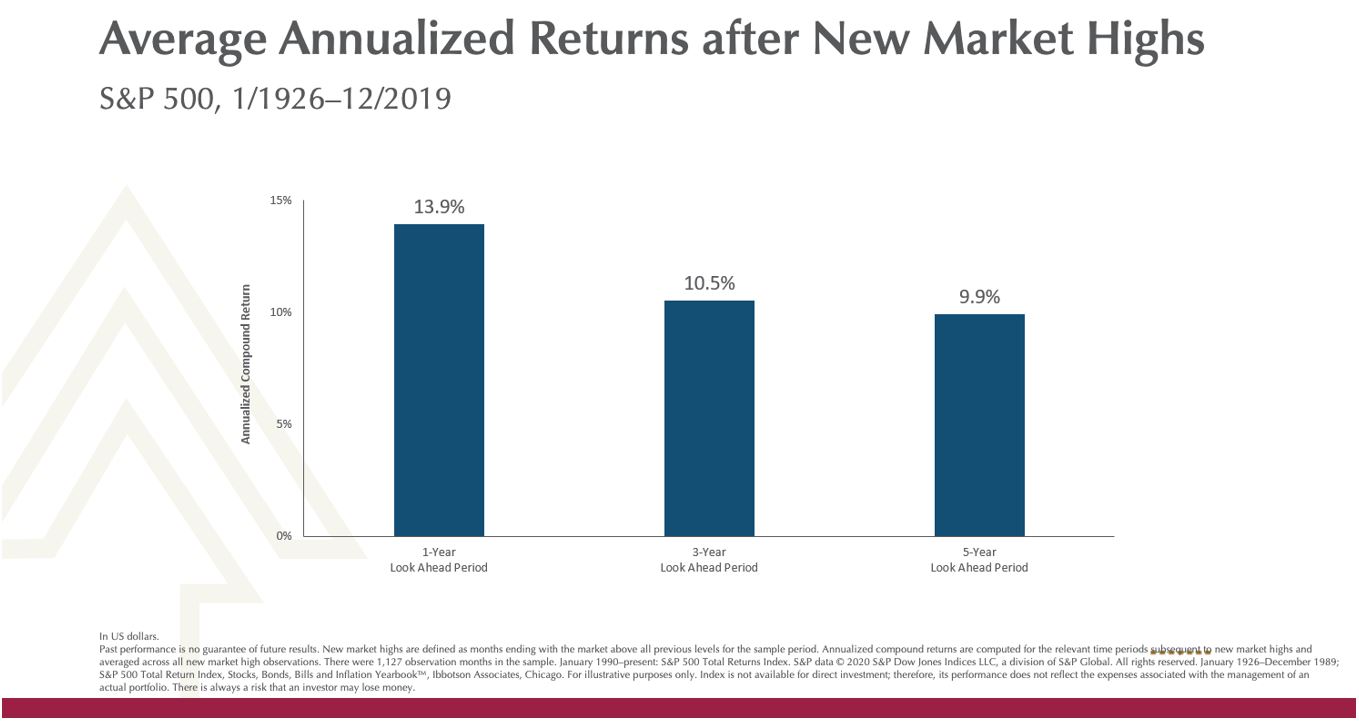

Being evidence-based and providing clients with data (such as that below) that shows the timing of entry does not really matter (provided points 1 & 2 above is fulfilled) helps to assure them.

The chart above tabulates the 1-year, 3-year and 5-year returns after the S&P 500 Index hit an all time high. S&P 500 represents the biggest US-listed corporations by market capitalisation. An all time high is a high point in the index that has never been reached before.

The data shows that subsequent returns after all-time-highs have been good.

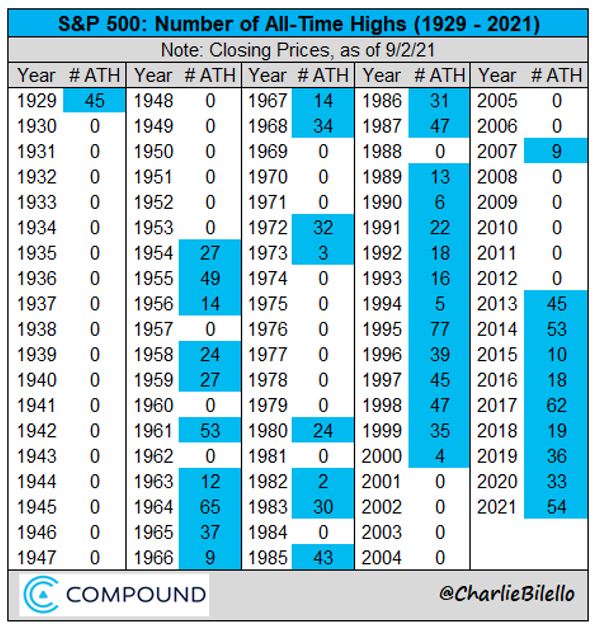

But how common are all-time-highs?

Charlie Bilello, CMT, CPA from Compound Advisers helps us by tabulating the number of all-time-highs every year on the S&P 500 since 1929. Turns out, all time highs are pretty common in recent history.

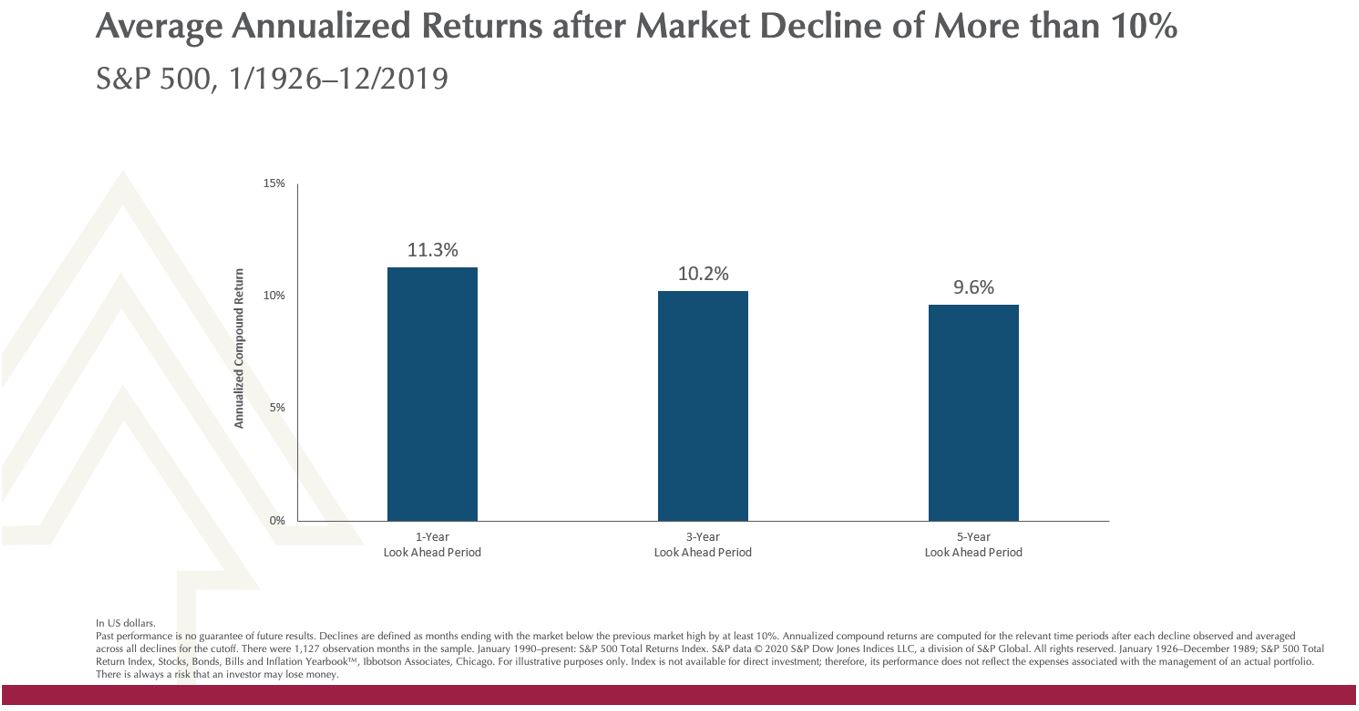

How about when there is a 10% correction in the market?

The chart above tabulates the subsequent 1-year, 3-year and 5-year returns after the market have decline more than 10%.

You would notice that the returns are very similar to that of the earlier chart. And it looks good as well.

However, being investors ourselves, we know how emotional it can be to see our investments drop immediately after we invest, or the “regret” of not buying down after we did a big lump sum investment.

One way to help make the first step of investing amidst the uncertainty is to invest in tranches or dividing our investment amounts over a period of say, 6-9 months. It does not help the investment returns in any way over the long term, but at least it gets us started in the important step towards enhancing the returns on our money over the longer term. (You can read what my colleague wrote about how to invest cautiously)

Incidentally, this morning I decided to go for a jog despite the overcast sky. It started drizzling towards the later part of my rounds, but I enjoyed the coolness and did make my way back home fairly dry and feeling fulfilled.

The writer, Evelyn Goh, is Deputy Chief Executive Officer and Chief Advisory Officer of Providend, Singapore’s first fee-only wealth advisory firm.

For more related resources, check out:

1. Holding Cash Might Not Be as Safe as You Think

2. Evidence-based Investing – Why Is It Important?

3. Retire Well in a High Interest, High Inflation Environment

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.