For many Singaporean parents, sending their children to university is an important life goal. A good tertiary education gives their children a head start on their future career. As education costs are expected to increase in the future, it is important to plan and set aside a children’s education fund as part of their wealth planning for the family.

At Providend, we believe in supporting our clients to achieve their life goals by providing them with honest, independent, and competent advice. In the area of children’s education planning, we have put in many hours of research to examine the total cost of a university degree at both local and overseas institutions.

The total cost includes 2 main components, namely tuition fees and living expenses. This information will give our clients a rough idea of the amount they need to set aside for their children’s education fund. Once the amount is determined, they can add this financial goal to their wealth plan.

In this 2-part article, we will examine the cost of tertiary education in Part 1, and look at the financial planning aspect in Part 2.

Education Planning Philosophy

Providend’s planning philosophy is to first make life decisions before making financial decisions. Planning for children’s education is no exception. Therefore, we begin education planning by considering the following factors:

- Time Horizon: When will your children begin their tertiary education?

- Country Selection: Will you send your children to local or overseas universities? Which country if overseas?

- University Selection: Which university will you send your children to?

- Academic Field: Which course of study will your children go to?

- Degree Level: Which degree level will your children attain? Bachelor’s, Masters, or PhD?

You may not have definite answers for the above factors initially, but they set you thinking about your children’s education needs. These needs might be based on your wishes while your children are still young, and revised regularly according to your children’s characters, talents, interests, and inspiration during their growing up years.

Once the above factors are determined, we can estimate the amount you need to set aside.

Education Research Methodology

The most recent education research we conducted was completed in April 2023. The main objective was to estimate the total cost of university education in various countries, universities, and academic fields.

Source of Research Data

Information on tuition fees and living expenses were retrieved from each selected university’s portal. CPI inflation data were taken from Singapore Department of Statistics (DOS) database[1] and World Bank database[2] for Singapore and overseas universities respectively.

Country Selection

The scope of our research covered universities in Singapore and other popular countries for Singapore parents. The top 3 overseas study destinations[3] we covered were Australia (AU), United Kingdom (UK), and United States of America (US).

University Selection

In each country, we chose the top universities in that country for conservative figures. Specifically, we selected all 6 autonomous universities[4] in Singapore, 3 universities from the Group of Eight[5] in Australia, 3 Universities from the Russel Group[6] in United Kingdom, and 3 Universities from the Private and Ivy League[7] in United States.

Academic Field

Since academic fields are very broad, we divided them into two general categories called medicine (including Dentistry) and non-medicine (Law, Business, Science, etc). The tuition fees for the courses under the non-medicine field do not generally deviate much to warrant further generalization into finer granularity.

Degree Level

We focused our research on undergraduate degrees. This is the first degree level for tertiary education, and it determines the duration for completing the whole programme. Anything beyond the first degree would mean additional years of study resulting in higher total education costs.

Tuition Fees

Tuition fees can vary widely across different universities and different academic fields. We used the 75th percentile to arrive at a good representative figure for tuition fees while avoiding being skewed by extremely high tuition outliers.

Tuition fees generally increase yearly due to inflation. We retrieved historical tuition fees from each university’s portal as far back as possible and used them to calculate the average tuition fees inflation. This enabled us to estimate the projected tuition fees in future.

Different universities adopt different fee structures. Singapore universities offer a cohort-based fee system, where the annual tuition fees for students who matriculate in a specific year are fixed throughout the duration of study. For overseas universities, tuition fees are typically calculated per unit, per term, or per quarter, and the fees are reviewed and adjusted regularly.

The total tuition fees for the entire course would be annual tuition fees multiplied by number of years of study for Singapore universities, and the sum of inflation-adjusted tuition fees over the number of years of study for overseas universities.

Living Expenses

Each university portal presented this information in different ways. We ended up normalising the living expenses into categories, such as accommodation (hostel and utilities), food (campus meals with occasional dining out), personal expenses (basic lifestyle), transport (public transport with occasional taxi or private hire rides), study cost (books and stationery) and miscellaneous expenses.

We calculated the average annual increase in living expenses by averaging the past 30 years of CPI inflation rates. The total living expenses would be the sum of inflation-adjusted living expenses over the number of years of study.

Foreign Currency Exchange Rate

For overseas universities, both the tuition fees and living expenses were quoted in their respective currencies. We converted the foreign currency to the Singapore Dollar (SGD) using the exchange rate on 31 March 2023. The exchange rates used were 1 Australia Dollar (AUD), 1 British Pound (GBP) and 1 United States Dollar (USD) to 0.8895, 1.6410 and 1.3306 SGD respectively.

Key Findings in University Education Research

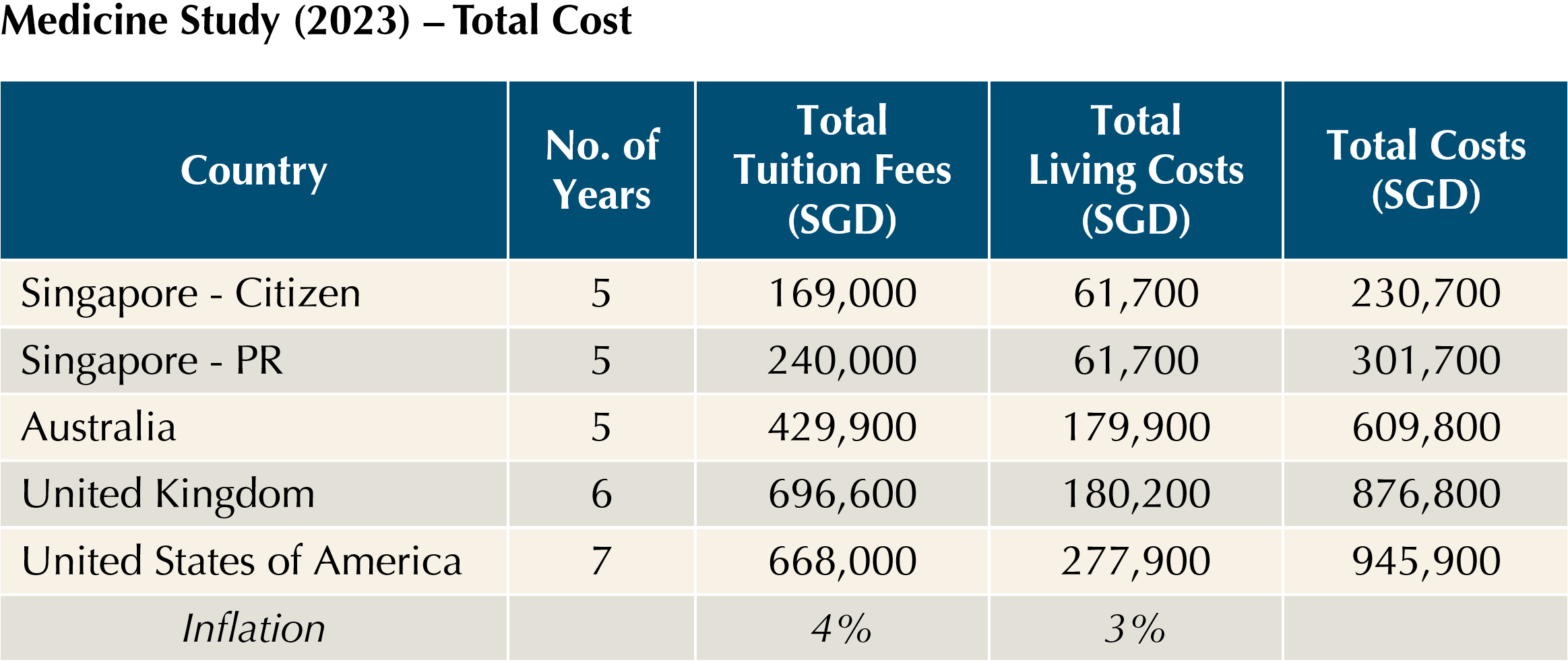

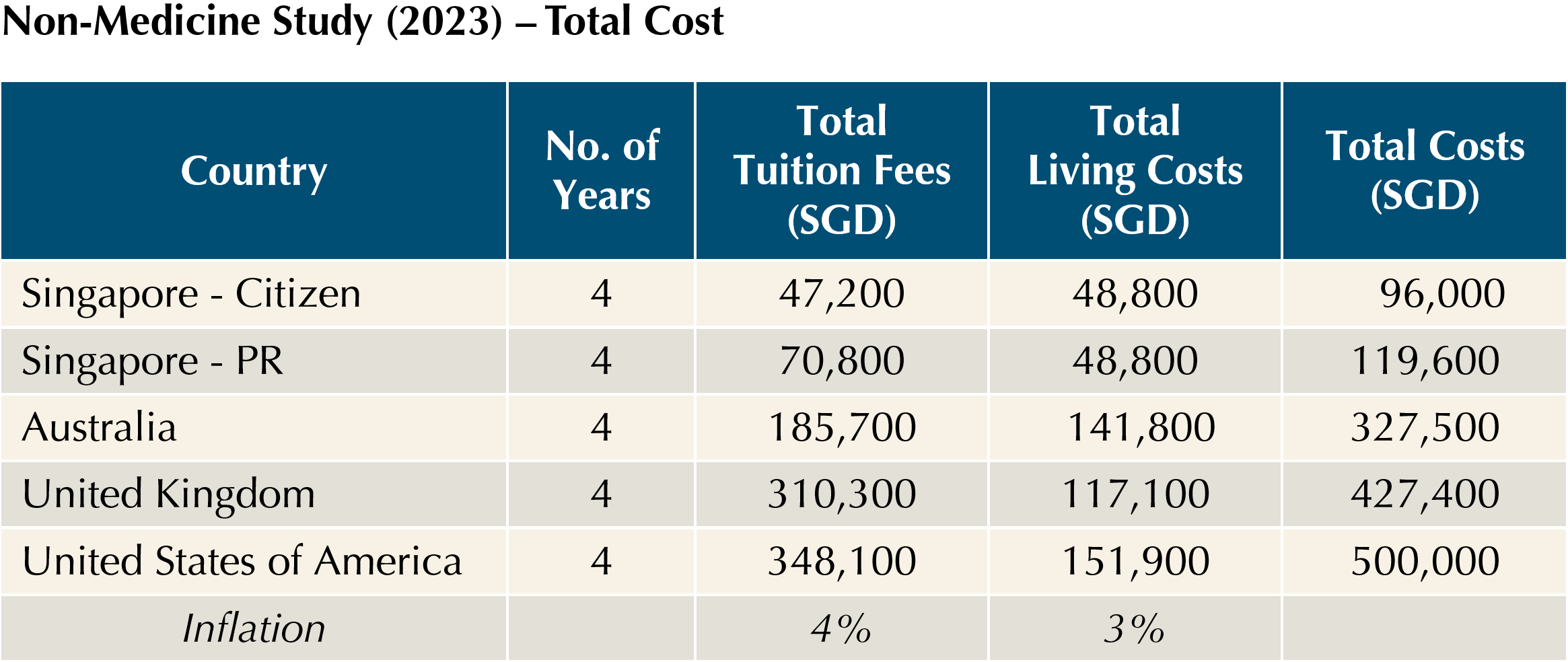

Based on the above research methodology, we present a summary of the total university education costs in various countries in the following tables:

Some key findings from the research data:

Some key findings from the research data:

- The total cost of university education ranges from slightly under $100,000 to almost $1 million in 2023.

- The total cost of overseas university education is higher than that of local study, with United States being the costliest location, followed by United Kingdom, Australia, and Singapore.

- The total cost of a medicine course is higher than that of a non-medicine course, due to 2 factors, i.e., higher tuition fees and longer duration of study.

- Each university in each country have different inflation rates for their tuition fees and living expenses. The average inflation rates are 4% and 3% for tuition fees and living expenses respectively.

- On average, the total cost for Singapore university education has increased by 8% since our previous research done in May 2021.

- Over the same period, the total cost of overseas university education also increased in terms of their respective currencies, but the increases were softened in SGD terms as we saw a strengthening SGD against those foreign currencies.

- Specifically, we saw total costs for an Australia education reduced by an average of 4.5% amidst the backdrop of AUD weakened by about 15% against SGD.

- On the other hand, total cost for United Kingdom and United States education increased by an average of 5% and 6% respectively, while GBP and USD weakened by about 13% and less than 1% against SGD respectively.

With an estimated cost in 2023, we can project the amount needed based on the average inflation rates when it is time to send our children for university studies. This serves as the baseline financial goal of our wealth planning. In the next part, we will explore how to achieve this goal.

– Footnotes –

[1] DOS: https://www.singstat.gov.sg/find-data/search-by-theme/economy/prices-and-price-indices/latest-data

[2] World Bank: https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG

[3] AECC Global: https://www.aeccglobal.sg/blog/top-5-study-overseas-destinations-for-the-singapore-students/

[4] MOE: https://www.moe.gov.sg/post-secondary/overview/autonomous-universities/

[5] Group of Eight: https://go8.edu.au/

[6] Russell Group: https://russellgroup.ac.uk/about/our-universities/

[7] Private and Ivy League: https://www.uopeople.edu/blog/what-are-the-12-ivy-league-schools/

This is an original article written by Tan Choong Hwee, Solutions Specialist at Providend, the first fee-only wealth advisory firm in Southeast Asia, and a leading advisory firm in Asia.

For more related resources, check out:

1. Money Conversations, Growing Up

2. Wealth Planning for Your Child’s Tertiary Education (Part 2) – Achieving the Goal

3. Providend’s Money Wisdom Podcast S1E48: From Cradle to Mortarboard

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.