As the year-end approaches, leading financial institutions—including UBS, Morgan Stanley, S&P Global, Oxford Economics, and Shenwan Hongyuan Securities—have released their 2026 outlooks. Below is a condensed summary of their core views and practical advice for retail investors:

I. Institutional Forecasts

1. Morgan Stanley

Labels 2026 the “Year of Risk Reboot”, forecasting the S&P 500 to rise 15% to 7,800 points (driven by 17% earnings growth). It is bullish on AI infrastructure, Japanese stocks, and gold (US$4,500/oz), and cautious on Europe and some emerging markets.

2. UBS

Mildly bullish on a global “high-quality recovery”. It favours US and European stocks (S&P 500 +8% to 10%), selective emerging markets (India, Mexico, Southeast Asia), industrial metals, and short-term US Treasuries.

3. S&P Global

Expects marginal trade policy improvements (USMCA, EU–Indonesia/India deals) but notes corporate caution on long-term investment due to tariff uncertainty.

4. Oxford Economics

Cautious on most commodities (oil, agriculture) amid weak demand; highlights US natural gas and gold as defensive havens.

5. Shenwan Hongyuan Securities

Bullish on A-shares (policy support, valuation recovery) and China’s global industrial chains (new energy, home appliances); cautious on export risks arising from inflation and trade frictions.

II. Core Practical Advice for Retail Investors

1. Stick to Long-Term Logic

Avoid impulsive trades on tariff or rate-cut news. Use historical data to build volatility tolerance—short-term swings often revert to fundamentals. Focus on trends such as AI and China’s high-end manufacturing.

2. Diversify Broadly

Avoid overconcentration in the US “Magnificent Seven”. Mix developed markets (S&P 500, Europe/Japan), targeted emerging markets (India, Mexico, China), and defensive assets (gold, short-term Treasuries).

3. Rebalance

Buy undervalued assets during corrections (e.g., 2025 tariff-hit tech) and trim overvalued sectors (e.g., AI).

Conclusion

2026 is neither a “layback profit year” nor an “inevitable loss year”. Institutional forecasts are logical deductions, not guarantees. For investors, prioritising discipline, diversification, and dynamic rebalancing is far more effective than guessing short-term movements.

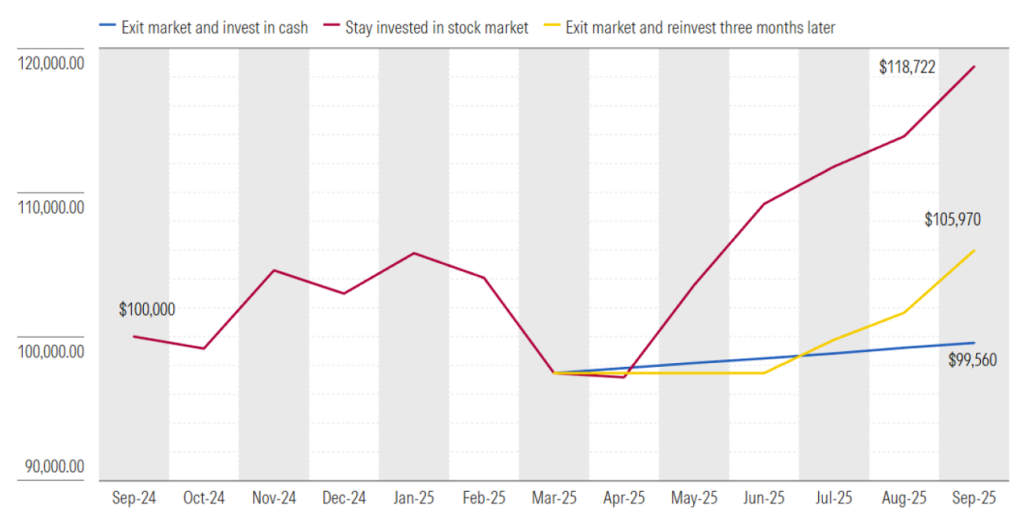

Additionally, 2026 will test discipline—market volatility often triggers costly behavioural traps (e.g., investors who withdrew during 2025’s tariff shock missed subsequent rebounds). Focus on controllable actions rather than unknowable outcomes.

This is an original article written by Dr Peng Chen, Senior Advisor and Director at Providend, Southeast Asia’s first fee-only comprehensive wealth advisory firm.

For more related resources, check out:

1. Moods and the Market: How to Invest and Keep Investing

2. Principles for Successful Investing

3. Avoid These Mistakes in Equity Investing

Download our Investment eBook titled “A More Reliable Way to Get Enough Investment Returns: Even During Times of Market Uncertainty” here.

To ensure a good investment experience, Providend is committed to delivering reliable returns, prioritising this over maximising returns and taking unnecessary risks that do not meet your needs. You can learn more about our purpose-driven approach towards Wealth Management and Investment Management.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.