“Transition” is the word that describes 2022 for me. For the financial markets, we transited from low inflation to a higher inflation environment, from low interest rates to rising interest rates and from a raging equities market in 2021 to global markets doing badly this year. In terms of business, my firm sold off our stake in a joint venture and exited it completely in June. With the pandemic in better control, we also went back to the office to work on a hybrid arrangement where we work some days in the office and other days from anywhere (including working from overseas for an extended period). On the personal front, my mother passed away suddenly in March, just shy of a few months after my father-in-law left us. My daughter also went to Melbourne for further studies and my son graduated from university to join the workforce. And in September, another family member’s health took a turn for the worse. Evenings and weekends at home have suddenly become quieter and family holidays will never be the same again. How fast things changed in just 12 months. There are always lessons to be learnt in life journeys and I would like to share 3 sets of my reflections with all of us before the year ends.

On Personal Wealth Planning

This year is a reminder that good times don’t always last. Because we have experienced almost a decade of low interest rate environment, job stability and strong growth in the equities market, many became complacent and started borrowing to buy all sorts of stuff. Besides borrowing to buy properties that may cost too much for them, people borrowed to buy cars and even insurance policies! Financial institutions happily dished out all sorts of schemes to encourage consumers to take loans. Sadly, those who have caved in might be suffering today. We should also be reminded that we should always spend below our means. Don’t just spend within. To spend within our means is to spend all that we earned. To spend below our means is to say, “even though I can afford it, I don’t have to spend it because I don’t need it.” It means not buying things that we don’t need, with the money that we don’t have, just to impress people whom we may not care about or even know.

Experiencing the demise of my loved ones has also reminded me of the importance of doing end-of-life planning because life is uncertain. When we are healthy, we think that we have control. But our health can deteriorate quickly. So please get your Advanced Care Planning and Lasting Power of Attorney done while you are still able to, so that one day, if you are in poor health or are mentally incapacitated, you have already appointed someone you trust to make decisions regarding your healthcare preferences, personal welfare, and properties. More importantly, your family’s harmony can be preserved. About 12 months ago, my father-in-law died just after 4 months of being diagnosed with lung cancer. But because he got his will done, his estate plan was executed quickly and smoothly with my siblings-in-law knowing very clearly what their father wanted. So do also consider estate planning while you are still in the pink of health.

On Investing

From Table 1, you will see that in 2021, S&P 500 and NASDAQ 100 gained almost 27% while the DJIA grew almost 19%. But it is a sea of red 12 months later today. However, the 3-Year to 10-Year returns tell you a more positive story. The problem with bad news is that they make you zoom in. But in long-term investing, we should really zoom out to get a better perspective of things. No one says it better than the legendary investor, Howard Marks, “The short run is by far the least important thing,” adds Marks, “It’s folly to try to predict what will happen to interest rates or how high inflation will rise. What matters is the long run. We try to buy the stocks of companies that will become more valuable, and the debt of companies that will pay their debts. It’s very simple. Isn’t that a good idea?”

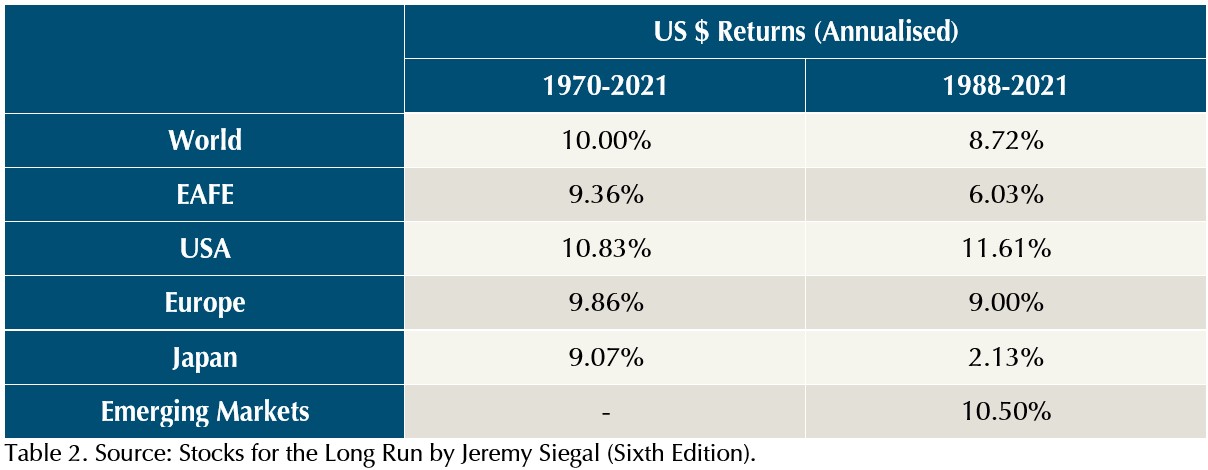

In fact, in Table 2, extracted from the book “Stocks for the Long Run”, its author Professor Jeremy Siegal at the Wharton School of the University of Pennsylvania showed that from 1970 to 2021, international equities did well in the long term.

So, the lesson here is to ignore the short-term volatility. Instead, focus on the long term and invest in a globally diversified portfolio through low-cost instruments such as ETFs, index funds, or non-forecasting funds. In the past 12 months, we helped our clients stay invested and got them to keep investing. Having said so, earlier this year, we also told those clients who will need money in the next 12 months to fund life events such as retirement or children’s education to consider taking some money off the markets first since they have achieved their targeted returns earlier than expected due to good portfolio performance over the past years. Clients who have done so can now have peace of mind regardless of how markets behave next year. So, the lesson here is that while we advocate staying invested for the long term, it is also important for those who are reaching a life event to have a systematic withdrawal plan for such a time like this.

On Life Planning

When both my parents’ health started deteriorating years ago, I volunteered to take them to their regular medical appointments which meant that I had to plan my schedule around them. It was my way of loving them knowing that they won’t have much time left. When I closed the casket of mum at the crematorium this year, I whispered to her in my mind, “Mummy, goodbye and see you soon. I hope you felt my love for you”. I will miss our conversations, the coffee breaks, the pushing her around on the wheelchair at the hospital. But I am grateful for these memories. This is also why I will take my family on a long holiday each year. With my children grown up and my wife’s health not as good as before, it will not be so convenient for us to do these long holidays anymore. So, in our wealth planning, do not just invest for future life events but also intentionally allocate money to important life goals today.

I have been advising and investing for clients for nearly 25 years and have gone through the many ups and downs of markets and the lives of our clients. The various philosophies of my firm, such as going for sufficiency in wealth planning and investment management, focusing on the reliability of returns by staying invested instead of trying to outguess the markets, and making life decisions first before making financial decisions, were all born out of convictions from reflections like these, year after year. I hope they are helpful for your own reflection as you end 2022. Have a blessed Christmas and new year!

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in The Business Times on 19th December 2022.

For more related resources, check out:

1. On Life Transitions, Legacy and Money

2. Money Advice for My Younger Self

3. Reflections About Life in 2021

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.