On 22nd December last year, I invested the monies in my SRS account into one of the investment portfolios that my company manages. About one month later on the 19th January, I went to check on how it has performed and to my pleasant surprise, it has grown 7.64%! I was very excited about it and so I shared with my management team over text. One of my colleagues who invested in the same portfolio as me in September last year, however, “complained” that his portfolio was still down 12%! He jokingly said that I was the best “market timer” and the next time when I decide to put in the next tranche, I should inform everyone so that they can follow me. I felt good.

In January this year, I decided that I will put in my second tranche. But because of my previous “good performance” and because I have been ranked the best “market timer” last month, I wanted to repeat my performance to “guard my reputation”. I was still thinking about the timing which I should invest this second tranche when it suddenly hit me: “why am I not doing what I have been preaching all this while, that is, not to “actively” manage my investment?

So, what exactly is active management? To explain this simply, assuming you are investing in the US stock market which is represented by the S&P500. The S&P500 consists of 500 big names such as 3M, Johnson & Johnson, Microsoft, Netflix, Nike and the like. The prices of each of these stocks move up and down differently every business day based on what buyers and sellers decide their price should be. But if they collectively move up on average, we can say that the US market represented by the S&P500 has gone up. And of course, if they collectively move down on average, we can say that the market has fallen. So today, if you have bought the S&P500 via an Exchange-Traded Fund (ETF) and stayed invested over time, you will get close to the market performance. But if you want to get a different performance (hopefully better performance), instead of staying invested in the S&P500 ETF, you could do a few things:

- Choose the best time to sell the S&P500 ETF when you think it is expensive and buy it when you feel that it is cheap again.

- Sell your ETF and buy individual stocks that are totally different from the S&P500 if you believe that the stocks you have chosen will do better than the S&P500 going forward

- Sell your ETF and pick only those few stocks in the S&P500 that you think will be winners, instead of also owning other stocks that you think will be losers in the short term

- Sell your investment in the S&P500 and say invest in the Japanese market i.e. Nikkei 225 if you believe that the Nikkei 225 will do better than the S&P500 in the short term

- Sell your investment in the S&P500 and buy S&P500 Bond Index if you feel that the bond market will do better than the stock market in the short term

- Do all the above, keep moving in and out from different markets, different asset classes (bonds to stocks or the reverse) whenever you feel it is better to do so in the short term

When you continue to do the above using predictive methods based on factors such as geopolitical data, economic data or past trends, or you buy unit trusts that perform the above, you are effectively “actively” managing your investments. And it all seems to make sense. But the question is, does active management work? Can one really accurately predict the future most of the time?

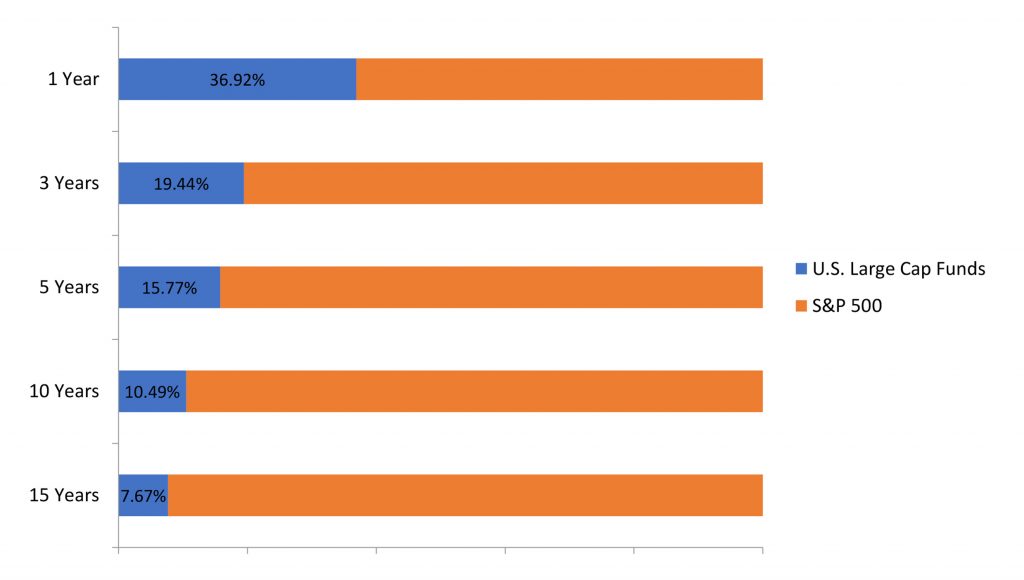

Chart 1: Percentage of U.S. Large Cap Actively-Managed Equity Funds in the U.S. that Outperformed the S&P 500 Benchmark

Source: S&P Dow Jones Indices LLC, CRSP. Data as of Dec 29, 2017. Chart is provided for illustrative purposes. Past performance is no guarantee of future results.

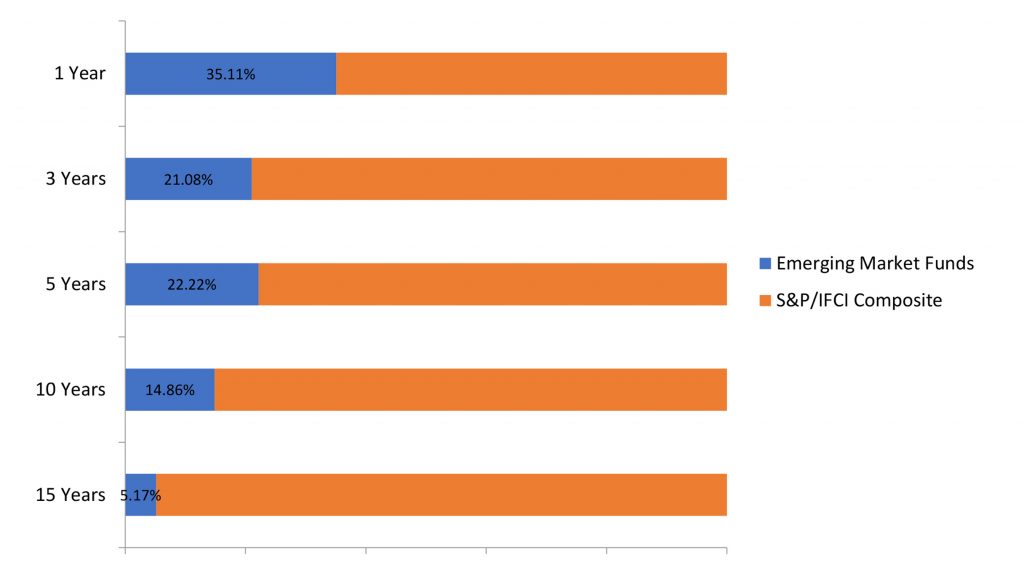

Chart 2: Percentage of Emerging Market Actively-Managed Funds in the U.S. that Outperformed the S&P/IFCI Composite Benchmark

Source: S&P Dow Jones Indices LLC, CRSP. Data as of Dec 29, 2017. Outperformance is based upon equal-weighted fund counts. All index returns used are total returns. The chart is provided for illustrative purposes. Past performance is no guarantee of future results.

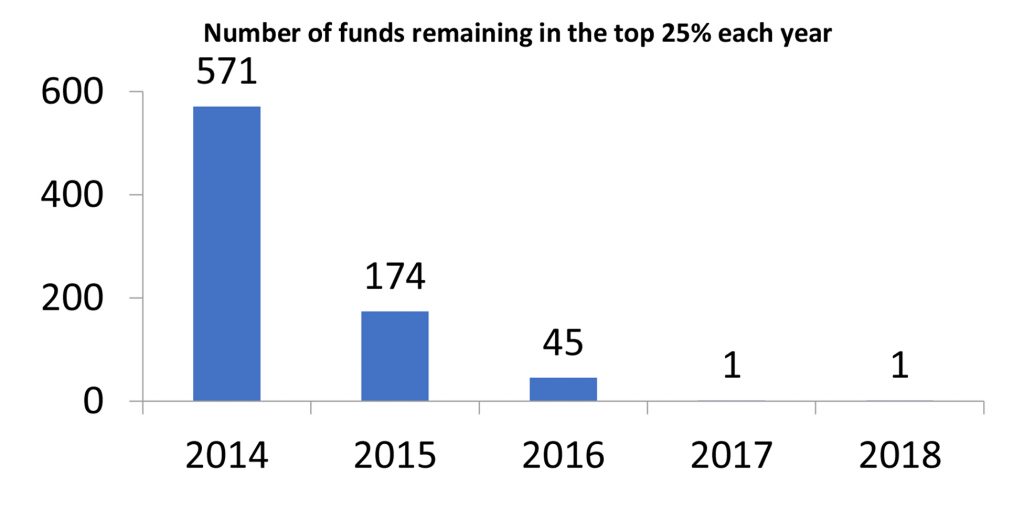

Chart 3: Active Fund Performance Persistence

Source: S&P Dow Jones Indices. Data as of 31st March, 2018

As much as we want to believe that there are many people out there (especially professionals) who can accurately predict when is the best time to get in and out of the market, or to switch from one asset class to another to beat the market, and as much as we want to believe in the bragging of some people who say they can do it and have consistently done so, there are sufficient data to show that this is not the case. As chart 1 and 2 show, most managers cannot beat the markets whether in the short or long term. Chart 3 shows us that even for those who could, they could not beat it consistently.

So, why would you want to pay so much management fees (average of about 1.75% p.a.) to someone who cannot do better than the market most of the time and even if he can this year, might not repeat the same performance next year? Why would you pay someone to “gamble” away your money by making predictions when you can simply get the real investment returns from low-cost index funds such as Vanguard (average fee of about between 0.20 p.a. to 0.4% p.a.) or low-cost evidence-based funds such as Dimensional Fund Advisors (average fee of about 0.3 p.a. to 0.5% p.a.)? My latest experience helped me understand why – Because it stroked my ego when I could guess better than others. And even though I know from evidence that the chances of me repeating my outperformance are very low, I still wanted to try. I was addicted to my one-time success. Thankfully for me, my Head of Investment brought me to my senses when he reminded us to regularly invest instead of trying to time the market. But it was my wife who really broke my “addiction”. When she found out about me checking the performance of my investment regularly, she chided me: “Check every day for what? Some days it will be up and some days it will be down. Not as if you are using the money now. Most importantly is when you need the money, it is up!” I got her point. So, I decided to cure my addiction in February by putting myself on Giro, and regularly invest on a monthly basis instead of trying to guess the market.

I am afraid my wife may take over my job soon.

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-Only Wealth Advisory Firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation. The edited version has been published in The Sunday Times, Invest Section, on 24th February 2019.

For more related resources, check out:

1. Conversation With Clients One Year After the Crash

2. How Providend Helps Affluent Families Have a Good Investment Experience

3. Moods and the Market: How to Invest and Keep Investing

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.