Since 2003, we have been advocating the use of term insurance instead of whole life policies. The thinking is pretty straightforward: the primary purpose of insurance is to replace income loss due to death, disability and a medical crisis. And since there will come a time in our life when we either no longer earn an income (like when we are retired) or when we have no more dependents, there is no need for permanent insurance coverage. There are only a few situations where permanent insurance coverage is required. Of the few situations that we need permanent insurance coverage, legacy planning and gifting is one of them. And in recent years, the purchase of Universal Life Policies (ULP) for the purpose of legacy planning and gifting has become very popular amongst the high networth and ultra-high networth. This is also due to many financial institutions aggressively pushing them.

What is a ULP?

There are 2 main types of ULP that are available in Singapore, Traditional ULP and Variable ULP. Variable ULP functions more like an investment-linked policy where the investment funds are managed by the fund managers appointed by the insurer while Traditional ULP functions like a whole life plan where the investment funds are managed entirely by the insurer. They can be sold as a regular premium product but in Singapore, it is usually sold as a single premium product with premium financing (taking a loan to pay a substantial portion of the premium) to reduce upfront premium outlay while enjoying the huge insurance cover. So for every $1 of the premium paid to the insurers to buy an ULP, a portion of it will be used to pay distribution and other cost and then the rest is invested. In Singapore, these policies are usually denominated in USD, and come with an annual minimum guaranteed return (crediting rate) that provides life protection coverage up to age 100 or 125. Due to space constraint, I will only be discussing Traditional ULP here.

Some Key Features of Traditional ULP

- Crediting Rate

The crediting rate is the return you get from the investment portion of your ULP. It comprises of a guaranteed (in Singapore, this is usually around 2%.) and non-guaranteed portion (depends on insurers’ investment performance). The guaranteed crediting rate for ULP ensures that the cash value of the ULP will increase by at least 2% over time.

- Sum Assured = Higher of Death Benefit or Cash Value (CV)

After deducting premium charges (can range from 7-9% of your single premium paid) and other distribution costs, cash value of ULP normally starts at 70-80% of the single premium paid. This cash value, after deducting ongoing costs like mortality charges, is expected to build up over time and may exceed the sum assured if the investment returns for the plan’s underlying funds are very good.

- Mortality Charges (Cost of Insurance Charges)

The coverage provided by the ULP is funded by deducting the mortality charges from the cash value on a periodic basis. The rate of mortality charges usually increases across age bands at an increasing rate due to higher claim risk at older ages. However, the absolute amount of mortality charges that will be deducted is dependent on the sum at risk. Sum At Risk = Sum Assured – Cash Value

As cash value increases over time, the sum at risk decreases. If cash value exceeds the sum assured, there is no more insurance element (Sum At Risk), hence no further deduction for mortality charges.

- Fees and Charges

This includes premium charges, mortality charges, policy fee (admin charge by the insurer and usually for the first 5 years of your policy term and surrender charges (if you surrender early)

- Risks

This mainly includes investment risk (lower than expected returns), currency risk (as the policy is usually in USD) and interest rate risks (for those on premium financing and increase in interest rate makes servicing the loan more costly).

How Are ULPs Being Marketed?

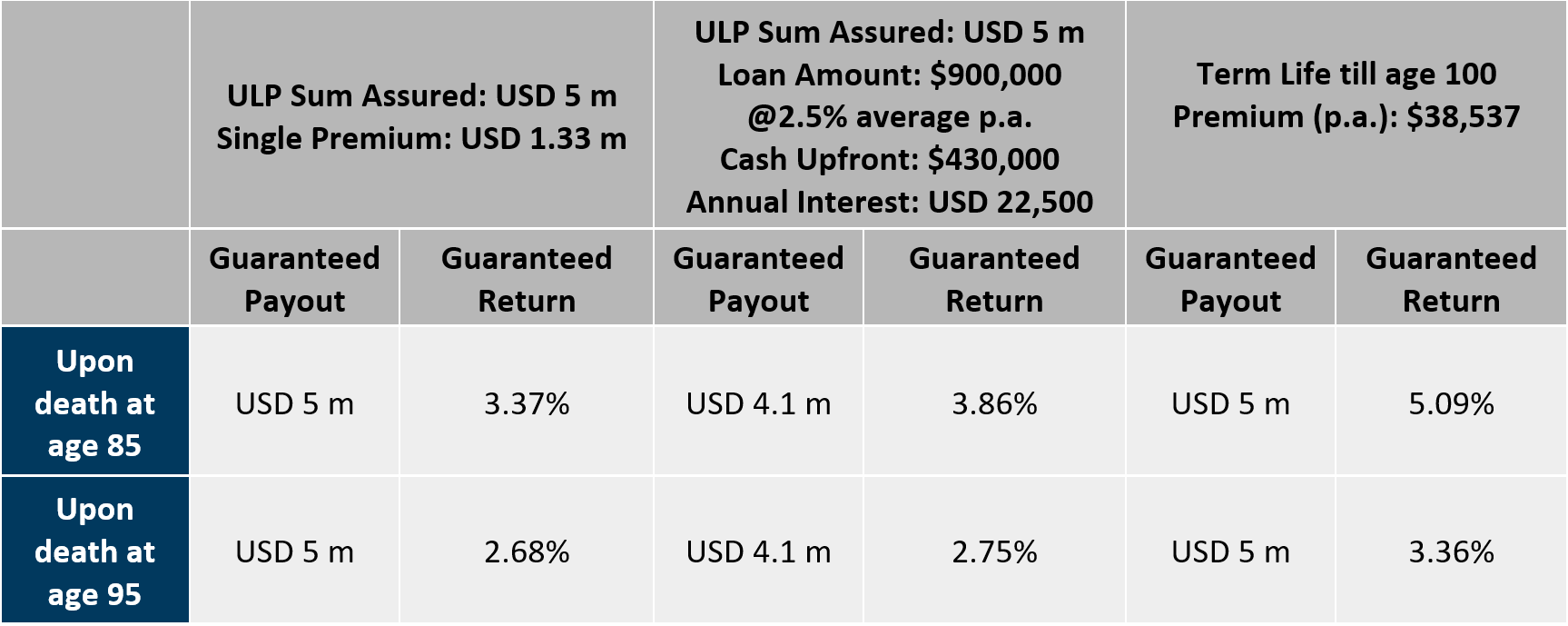

ULPs are usually touted as a good instrument that allows the affluent to free up more cash for their retirement while still able to leave a significant legacy. So say an affluent individual has accumulated USD10 m at retirement but wish to set aside USD5 m for legacy upon his demise. In this case, he can only retain USD5 m for his own retirement spending. However, if he were to use USD1.3 m to buy a ULP with a sum assured of USD5 m, he can now have USD8.7 m for his own retirement spending instead. But one can also use the cheaper alternative of a term insurance to achieve a similar outcome (Table 1).

Table 1: A comparison between a ULP (with and without premium financing) and a term insurance

Table 1: A comparison between a ULP (with and without premium financing) and a term insurance

From table 1, we can see that term plan is still a more cost-effective option when it comes to legacy planning. For clarity, you can also watch this video here where we elaborate on the comparison between using a ULP and a simple term life insurance.

However, the key risk of using term insurance is that one may live beyond 100 years old. The main attractions of a ULP are that the coverage goes beyond age 100. In addition, ULP is eligible for applicants as old as age 80, while most retail term or whole life insurance has a maximum entry age of around 65 to 75-year-old. A healthier applicant might also be eligible to buy the policy at a discount due to good health. In addition, you can take a loan to finance the premium. But for all these advantages, you pay a higher price than term insurance. While we do not rule out the usefulness of ULP, we don’t think it is the holy grail to legacy planning. So before you buy your next ULP, do consider if you really want to spend so much. It is always good to consider other more cost-effective options while understanding the trade-offs.

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-Only Wealth Advisory Firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation.

The edited version of this article has been published in the Money Wisdom Column of The Business Times Weekend on 28th November 2020.

For more related resources, check out:

1. Demystifying Universal Life Policies (II)

2. Providend’s Money Wisdom Podcast S2E5: The Must-Have Insurance at Different Stages of Your Life

3. Can You Still Buy Insurance if You Have Medical Conditions?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.