In 2008, the year of the Great Financial Crisis, I wrote an article in July that year, that was published on The Business Times and it went like this:

It was Monday (yes, just 2 days ago) and I was really stressed. I am due for article submission for this column, but I have absolutely no idea what I was going to write. I mean, I have been writing for years now, what have I not written that you don’t already know? And as you know, there hasn’t been much good news about the world economy and financial markets lately. Sub-prime blow-up, rising oil prices, inflation fueled by rising commodity prices, writing down of losses by the banks and the latest, the collapse of IndyMac and the trouble fumes fanning at Fannie Mae and Freddie Mac, the ailing mortgage giants in the US. How can I encourage you in this time of great difficulty? Financial markets have been tumbling and many experts have been telling you the same story: This is a good time to invest or stay invested. The problem is: It is easy to say so when you are not investing your own money. Try telling that to someone who has invested his lifelong savings and seeing it disappear slowly every day. And in my moment of desperation to meet the article deadline, I remembered this story.

Chance is a man who has grown to middle age living in a solitary room in a rich man’s mansion, bereft of contact with other human beings. He has two all-consuming interests: Watching television and tending the garden outside his room. When the mansion’s owner dies, Chance wanders out on his first foray into the world. He is hit by the limousine of a powerful industrialist who is an adviser to the president. When he is rushed to the industrialist’s estate for medical care, he identifies himself only as “Chance the gardener.” In the confusion, his name quickly becomes “Chauncey Gardiner.” When the President visits the industrialist, the recuperating Chance sits in on the meeting. The economy is slumping; America’s blue-chip corporations are under stress; the stock market is crashing. Unexpectedly, Chance is asked for his advice:

Chance shrank. He felt the roots of his thoughts had been suddenly yanked out of their wet earth and thrust, tangled, into the unfriendly air. He stared at the carpet. Finally, he spoke: “In a garden, “he said, “growth has its season. There are spring and summer, but there are also fall and winter. And then spring and summer again. As long as the roots are not severed, all is well and all will be well.”

He slowly raises his eyes and sees that the President seems quietly pleased-indeed, delighted –by his response.

“I must admit, Mr. Gardiner, that is one of the most refreshing and optimistic statements I have heard in a very, very long time. Many of us forget that nature and society are one. Like nature, our economic system remains, in the long run, stable and rational, and that’s why we must not fear to be at its mercy…. we welcome the inevitable seasons of nature, yet we are upset by the seasons of our economy! How foolish of us.

This is a brief summary of the early chapters of Jerzy Kosinski’s novel Being There, retold by the late John Bogle, the founder of Vanguard. A simple truth about nature and yet so much we can learn from it: “growth has its season. There are spring and summer, but there are also fall and winter. And then spring and summer again. As long as the roots are not severed, all is well and all will be well.”

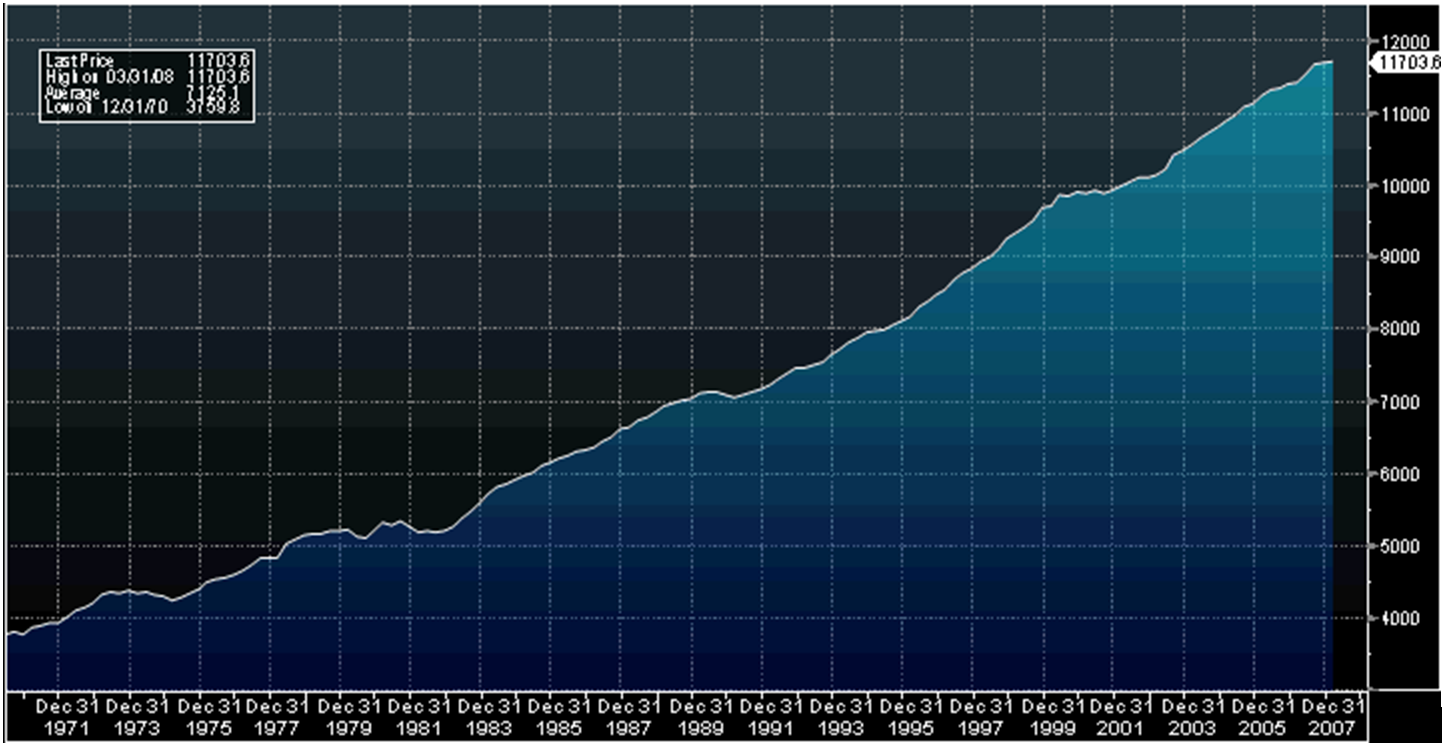

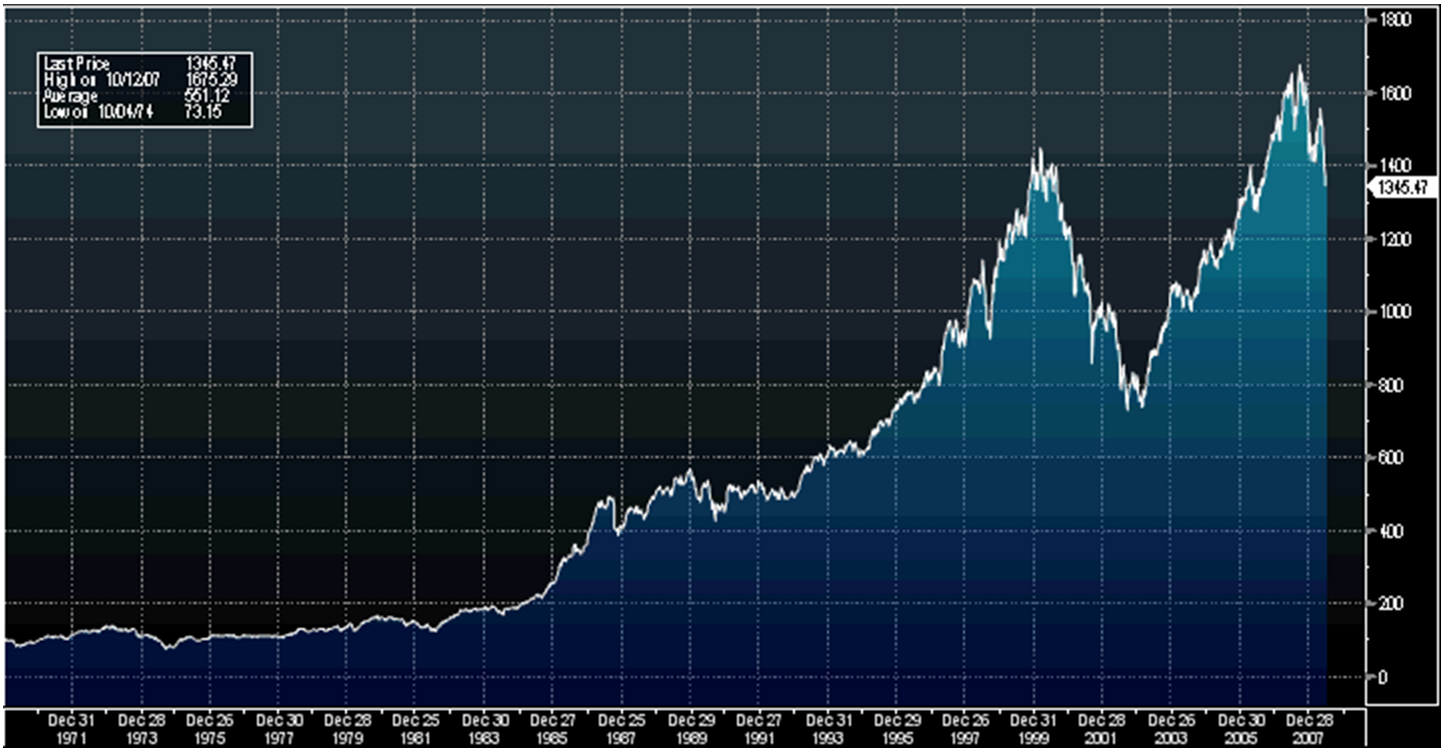

Do you believe in the resilience of the human race? We are after all the most powerful living thing created by God. Do you believe in the sustenance of trade and the enterprise? I am sure you will agree that we all have needs that can only be fully satisfied through products and services created and sold by corporations. If you believe, then our economic roots are not severed, and all is well, and all will be well. We have hope in the investment we made in these companies. Yes, sometimes, it will be more barren autumn, a colder winter. And other times, it may be a verdant spring or a hotter summer, but our economies will continue to grow, just like how it has grown in the past decades (see chart 1). We only need to believe that growth has its season and we must be prepared to ride through the seasons of life and stay invested long term. In investing, know that time is your friend, plant the seed of growth in the garden and in due season, you will reap what you sow. Impulse is your enemy, react to your fears and dig out the seeds before the season is over and you may never see the fruit. Most importantly, stay the course. Let the uncertain years roll by and face the future with faith. Do not let short-term fluctuations; fear, greed and news that have no meaning at all to your long-term investing affect your judgment. The world markets too, have its season, but in the longer term will always grow, because its roots have remained strong and intact (see chart 2).

Chart 1. The Economic Garden of US – US Real GDP Growth from 1970 to 2008

Chart 1. The Economic Garden of US – US Real GDP Growth from 1970 to 2008

Chart 2. The World Garden – MSCI World Index from 1970 to 2008

Chart 2. The World Garden – MSCI World Index from 1970 to 2008

This article is short, not because I have nothing more to write, but because I hope in its simplicity, it has given you courage to remain invested and optimistic towards your dreams. Let me end with our story’s character, Chance final words of wisdom:

“I know the garden very well. I have worked in it all my life…. Everything in it will grow strong in due course. And there is plenty of room in it for new trees and new flowers of all kinds. If you love your garden, you don’t mind working in it, and waiting. Then in the proper season, you will surely see it flourish.”

My stress is finally gone.

10th March 2020 – Author’s Note

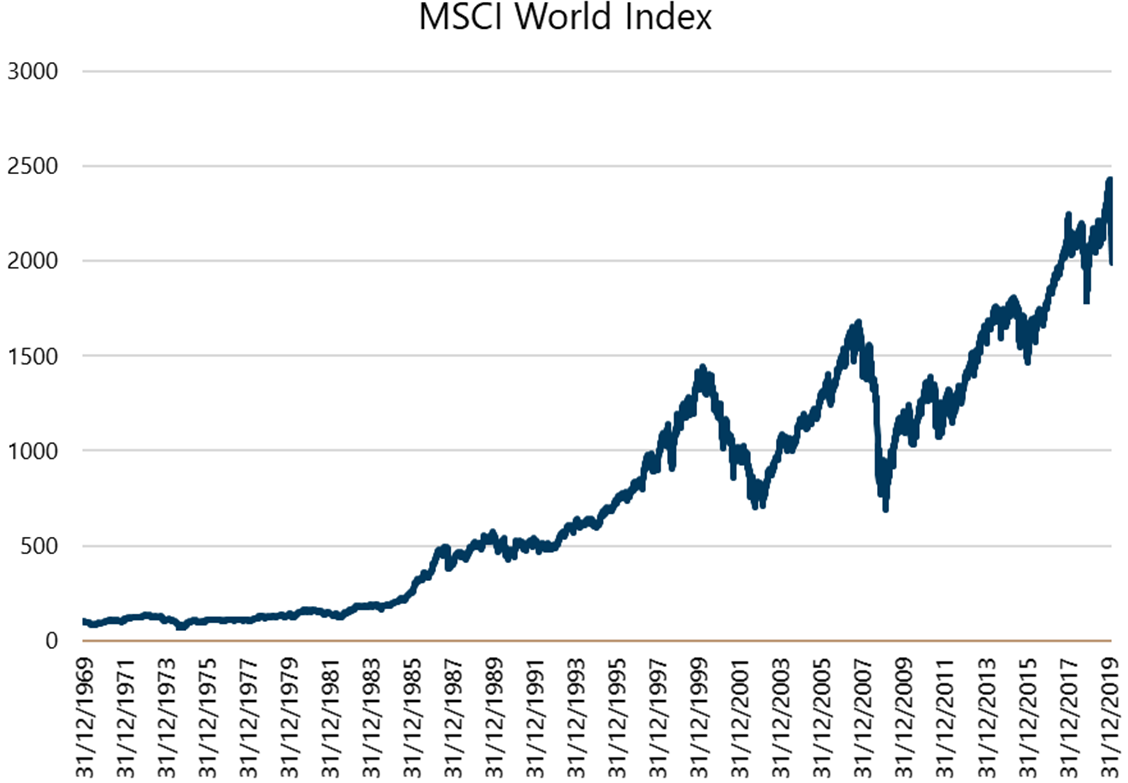

When I wrote this article in July 2008, which was the start of the Global Financial Crisis. There was panic all over wall street and investors from all over the world started selling off equities. The S&P500 ended that year with a drop of 37%. Investors saw no end in sight to the carnage. I wrote this article then to encourage investors to see beyond the short-term volatility but to stay invested because I was confident that “spring” will come again. And if we look at where the market is today 12 years later (see chart 3), the fall in the market back in 2008 was indeed just the “winter months”. Spring came 6 months later and the “garden” grew again.

12 years later, it seems like it is all happening again. At the time of writing this commentary, the S&P500 just fell almost 20% from its peak. The current market sell-off is mainly due to panic caused by the Covid-19 virus. Investors are concerned with how it will affect the economy in the short term. And most recently, the oil war started by Russia and Saudi Arabia triggered more selling. The reason for the fall may be different from that of 2008. But I guess as investors investing for the long term, the question we really need to ask ourselves is: are the economic roots of our world severed? The answer is a clear “no”. Just like SARS and many other epidemics and pandemics, this too shall pass. Oil wars will be over. Economic activities will soon resume to normal and soon, “spring” WILL come again. But when it comes, you want to be there to welcome it. So yes, it may be winter now. Yes, keep warm if you need to. Don’t fall sick but stay invested or add more money into your portfolios if you have some spare cash, for growth will come just like before. And who knows, 5, 10 or another 12 years later, you may be telling this same story to the younger generation.

Chart 3. The World Garden – MSCI World Index from 1970 to 2019

Chart 3. The World Garden – MSCI World Index from 1970 to 2019

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-Only Wealth Advisory Firm. He has been advising clients since 1998. The edited version has been published in The Business Times in July 2008.

Here is the Ebook “Chicken Soup for The Worried Soul – Investing in Troubled Times” as promised. While it seems like a bad situation now, history has shown that life eventually must go on. Humanity has come through various epidemics like the Spanish flu, Ebola and of course SARS, so eventually, we will also figure out a way to overcome COVID-19. Let’s keep our eyes on the future and make sure our financial plans and investment portfolios emerge from this situation in good shape.

For more related resources, check out:

1. Retirewell® Part 5: Investment Philosophy for a Retiree Client

2. To Do Well In Investments, Don’t Focus Too Much On Forecasts

3. Stay Invested for The Long Term? Think Again!

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.