Once we understand that reliable investing is about capturing returns from the market rather than trying to outsmart all the other market participants, it becomes natural to then ask: Why do stock markets always rise in the long run?

When we invest in the stock markets, we must know that we are investing in real businesses. Fundamentally speaking, it is ultimately the earnings of these businesses that drive stock prices. And as long as there is increasing productivity and a growing demand for goods and services, these businesses as a whole will continue to grow in their earnings. But what will cause demand to increase? The answer is population growth and a rising standard of living.

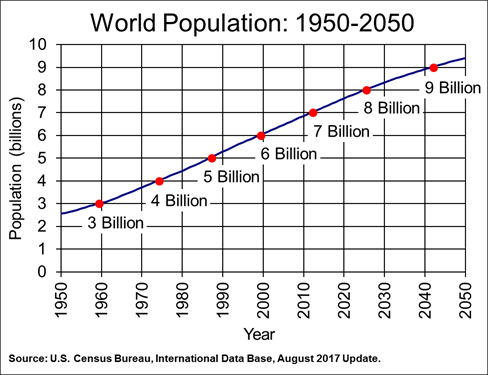

Chart 3: World Population Growth | Data source: U.S. Census Bureau, International Data Base. Data as of August 2017

As you can see from Chart 3, world population has been growing all this while and will continue to grow into 2050. And as population grows, there is an increase in demand for goods and services. The human race is also such that there will always be a desire to increase our standard of living. Both of these factors will cause consumption to always go up over the long run and businesses collectively will do better.

But of course, from time to time, there will be periods where consumption may drop and thus affect businesses and thus their stock prices. These periods are either due to business cycles (where there is a mismatch between consumer demand and supply of goods and services by businesses) or occasional unexpected events such as wars, terrorism, fear of a pandemic and so on, that caused consumers to be fearful and as such reduce consumption. But when the business cycles correct itself (and they do!) and when consumers’ fears subside and demand for goods and services return (and they do too!), business earnings return, and the stock markets rise again.

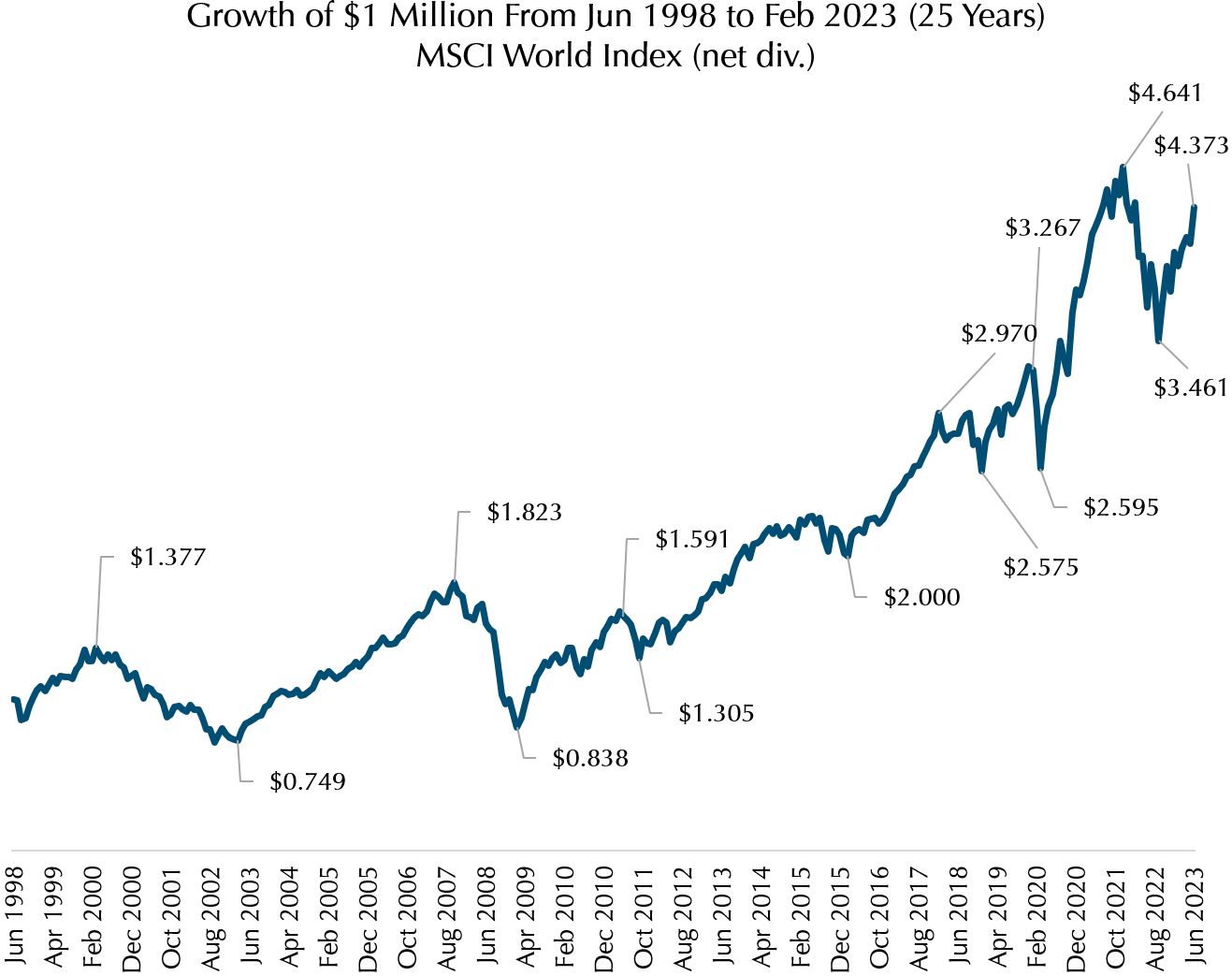

Chart 4: Growth of $1 million from Jun 1998 to Jun 2023 | MSCI World Index (net div.) | Data source: Dimensional

However, you may ask, “some companies may not survive during these periods and can become bankrupt, right? How do I then choose the stronger businesses that will not?”. The answer is found in the index fund. When you invest in an index fund that tracks an index like the S&P500 or even the Straits Times Index (STI), you automatically invest in the strongest companies at that point in time. Yes, these companies might not do well in the future. And if that happens, they will be replaced in the index by companies that become stronger than they are. Even if they go bust before they are replaced, because you are so diversified, you will not be badly affected. As such, as a whole, the stock markets always rise over the long term as can be seen in Chart 3.

Once you understand the above, you…

- Realise that not only is it difficult to guess when exactly the stock market will rise or fall, there is no need to do so if you are investing for the long term.

- Begin to understand why most people, even professionals cannot correctly guess where markets are headed, and even if they do, they cannot get it right consistently.

- Do not need to be fearful of short-term fluctuations of the stock markets but just stay invested for the long term.

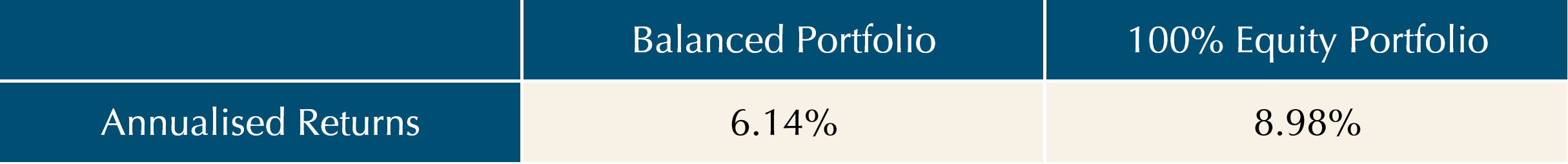

Table 15: Portfolio Returns from Sep 2016 to Apr 2023 | Data source: Providend

Table 15 shows two of the index-based portfolios that we have being using for our retiree clients since September 2016. During this period, there were numerous upheavals such as the Trump Election, Brexit, the COVID Crash and high inflation.

So, what did we do to achieve the above returns? We simply avoided guessing and stayed invested and coached our clients to stay invested. Even if the markets were to fall next week, either because of recession or war, we would not be perturbed. This is because, over the last century, the world has gone through two world wars, a great depression and the Spanish flu which collectively have killed 100 million people. We have been up against the Hong Kong flu, the oil crisis, the Asian financial crisis, the tech bubble, and terrorism like we never experienced before. And closer to home, even though we have seen SARS, H1N1, COVID-19 and other virus attacks, as well as the Great Financial Crisis of 2008, the stock markets have continued to rise.

“But this time is different”, is a common remark we always hear from doomsayers. Of course, this time is different! History has shown us that almost every time the markets tumble, it was due to a different reason. But the one thing that remains the same throughout history and will remain the same going into the future is this: As long as humans continue on the path of continuous progress, businesses collectively will do well, and stock markets will always rise.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Southeast Asia’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version has been published in The Business Times on 30 September 2017.

Here are the links to the RetireWell™ eBook chapters:

- Part 1: Drawing Down Retirement Money

- Part 2: A Tale of Two Retirees and Their Fortunes

- Part 3: Ensuring a “Safe Retirement Income Floor”

- Part 4: Investment Philosophy for a Retiree Client

- Part 6: Setting Aside Adequate Additional Buffers

- Part 7: Capturing Returns Effectively

- Epilogue 1: Purpose-Driven Retirement Planning

- Epilogue 2: Retirement – It’s About the Kind of Life You Want to Lead

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.