In the past few years, in my conversations with investors, there was a number who told me that they were worried about the stock markets and that they thought that a big crash was imminent. As it turned out, they were wrong – the stock markets actually performed very strongly over the past few years. As we have a finite number of years to accumulate sufficient funds for our retirement, the investors who stayed out of the market missed a valuable opportunity to grow their nest eggs.

The thing is it is almost impossible to know how markets will perform from year to year. “People that think they can predict the short-term movement of the stock market – or listen to other people who talk about (timing the market) – they are making a big mistake,” says Warren Buffett. However, there is clear evidence that if you are invested in a cost-efficient, diversified portfolio for the long term, your odds of investment success are excellent. If you are really worried about the market in the short term, one way to manage this fear is to simply invest a part of your savings, rather than all of it, so that you can mitigate the risk of being wrong about the market while being able to sleep well at night.

There is another method. If you are right that a market crash is coming, this method will actually help you to have better returns than someone who invests fully now, at least over the short to medium term. And if you are wrong about a market crash, you will still enjoy a decent return. Either way, over the long term, the odds of you enjoying a successful investment experience are outstanding. How does that sound? By the way, it’s an extremely simple strategy that Warren Buffett also recommends. It’s called dollar-cost averaging (DCA).

A DCA strategy means that you invest a certain amount at fixed intervals over a period of time. For example, if you invest $100 on the first day of each month over a ten year period, that’s a DCA strategy.

I am going to show you three chart patterns: up, down, and U-shaped. Generally, when you take a snapshot of a market chart, they will look like one of these three patterns. Firstly, markets tend to go up over the long term, not least due to increasing demand for goods and services brought on by a rising world population benefiting from higher standards of living. In the shorter term, however, they can and do go down from time to time. And in the medium term, while recovering from a decline they can form a U-shaped curve before rising again.

Now you have two main choices as to how you can invest your money. The first way is to invest a large sum at one go (elegantly known as the “lump sum strategy”). The second way is by using the DCA strategy mentioned earlier (inelegantly known as the “invest a little bit at a time strategy”). Which method will give you better returns?

Let’s take a look at how they compare if markets were to decline. Using the Great Financial Crisis as an example, this is how both strategies performed:

Chart A: Dollar Cost Averaging vs Lump Sum In A Declining Market

From Chart A, we see that in a declining market, a DCA method would have done better than a lump sum strategy. You would still have lost money, but remember that this is a temporary loss and not a permanent one unless you need the money, or if you panic and sell everything.

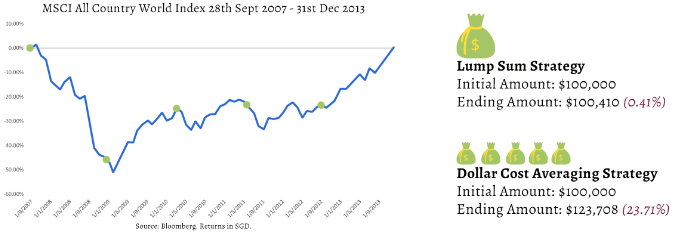

Now let’s see how both methods perform in a U-shaped situation, such as from 2007-2013.

Chart B: Dollar Cost Averaging vs Lump Sum In A U-Shaped Market

Chart B isn’t exactly U-shaped, but I’m sure you get what I mean. Again, the DCA strategy triumphed over the lump sum strategy here to give a relatively decent return in spite of having the misfortune of investing during the greatest financial crisis we have seen since the Great Depression. The key was to keep investing when the market was down and you would have benefited when it recovered because your average price was lower.

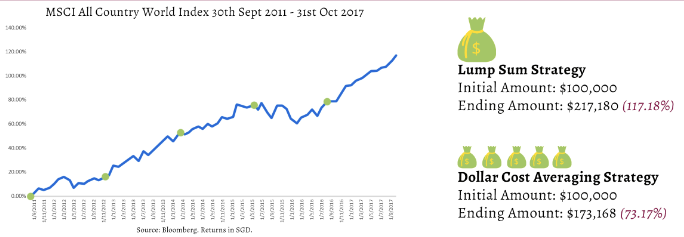

Now let’s look at a rising market.

Chart C: Dollar Cost Averaging vs Lump Sum In A Rising Market

In Chart C (Rising Market), the lump sum approach prevails. Incidentally, because over the long term most stock market charts end up looking like the one above, the lump sum approach would be superior over most long term time horizons. But while the DCA strategy wouldn’t have made you as much money as the lump-sum strategy, you would still have done well for yourself.

So from a performance standpoint, a DCA strategy outperforms a lump sum strategy in two out of these three scenarios. However, there is another very important way in which a DCA strategy could help most investors – in their emotional stability. Ample data has shown us that most investors are unable to withstand the fluctuations of the markets, and tend to bail out during the tough times; thereby making what would have been temporary losses permanent instead. (As the saying goes – when the going gets tough, the tough get going. Unfortunately, many investors seem to have interpreted “get going” as “get out”.) I believe a DCA method would help most investors to not only stay invested – because they would only have invested a portion of their savings – but to also keep investing through the tough times since it means that they can keep getting a lower average price.

So if you are worried about the market crashing soon, think about using a DCA strategy. If you have a long investment time horizon and a strong emotional constitution, you could consider investing a lump sum. And if you can’t decide which one you prefer, you could simply do both.

This is an original article written by Sean Cheng, Portfolio Manager at Providend, Singapore’s Fee-only Wealth Advisory Firm. The edited version has been published in The Straits Times on 15 April 2018.

For more related resources, check out:

1. What Happened After The Global Financial Crisis

2. How To Make Lump Sum Investing Less Fearful

3. Lump Sum vs Dollar Cost Averaging Strategy

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.