I have not been writing about investments for quite some time. And the reason is that there is really nothing new for me to talk about. You must be thinking that I am joking. So much is happening around the world that can affect investing and here I am saying that there is nothing to write about?

A couple of weeks ago, when I was having lunch with a couple of clients, they asked me about my market views in the light of the recent trade war between China and US, and how it will affect their portfolio. I told them honestly that I don’t really believe in giving a view because these so-called market outlook only concerns those who believe they can get in and out of the market at the right time. But the sad truth is, most get it wrong most of the time. For our clients who are investing with a long-term horizon towards their retirement and in their retirement, there is really no need to be worried about what happens in the short term. So why this conviction?

It Is Earnings That Drive Stock Prices

When we invest in the stock markets, we are investing in real businesses. Fundamentally, it is ultimately the earnings of these businesses that drive stock prices. And as long as collectively, there is a growing demand for these goods and services, the stock market as a whole will continue to do well over the long term. But what will cause demand to increase? The answer is in population growth and a rising standard of living.

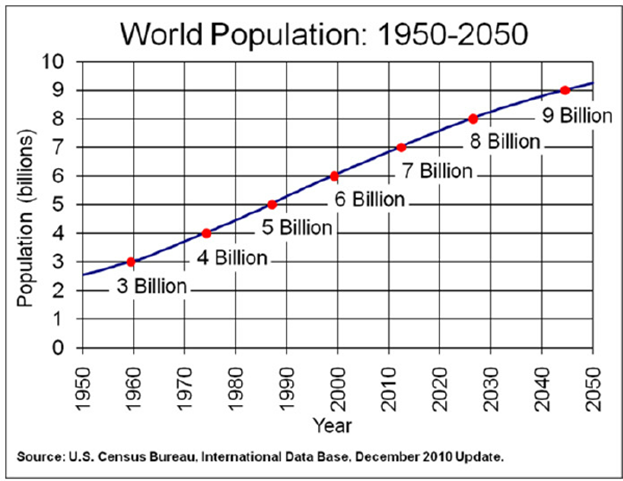

Chart 1: The Predicted Rise in The World Population

As you can see from Chart 1 above, over the past decades, the world population has been growing and will continue to grow into 2050. And as the population grows, there is an increase in demand for goods and services. The human race is also such that there will always be a desire to increase our standard of living. Both of these factors will cause consumption to go up over the long run and businesses collectively will do better.

Though Short-Term Events Affect Earnings

But of course, from time to time, there will be periods where demand for goods and services may drop which affect businesses and thus their stock prices. These periods are either due to business cycles (where there is a mismatch between consumer demand and supply of goods and services by businesses) or occasional unexpected events such as wars, debt crises, terrorism, fear of an epidemic or most recently, a trade war. They caused consumers to be fearful and as such reduce consumption.

But Stock Market Goes Up In The Long Term

The good news is, business cycles always correct itself over time and panic events always blow over too. When these come to pass, businesses produce again. Consumers’ fears subside and demand for goods and services return to normalcy. These cause business earnings to come back and the stock markets rise again.

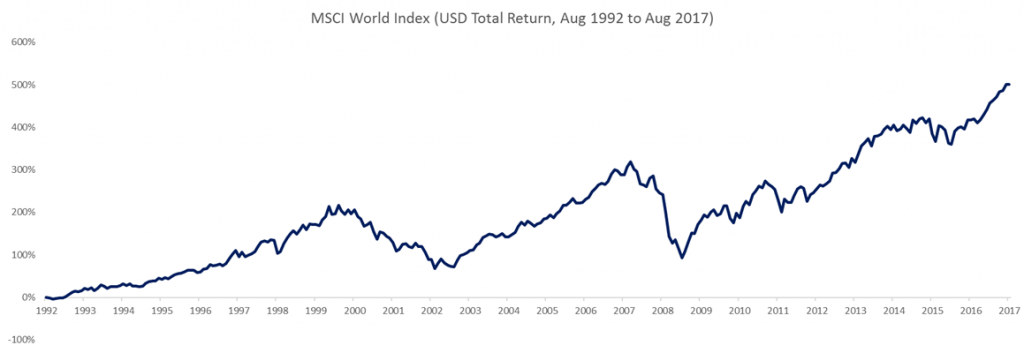

However, you will always hear people say, “this time is different!” Of course, this time is different! History has shown us that almost every time the markets tumble, it was due to different reasons. But over the last century, despite the fact that the world has gone through 2 world wars, a great depression, the Spanish flu that collectively has killed 100 million people, and although we have experienced the Hong Kong flu, the oil crisis, the Asian financial crisis, the tech bubble, terrorism like we never experienced before. And closer to home, even though we have seen SARS, H1N1 virus attack and the Great Financial Crisis in 2008, and more recently, Brexit and the US elections, the stock markets have continued to rise through it all (see Chart 2 below). This is because the fundamental driving stock prices remains intact – that the world population continues to grow which in turn pushes demand for goods and services that drive rising stock prices.

Chart 2: MSCI World Index

Perhaps we should all take heed from King Solomon of Israel, arguably the wisest man ever lived.

“A generation goes, and a generation comes, but the earth remains forever.

The sun rises, and the sun goes down, and hastens to the place where it rises.

The wind blows to the south and goes around to the north; around and around goes the wind, and on its circuits the wind returns.

All streams run to the sea, but the sea is not full;

to the place where the streams flow, there they flow again.

All things are full of weariness; a man cannot utter it;

the eye is not satisfied with seeing, nor the ear filled with hearing.

What has been is what will be, and what has been done is what will be done,

and there is nothing new under the sun.

Is there a thing of which it is said, See, this is new”?

It has been already in the ages before us.”

Ecclesiastes 1:4-10

We are made to believe that this time is different. So we busily move our investments in and out of the markets. As a result, huge fees are incurred. Stress level goes up. And at the end of it all, we still lose money. In truth, “there is nothing new under the sun. It has been already in the ages before us.”

So there is nothing new about investments that I can write about. It is the same old boring story I tell, each time, all the time. But I have come to learn, over the past 2 decades of my career, that when investing is boring, it actually works.

The writer, Christopher Tan, is Chief Executive Officer of Providend, a Fee-only Wealth Advisory Firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation. The edited version has been published in The Straits Times on 15 July 2018.

For more related resources, check out:

1. How To Make Lump Sum Investing Less Fearful

2. Why Rolling Returns Could Increase Your Investment Conviction

3. To Do Well In Investments, Don’t Focus Too Much On Forecasts

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.