In the recent 3 years, we have witnessed a rise in the number of people coming to us for end-of-life, legacy, and estate planning. Perhaps they were reminded that death can happen suddenly, something which they saw during the pandemic. Many who came have gone to various financial institutions and professionals and oftentimes been recommended “products” such as Universal Life Policies or legal and tax structures as the solution. But somehow, they felt that something was missing yet, they can’t put a finger on what was not right. So, let me use a case study to share how this can be done.

Richard and Eva own an engineering firm. They have 3 children, Catherine (who is a doctor and married to another doctor), is not interested in the family business. Gladys (who is single), is the only child who is involved in the family business as the assistant general manager, and Michael, is an admin assistant. He suffers from bipolar disorder and may not be able to manage money well. He has a girlfriend whom he may marry in a few years’ time. The siblings get along well with each other. When Richard and Eva came to us, they were concerned with who will care for them and manage their financial affairs when they become older and are unable to do these things themselves. They have not put in place their wills, Lasting Power of Attorney (LPA) and have not gone through the Advance Care Planning (ACP) process. They also would like to retire soon.

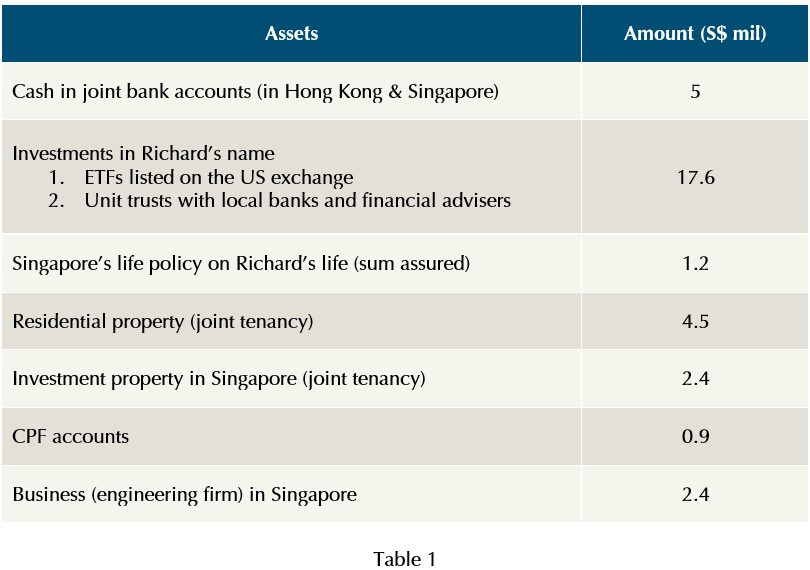

This was what we found out during our initial discovery meeting with the couple:

- His assets as shown in Table 1.

- They want to retire with $25,000 per month adjusted for inflation.

- Preserving family harmony and building relationships are of utmost importance. As such, asset distribution must be fair, not just in quantum but in terms of who should rightfully own the assets.

- The plan must convey Richard and Eva’s trust in their children.

- Do not just want to distribute on demise but some lifetime gifting to help children now.

- As Eva and the 3 children are not investment savvy, some monies need to be managed professionally upon Richard’s mental incapacity or demise.

- Catherine and Gladys to take care of their parents if they are physically or mentally incapacitated.

- To ringfence the assets from current and future children-in-law for now and potential creditors should any of the children becomes bankrupt.

- Unmarried children should always have a house to stay in.

- Mitigate the incidence of overseas estate duty where possible.

Based on their desires, we then went into a discussion on what assets should be distributed in their lifetime and upon their demise.

Lifetime gift

- We worked out that Richard & Eva will need to set aside S$7 mil for their retirement. This amount cannot be distributed.

- Engineering business to be transferred to Gladys in Richard and Eva’s lifetime. It will not be fair for Catherine and Michael to have a share in this business since they have never been involved.

- Worked out that $200,000 be gifted to each of their children, even though Michael may not be able to manage it well. The couple wanted to be fair and show him some trust.

On demise or loss of mental capacity

- Insurance proceeds and investments are to be managed by an investment manager for income distribution upon Richard’s demise or mental incapacity.

- CPF proceeds to be distributed equally to the 3 children using the CPF nomination.

- Residential property to be sold upon both Richard and Eva’s demise and distributed via wills.

- Upon both Richard and Eva’s demise, investment property is to be given to the children via wills and inhabited by unmarried children and only be sold with proceeds distributed when all children are married.

- Richard and Eva will trust their 3 children to manage the CPF monies and proceeds from the sale of properties on their own.

Next, we worked out a high-level solution for the couple.

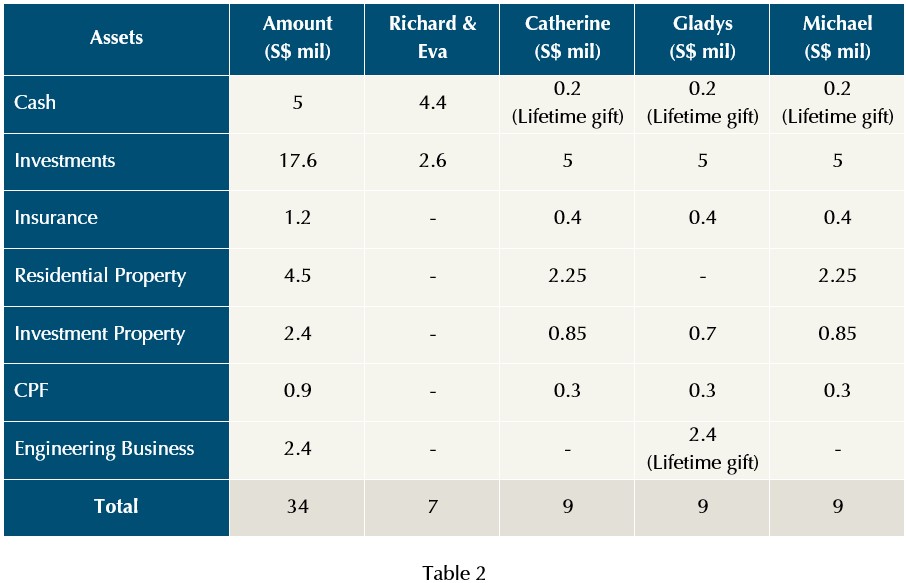

- Worked out the asset distribution as shown in Table 2.

- Transfer the money in Hong Kong to Singapore bank accounts and restructure the investments out of the US exchange to mitigate the incidence of estate duty.

- Write their wills to distribute the properties and residual assets with Catherine and Gladys being the executors and trustees as well as do their CPF nominations.

- Set up a revocable, discretionary standby trust and appoint a corporate trustee. The trust is dormant and only activated upon Richard’s mental incapacity or demise. The trust will have a schedule listing down children in-laws as excluded persons and will never benefit from the trust.

- Put in place a letter of wishes to guide the trustee on distribution to the beneficiaries. This will include a monthly amount to be paid and in the event of a beneficiary being bankrupt, payments will stop. An annual amount will also be given for the beneficiaries to go for a family holiday together. This is to help build family relationships.

- Put in place an investment mandate to guide professional managers when they take over on Richard’s demise.

- Appoint David (Eva’s brother) as the protector of the trust.

- Put in place LPAs for both Richard and Eva, appointing Catherine, and Gladys as donees as well as ACP spokespersons.

Once we agree with the high-level solution, we will find an appropriate corporate trustee for Richard and Eva as well as coordinate the details of the wills, trust deed and LPA with our legal partners. Finally, when all is in place, a family conference can be organised to brief all beneficiaries on the plan and the intentions behind it.

While financial instruments and legal structures are products that can be useful in legacy and estate planning, what is more important is for one to first make their “life decisions” before deciding on the suitable “products”. In this case, it is about ensuring family harmony, building relationships, communicating trust and at the same time, protecting and providing for Richard and Eva’s family. While I have used someone with significant wealth to allow for a richer discussion, the thought process is similar for less affluent families.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in The Business Times on 17th April 2023.

For more related resources, check out:

1. On Life Transitions, Legacy and Money

2. My Reflection on the True Value of Estate & Legacy Planning

3. Are You a Beneficiary of an Unexpected Inheritance from Your Loved Ones?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.