Over the past one month, the talk in town has been on rising interest rates and yields of fixed deposits, Singapore Savings Bonds and T-bills. This is not surprising as we have not seen such high returns from cash and near-cash instruments for a long time. And with equities taking a hit this year, financial institutions are touting their fixed deposit accounts, safer products such as retirement income and cash management plans, especially to retirees and near-retirees. But that is the problem when wealth planning is done piecemeal and, on a product-based manner depending on the “flavour of the season”. Remember just a few years ago, financial institutions were pushing premium-financed insurance products when interest rates were low? Those who took a loan then and bought such plans could be regretting now with interest rates rising and some may even find it hard to service the interest payments today. (Here’s an article on how increasing interest rates affect your leveraged policy returns.) To decide on the appropriate financial instruments to use and how much money you should allocate to them, we first need to do up an effective retirement plan. This starts with first understanding the risks that retirees and near-retirees face, their lifestyle aspirations, and the current assets they hold.

When one is in or near retirement, they would have built up their assets which can comprise of cash, CPF, insurance, properties, equities, bonds, and other investments. They now need to have a plan where they can efficiently spend and mitigate the 5 risks they will face during retirement and perhaps still leave behind a financial legacy for their loved ones. These risks are

- Longevity risk, the risk of outliving their assets due to longer life expectancy.

- Inflation risk, the risk of losing purchasing power due to inflation (something which is very real now).

- Healthcare risk, the risk of not being able to cope with high medical expenses which can be solved by having an affordable comprehensive insurance plan.

- Investment risk, which includes volatility risk and sequence of return risk. As a case in point, the current high volatility of equities may cause retirees to panic sell their investments and realise losses. Some retirees may have no choice but to sell their investments (which have fallen in value this year) to fund their living expenses now. This is what sequence of return risk is all about.

- Overspending risk, the risk of spending too much in the earlier years of retirement leaving insufficient assets for the later phase of retirement.

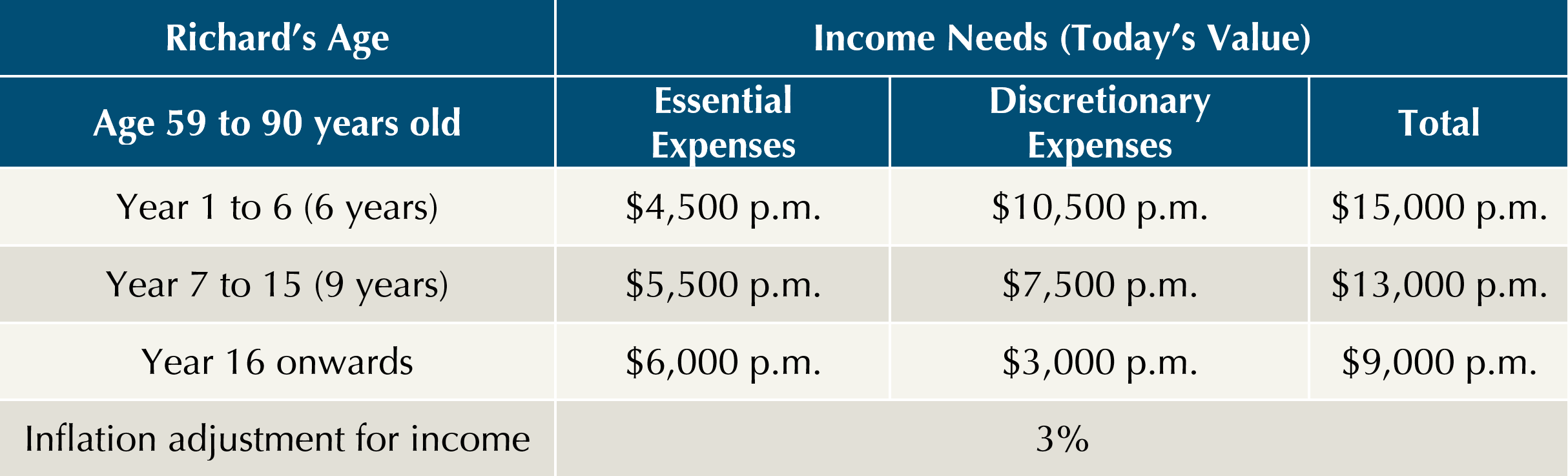

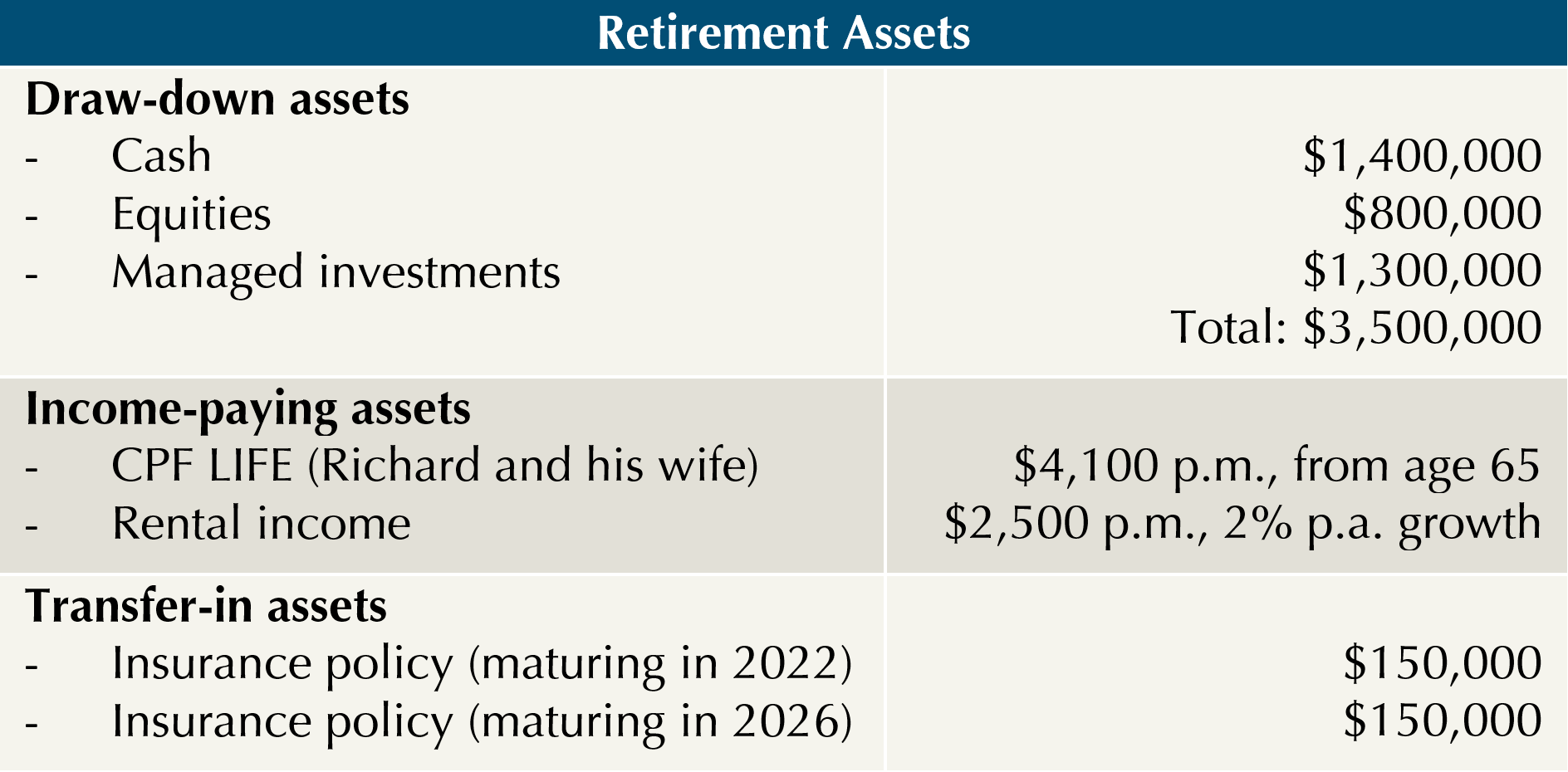

Let me use the case of Richard to illustrate how we would plan and mitigate these risks for our retiree and near-retiree clients.

Our approach to planning for our clients is based on the following principles

- For monies needed in the immediate 5 years of retirement, they must come from instruments or assets that can give a reliable stream of income regardless of the volatility of financial markets. Examples are cash in bank accounts, CPF Ordinary and Special accounts (which you can withdraw after age 55 after setting aside the prevailing Full Retirement Sum) and matured insurance endowment plans.

- For monies required to fund essential expenses, they should come from investment grade bonds, CPF LIFE, retirement income products and rental income.

- For monies needed in later years of retirement and to fund discretionary expenses, they can be in portfolios of equities and bonds and the later you need the money, the more the portfolios can have greater proportions in equities.

So, in the case of Richard, based on his retirement income needs at different stages of his retirement and the above principles, we reallocated and restructured his assets into the various “buckets”

- Income bucket – consists of CPF LIFE payouts at age 65, rental income and we also used a substantial portion of his cash to buy into investment grade bonds which will pay coupons. This will ensure that he will always have a reliable stream of income from day 1 of his retirement to fund his essential expenses for as long as he (and his wife) lives, mitigating longevity risk regardless of the volatility of financial markets.

- Bucket 1 – consists of cash, CPF OA/SA balances, and insurance endowment plans which will mature in the future. This will pay for Richard’s discretionary expenses for the immediate 5 years. This also mitigates sequence of return risk.

- Buckets 2 – 6 – These buckets are only needed in the later part of retirement and so we restructured Richard’s equities and managed investments into the various buckets which are invested into portfolios of varying equities and bonds proportions to beat inflation. For example, bucket 2 holds mostly bonds and lesser equities and will be needed to fund his discretionary expenses from 6th to 10th Bucket 3 will be needed from 11th to 15th year, bucket 4 will be needed from 16th to 20th year, bucket 5 will be needed from the 21st to 25th year and bucket 6 will consist of mostly equities and only needed from the 25th year of Richard’s retirement when Richard is about 85 years old. This will mitigate the risk of Richard wanting to sell his investments earlier than he should due to market volatility.

The conversations with our new clients planning for retirement this year have been interesting. There are so many options for the income bucket and bucket 1. Bond yields are higher and there are so many options ranging from fixed deposits, SSBs, T-bills and cash management portfolios to choose from. Prices for equities have fallen by close to 20% making it cheaper to deploy money into the portfolios for buckets 2-6. Their retirement looks so bright! For existing clients, the conversations since 2021 have also been about where to better park their monies in bucket 1 as well as taking profit from the investments in later buckets if they need it in the next 1 year as the past years have been great years for financial markets and the portfolios have gone up so much in value. So, whether one is in retirement or planning for one, they can be assured of a reliable stream of income regardless of market situations. And with a structured spending plan, product decisions are more purposeful and the risk of overspending is also mitigated.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in The Business Times on 19th September 2022.

In the near two decades that we have worked with retirees, we understand one thing: Reliability of income is more important than return on investment at this phase of your life.

As such, we have developed a proprietary methodology called RetireWell, that can help you draw down strategically from your retirement nest egg.

Our Retirewell methodology was featured in The Business Times every month for almost a year in 2017 and has 11 parts to it.

With Retirewell, we will design a plan that will give you a safe and reliable stream of income for the rest of your life, with provisions for legacy in the event of demise, so that you can live up your retirement with peace of mind.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.