The Federal Reserve has just announced yet another interest rate increase by 0.75% at the recent Federal Open Market Committee in an effort to combat rising concerns of inflation.

Consumers should already start experiencing the effect of what is happening globally, either through higher food costs or increasing mortgage interests. On the flip side, lenders are also getting higher yields on their fixed deposits or bonds as a result.

We have enjoyed cheap borrowing rates for a long time, resulting in many leveraging strategies, particularly premium financing on retirement income insurance products being popularly sold out there. While I tend to steer away from using insurance for wealth building, I do wonder sometimes if there is a potential use case with leverage. Or as they like to say, it is very tempting to “use other people’s money” to generate more returns for yourself.

In today’s climate, I wonder if it still makes sense.

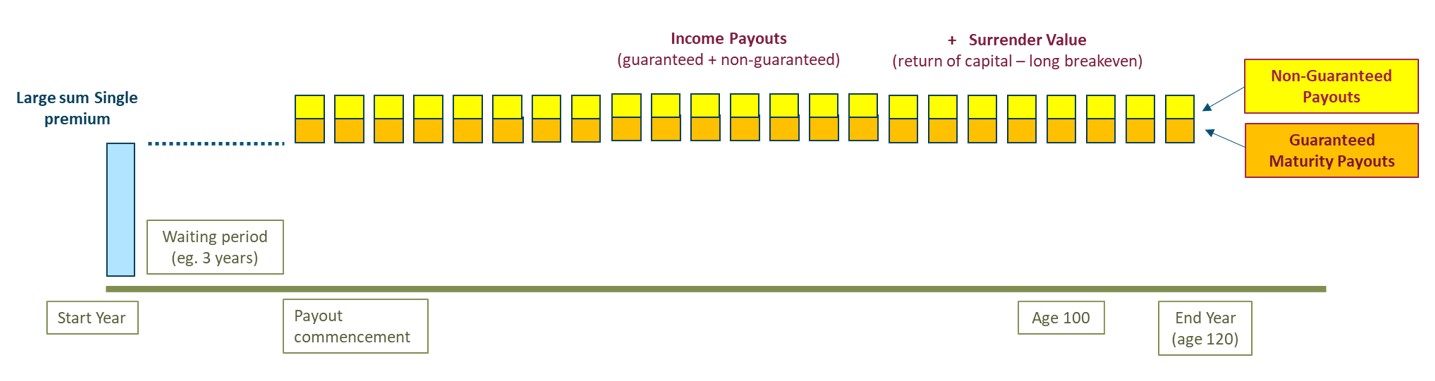

1. How does a retirement income policy work?

A typical retirement income policy starts off with a large single premium to fund the policy. After a fixed waiting period of about 2 to 5 years, the policy starts paying a monthly income in the form of a guaranteed amount and a non-guaranteed amount (depending on returns of the par fund). There is a surrender value that starts with 80% of the policy value which increases over time and can be given back to the policyholder at the end of the duration.

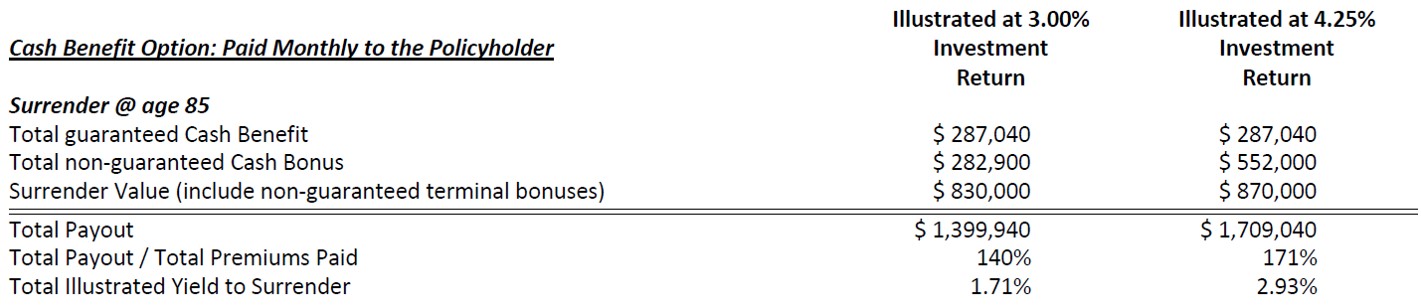

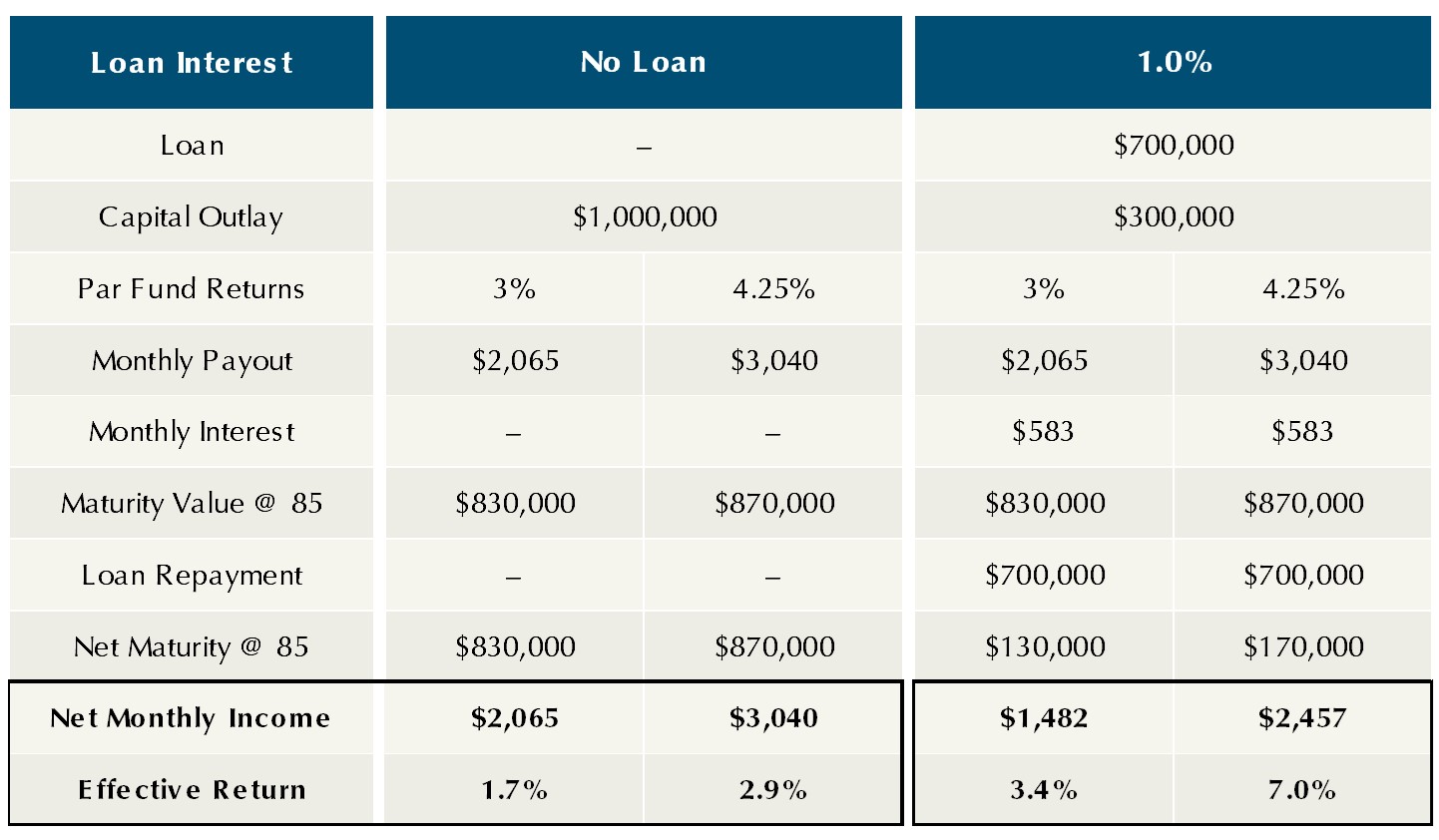

To give you a sense, here’s an actual example of a policy with the following features:

- Profile: Male, Age 60, Non-Smoker

- Single Premium: $1m

- Monthly payouts after 3 years:

- $2,065/month based on 3% returns on par fund

- $3,040/month based on 4.25% returns on par fund

- Surrender value at 85 years old:

- $830k based on 3% returns on par fund

- $870k based on 4.25% returns on par fund

The policy details will also typically provide you with the returns you are getting, after factoring in both the payouts and surrender value. In this case, if the par fund’s annualised performance is 3%, the policyholder gets 1.71% annualised return while if the par fund’s performance is 4.25%, the policyholder gets 2.93% instead. It is important to note that the par fund’s returns are NOT the policy holder’s actual returns.

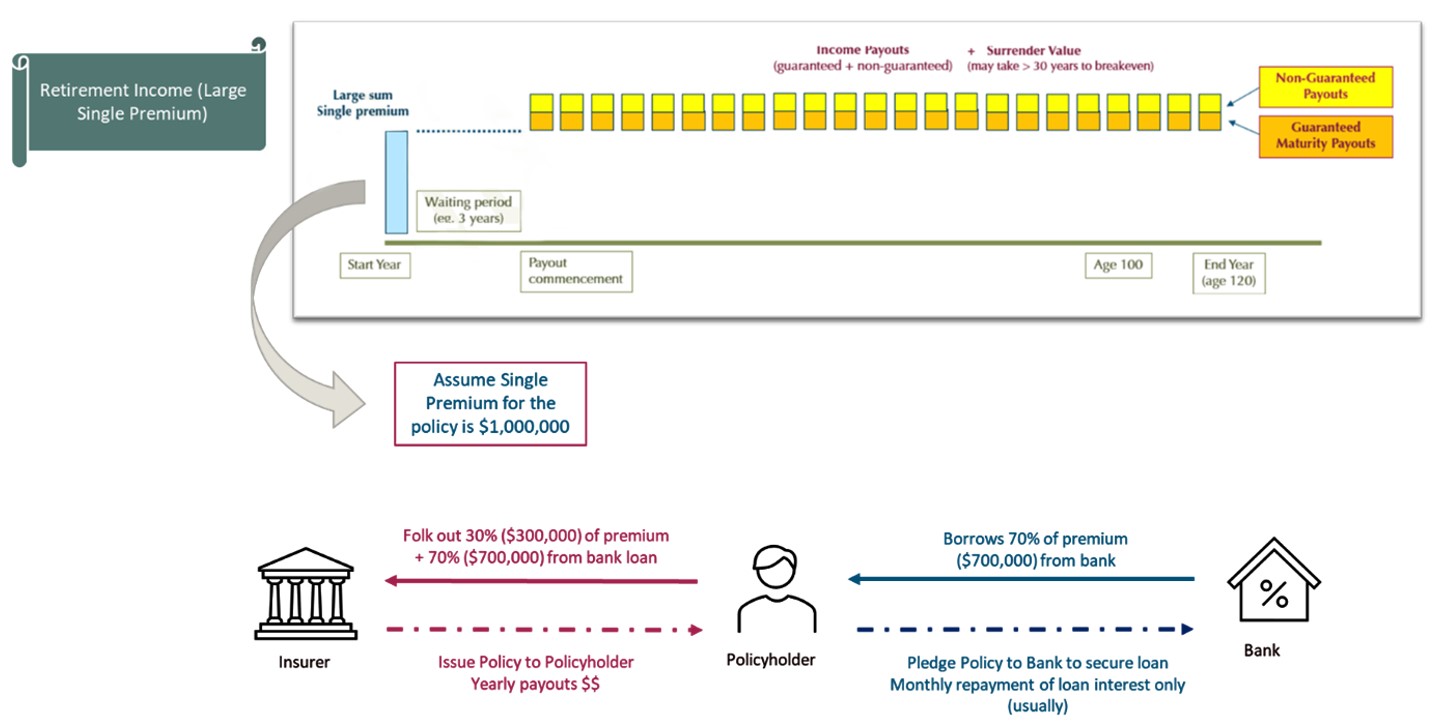

2. Leveraging

As you probably observed, returns from insurance policies tend to be low. This is because not only is the asset allocation leaning towards the safer side with over 60% in bonds and cash-like instruments, the fees and commissions further eat into the returns a policyholder gets.

Hence, a popular method to boost returns is to do premium financing by taking on a loan through a bank.

Using the same example above, assuming that instead of paying the full $1m single premium upfront, the policyholder only comes up with $300k. The remaining $700k is funded through a bank loan secured against the policy, typically on an interest-only repayment schedule.

When the policy starts paying out after the waiting period, part of it is used to cover the ongoing interest repayment. After factoring in the cashflows, the idea is to increase the returns from the policy, since the capital outlay is only $300k in this case. The key consideration when leveraging is making sure that your returns are higher than what you are paying in interest.

As an example, let’s say if your cost of borrowing the $700k is at 1% interest per year. You will be paying $583/month for the first 3 years to service the interest repayment, and from year 4 onwards, your policy will start paying out the income and your net cash inflow will be projected to be between $1,482 and $2,457 per month based on 3% and 4.25% par fund returns. In terms of returns, what was previously between 1.7% and 2.9% gets boosted to between 3.4% and 7.0% from the leverage.

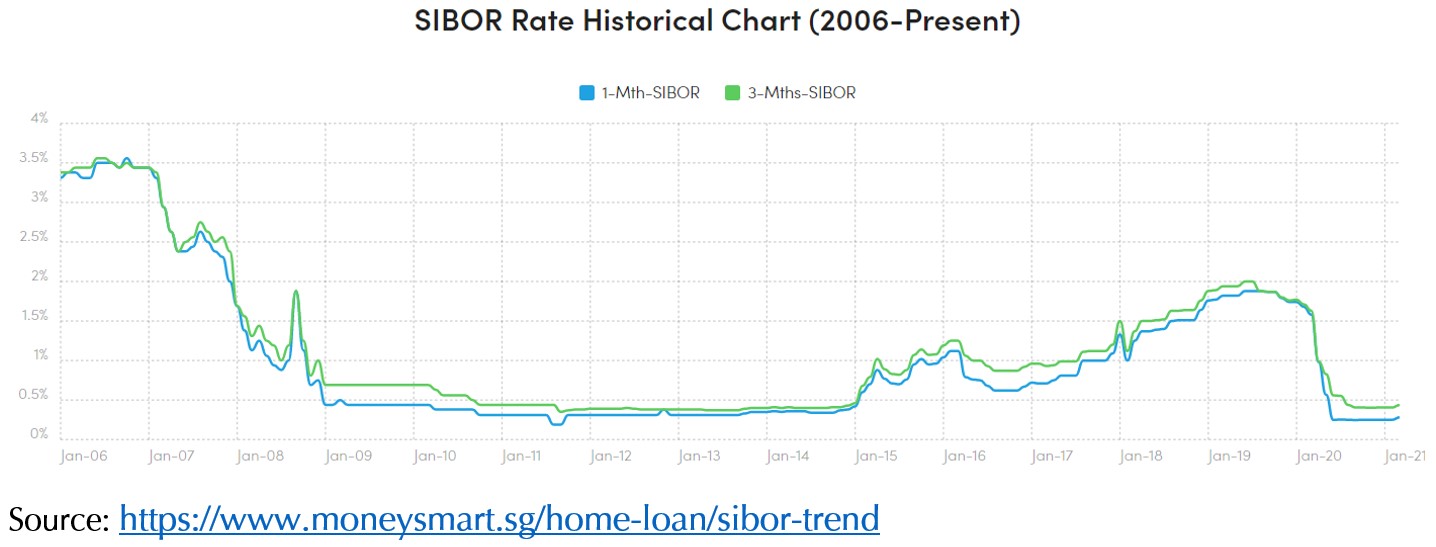

3. How has interest rates been across history

You can see that a large part of whether this strategy work is dependent on the interest rate on the loan. So how has that been in the past and what can we expect moving forward?

Typically, the interest rate is based on a spread + Cost of Fund (COF) or an agreed reference such as the Singapore Dollar Swap Offer Rate (SOR), Singapore Interbank Offered Rate (SIBOR) or the Singapore Overnight Rate Average (SORA).

Historically, you can see there are periods where SIBOR rates were above 3%, and if you include the spread, total interest payable could be closer to 4%. And it looks like we are currently already heading that way, considering the global challenges at the moment.

4. Returns vs Interest Rates

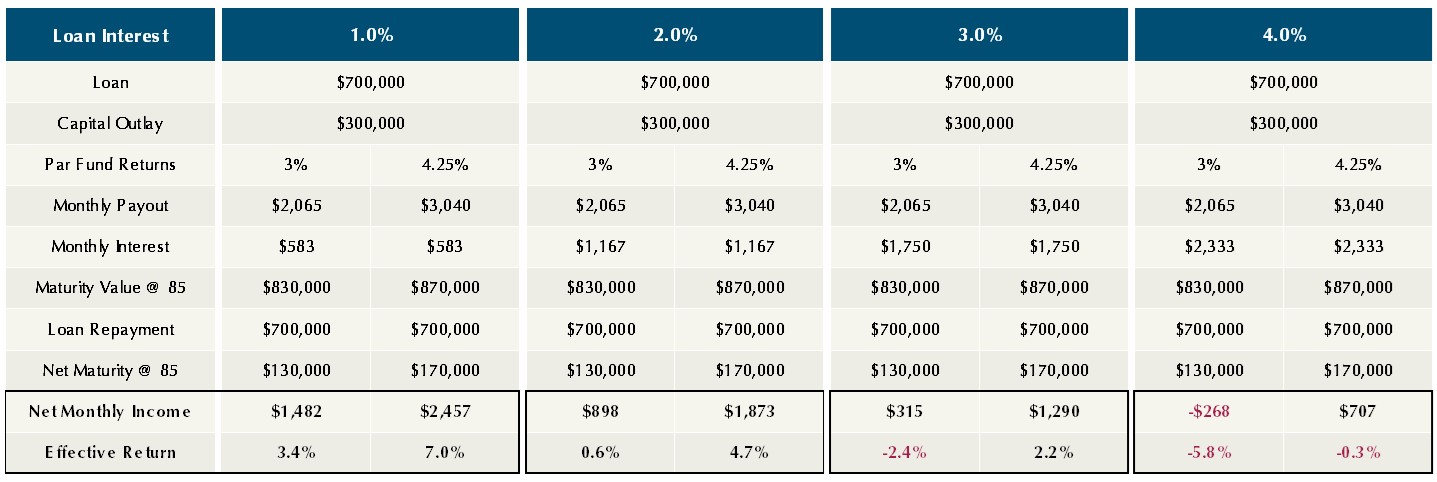

Putting it all together, the table below gives you a sense of how your returns and cashflow will look like with different interest rates.

From here, we can observe that leveraging makes sense for interest rates below 2%. When it gets up to 3%, your returns would be better off by not leveraging at all. At 4%, your returns and even cashflow start becoming negative!

Apart from interest rates which you have seen, there are other considerations you should also be aware of.

1. Liquidity – Signing up for an insurance policy is a long-term commitment. That means you will be giving up a lot of flexibility because of heavy penalties if you decide to surrender early. This also means that in the event of a sharp increase in interest rates, you typically cannot tap onto the policy value to repay the loan without taking a hit.

2. Market risks – The calculation exercise above assumes that the returns of the par fund are according to the projected 3% and 4.25%, but there is always a risk that the returns could be lower.

3. Total Debt Servicing Ratio (TDSR) – The loan will be counted towards your TDSR which can affect your ability to take on a new loan or mortgage for property.

4. Loan Call-Back – The bank can decide if they want to call back the loan if they feel that the borrower is in a weak financial position.

As a conclusion

After reviewing the numbers, I personally did not find a compelling reason to buy into such a product, as the positives do not seem to outweigh the risks for me.

There was a time when it felt like a no-brainer because of how low interest rates were, and it did seem like it will stay that way. That view has totally flipped today.

Risk can often come as a surprise that challenges your past assumptions. And I think we are currently in such a time now.

This is an original article written by Tan Chin Yu, Senior Client Adviser of Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Is Premium Financing Still as Attractive?

2. Chasing Returns in the Retirement Game

2. My Realisations of What Wealth Planning Is Really About

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.