So far, I have shared how we can use our proprietary tool, RetireWell™, to give our clients, Richard and Eva, a reliable income stream throughout their retirement.

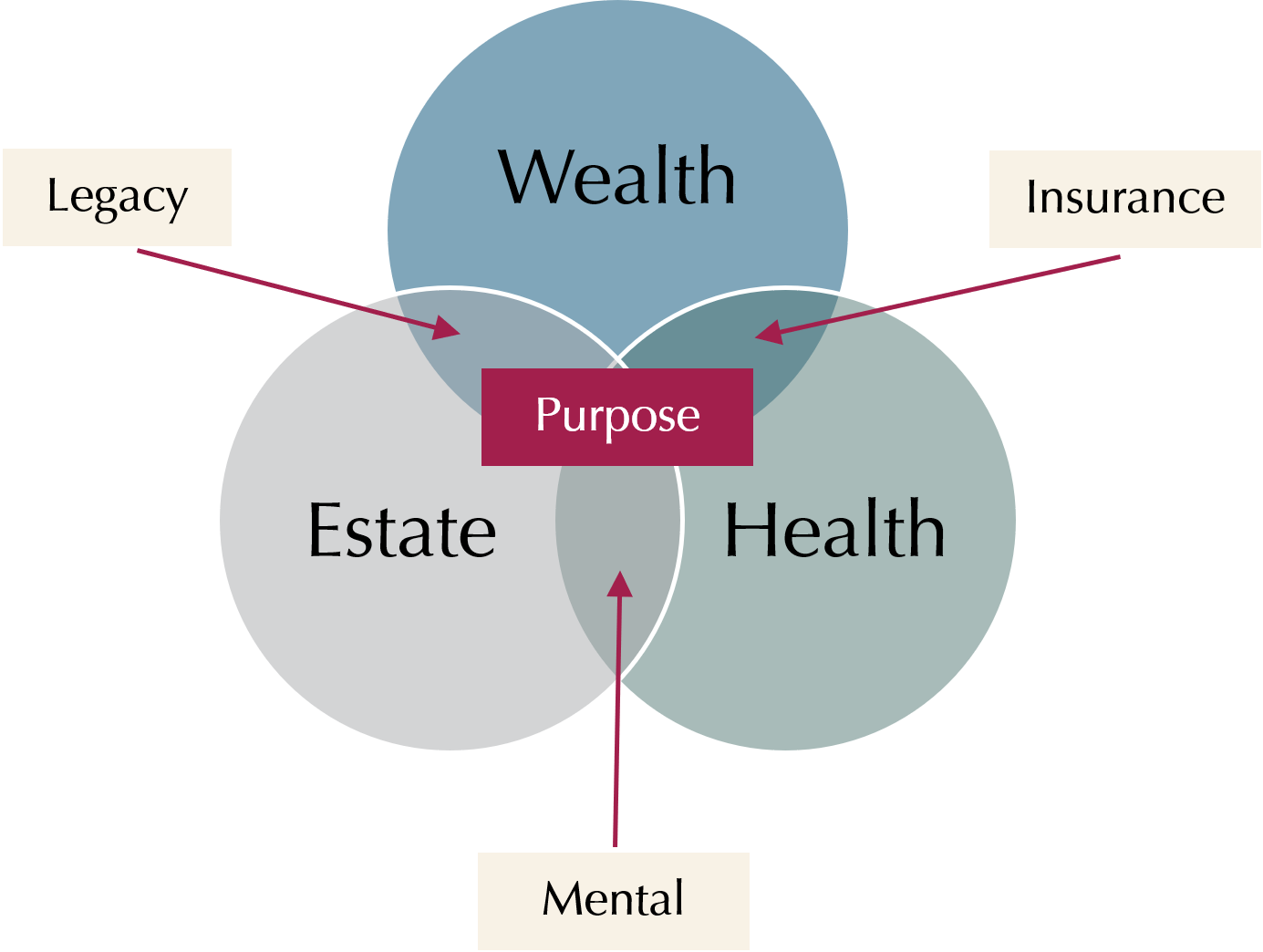

However, retirement planning is beyond just planning the wealth aspect. In holistic retirement planning, it is also about taking care of the retiree’s health to enjoy his retirement and plan for his estate upon his unfortunate demise (See Diagram 1). There is also a need to consider the “in-betweens” – Insurance, when retirees are not healthy and need money for medical expenses. Mental incapacity, when they are between living and dying and need someone to take care of their daily affairs. And legacy planning, when you are finally called home. But how does one make these delicate decisions? I strongly believe that retirees should make them based on their life’s purpose.

Diagram 1: Holistic Retirement Planning | Data source: Providend

It was Victor Frankl, a holocaust survivor who once said that “ever more people have the means to live, but no meaning to live for”. And if I may borrow and adapt his words, in the context of retirement, without a life’s purpose, you might have the means to retire but no meaning in retirement.

So, what is a life’s purpose?

It is the reason why you exist on this earth or if it is easier to help you understand, it is what you want to exist for, going forward in your life. Putting it another way, it is what you want others to say about you when you die. It is the legacy (and I don’t mean financial legacy) you want to leave behind. It is more than just goals. It is your life’s calling. But how can a retiree know or discover his or her life’s purpose? Personally, it took me about 3 months of intense reflection to discover my own purpose in life. And I have taken clients away for a 4-day retreat to help them discover their purpose. And yet, we were just scratching the surface! So, due to space constraints, I will simply say that you can discover your purpose through walking down memory lane, remembering significant life events to distil your values and beliefs, combining them with your passions and motivations in life as well as your strengths, to help you derive your life’s calling.

But how do you let purpose drive your financial planning in retirement?

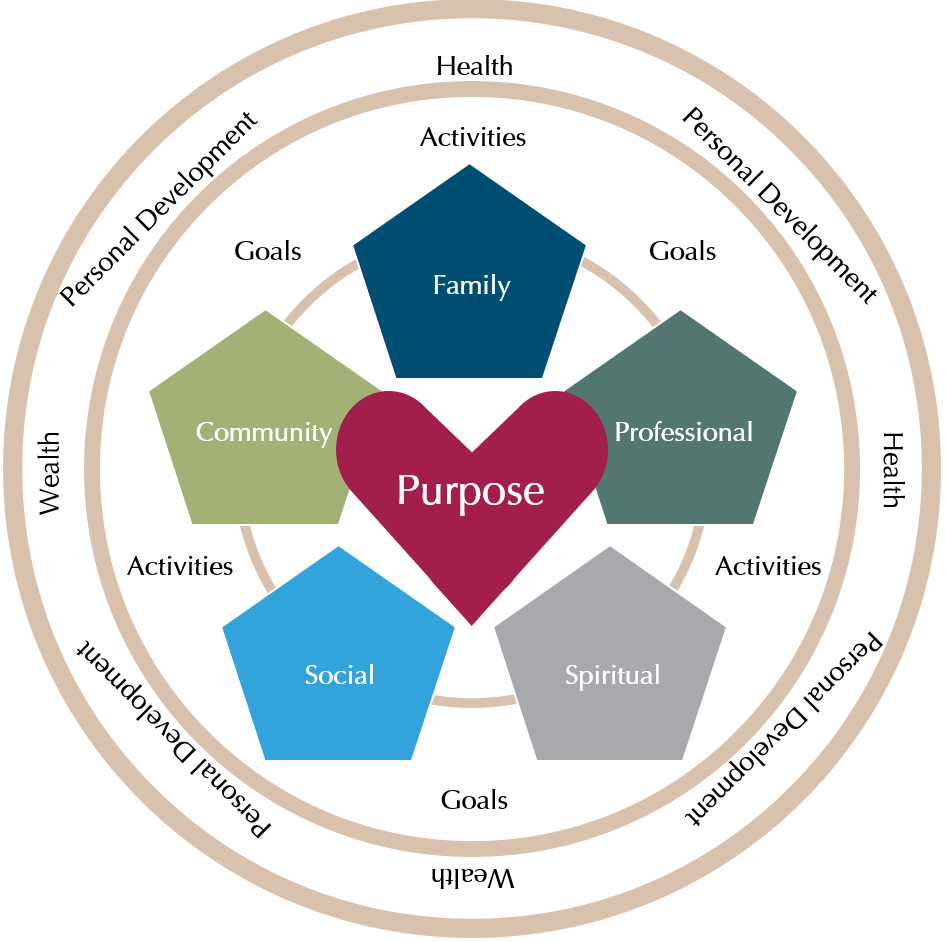

Some years ago, I developed a model to help individuals live a purpose-centred life (see Diagram 2).

Diagram 2: The Finishing Well Model | Data source: Providend

According to the model, broadly speaking, we live our lives in 5 arenas:

- Family

- Professional (work)

- Spiritual (faith)

- Social (friendships)

- Community

Within each arena of our lives, we have different roles and responsibilities during different seasons of our lives. For example, when we are younger, we may have more roles and responsibilities in say, the family and professional arenas and therefore have less time for the rest. But for retirees, in this season of their lives when their children have all grown up, they are needed less at home and thus may find that they have more time to live out their roles (that come with responsibilities) in the spiritual, social, and community arenas. To live a purposeful life in retirement, the retiree should see how he can align his roles along with the responsibilities, with his purpose.

As an example, Henry’s (a retiree) life purpose statement is: “No one should be poor forever. I live to care for and serve the poor by providing them with education and employment to break the poverty cycle.” As such, in his social arena, he can decide that in his role as a buddy to Peter, James, and John, his responsibility to them is to lead them to have a meaningful retirement by caring and helping the poor together. In this way, Henry’s role and responsibilities in his social arena will be aligned with his purpose. While doing his “friendship thing”, he is also living his calling.

Henry then ensures that he fulfils his role and responsibilities by setting goals and activities to reach those goals. For example, he sets a goal that states: “Peter, James, and John to enjoy a meaningful retirement in 2017, evidenced by them being actively involved with the poor on a monthly basis.” To support those goals, Henry planned several activities with his friends in 2017 such as:

- Develop a financial education programme to teach the poor

- Organize 4 trips to visit the poor in the hill regions of Cambodia

- Raise funds for the poor in Cambodia

To better achieve these goals, he will need what I termed “enablers”. According to the model, they are:

- Health

- Personal development

- Wealth

Enablers are not goals. But when you have them, they enable you to better do your activities. In Henry’s case, he planned 3 exercise days (health enabler) to build his core muscles and stamina, in order to be able to cope with the harsh environment in the hill regions in Cambodia. He also planned to sign up for a series of 6 financial education courses, as well as a facilitation course (personal development enabler), to equip himself to develop the financial education programme to teach the poor. And in order to be able to do the above, he needs to budget to ensure that his funds are allocated to the above programmes, as well as gym membership and paying for a trainer. He also set aside funds to give to the poor on a long-term basis as well as all his expenses traveling to Cambodia. This is the wealth enabler.

For retirees, they are in the last phase of his or her life. Time is short and by being clear with his life’s purpose, retirees are able to focus their time on activities that matter the most to him. What this also means is that retirees can best plan how much financial resources they need and how best to allocate them. How they live their retirement life and spend their money will be purpose-driven. With such great intentionality, this could be the best time of their life.

When I did this for myself years ago, I had a paradigm shift. Firstly, I can live my purpose by doing the small things in my life on a daily basis. In addition, money no longer becomes a goal. It is an enabler. If we chase money as a goal, it is like leaning the ladder on the wrong wall. When you climb up, you will be disappointed. When you see money as an enabler, you will use money and love people and not love money and use people. You will not buy things that you don’t need, with the money that you don’t have to impress people that you don’t even know. When you do purpose-driven financial planning, you no longer crave or desire anything you don’t already have. You will begin to live a life of contentment. And contentment is not a passive acceptance of your situation. Rather, it is a conscious choice to enjoy, appreciate, and accept what you have, while giving up the craving for the things you do not have. Because you know and accept that you can’t have everything, and you don’t need to have everything.

Many people make financial decisions and let their lives follow the financial decisions they make. Life may be disastrous if you do that. Let me encourage all of us to first make a life decision, and let your financial decisions follow it. When you do so, your life, whether in retirement or not, will finish well.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Southeast Asia’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

Here are the links to the RetireWell™ eBook chapters:

- Part 1: Drawing Down Retirement Money

- Part 2: A Tale of Two Retirees and Their Fortunes

- Part 3: Ensuring a “Safe Retirement Income Floor”

- Part 4: Investment Philosophy for a Retiree Client

- Part 5: Stock Markets Always Rise Over the Long Term

- Part 6: Setting Aside Adequate Additional Buffers

- Part 7: Capturing Returns Effectively

- Epilogue 2: Retirement – It’s About the Kind of Life You Want to Lead

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.