To conclude this book, I would like to first share the results of a survey and summarise what we have covered.

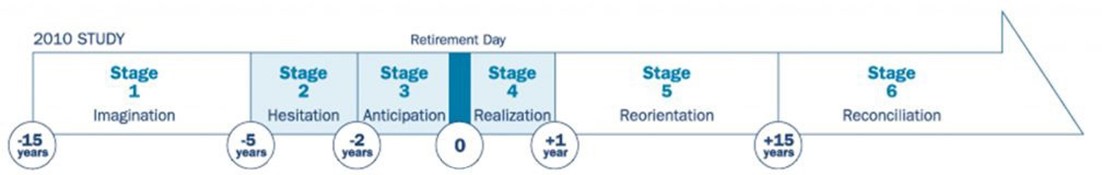

A survey was done in 2010 to understand the retirement journey of individuals (The New Retirement Mindscape II Study, 2010 Ameriprise Financial Inc.). I thought it was a good starting point to understand what retirement planning should be. It detailed six distinct stages in this journey.

Data source: The New Retirement Mindscape II Study, 2010 Ameriprise Financial Inc.

Stage 1: Imagination (6 to 15 years before retirement)

Individuals start to form ideas and are positive about what retirement would be. They start to plan for it but because of other more immediate financial obligations, they can’t do much and generally feel unprepared.

Stage 2: Hesitation (3-5 years before retirement)

Individuals begin to visualise retirement but question their own preparedness. As such, they begin to actively seek advice and are especially concerned about health insurance.

Stage 3: Anticipation (2 years before retirement)

Individuals are excited about retirement, feel most on track and prepared. This is the stage where they feel most empowered, happiest and hopeful.

Stage 4: Realisation (Retirement Day and the year following)

Individuals felt let down. It wasn’t what they imagined it to be. Loss of job and income is the hardest thing. They are also concerned about physical disability. They feel the least happy of all the stages.

Stage 5: Reorientation (2 to 15 years after retirement)

Individuals after coping with early feelings of disappointment, begin to adapt to the retirement lifestyles by modifying their goals and routines. They feel that having control over time is the best thing about retirement. Although concern over health rises.

Stage 6: Reconciliation (16 or more years after retirement)

Individuals begin to experience physical disabilities and a sense of emptiness. They also enjoy lesser of retirement. Loss of social connection is the hardest thing.

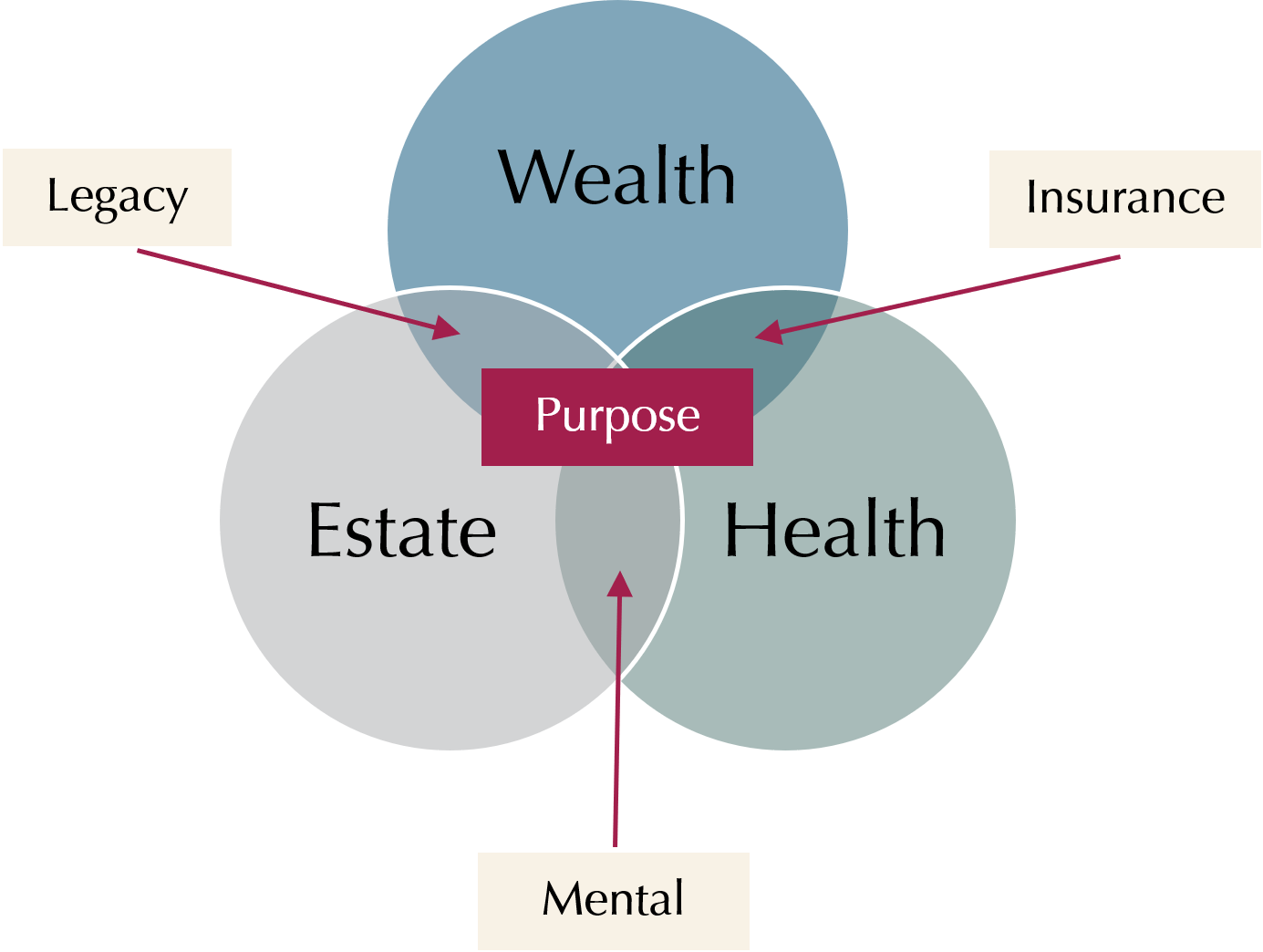

Although this survey was done in the U.S., and one might say it is not relevant to retirees living in this part of the world, our near 20 years of experience walking with our clients at different stages of their retirement journey proves these emotions to be true even for retirees in Singapore. As such, we advocate a holistic retirement planning model that puts the retiree’s purpose at the centre of all his financial decisions (see Diagram 1). Having a clear sense of purpose gives clarity to the kind of life one wants to live now before retirement and enables him to continue to live this meaningful life even into retirement. It is this clarity that will mitigate the negative emotions throughout the individual’s retirement journey and encourage the individual to live a healthy lifestyle. I have explained this in greater detail in the preceding chapter.

Diagram 1: Holistic Retirement Model | Data source: Providend

The rest of the financial decisions, such as insurance planning, mental incapacity planning, legacy planning are done to support his life’s decision (his purpose). In addition, the individual will need to make sure his monies are properly managed to allow him to live his purposeful retirement life. In this regard, I have shared that there are 4 risks that retirees face:

- Longevity risk – the chance of outliving their retirement savings

- Inflation risk – the prospect of reduced purchasing power over time

- Market risk – the possibility of market volatility affecting their investments and income

- Spending risk – the risk of overspending or underspending during their retirement years

I have also shared throughout this book about our RetireWell™ methodology which allows retirees to integrate all their assets such as investment property, CPF LIFE, insurance endowment plans, private annuities, bonds and equities to mitigate against all the above risks. The concept is simple. By allocating these assets into various “buckets” (investment portfolios) with different risks and returns and invested over different time horizons, the retiree is able to draw down a reliable income stream throughout their lives.

I have also shared that in investing the monies in the investment portfolios, we do not use actively managed funds that employ market timing strategies. This is because, most active managers cannot beat the markets and for those who do, they cannot do it consistently. One reason is that many fund managers simply may not have the skill required to beat their benchmarks over the long run. Even if they do, because of the high fees they charge, it eats into the returns for investors and results in underperformance. Moreover, while there may be fund managers who may have the skill to beat their benchmarks consistently net of the costs, identifying who they are is a challenge. As such, we prefer to use low-cost indexed funds (such as Vanguard) or evidenced-based funds (such as Dimensional Fund Advisors). This approach has proven to deliver the returns we need.

Just recently, I booked a Grab car and when it came, I was pleasantly surprised that it was a Lexus. Once I got up, I went into an interesting conversation with the driver. I asked him if he could make money driving a high-end car. His reply inspired me.

He said it all depends on what kind of life you want. He said for him, he enjoys a simple life, doing what he likes. That to him is driving a good Grab car and having the flexibility to go for a few vacations a year with his wife. In order to do that, he and his wife are very thrifty on their day-to-day expenses. They go for trips during off-peak periods and fly, stay, and eat cheaply.

I thought to myself that this guy really understands the meaning of first making a life decision and letting all his financial decisions support his life decision.

He does not begin life by deciding what he wants to own. He starts life by deciding how to live. His most impulsive expense is probably renting a Lexus. But he declutters the other aspects of his life to live it.

So, before you decide how you want your money to be managed in retirement, decide the kind of life you want to live. Decide what you want to live for and how you want to live it. By planning for your retirement this way, you will live life whether now or in retirement, more at peace with yourselves, knowing you are truly living out your purpose and that your monies are being managed the way it is, to enable you to do that.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Southeast Asia’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

Here are the links to the RetireWell™ eBook chapters:

- Part 1: Drawing Down Retirement Money

- Part 2: A Tale of Two Retirees and Their Fortunes

- Part 3: Ensuring a “Safe Retirement Income Floor”

- Part 4: Investment Philosophy for a Retiree Client

- Part 5: Stock Markets Always Rise Over the Long Term

- Part 6: Setting Aside Adequate Additional Buffers

- Part 7: Capturing Returns Effectively

- Epilogue 1: Purpose-Driven Retirement Planning

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.