When it comes to retirement planning, it is important to consider two phases: accumulation and withdrawal. However, our experience has shown that more emphasis is often placed on the accumulation phase, despite the withdrawal phase being more complex and requiring greater attention.

The withdrawal phase of retirement planning is notably intricate as retirees face various risks during this period, which include:

- Longevity risk – the chance of outliving their retirement savings

- Inflation risk – the prospect of reduced purchasing power over time

- Market risk – the possibility of market volatility affecting their investments and income

- Spending risk – the risk of overspending or underspending during their retirement years

To make matters worse, with the potential for a lower return environment in the future, retirees face increased difficulties in ensuring they have adequate income during their retirement. In this book, we demonstrate how retirees can achieve just that through careful planning.

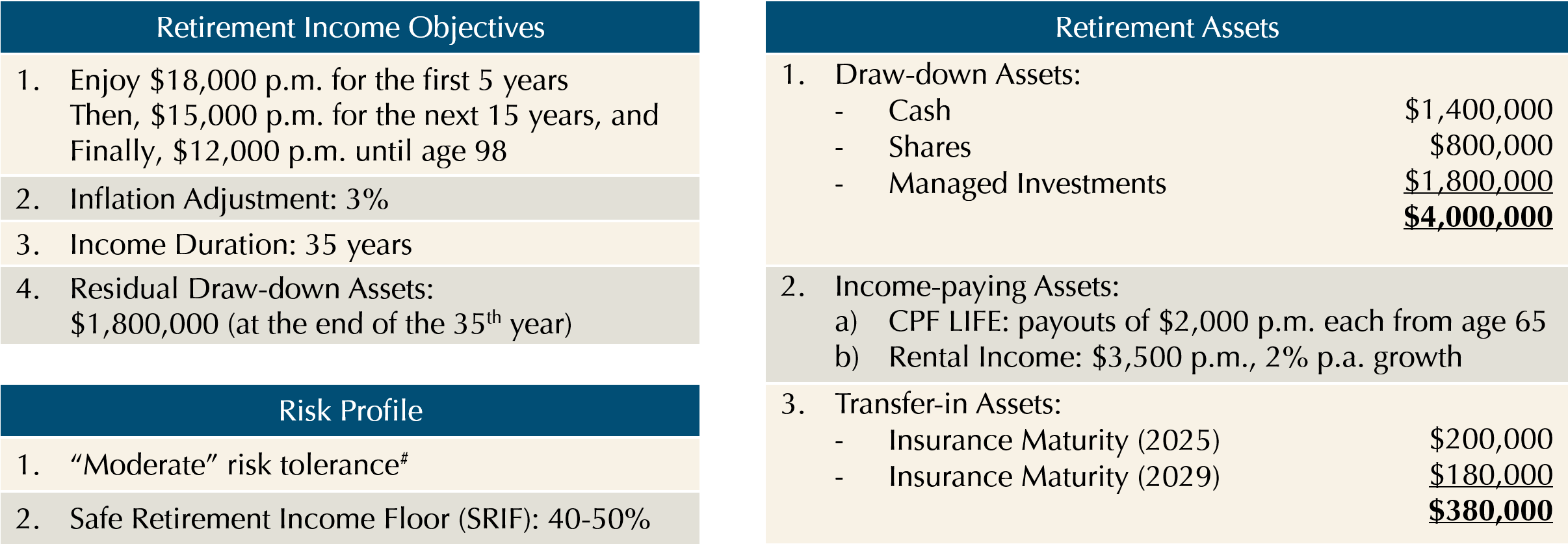

The Case Study of Richard and Eva (Age 60 and 58)

#A retiree risk profile is measured by his safe retirement income floor (SRIF) requirement. A SRIF of 50% means on average, a retiree requires 50% of his income requirement to be certain. The higher the SRIF, the more conservative the retiree is.

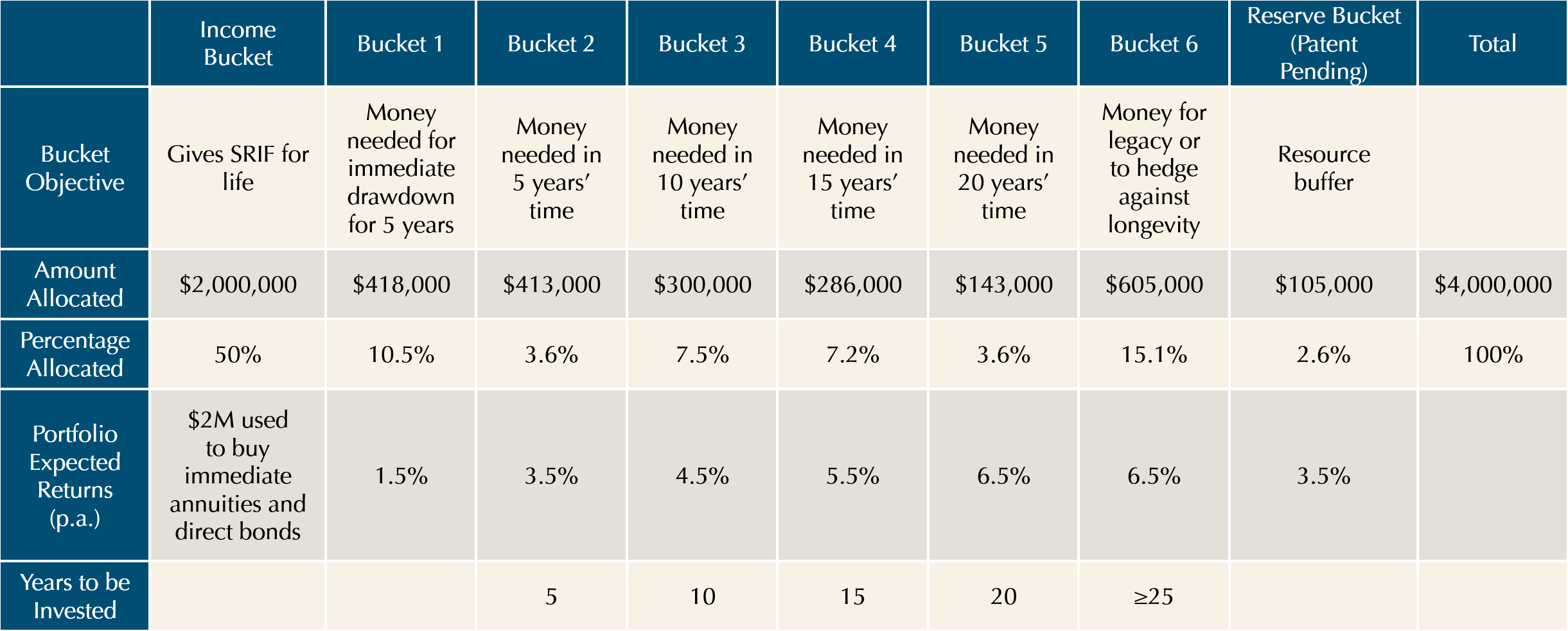

To meet Richard and Eva’s objectives, we can use our proprietary retirement planning tool, RetireWell™, to distribute $4 million of their draw-down assets into the various buckets shown in Table 1.

Table 1: How RetireWell™ Optimiser Allocated Richard and Eva’s Resources | Data source: Providend

How RetireWell™ Works

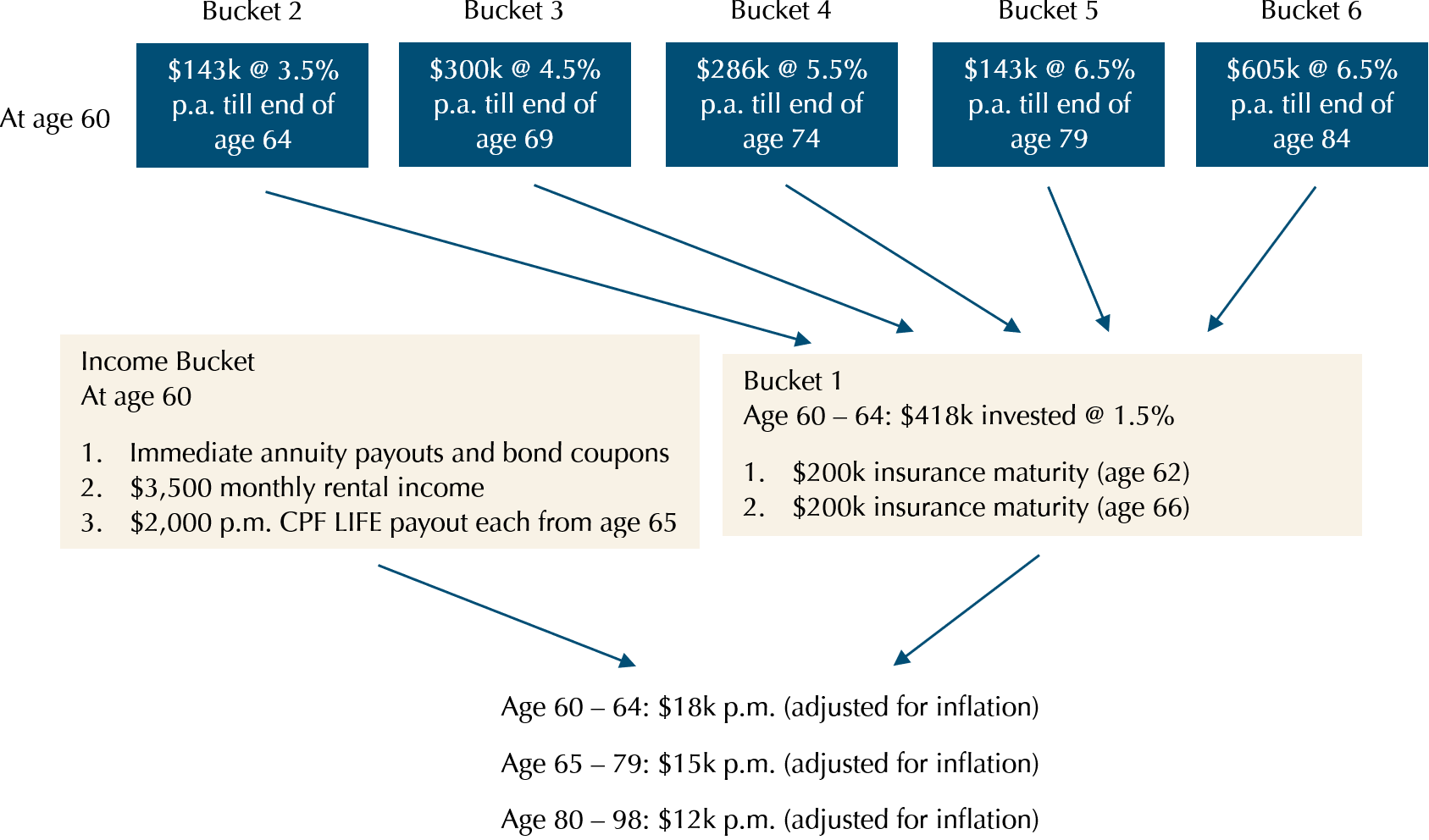

Over the course of 38 years, Richard and Eva will receive a monthly income, which will be annually adjusted for 3% inflation. A fraction of this income will be sourced from the Income Bucket, which furnishes a secure retirement income floor, while the remainder will be drawn from Bucket 1.

Bucket 1 will hold adequate cash reserves to support withdrawals for 5 years. Subsequently, when the cash is depleted, funds from the sale of investments in each of the remaining buckets will be transferred into Bucket 1 at the end of their respective investment periods.

At the end of the 38-year period, when Eva reaches the age of 95, all buckets (excluding the Income Bucket and Bucket 6) will be exhausted. If both Richard and Eva have passed away at that point, Bucket 6 will retain $1.8 million, which will form part of their estate. Should Richard and Eva live on, funds from Bucket 6 and the Income Bucket can be used to continue meeting their needs.

Offering Retirees Security and Peace of Mind

RetireWell™‘s unique strength is its emphasis on maintaining the immediate 5 years of cash requirements in secure instruments such as annuities, direct bonds (Income Bucket) and low-risk, cash-like assets (Bucket 1). This is done to ensure that retirees will have a consistent income stream, regardless of market fluctuations. Funds required later in retirement are distributed across different buckets, in higher return portfolios, invested for longer investment periods. This approach aims to reduce and manage the volatility risk associated with the financial markets.

In addition, a resource buffer is set aside in the Reserve Bucket (patent pending) and invested in a conservative portfolio so that potential shortfalls in periods with muted investment returns can be adequately covered, if necessary.

RetireWell™ can also incorporate a diverse range of assets and instruments that retirees may already have accumulated, and even integrate government schemes.

Using RetireWell™, retirees can enjoy reliability of income with a safe retirement income floor in their retirement years regardless of market conditions, address all the above-mentioned risks and enjoy peace of mind in retirement.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Southeast Asia’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version has been published in The Business Times on 29 October 2016.

Here are the links to the RetireWell™ eBook chapters:

- Part 2: A Tale of Two Retirees and Their Fortunes

- Part 3: Ensuring a “Safe Retirement Income Floor”

- Part 4: Investment Philosophy for a Retiree Client

- Part 5: Stock Markets Always Rise Over the Long Term

- Part 6: Setting Aside Adequate Additional Buffers

- Part 7: Capturing Returns Effectively

- Epilogue 1: Purpose-Driven Retirement Planning

- Epilogue 2: Retirement – It’s About the Kind of Life You Want to Lead

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.