One of the key features of the RetireWell™ planning methodology is to have a portion of assets set aside with the aim of producing a fixed and constant stream of income, rain or shine. Having an appropriate amount of money placed in safe, income-producing assets is important in ensuring that regardless of the market fluctuations, retirees have a basic income that they can rely on. This alone addresses, in part, three key needs of retirees.

These are:

- The need to hedge against living too long, so that their money will not run out before they do.

- The need to have a minimum monthly sum to meet expenses regardless of financial markets volatility.

- The need to mitigate the risk of overspending in the earlier years of retirement leaving insufficient money towards the end of retirement.

The “Income Bucket” in our RetireWell™ methodology is meant to take care of these needs.

RetireWell™ Income Bucket

The Income Bucket is designed to provide a controlled and consistent income stream for life, regardless of the performance of the market. It is what we call a “safe retirement income floor” (SRIF). Instruments that are suitable for this bucket would be direct bonds, private annuities, rental income from properties and for Singaporeans and Singapore Permanent Residents – CPF LIFE.

CPF LIFE

CPF LIFE (which stands for Lifelong Income for the Elderly) is the national annuity scheme run by the CPF Board. Currently, this annuity provides a guaranteed return of at least 4% p.a.

We accumulate the premiums required for this annuity through our working and voluntary CPF contributions and accumulated interest on our CPF account balances. The CPF Board currently guarantees that we will get a minimum return of 2.5% p.a. on Ordinary Account (OA) balances and 4% p.a. on Special Account (SA), Medisave Account (MA) and Retirement Account (RA) balances as well as CPF LIFE.

In order to generate these returns, our CPF is invested in special issues of the Singapore Government Securities (SGS) (otherwise known as Singapore Government Bonds) which are AAA-rated and thus deemed very safe. These bonds are issued exclusively to the Board to meet its interest and other obligations. They do not have quoted market values and the Board cannot trade them in the market.

By investing in Special SGS, we are effectively lending our monies to the Singapore government for a guaranteed 2.5% p.a. to 4% p.a. return with very low risk.

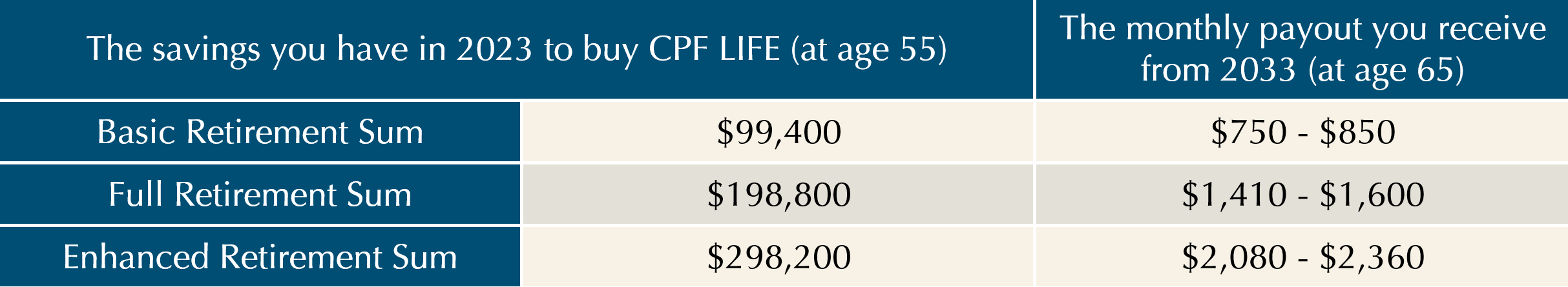

At age 65, depending on the plan you choose (standard, basic, or escalating) and the amount you have in your RA then, you will get a different amount of monthly pay-outs. (See Tables 5 and 6)

Table 5: Different pay–outs per month for different amounts in RA at age 55 | Data source: Providend

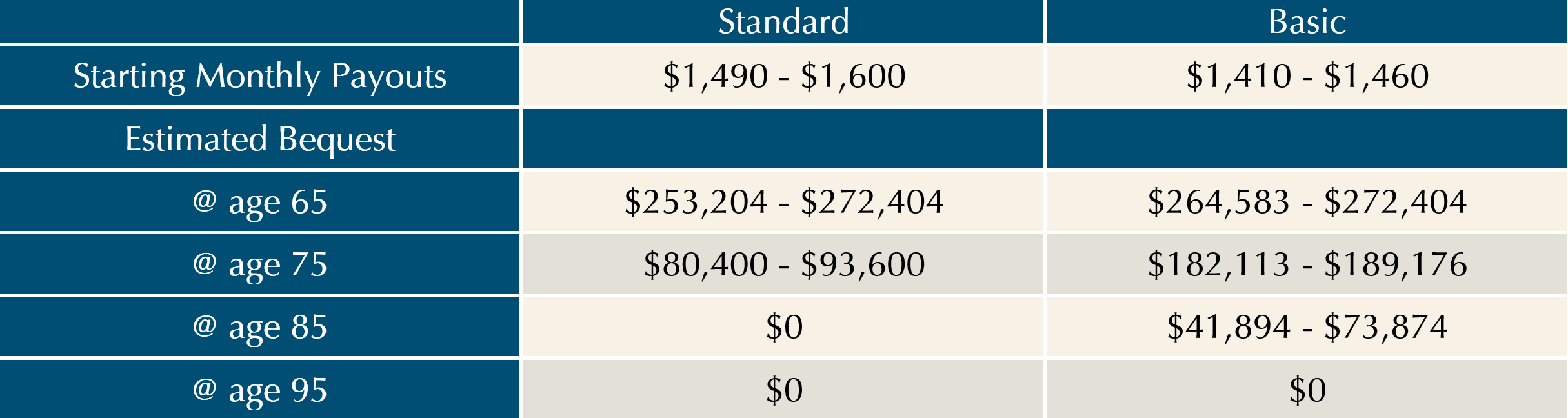

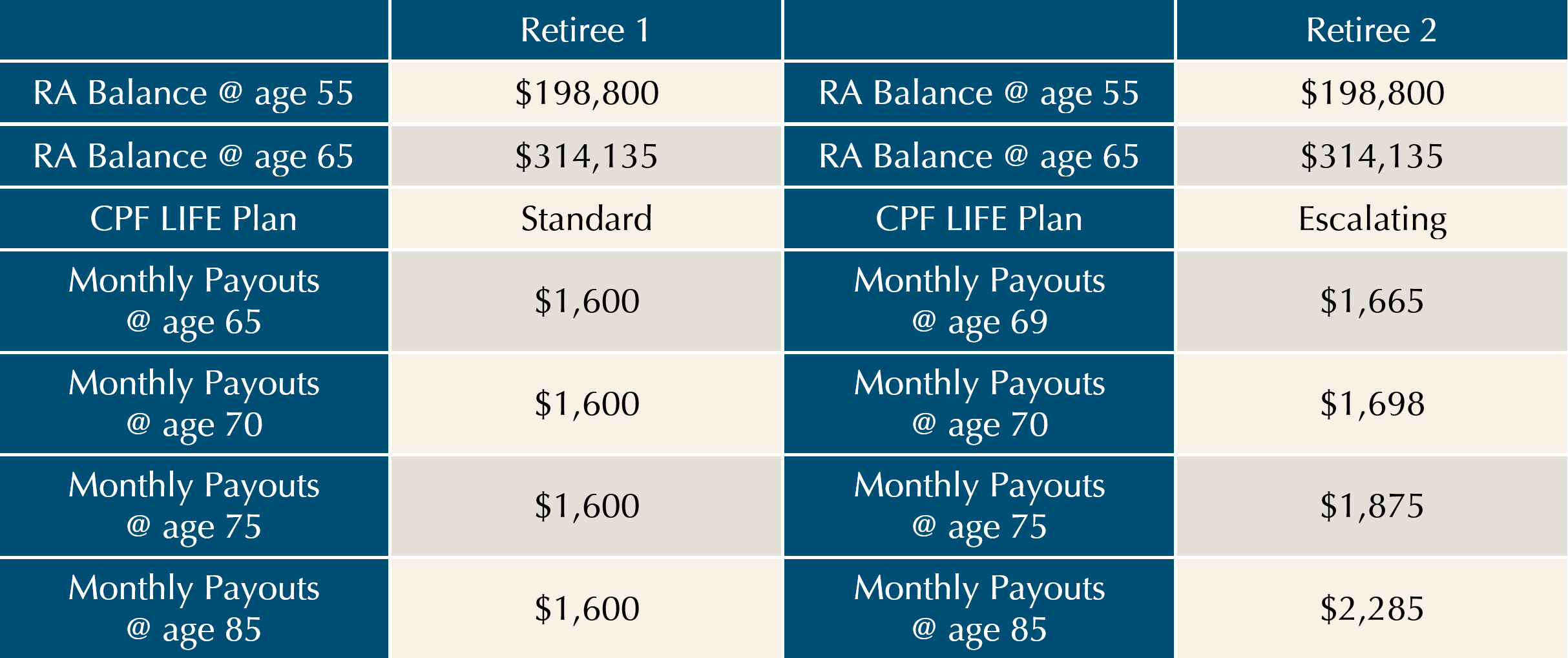

Table 6: Estimation of the different pay–outs and bequest for different plans assuming the Full Retirement Sum of $198,800 currently in your RA at age 55. For illustration purposes only | Data source: Providend

So, which plan should you choose?

If you look at Table 6, the Standard Plan pays a higher payout during your lifetime but a lower bequest upon demise. Conversely, the Basic Plan pays a lower payout but a higher bequest upon demise. The Escalating Plan has the lowest initial pay-outs of all, although they will increase by 2% every year (see the tables in the next section).

Comparing the Standard and Basic Plans, the difference in monthly pay-outs hovers at around $100. However, the difference in bequest amounts is relatively big. The question you should ask yourself is whether the roughly $100 of additional pay-out per month is going to make a material difference to your retirement lifestyle. If the answer is no, from a financial standpoint, the Basic Plan is more suitable, especially so, when the bequest amount is a lot more if death occurs in the later years.

What About the Escalating Plan?

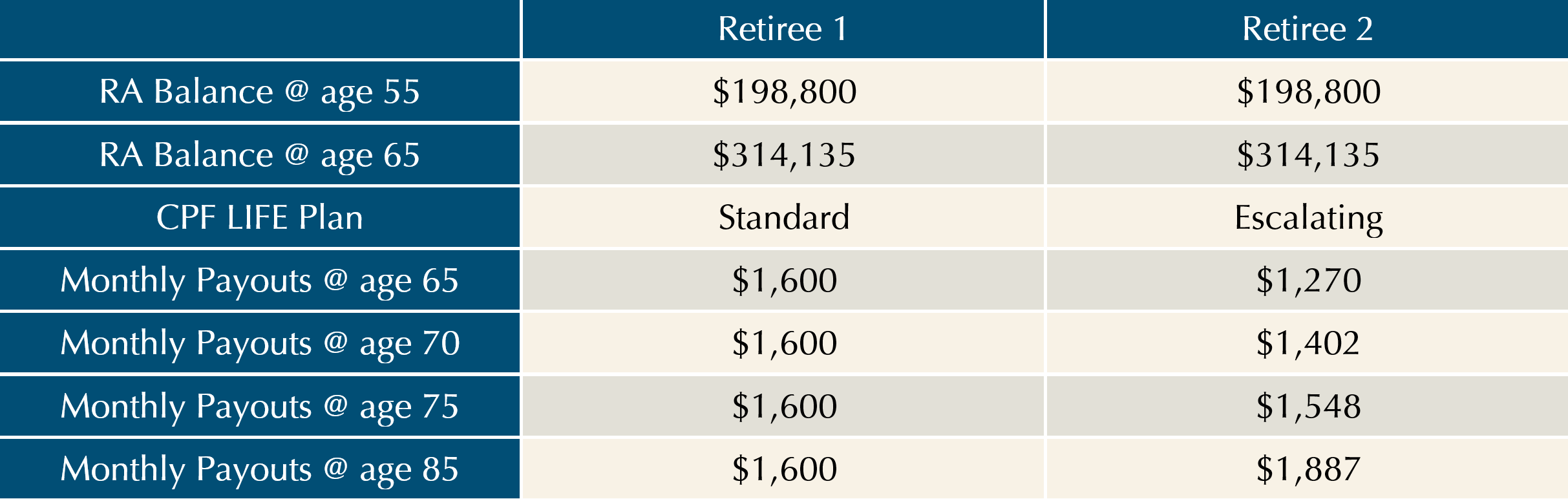

The differentiating feature of this plan is that the pay-outs will increase by 2% p.a. and it is targeted at retirees who want their pay-outs to hedge against increases in cost of living over time. However, retirees who want to choose this plan at age 65 must be prepared to accept that starting pay-outs will be about 20% lower than that of the Standard Plan (see Table 7). If you want the same starting pay-outs as the Standard Plan and yet receive escalating pay-outs, you can either:

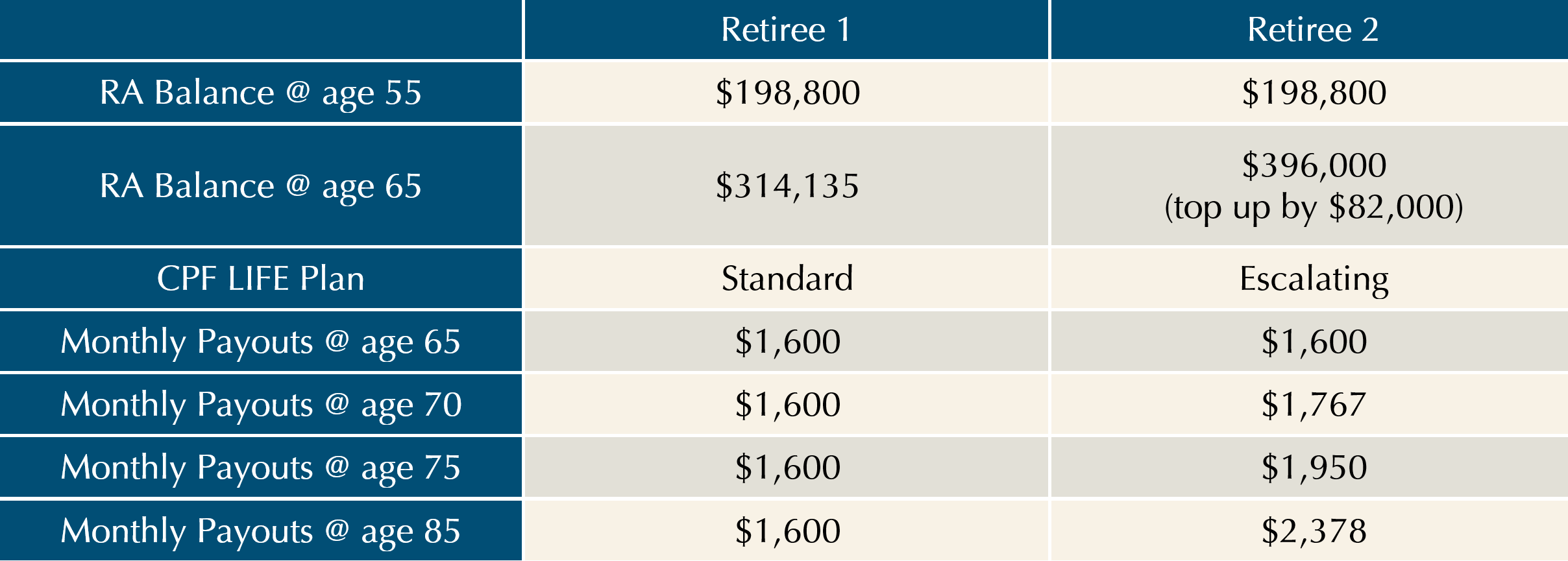

- Top up your CPF LIFE premiums further (see Table 8) or

- Delay your pay-out start age (see Table 9)

Table 7: Different pay-outs for CPF LIFE Standard Plan and CPF LIFE Escalating Plan | Data source: Compiled by Providend; Data from CPF website

Table 8: Topping up CPF LIFE premiums further | Data source: Compiled by Providend; Data from CPF website

Table 9: Delaying pay-out start age | Data source: Compiled by Providend; Data from CPF website

The income bucket is an important component in our planning for retiree clients. It is the bucket that gives our clients the safe retirement income floor throughout their lives, regardless of financial markets’ performance. It also mitigates overspending risk as the pay-outs are controlled on a monthly basis. CPF LIFE is an excellent scheme to use because of its high guaranteed return relative to the low level of risk required. Although there is a maximum you can buy (currently you are only allowed to top up a maximum of $298,200 into your RA at age 55). Where suitable, it would be a good idea for you to make full use of this low-cost annuity scheme. You will not find a better annuity in Singapore.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Southeast Asia’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness”.

The edited version has been published in The Business Times on 27 May 2017.

Here are the links to the RetireWell™ eBook chapters:

- Part 1: Drawing Down Retirement Money

- Part 2: A Tale of Two Retirees and Their Fortunes

- Part 4: Investment Philosophy for a Retiree Client

- Part 5: Stock Markets Always Rise Over the Long Term

- Part 6: Setting Aside Adequate Additional Buffers

- Part 7: Capturing Returns Effectively

- Epilogue 1: Purpose-Driven Retirement Planning

- Epilogue 2: Retirement – It’s About the Kind of Life You Want to Lead

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.