This article is a two-part series and you can find part 1 here.

Given the cost of the delivery options, check-ups, cost of complications during prenatal & delivery and potential congenital illness costs, how could the available insurance plans help?

In this section, we go through the types of insurance plans that may be applicable to address these worries.

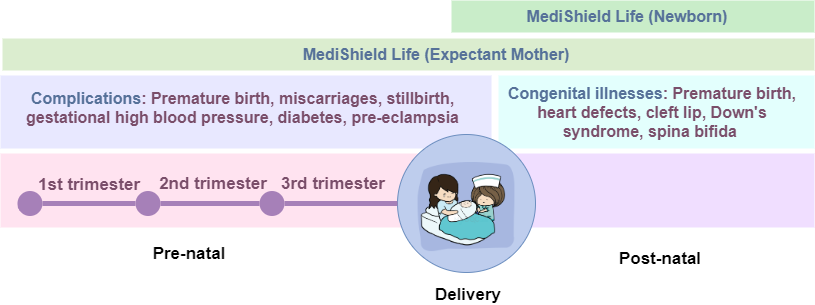

MediShield Life

All Singaporeans and permanent residents are covered with MediShield Life when they are born. MediShield Life is the most basic health insurance, designed to help Singaporeans pay for larger B2/C class wards hospitalisation bills.

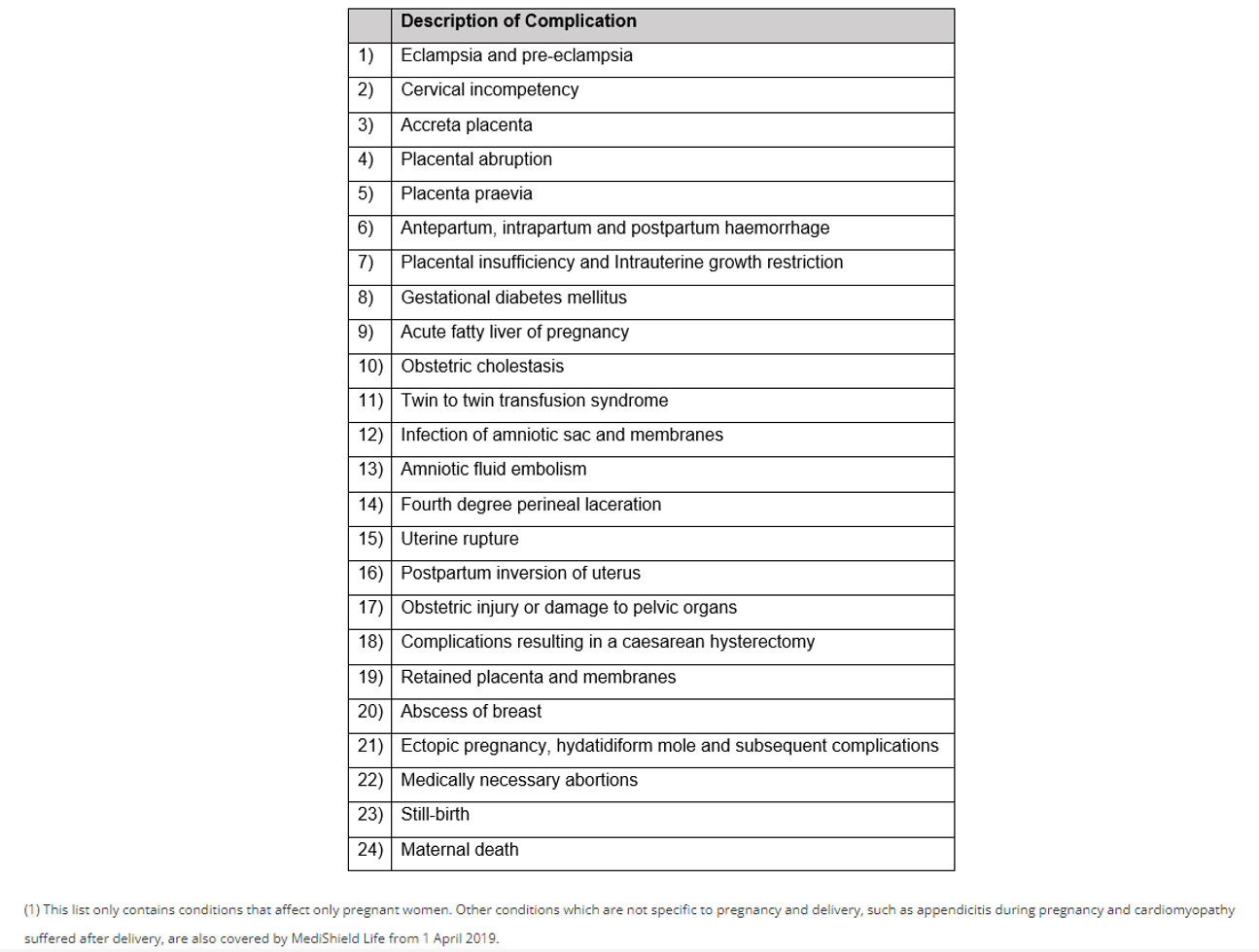

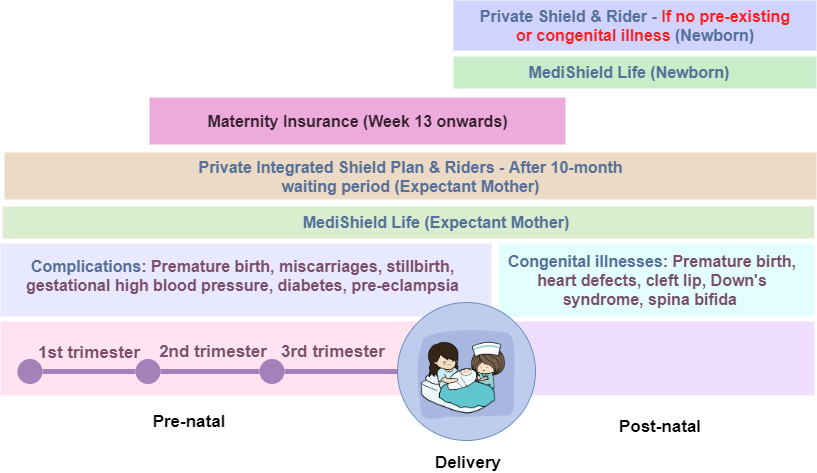

Expectant mothers admitted to B2/C class wards inpatient during pre-natal, delivery and post-natal can be covered for inpatient treatments up to $150,000 annually. This coverage extends to serious pregnancy and delivery-related complications listed in MediShield Life:

Newborns are also covered under MediShield Life when they are born.

Expectant parents will be glad to hear that a child diagnosed with congenital conditions after 1st March 2013 will be covered by MediShield Life. This means that Singaporeans and permanent residents have a basic healthcare layer to fall back upon if they are diagnosed with congenital issues.

Bryler Tan became one of the first patients to benefit from this change.

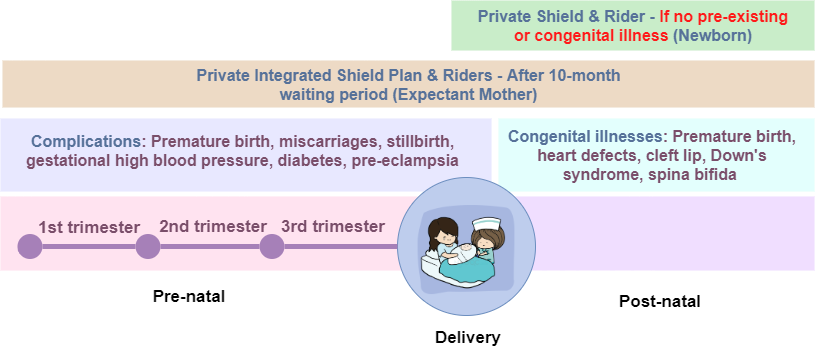

Private Integrated Shield Plans & Riders (IPS)

MediShield Life provides us with a basic healthcare protection layer. However, some of us may prefer higher grade healthcare options such as inpatient and outpatient treatment in B1/A class wards in government restructured hospitals and private hospitals.

Private insurers provide higher grade health insurance coverages through their integrated shield plans such as Prudential’s PRUShield, Great Eastern’s GREAT SupremeHealth, Singlife’s MyShield, AIA’s HealthShield, AXA Shield, and Raffles Shield.

Inpatient pregnancy complications are typically covered by integrated shield plans – As charged, which means the cost incurred due to the pregnancy complication is fully covered under the plan limit. However, do note that most IPS has a 10-month waiting period before you can claim for pregnancy complications.

Typically, private insurers do not cover newborns with congenital problems. Thus, a child with an immediately discovered congenital problem has to rely solely on MediShield Life.

If the newborn does not exhibit congenital problems initially, the parents can purchase IPS for the newborn. Do take note that there is also a waiting period before the IPS is able to cover the congenital problem. The waiting period is one of the main reasons for parents to help their newborn apply for an integrated shield plan as early as possible.

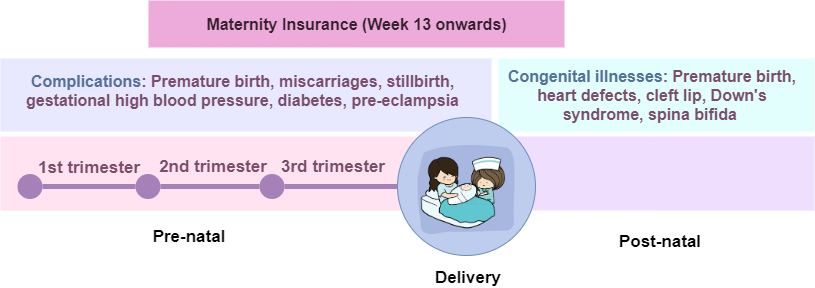

Maternity Insurance

Local private insurers have come up with maternity insurance plans that sought to address expectant families’ prenatal needs. Some of these plans include AIA’s Mum2Baby, AXA’s EmpoweredMum, GE’s GREAT Maternity Care, Prudential’s PRUMum, and Singlife’s MyMaternity Plan.

The main assurances provided by these maternity insurance plans are:

- Coverage for hospitalisation due to pregnancy complications

- Coverage for protection against congenital illness for newborn

- Lock-in insurability for the newborn

Different maternity plan providers have unique benefits but the assurance for the above is what most expectant parents are concerned about and willing to be insured.

Typically, expectant mothers can only purchase maternity insurance and be insured from week 13 onwards and the coverage could last up to 3 to 6 years depending on the plan.

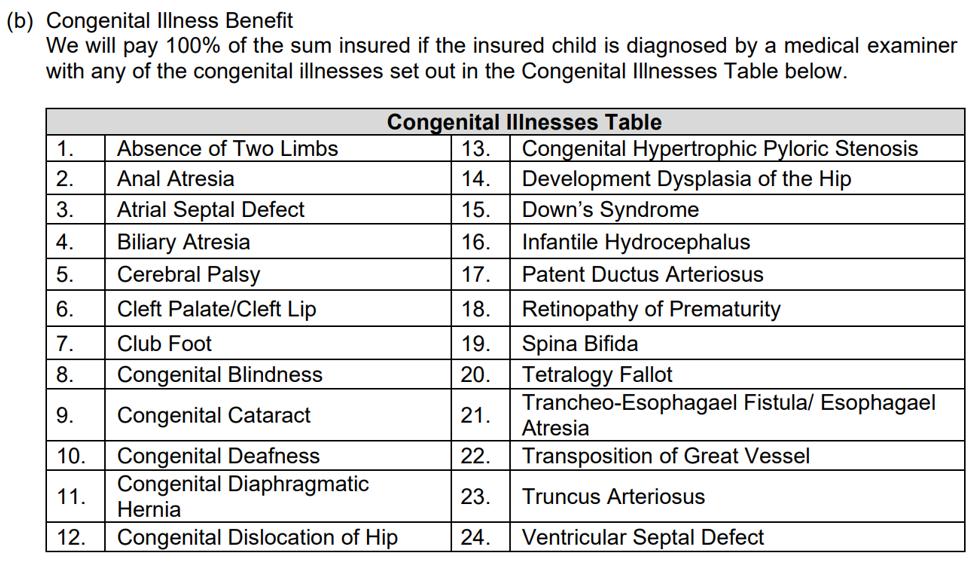

Maternity insurance does pay out the sum assured if the medical examiner diagnoses other/additional medical complications. This set of medical complications covered by maternity insurance may differ from insurer to insurer.

The table above shows the range of congenital illness benefit covered by Singlife’s MyMaternityPlan.

Typically, the maternity insurance will pay out 100% of the sum assured if the insured child is diagnosed with these congenital illnesses listed under the plan’s coverage. In the current market context, the sum assured that the expectant mother can apply is between $5,000 to $30,000. The lump-sum sum assured may defray some of the short-term costs to get the best care for the newborn and help supplement the income shortage for the family.

The sum assured from private health insurance and local maternity insurance would be very limited in providing money for a lifetime of treatment and lifestyle adjustments necessary due to the congenital illness.

One of the big worries of expectant parents is whether their shield plans and maternity plans alleviate the cost of premature birth and long neonatal intensive care unit (NICU) stays. Premature births can range from a few days to… a long time. The costs could reach seven-figures or six-figures.

Majority of the local maternity insurance plans would pay 1% of the sum assured for each day of hospitalisation, up to a limited number of days for the contractual term. Typically, the number of days is up to 30 days.

Given that the sum assured of these maternity insurance plans currently ranges from $5,000 to $30,000, the maternity insurance will alleviate $1,500 to $9,000 of this cost. This means that if the NICU stay is long, local maternity insurance may not alleviate much of the cost.

Long preterm NICU stays remains a risk that is challenging for expectant parents to tackle, excluded by private health insurance and the monetary payout of maternity plans are not enough to alleviate our worries.

One of the biggest benefits of getting a maternity insurance plan is to enable expectant parents to lock in the insurability of their newborn if a congenital illness arises after birth.

In most cases, the insurer is likely to reject the insurance application if the child is born with a congenital illness.

However, if the expectant mother is insured under local maternity insurance, it would allow the newborn to be insured with a Life policy as well as health insurance with exclusions related to the congenital illness.

For example, a local insurer’s maternity insurance allows the mum or dad to purchase a Life policy and the child can be insured on their private shield plan, up to restructured government A ward, without the need for medical underwriting. If the Life policy is bought under the expectant mother as the life assured, it is transferrable to the child without medical underwriting up to a certain limit.

However, the child will not be covered for any pre-existing conditions or congenital illness for the rest of the child’s life discovered within the free first year and before.

Through maternity plan, it creates a child’s insurability in the future should there be any unforeseen congenital illness. Especially securing insurability in ISP coverage for the rest of the child’s life to be a great advantage as the duration of care and the magnitude of the cost that the plan will defray in the future can be potentially long and high.

Strategies for Maternity & Young Child Protection

It can be quite confusing for parents to think about how to plan for the protection needs of their newborn.

We would like to give some guiding principles.

Each of our child has different set of health profile, and our financial resources are different and so there is no one size fits all. This means that we have to prioritise our protection goals and channel our resources to manage the areas that have the greatest impact, or highest monetary impact or both.

Here are some protection goals, ordered from most important to the least.

Protection areas that are strongly recommended to be in place:

- Adequate health insurance, disability income for the parents. The income from working parents is the most important in the family because the children, other dependents rely on that to give them a good life.

- Advanced-stage critical illness coverage for the parents. In the event that the parents suffer from a late-stage critical illness, they would have to spend money on alternative care, lose their income because they might not be able to work, which will greatly impact their ability to take care of their child.

- Life insurance coverage for the parents. In the event that any one of the parents passed away, there are enough funds to pay off any liabilities, and provide income for their dependents.

- Health insurance for the child. Inpatient and outpatient treatment for individuals may be the most frequent healthcare cost that you wish to insure for. It is common for newborn to be admitted into hospital for check-up due to some conditions. If we apply for our child when they are in a clean bill of health, it will assure coverage for the grade of medical care you prefer them to have access to without exclusion.

The message here is to ensure that parents take care of the insurance for the important areas here before focusing on the child.

Do You Need to Buy Maternity Insurance?

The case to purchase a maternity insurance plan to alleviate expectant parents’ worry over pregnancy complications and possible congenital illness is weaker due to the breadth of coverage that the family have through MediShield Life and private integrated shield plan, and that the sum assured can only address short-term congenital medical illness needs.

The maternity insurance plans are limited in care for the big worries such as long NICU stays or the costs if parents decide to switch from natural birth to C-section.

That said, the biggest benefit to the expectant parents to get a maternity insurance plan is to lock in the future insurability of the child to a certain degree. Most maternity insurance plans will allow the parents to purchase insurance plans or transfer the plans bought together with the maternity plans eventually to the child without any medical underwriting up to a certain sum assured.

However, do note that any pre-existing conditions and congenital illnesses are excluded from coverage. Despite this, it would allow the child to have at least greater healthcare options for treatments that do not involve congenital issues. Hence, it hedges the child’s long-term healthcare to a certain degree.

It is strongly recommended for parents to apply for a private integrated shield plan for their child as early as possible. Some insurers allow the application to be submitted upon having a birth certificate.

Here are some protection areas to think about if you have more financial resources, or are in more unique situations:

- Advanced-stage critical illness coverage for the child. The lumpsum payout would help alleviate a large part of the expenses incurred by the parents, and perhaps allow one spouse to temporary leave their job to take care of the sick child.

- Early-stage or multi-pay critical illness coverage for the child. This protection need is lower in priority than #1 in that assuring against advanced-stage illnesses is more important, but if the expectant parents have adequate resources, and do not mind having more comprehensive critical illness coverage may consider this type of plan.

- Personal accident policy for the child.

While we normally advocate term insurance to cover late-stage critical illness or life insurance, the premiums to cover an infant for whole life through a limited whole life plan with critical illness riders are as competitive as the premiums to cover an infant with term insurance.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s first fee-only wealth advisory firm, and Chief Editor of Investment Moats, Singapore’s most well-read financial blog.

For more related resources, check out:

1. The Journey to Parenthood Part 1: The Many Unexpected Maternity Costs

2. On Life Transitions, Legacy and Money

3. The Case for Term Insurance

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.