Pregnancy can mean the beginning of a new stage in a woman’s life, with all the changes that new stage can bring. There are the obvious ones such as the cravings, fatigue, nausea, and changes to your body shape.

But there are also the pragmatic aspects such as financial and social change.

A lot of my friends told me that emotionally they swung fast from overjoyed to a mixture of anxiety and happiness about bringing a new life into the world and being wholly responsible for it.

Part of the anxiety may be due to the number of decisions that expectant parents have to make that was unfamiliar to them. One of the considerations that would pop up is whether to buy some sort of maternity insurance plan or not to buy.

Did all my friends get maternity insurance? Is it a good-to-have or a must-have for every responsible expectant parent?

What may perplex many expectant parents is when they tried to find information on how to have a coherent maternity protection strategy, they get led to content by insurers on their maternity insurance plans. The focus of the content invariably centers on the positives of maternity insurance, but it leaves expectant parents wondering if maternity insurance is the only protection standing between them and potential financial pain.

We want to change that.

In this article, we want to shed light on what are some of the potential risks expectant parents may face in their parenthood journey. We will also explain to you the common insurance protection available and their breadth and depth of coverage.

We hope that by the end, you have a good sensing of your overall maternity protection strategy, whether you have any protection shortfalls and what you can do about it.

The Journey to Parenthood

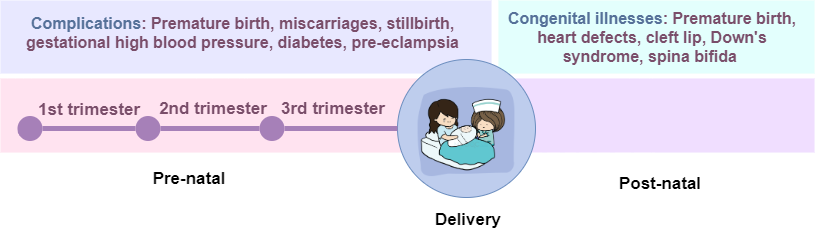

To bring your baby to this world, expectant parents go through a journey of check-ups, consultations, and classes before the eventual delivery day come. We largely classify the milestones expectant parents will go through in three phases: Pre-natal, Delivery, and Post-natal where we understand how much the expectant parents can be financially prepared.

Pre-natal

Prenatal refers to the phase of life when you are pregnant or areas to consider when you are pregnant.

There are a series of services that you need to engage in leading up to your pregnancy. They usually cost money either as a standalone session or as a package and different gynecologists charged differently.

- Pre-natal check-ups for the First trimester. It is mainly to ensure the pregnancy is developing well and to calculate the expected due date.

- Pre-natal check-ups for the Second trimester. It is mainly to ensure that the expectant mother is in good health and to check for any structural anomalies in the fetus.

- Pre-natal check-ups for the Third trimester. It is to monitor and assess the growth and well-being of the fetus.

- Pre-natal classes. Classes that provide guidance on labour, baby care, lactation skills, and proper nutrition.

- Childbirth delivery options and types of hospital stay. There are 3 options in childbirth delivery – natural unassisted delivery, assisted delivery, and Caesarean Section. Choice of government or private hospital stays.

Expectant parents should budget for the costs of check-ups and classes, considering the level of care and service quality that is acceptable during the prenatal period as these costs are usually out-of-pocket.

Expectant parents may also be concerned about complications during prenatal periods such as premature birth.

Delivery

Expectant parents would usually be filled with a mixture of excitement but also anxiousness about how things will go. In most cases, you would be admitted to the hospital of your choice for delivery.

Expectant mothers usually go into labour sometime between week 37 and week 42 of pregnancy. If labour roughly occurs before 37 weeks, the birth is usually considered premature or preterm.

The experiences of delivery may differ for each expectant mother. Some can go through the process as they wished but for others, there may be complications such as prolonged labour, fetal distress, excessive bleeding, etc. As such, expectant parents may be concerned about the emotional and financial implications.

Post-natal

Once the expectant mother gives birth, the mother and newborn would have to be carefully cared for at least for the first 6 weeks. The parents and newborn would need to make regular visits to the doctor to check whether everything is okay.

Expectant parents would be concerned if their child is discovered with congenital issues. Depending on the issue or illness, medical treatment could be short-term, and able to be treated immediately (such as mild Jaundice), but more serious issues (such as congenital heart defects) may require longer-term care.

New parents would also be concerned and wish for greater clarity regarding the type of insurance protection plans that they should get for their newborn. As most of us have limited financial resources, new parents should prioritise and have a sound strategy to think about scaling up and protecting their baby when they have more resources.

Unexpected Maternity Costs That May Worry Expectant Parents

There are some costs that you will expect to pay for but what may usually worry expectant parents more are the unknown costs due to their lack of knowledge and experience.

In general, they fall into two categories:

- Complications of Pregnancy

- Congenital illness

Common Complications of Pregnancy

Some expectant mothers may experience health problems during pregnancy. Some may result in complications that may impact the mother’s health, the fetus’s health, or both.

Based on our research, the top 5 pregnancy complications are:

- Premature birth

- Miscarriages, stillbirth

- Gestational high blood pressure

- Gestational diabetes

- Pre-eclampsia

These could be on your mind when you think about the potential financial costs that might be incurred as they will relate to inpatient treatments in hospitals and medical facilities.

A common concern of expectant parents is whether the cost of C-sections would be covered by medical insurance as the cost can vary, ranging between SGD$12,000 to SGD$20,000.

Some parents may choose a natural delivery initially. However, during delivery, there may be serious complications that require the would-be mother to undergo an emergency C-section procedure.

However, there are also situations where the delivery is too prolonged, and the expectant parents eventually opt to switch to a C-section. These are considered elective C-sections.

Insurers treat these two types of C-sections differently. With the doctor’s assessment that there are serious complications and required an emergency C-section, this is covered under normal health insurance plans assuming the complicated conditions are covered. However, elective C-sections are usually not covered by insurance except global health insurance.

Congenital Illness

3% to 4% of babies are born with some type of congenital illness – health problem or physical abnormality. They can be very mild or severe or even life-threatening, in which the baby may only live for a few months.

The most common congenital illnesses are:

- Heart defects

- Cleft lip/palate

- Down’s syndrome

- Spina bifida

Expectant parents are especially concerned about the short-term and long-term well-being of their newborn.

At some point, expectant parents would be worried about the financial implications. Newborns with congenital illness may need extra care during the initial years, perhaps surgery to correct certain aspects of the illness to give the child a better life going forward. For others, the costs may be more long-term.

Premature birth is a birth that takes place more than 3 weeks before the baby’s estimated due date. Or a birth that occurs before week 37 of pregnancy.

When the baby is born can range from late preterm to extremely early preterm. A baby that is born preterm could have complicated medical problems subsequently.

Premature birth can be classified as a complication during delivery or as a congenital illness so we could actually categorise this in either the section before or this, but we choose to label it under congenital illness.

Premature birth is a big area of worry because it is emotionally tough for parents to see their newborn going through the ordeal. Financially, the burden can be quite hefty.

When a baby is born preterm, certain organs might not have developed fully so they would need special care. Preterm babies are moved to a special area of the hospital called the neonatal intensive care unit (NICU). The NICU has advanced technology and trained healthcare professionals to give special care for the tiniest patients.

The cost of NICU stay can be very expensive, depending on the length of stay. The daily room rate of an NICU averages $200 a day to $750 a day. This cost depends on the level of care needed. If the baby is born very far from the planned gestation, then the stay would be longer, and the cost will be higher.

In 2021, Channel NewsAsia announced that little Yu Xuan stayed 13-months in NUH NICU, making her the longest-staying baby in NUH’s unit. The total cost of Yu Xuan’s stay comes up to S$230,000.

In April 2022, Today profiled Sherlyn Chua, who was born extremely preterm and had to stay in the hospital for 400 days. The parents revealed that the hospital bill is a “seven-digit figure”.

Not all congenital illnesses run into this length of duration, but it can still be a challenge for expectant parents to navigate this.

This is an original article written by Kyith Ng, Senior Solutions Specialist at Providend, Singapore’s first fee-only wealth advisory firm, and Chief Editor of Investment Moats, Singapore’s most well-read financial blog.

For more related resources, check out:

1. The Journey to Parenthood Part 2: Managing Potential Maternity Costs with Insurance

2. Will a Medical Crisis Break You and Your Family?

3. How to Make Your Child a Millionaire on $1 per Day

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.