Last month, I wrote a piece in this column that took an honest look at ESG investing. The conclusion was that

- We cannot conclude the ESG companies will give higher expected returns.

- Fund managers using ESG strategies as their mandate may not consistently deliver higher returns.

- Cost of implementation matters.

I also highlighted the difficulty in assessing the impact of ESG of a company is due to many ESG data providers using different approaches to assess ESG. Despite this challenge, we still decided to move quickly and worked with our investment partner, Dimensional Fund Advisors to launch two SGD share classes of their ESG funds for investors in Singapore – Global Sustainability Core Equity Fund and Global Sustainability Fixed Income Fund. And as part of our commitment to contributing to a better world, we put our company’s treasury money and my personal funds into these two funds even before our clients started investing in them. Why this move?

Alignment with our investment framework

As a fund manager, Dimensional is honest to say that there is not enough evidence to show that there is a consistent relationship between ESG investing and better returns. And since it is the style of the managers that deliver the returns, we need a manager that invest in a way that aligns with our investment framework. We believe that for an investment to generate long-term returns, it must participate in and contribute to global economic production and instead of investment based on market speculation, it must be based on real market return data observed across multiple economic and market cycles. And we are also convicted that an investment portfolio should be well-diversified to enhance its risk-return trade-offs. In addition, we should keep cost of investment implementation low as the lower the costs, the more the net return. We chose Dimensional ESG offerings because they meet all the above which I will elaborate further.

Robust and evidence-based investment process

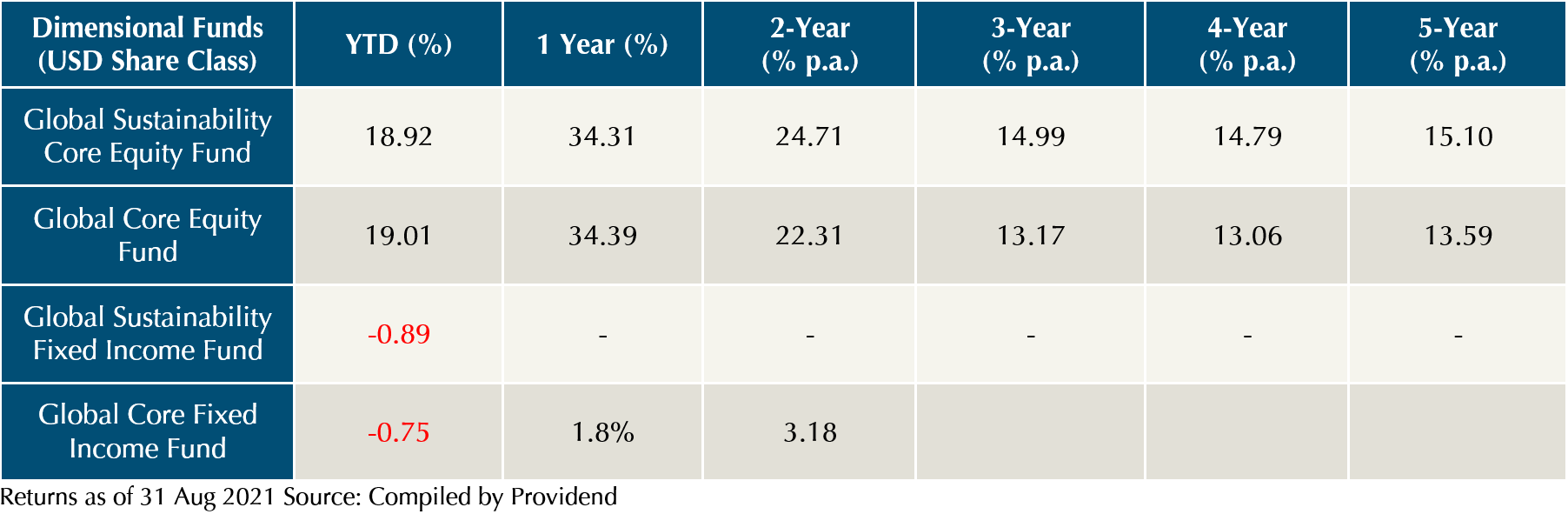

Dimensional built all their investment portfolios based on evidence and sound investment principles. Instead of trying to outguess markets, their funds stay invested in different sectors and countries through the best and worst of times. And instead of trying to pick mispriced securities (which is what most fund managers try to do), Dimensional trust prices and invest in thousands of issuers of stocks and bonds (this is more diversified than index funds) because they believe that asset prices quickly adjust to reflect all available information and it is futile and too costly to try to capture the mispricing. In addition, Dimensional tilt a portion of their portfolios to small caps, value, and more profitable companies. Evidence from across time and geography has shown that these companies give a higher expected return. While Dimensional may not be the only manager who believes in this philosophy, they implemented it in a cost efficient and effective way over the past 4 decades. The total expense ratios for the Global Sustainability Core Equity Fund and Global Sustainability Fixed Income Fund are 0.28% p.a. and 0.3% p.a. respectively, low even by non-ESG funds standard.

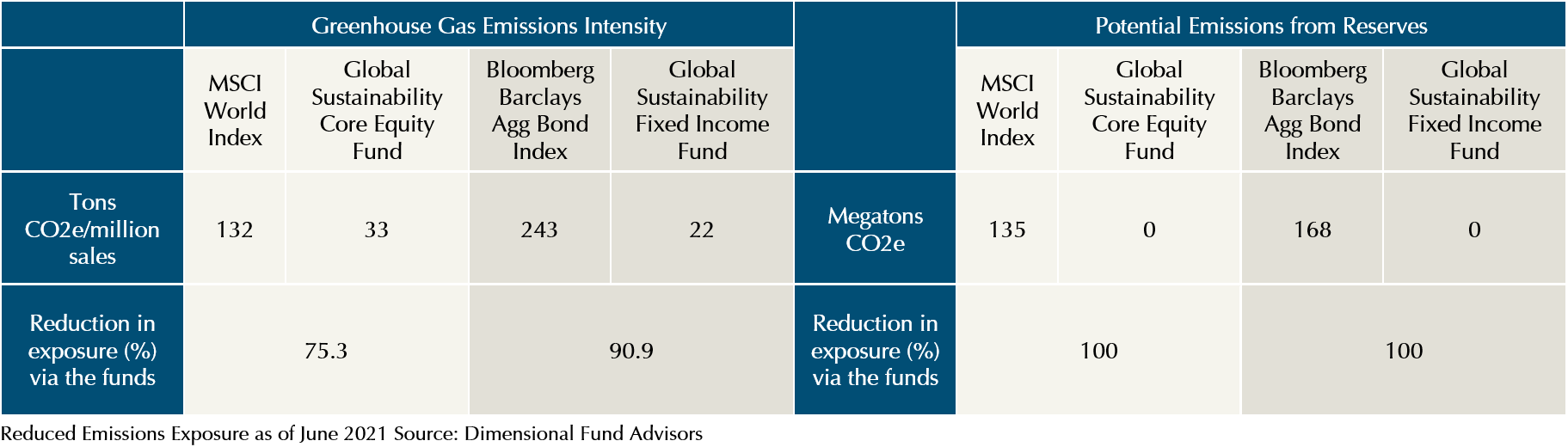

With this as the starting point for their ESG funds. Dimensional then use ESG-related research to identify environmental risks they believe have the potential to impose significant costs on future generations. Extensive evidence points to climate change and greenhouse gas emissions as the main culprit of it. So, they target a meaningful reduction in exposure to greenhouse gas emissions and potential emissions from fossil fuel reserves in their ESG portfolios. To do that, they first obtain the Greenhouse Emissions Intensity (measured by Greenhouse Emissions Amount/Revenue) of the companies and exclude companies who do not meet the mark from their ESG portfolios. The different categories of emissions are:

- Direct emissions from operations that are owned or controlled by reporting companies. An example would be carbon dioxide emissions due to fuel burning by energy companies.

- Indirect emissions from the generation of purchased or acquired electricity, steam, heating, or cooling consumed by reporting companies. Examples would be hotels which use a lot of electricity due to air-conditioning or data centres that consume a lot of electricity.

- Other considerations are potential emissions (like energy companies having reserves that they may burn in the future), oil and gas companies’ toxic spills and companies involved in deforestation (such as palm oil companies).

We like this approach because ESG conscious investors can see the actual reduction in the carbon emissions and the positive impact they are making through their investments (see table).

Dimensional also enhances investors’ value through stewardship, especially in governance. From 1 July 2019 to 30 June 2020, they had 640 engagements with the boards of the companies they invested in on matters such as compensation/remuneration, environmental and social as well as issues on board composition. A stronger governance practice such as improved board oversight and alignment of management and shareholder interests can improve returns and reduce risks. Through their investment process, Dimensional was able to allow investors to contribute to ESG without sacrificing returns (see table).

Launching the SGD share classes of the sustainability funds with Dimensional is a natural outflow of our desire to positively impact the world. We did not do it for higher investment returns but to allow our clients and us to express that desire without losing investment returns needed to enable life goals. Did you notice that it has been getting hotter in Singapore the past few years and when it rains, it is a huge storm? The climate has changed in a bad way and scientists believe that this is due to greenhouse effect that is largely caused by carbon emissions. If you can contribute to a better world for our future generation without sacrificing investment returns, would you?

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation.

The edited version of this article has been published in the Money Wisdom Column of The Business Times Weekend on 23rd October 2021.

For more related resources, check out:

1. Manage Your Finances to Live Your Best Life

2. How Providend Helps Affluent Families Have a Good Investment Experience

3. My Reflection on the True Value of Estate & Legacy Planning

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.