If you are waiting for the right time to invest in the market, that time is now.

You might think I’m crazy. The S&P 500 Index is at an all-time record high, traditional market valuation metrics such as P/E ratios are above their long term averages, and the U.S. market is already in its ninth bull year—the second-longest bull run in history. Many people I’ve spoken to say that they are worried about the level of the market and fear that a market crash is coming, so they are holding onto cash for now.

When Is The Best Time To Invest In Stocks?

If you are doing the same thing—I certainly understand the sentiment. Nobody wants to go into the market at the wrong time and lose money.

But let’s play this scenario out. Let’s imagine that you do invest now, when markets are high, and within a few months, we experience a U.S. financial market crash that is the worst seen in almost a hundred years, with some analysts saying that it could turn out to be even worse than the Great Depression. Let’s say you have the fortitude to stay invested and do not pull out any of your investments. A few years later, several European countries get close to default, and more than a few analysts comment that this may lead to a crisis that is even worse than the financial crisis before it. You stay invested. Then a few years later, China’s stock market goes into a meltdown, leading to a global market rout. Still, you stay invested.

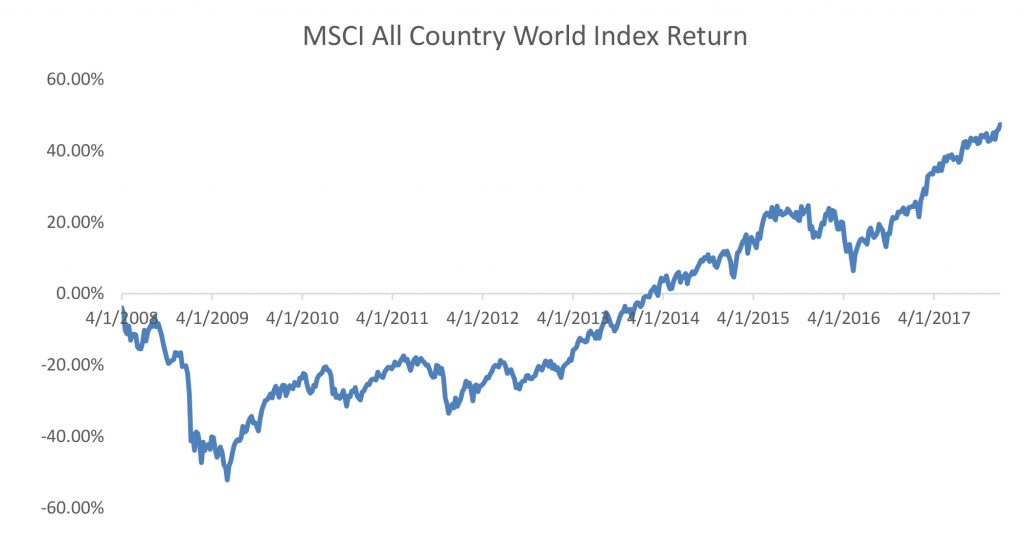

It is hard to imagine a scenario that could be worse than what I’ve described above. Yet you’ve probably realized that this is exactly what investors would have gone through if they had invested in during the year of the Great Financial Crisis. How would have an investor have done? From the beginning of 2008 till the end of September 2017, a globally diversified equity index such as the MSCI All-Country World Index has gone up by 48.74%, or 4.15% per annum (pa).

That doesn’t sound so bad, does it?

Source: Bloomberg. Returns in SGD. Period measured from 1st Jan 2008 to 30th Sep 2017.

But wait, you say. That time was different. The world is a different place now. It is possible that the market will crash soon and be even worse than what we have gone through over the past ten years. A few famous experts have also said the same thing.

Yes, that might happen of course. But what if it doesn’t? It wouldn’t be the first time that experts got their predictions wrong. What if the market continues to go up by 30% over the next few years, then declines by 10%, and then resumes climbing upwards? If you had stayed in cash in this scenario, you would have missed out on a lot of gains, and you would have lost valuable time to grow and compound your money for your retirement years.

Waiting for a crash that never comes can be very expensive.

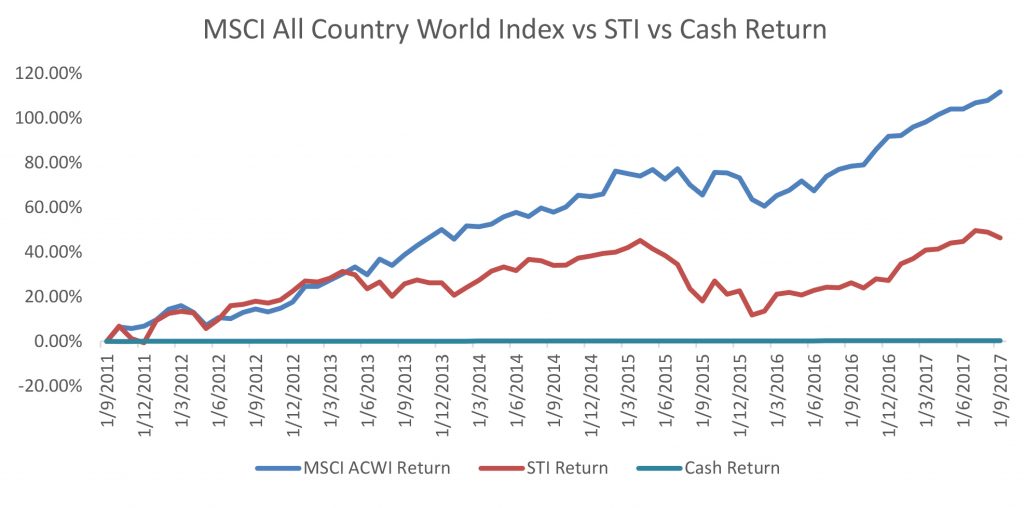

To illustrate just how expensive a mistake that can be, let’s rewind to 2011. At that time, due to the European debt crisis, a famous investor said that the markets were definitely going to crash within a year or two and that it would be much worse than in 2008. If you had therefore held cash since 2011, the opportunity cost would have been staggering. The Straits Times Index has since delivered 46.26%, or 6.54% pa. A globally diversified equity index such as the MSCI All-Country World Index has gone up by 111.93%, or 13.33% pa. Instead, your savings would have earned about 0.05% pa in a typical bank account while being eroded by inflation.

Source: Bloomberg. Returns in SGD. Period measured from 30th Sep 2011 to 30th Sep 2017.

So if you had $100,000 in your savings account in 2011, you would have earned a compounded return of $300.38 after six years. In contrast, the Straits Times Index would have given a return of $46,243.36, and the MSCI All-Country World Index would have earned you $111,869.94[1]. Multiply that amount with respect to how much you actually held, and you have a rough idea of how costly it would have been to stay in cash.

Paying Attention To Market Timing

Great weight tends to be attached to the opinions of industry experts because they’re supposed to know much more than the layperson, but comprehensive studies across decades have shown that, on average, experts tend to get their predictions right only about half the time. One study tracked more than 6,000 forecasts over 14 years from 68 investment gurus and found their accuracy to be about 47%[2]. 47%! You might as well flip a coin. And this is despite the fact that investment experts can spout sophisticated-sounding jargon like Fibonacci retracements, stochastic oscillators, 30-day moving averages, Shiller P/E ratios, yield curves and whatchamacallit. I remember one particularly honest Head of Investments at a foreign bank said at the end of his presentation that if he was so certain that his predictions would come true, he wouldn’t need to be there working on a Saturday morning. If experts can frequently be wrong, I believe it is only wise to accept that we can be wrong too.

Furthermore, timing the market properly requires you to get two decisions right—when to get out, and when to get back in. Let’s assume for a moment that you can find a super-guru who can get 70% of his predictions right, which would be absolutely marvellous seeing as the average investment guru is only 47% right. What would be the probability of this super-guru getting both decisions on when to get out and when to get back into the market correct? The math tells us that would be 49%[3]. Again, you might as well flip a coin (or if you’re bored of that you could try eenie-meenie-miney-mo or some other equivalent).

I wrote earlier that the time is right to be invested because to invest or not to invest is not a binary decision. You don’t have to go all-in or nothing. Just as there is a risk in investing, there is a risk in not investing. It would be more prudent to invest a portion of your cash holdings into a portfolio that fits your need, ability and willingness to take risks—a portion that would allow you to sleep at night while mitigating the risk that you could be wrong about a market crash.

This is an original article written by Sean Cheng, former Portfolio Manager at Providend, Singapore’s Fee-only Wealth Advisory Firm. The edited version has been published in The Straits Times on 15 October 2017.

[1] Do note that these figures are purely based on the Index returns. You cannot directly invest in an Index.

[2] https://www.cxoadvisory.com/gurus/

[3] 70% x 70% = 49%.

For more related resources, check out:

1. Why the Market Might Make A Lot of Sense

2. Retirewell® Part 10: Stock Markets Always Rise Over The Long Term

3. Stay Invested for The Long Term? Think Again!

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.