Can AI Replace a Human Adviser?

Artificial intelligence (AI) tools like ChatGPT are increasingly capable of analysing financial data, generating reports, and answering complex questions in seconds. But the real question is: can AI truly replace a human financial adviser?

In this series, ‘Can AI Replace a Human Adviser?’, we examine real-life case studies of clients navigating major life transitions and put AI to the test against a Providend Client Adviser. As these stories unfold, we reveal what AI gets right, what it gets dangerously wrong, and why human advice may still matter more than you think.

Case Study: How to Plan Wisely After a $3 Million Inheritance

Nicholas, 35, is a regional marketing manager at a multinational firm, earning a take-home income of $80,000 a year. He is single and lives comfortably in a condominium that his parents helped him purchase. Recently, he received a significant inheritance of $3 million following the passing of his father, who had built a successful family business. His mother, now in her 60s, is financially independent and has encouraged him to use the inheritance wisely, not just for comfort, but to build something meaningful for his own future.

Nicholas hopes to make thoughtful use of the inheritance, to grow it responsibly while also giving himself the freedom to enjoy life. He dreams of travelling the world at least once a year for a month, exploring new cultures and experiences, while still saving for the future. For years, his financial habits have been straightforward: regular savings, moderate investing, and living within his means. But the sudden inheritance has made him realise he now needs a more strategic plan. He is considering buying another property, investing more aggressively, or even taking a career break to pursue a passion project.

At the same time, he is mindful of the emotional weight of this inheritance. It represents his parents’ legacy and sacrifices, and he wants to honour that by making sound, meaningful choices. Yet he isn’t sure how to balance prudence with living a fulfilling life.

His question is: “How can I use this inheritance wisely to enjoy life, travel, and invest in my future, while honouring the legacy my parents left me?”

To find out, we posed Nicholas’ exact situation to ChatGPT and asked it to act as their financial adviser. Our Lead of Advisory Team, Chin Yu, reviewed the AI-generated plan, analysed its conclusions, and compared them against what a real human adviser would do. Here is what he found.

What ChatGPT Recommended

As a first step, ChatGPT encouraged Nicholas to take time to process the news of his inheritance and reflect on what “living meaningfully” means to him, beyond travel. It also prompted him to consider how important financial security is, the legacy he hopes to leave, and the kind of impact he wants to make during his lifetime.

Next, ChatGPT recommended securing the basics:

- Emergency Fund: Keep 12–24 months of living expenses in a high-interest account or money market fund. With your lifestyle, this might be around $50,000–$100,000.

- Debt: If your condo has a mortgage, evaluate whether paying down some of it makes sense. Interest rates, tax implications, and liquidity are all factors.

- Insurance & Estate Planning: Make sure your insurance coverage is adequate (life, health, disability). Update your will and consider setting up trusts if needed.

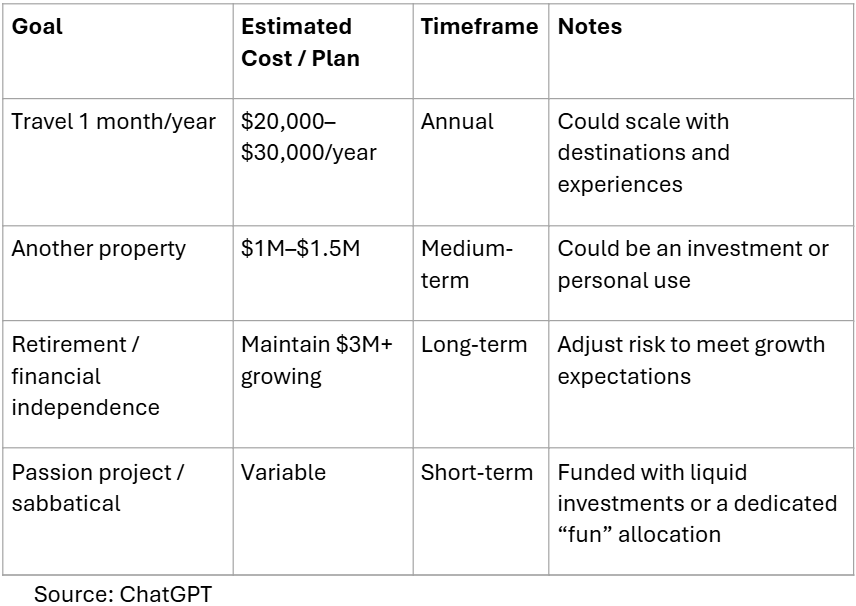

After this foundation was set, ChatGPT recommended that Nicholas prioritise and quantify his goals, so the inheritance could be allocated meaningfully.

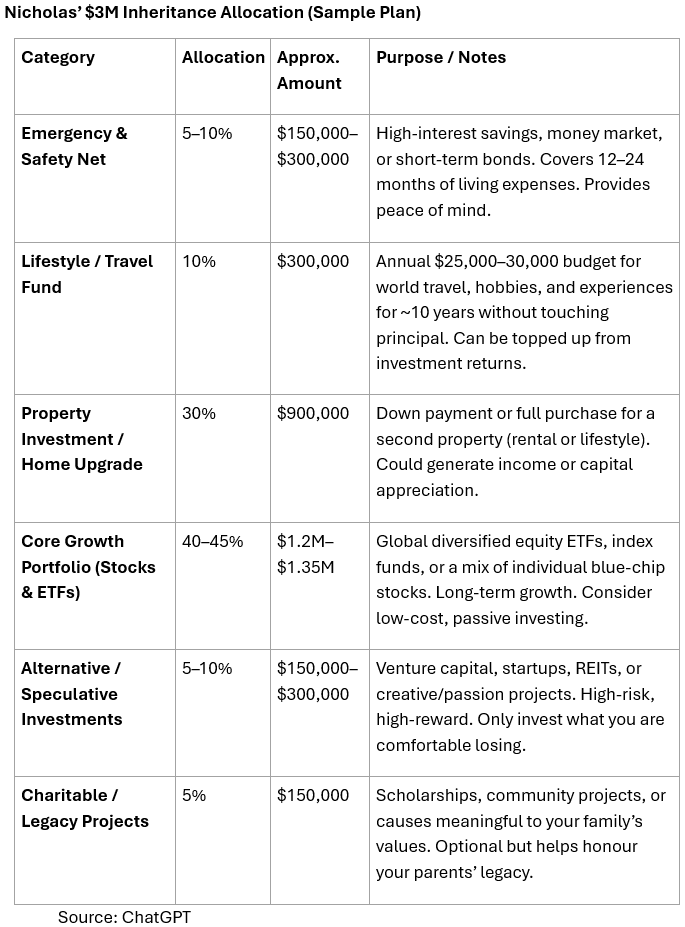

ChatGPT also proposed a broad investment framework for the $3 million inheritance, including capital preservation, a core growth portfolio, a lifestyle allocation, and a small speculative or passion-project allocation. Real estate investment was also suggested as a potential strategy for income or appreciation.

It concluded by offering suggestions on honouring the inheritance through charitable or family-aligned projects, tying the wealth back to personal values.

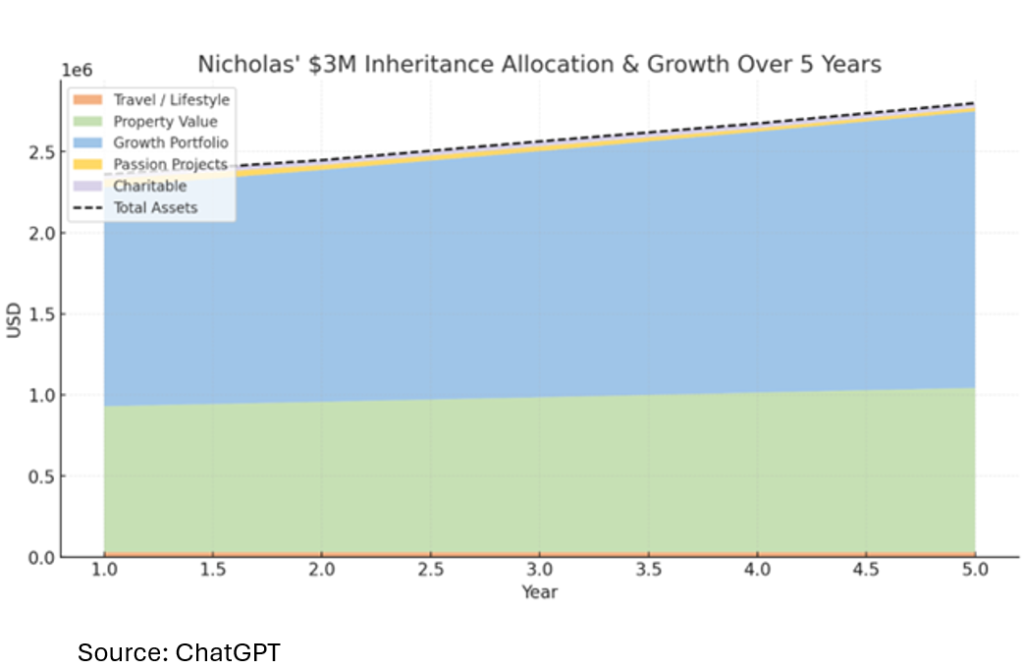

A sample allocation plan for the $3 million was generated, illustrating how the funds could be structured and how they might grow over five years.

Where ChatGPT Worked Well

First, I appreciated ChatGPT’s emphasis on pausing to reflect on the meaning behind the inheritance. At Providend, we often remind clients that life decisions should come before financial decisions. Understanding one’s Ikigai — what brings joy, purpose, belonging, or contribution — is fundamental. Only then should finances be arranged to support those decisions.

ChatGPT also correctly emphasised the foundational steps: emergency liquidity, adequate insurance, and managing debt before investing. These are important hygiene factors that create a stable base for any long-term plan.

Its use of a goal-based investing approach was also sound. This method ties investments directly to meaningful objectives, encourages disciplined investing, and aligns risk levels to time horizons — a robust framework widely used in evidence-based financial planning.

What I Thought Could Be Different

While ChatGPT provided a helpful framework, inheriting money is often an emotional event that requires deeper reflection than a standard financial checklist.

For many, an inheritance is not just a financial windfall; it represents a lifetime of hard work, sacrifices, hopes, and dreams of the person who passed away. Before any investment decisions are made, it is important to understand what the inheritance truly means to Nicholas — emotionally, relationally, and symbolically.

We also frequently see inheritors struggle to use the funds even for meaningful purposes. Although Nicholas’ mother encouraged him to use the money wisely to build something purposeful, many people feel a sense of guilt, detachment, or responsibility when spending inherited wealth. These emotions deserve space and should be explored properly.

Moreover, reflecting on what it means to “live meaningfully” is not a straightforward task. At Providend, uncovering a client’s Ikigai involves asking thoughtful, sometimes difficult questions:

-

What small joys bring life meaning?

-

What relationships matter most?

-

What aspirations, missions, or personal callings feel important?

-

What environment or relationships does he feel most at home in?

Designing a wealth plan is, essentially, designing a life. The discovery process, facilitated by a trusted adviser who understands the individual, is therefore the most critical step. It helps clarify priorities, examine trade-offs, surface fears, and explore possibilities in ways AI cannot.

Finally, wealth planning is not a one-time event. After the initial plan is designed, it must be reviewed regularly as life evolves. Goals change, risks shift, and new opportunities or challenges emerge. Investments also require ongoing monitoring to remain appropriate. For Nicholas, this means periodically reviewing the sustainability of his retirement income in light of market uncertainty, actively managing the performance and cash flow of any property he acquires, and reassessing his charitable giving to ensure it continues to honour his father’s values and intentions.

Overall, I felt that ChatGPT provided a good foundation to help Nicholas begin his planning. Yet to turn this starting point into a plan that is truly meaningful, much deeper thought, careful discussion, and ongoing reviews are needed — so that Nicholas and his family can have peace of mind and remain aligned in how they steward the inheritance, alongside a trusted partner who can help them navigate these important questions together.

How I Would Advise Nicholas Personally

If I were advising Nicholas, I would not start with charts, allocations, or projections. I would start with him, his story, his parents, and what this inheritance truly means to him. Beyond the fact that the money arrived through loss, it is also likely a sum of wealth that Nicholas has never had to manage before in his life.

I would encourage Nicholas to take his time, to sit with the emotions, the gratitude, the uncertainty, and even the guilt that sometimes comes with inherited wealth. Only when he feels ready would we begin shaping a plan together.

1. Understanding what matters most to him

Our first conversation would centre on his life, his sources of Ikigai, and what makes his life worth living, rather than his money.

- What are the things that brings him life satisfaction?

- Why does he want to have annual travels around the world for a month?

- Where is he currently at in terms of living out his Ikigai, and what are the areas that he would like to change to align him closer?

- Who are the people that means the most to him and how does spending enough time with them look like?

- Does he have a personal mission that resonates with him and what are some of the potential challenges he face?

- What values did his father pass on that he wants to honour?

These questions not only help to uncover what “living meaningfully” actually means for him but also help to decide between trade-offs when crafting a wealth plan.

2. Designing a plan that aligns with his Ikigai

Once we are clear about what truly matters to Nicholas and his foundations are secure, we can then design a plan that supports a life of worth, one that reflects his Ikigai. This would include:

- Creating a long-term income plan that provides reliability and peace of mind, while supporting the version of a “good life” that Nicholas envisions. This also involves thinking about the type of work he may want to do, both now and in the future. Work that aligns with his personal purpose and mission, and ensuring the plan gives him the flexibility to pursue it.

- Mapping out income needs that evolve over time, recognising that what Nicholas wants in this season of life may look different from what he hopes for later. For instance, he may prioritise spending more time with family now, and pursue other interests or personal projects down the road. The plan must also be robust enough to address key retirement risks such as investment volatility, inflation, healthcare costs, and longevity.

- Exploring potential one-time purchases, such as upgrading his property, but only if such decisions genuinely support the meaningful life he aspires to. These discussions naturally involve trade-offs, for example, balancing property decisions with his desire for more travel or other experiences that also require financial resources.

- Setting aside an allocation for passion projects, ensuring he has the means to explore ideas or pursuits that matter deeply to him, while keeping his other long-term goals on track.

- Keeping a small portion for giving or honouring his parents, in ways that feel authentic to him, including the possibility of setting aside something as a gesture of love for his mother.

- After which, establishing a strategic asset allocation for his inheritance, grounded in an evidence-based approach to give him the highest probability of long-term success.

The goal is not just to preserve his inheritance, but to help him use it in ways that feel purposeful, today and many years from now.

Above all, I would want Nicholas to know that he does not have to navigate this alone. He will have someone journeying with him, through the changes that may come both from within himself and from the world around him. Our role is to walk alongside him, helping him make thoughtful, values-aligned decisions with a sense of peace, clarity, and confidence.

Broader Lessons: What This Case Study Shows About AI in Financial Planning

This case study shows that AI has become a genuinely useful partner in the financial planning process. Its ability to organise information quickly, present structured frameworks, and highlight potential blind spots makes it an excellent starting point, especially for individuals who may not know where to begin.

At the same time, AI does have limitations. It works best when the inputs are clear, the goals are well-defined, and the emotional landscape is simple. Where it struggles is exactly where human life becomes most complex — moments of grief, conflicting priorities, family expectations, identity shifts, and deep questions about meaning and purpose.

What this means is that AI is neither a replacement for human advisers nor merely a novelty. Instead, it can serve as a powerful complement. AI provides speed, structure, and breadth; human advisers bring depth, empathy, and judgement. Together, they create a planning experience that is both more efficient and more human.

In a future where AI continues to improve, the role of the adviser will not diminish but will evolve. Advisers who can integrate AI tools into their process will spend less time crunching numbers and more time helping clients make thoughtful, values-aligned decisions. And clients will benefit from plans that are both technically sound and personally meaningful.

Ultimately, the strongest wealth plans will come from the combination of two strengths:

AI’s ability to illuminate possibilities, and the adviser’s ability to make those possibilities truly fit the client’s life.

This is an original article written by Tan Chin Yu, Lead of Advisory Team at Providend, the first fee-only wealth advisory firm in Southeast Asia and a leading wealth advisory firm in Asia.

For more related resources, check out:

1. How to Make Life Decisions (Ikigai Decisions)

2. To Live the Good Life, Make Life Decision First Before Wealth Decisions

3. Here’s Why We Charge a Higher Fee Than Robos

To receive first-hand wealth insights from our team of experts, we invite you to subscribe to our weekly newsletter.

Through deep conversations with our advisers, you will gain clarity on what matters most in life and what needs to be done to live a good life, both financially and non-financially.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.