Note: This article has been updated on 4 April 2023.

In 2020, the MediShield Life Council conducted the first major review of the MediShield Life scheme since its launch in 2015. One key finding was that the cost of cancer treatment has been rising at a much faster rate than other treatments and, if not quickly addressed, would make the scheme unsustainable in the future.

It was revealed that the national cancer drug spending would increase from $375 million to $2.7 billion in 2030, increasing at a far faster rate at 20% yearly as compared to 6% for other diseases. This is partly due to the rising cancer prevalence among Singaporeans, as well as the availability of more advanced medical treatments that come at a higher cost.

If left unchecked, the runaway for such healthcare spending would eventually lead to escalating insurance premiums, making it unaffordable for many people.

To this end, changes to the MediShield Life scheme regarding cancer benefits have been implemented since 1 September 2022 and the same will apply to Integrated Shield Plans from 1 April 2023.

Cancer drug treatments must fall under the new Cancer Drug List (CDL) for them to be claimable under MediShield Life or Integrated Shield Plans, whilst those outside of the CDL will not be claimable. As treatments under the CDL are typically more cost-effective and have proven clinical outcomes, this approach will help to manage the rising cost of treating cancer.

New Changes to MediShield Life (MSL)

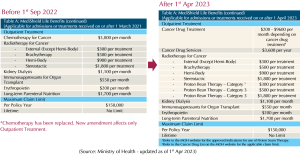

The new changes to MediShield Life are specifically on outpatient chemotherapy for cancer, as shown in Figure 1.

Figure 1

Before 1 September 2022

- Chemotherapy benefit is fixed at $3,000 per month, regardless of whether the cancer drug treatment falls under CDL.

After 1 September 2022

- Chemotherapy benefit now has two parts: cancer drug treatment and cancer drug services.

- Cancer Drug Treatment benefit ranges from $200 to $9,600 per month depending on the cancer drug, and these drug treatments must be under CDL.

- Claim limit of specific cancer treatments can be found here: https://www.moh.gov.sg/home/our-healthcare-system/medishield-life/what-is-medishield-life/what-medishield-life-benefits/cancer-drug-list

- Cancer drug services benefit is capped at $1,200 per year, regardless of whether the treatment falls under CDL. Such services include consultation, scans, lab investigation, treatment preparation, administration, support care drugs, and blood transfusions.

After 1 April 2023

- Cancer drug services benefit cap is increased from $1,200 to $3,600 per year.

How comprehensive is the CDL?

According to the Ministry of Health (MOH), about 90% of cancer drug treatments are under the CDL and hence would cover most of the cancer drug treatments used here. Moreover, MOH will update the CDL every few months to keep abreast with medical advancements and the latest clinical evidence.

Even so, the benefits under MediShield Life are designed for subsidised patients pegged to B2 and C wards in public hospitals. Those with higher ward expectations, for example, private hospitals, would need higher benefits such as the Integrated Shield Plan (IP).

New Changes to the Integrated Shield Plan (IP)

The changes on cancer treatment benefits will be implemented on IP from 1 April 2023. Similarly, cancer drug treatments under the CDL will be claimable and those outside the list will be excluded.

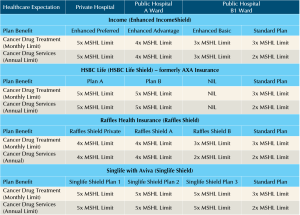

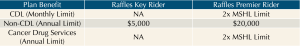

Figure 2.1 highlights the new IP benefits for the various insurers that you may be under.

Cancer Benefits under the IP (without rider)

(MSHL = MediShield Life Limit)

Figure 2.1

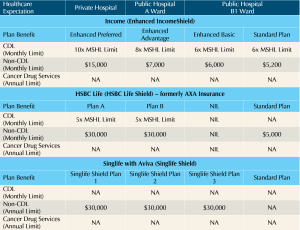

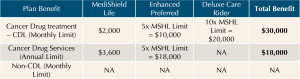

Example: Claims on CDL treatment using Enhanced IncomeShield (Preferred).

Assuming a CDL drug that is being used has a claim limit of $2,000 per month under MediShield Life, Figure 2.2 shows how much one can claim if the policyholder has an IP for private hospitals from NTUC Income. In this case, the maximum limit this person can claim is up to $10,000 per month for this CDL drug. In addition, the policyholder can also claim up to $18,000 per year for cancer drug services.

Figure 2.2

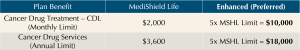

Cancer Benefits for the IP Rider

As the IP rider is not regulated by MOH, it can cover cancer drug treatments outside of the CDL but is subject to certain limitations.

A compilation of upcoming key benefits to IP riders can be found in Figures 3.1 and 3.2.

Cancer Benefits under the IP (rider)

Figure 3.1

Raffles Health Insurance offers 2 types of IP riders which can be attached to any of its plans (Figure 3.2).

Figure 3.2

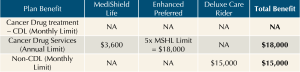

Example: Claims on CDL treatment using Enhanced IncomeShield (Preferred) and riders.

From the example used in Figure 2.2, if the policyholder has an IP rider, the amount of cancer claim limits is further increased, as shown in Figure 3.3.

His cancer drug treatment limit is now at $30,000 per month for CDL drugs, and $18,000 per year for cancer drug services.

Figure 3.3

Example: Claims on Non-CDL treatment using Enhanced IncomeShield (Preferred) and riders.

We know by now that non-CDL treatments are not covered under MediShield Life and IP. But with an IP rider, policyholders are now eligible to qualify for non-CDL claims.

Assuming a qualifying non-CDL drug costs $10,000 per month, if one has a private hospital IP rider from NTUC Income, he or she would now be able to claim up to $15,000 per month for non-CDL treatments, as illustrated in Figure 3.4.

Figure 3.4

What is the qualifying non-CDL treatment?

Cancer drug treatments that fall outside of CDL can be further classified using a guide provided by the Life Insurance Association, which helps to determine if these treatments may be claimable under non-CDL benefits.

As the guide is quite technical, it is preferable to seek advice from one’s doctor and the IP insurer to check if a particular non-CDL treatment falls under the approved classification.

When would the new IP changes be applicable to you?

To support those undergoing cancer treatments, all insurers offer transitional support by delaying the implementation of the new IP changes to 1 October 2023. To qualify, policyholders must have undergone cancer drug treatment, have made a claim between 1 January 2023 to 31 March 2023, and whose policies are due for renewal between 1 April 2023 to 30 September 2023.

Policyholders whose policies are due prior to 1 April 2023, will have the new IP changes implemented on the next annual renewal.

To further support the IP policyholders, IP premiums are restricted from any upward increase from now till 31 August 2024. However, this does not apply to IP riders.

Is my MediShield Life and IP sufficient to cover the cost of cancer treatment?

With the upcoming changes in IP, cancer drug treatment that falls outside of the CDL will not be claimable under MediShield Life or the IP (main plan).

To fund these non-CDL treatments, it may require to either dip into one’s personal savings, claim from the add-on IP rider or even from a critical illness policy. The choice of these funding options is dependent on the size of your personal savings, your healthcare expectations, as well as your risk management perspective.

The following are three groups of people and how they might be impacted by these changes.

Group 1 – Those with only MediShield Life (no IP)

With these changes, you can now enjoy a higher claim limit for the more expensive cancer drugs provided that they fall within the CDL.

Key concerns:

- In some cancer treatments where a combination of drugs is required, the claim limit might not be sufficient as it is based on the drug with higher claim limit and not an aggregation of individual drug claim limits.

- Moreover, any treatments outside of the CDL would have to be funded through your personal savings.

- As MediShield Life is designed for public hospitals in B2 and C wards, those who seek treatments at higher wards will find the claim limits inadequate.

Group 2 – Those with IP only (no IP rider)

The higher claim limit for cancer drug treatments should be hugely sufficient if your IP matches the hospital ward class of your choice, and the treatments fall within the CDL.

Key concerns:

- However, any treatments outside of CDL would have to be funded through your personal savings.

Group 3 – Those with both the IP and IP rider

The higher claim limits from the IP and IP rider should be adequate if your IP matches your healthcare expectation and the treatments fall within the CDL.

In addition, the IP rider also provides a monthly claim limit for non-CDL treatments, minimising the risk of out-of-pocket expenses.

Key concerns:

- In situations where the cancer treatment falls out of the non-CDL category, such expenses would have to be self-funded. However, you may cover this potential gap with a critical illness policy or a cancer-only policy.

- The cost of IP riders rises with age and may become unaffordable over time.

This is an original article written by our Insurance Team at Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Impact of MediShield Life Changes

2. Can You Still Buy Insurance if You Have Medical Conditions?

3. The Basic Principle of Insurance Planning

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.